How To Calculate The Amount You Can Get Taxrelief On

For 2022 and 2023, to calculate the amount of costs you canget tax relief on:

- Add your electricity, heating and internet costs and multiply the total costs by the number of days worked at home

- Multiply by 30%

For the years 2020 and 2021, the relief for internet was30%, as above. However, the relief for electricity and heating was 10%, sothese costs would be calculated as follows:

- Add the costs for electricity and heating and multiply the total costs by the number of days worked at home

- Multiply by 10%

For the years 2018 and 2019, the relief for electricity andheating was also 10%, and calculated in the same way, but there was no relieffor internet costs.

Amount of tax relief

When you know the amount of costs that you can get tax relief on you cancalculate your tax savings. You get tax relief on the amount of your costs at arate of 20% or 40%, whichever is the highest rate of income tax you pay.

If your employer pays you an allowance towards your expenses, that amountpaid is deducted from the amount you can claim back from Revenue.

Earned Income Tax Credit

You can claim the earned income tax credit in New York if you have a qualifying child and can also claim the federal earned income tax credit. You are not entitled to this credit if you claimed the Noncustodial Parent New York State Earned Income Tax Credit . The credit equals to 30% of your allowable federal earned income tax credit minus your household credit.

How To Calculate Your Tax Back

- Select a tax year you can only go back four tax years.

- Enter your total gross pay.

- Enter your total tax paid.

The tax refund calculator will give you an estimation of the refund you might be due if you have overpaid tax through your salary under PAYE.

If the calculator shows that you have not overpaid tax you may be due a refund for other reasons. In most cases you need to follow a specific process to claim back what you are owed otherwise your entitlement will not be refunded.

Please read on to find out more about tax refunds, the refund process and what you can do to make sure you dont overpay income tax.

Read Also: What Is The Deadline For Filing Tax Returns

Tax Withholding Estimator: Calculating Taxable Income Using Exemptions And Deductions

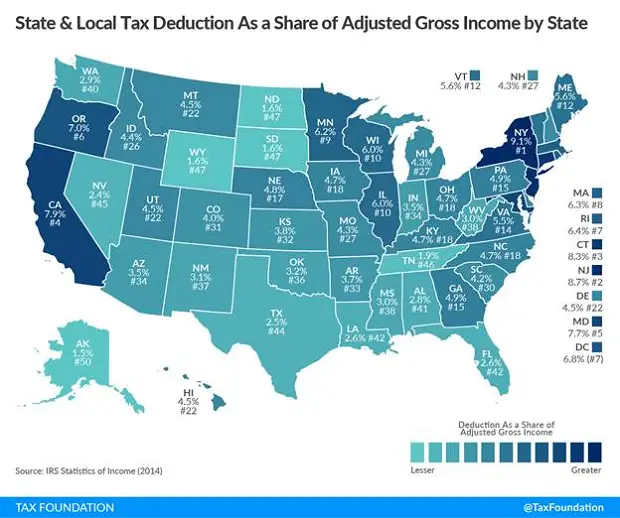

Federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

Is My Income Taxable

Most types of income are taxable. You will enter wages, withholdings, unemployment income, Social Security benefits, interest, dividends, and more in the income section so we can determine your 2021 tax bracket and calculate your adjusted gross income . This amount minus your deductions is used to calculate your taxable income.

Recommended Reading: How To Calculate Pay After Taxes

How Do Tax Credits Work

A tax credit is subtracted directly from the amount of tax you owe, so it reduces your total tax liability dollar for dollar, and the value of the credit is the same for everyone who is eligible to receive it. This is different from tax deductions, which subtract from your taxable income.

The value of a tax deduction depends on your marginal tax rate, so the more income you earn, the less a deduction is potentially worth. Here are a few examples of the most common tax credits claimed by taxpayers each year.

Most Common Tax Credits

- Earned Income Tax Credit

- The earned income tax credit helps low- to moderate- income workers and families who meet certain requirements reduce their tax liability.

- Child Tax Credit

- You could increase your tax refund by thousands of dollars by claiming the child tax credit for each child you claim as a dependent. If you received an advance payment of part of your 2021 CTC under the American Rescue Plan, you can claim the rest of the CTC when you file your tax return for the 2021 tax year.

- Savers Credit

- Putting away money for retirement may entitle you to a savers credit on your tax return. If you contributed to an IRA this year, the retirement savings contribution credit will reduce your tax liability by between 10% and 50% of the amount of your contributions, depending on your income.

- Education Credits

- The IRS offers credits for qualifying education expenses, such as the American opportunity tax credit and the lifetime learning credit.

How To Use The Tax Calculator

Here’s what you’ll need to estimate your income tax refund or bill using our calculator:

- Personal info: Your filing status and age.

- Income: Your gross income for the tax year, as well as how much you contributed to a 401 or traditional IRA. .

- Dependents: How many dependents you claim. .

- Deductions: This field will be pre-filled with the standard deduction after you select your filing status. If the total of your itemized deductions this includes things like mortgage interest and medical expenses is larger, enter that amount.

- Payments: If you were an employee, check your final pay stub of the year to see how much of your income was withheld for income taxes and enter that number in this field. If you had multiple jobs, add up how much each employer withheld for taxes. If you were self-employed, add up your quarterly estimated payments.

In addition to estimating how much you’ll get back as a refund, or how much you’ll owe, the calculator shows your effective tax rate, or the percentage of your income you pay in taxes overall.

Don’t Miss: How To Be Tax Exempt

How Much Can I Claim

You may have extra costs when you are working from home including heating,electricity and broadband costs. Your employer can pay you a contributiontowards these costs or you can make a claim for tax relief during the year orafter the end of the year.

If your employer pays you a working from home allowancetowards these expenses, you can get up to 3.20 per day without paying anytax, PRSI or USC on it. If your employer pays more than 3.20 per day tocover expenses, you pay tax, PRSI and USC as normal on the amount above3.20. You should note that employers are not legally obliged to make thispayment to their employees.

If your employer does not pay you a working from homeallowance for your expenses, you can make a claim for tax reliefduring the year or after the end of the year. You will get money back from thetaxes you paid. If you share your bills with someone else, the cost is dividedbetween you, based on the amount paid by each person .

The amount of costs you can claim is based on:

- How many days you worked from home

- The cost of your expenses

- The percentage of your costs that Revenue counts as working from home expenses

You can claim relief on costs at the following rates:

- For 2022 and 2023, 30% for electricity, heating and internet costs

- For 2020 and 2021, 30% for internet costs and 10% for electricity and heating costs

- For 2019, 10% for electricity and heating costs only

Child And Dependent Care Credit

You qualify for the child and dependent care credit if you are eligible for the federal child and dependent care credit, whether you claim it or not on your tax return. The is determined by the number of your qualifying children and the amount of child care expenses paid during the year. The credit is worth up to $2,310 for the tax year 2020. If the credit is more than the amount you owe in taxes, you can receive a tax refund.

Recommended Reading: Where Can I Get 1040 Tax Forms

Which Box On My W2 Form Do I Look At To Know How Much I Get Back

Yeah I was just wondering how do I know how much I will get on my W-2 from when I look at it

@f6b8a13ca254 wrote:

Yeah I was just wondering how do I know how much I will get on my W-2 from when I look at it

Box 2 on our W2 is the amount of tax withheld from your wages. However, this does not tell you how much you will get back.

On your form 1040, you will see your refund on line 34. If you owe, the amount will be on line 37.

Does It Calculate My Tax Credits And Deductions

Yes, just, enter your information such as status, income, number of dependents, and any deductions or credits you anticipate claiming. The tax return estimator will then provide an estimate of how much money you can expect to receive back from the IRS.

If you want to know how much money you will get back from the government come tax season, there are a few easy ways to calculate your federal tax credits and deductions online. Using a tax calculator is the simplest way to estimate your return, and it only takes a few minutes.

Keep in mind that this is only an estimateyour actual refund may be higher or lower depending on your taxable income and adjusted gross income.

Recommended Reading: How To File Taxes Separately While Married

Here Are A Few Tax Credits And Deductions That Can Make Your Tax Refund Larger

Although tax refund calculators are a resourceful tool that can estimate how much youll get back on taxes, they dont account for the various credits and deductions you can claim. If you want to be sure youre getting the maximum refund, dont forget to apply these credits to your return, given you qualify for them.

The Earned Income Tax Credit

You may qualify for the EITC is your Adjusted Gross Income doesn’t exceed the IRS’ income limits. If you don’t have any children and file single, head of household, qualifying surviving spouse, or married filing separately and earned less than $16,480 is 2022, you may be entitled to receive an EITC credit of between $2 and $560.

In order to collect the EITC using the married filing separately status, you must be legally separated or lived apart from your spouse for the last six months of 2022.

If you decide to file your taxes using a tax preparation company, you should be guided through all the deductions and credits to ensure those you qualify for are applied to your return.

Read Also: Do You Have To File State Taxes In Florida

Taxbackcom Reviews & Feedback

- BaskaranGreat Support, Very kind, High quality Professional interaction. Please keep doing the great work. Dedicated self service portal area to upload documents. Would appreciate if declaration as well could maintained online or support offline PDF document with save option at initial stage to estimate refund instead of sending out hard copies to avoid corrections.

18 February 2022

- Eamonn KeoghThis is a very good service. The Taxback team made it very easy and uncomplicated for me to access my tax back.

14 February 2022

- Eoin KelleherTaxback.com and Nina Velikova are excellent in pursuing all your overpaid taxes – I can’t recommend them enough for their professionalism and expert help.

02 February 2022

- Mattia FiorentiniNot so fast service due to Xmas holiday but professionalism is one of their point and they respect it.

10 January 2022

- Excellent!They make everything easy taking care of the whole process. Really great service. Trustworthy.

01 January 2022

- Ron BritI was thankful to the one who assisted me as I process my tax refund. It was a great service. Keep it up

18 December 2021

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

You May Like: What Is The Penalty For Not Paying Taxes

About Filing Your Tax Return

If you have income below the standard deduction threshold for 2022, which is $12,950 for single filers and $25,900 for married couples filing jointly, you may not be required to file a return. However, you may want to file anyway because you may be able to take advantage of several features and benefits in the tax system which could reduce the amount you owe, or in many cases, especially for people with low incomes, increase the amount you could receive in a refund. Some key factors to make sure you look out for include:

Calculating The Federal Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called ,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

Recommended Reading: How Much Would I Pay In Taxes Calculator

Canadian Tax Refund Calculator

Most people want to find out if its worth applying for a tax refund before they proceed. The best starting point is to use the Canadian tax refund calculator below. This handy tool allows you to instantly find out how much Canadian tax back you are owed.

The Canadian tax calculator is free to use and there is absolutely no obligation. You simply put in your details, get your refund estimation and then decide if you want to apply. We will also email a copy of your refund estimation through to your inbox so you can refer to it later.

The average Canadian tax refund is $998 so check it out today and take the first, important step towards getting your tax back.

- The Canadian tax calculator is FREE to use

- Instant estimation provided

- Estimation sent to your inbox

Reminder: How Paye Works

First things first! Let us have a quick recap at how Pay As You Earn works.

Nearly everybody is entitled to earn a tax-free amount each year. This is called the personal allowance. In 2022/23, this is £12,570 . Under PAYE this £12,570 amount is given to you in chunks to set against your income. So, if you are paid monthly, you would be given £1,048 of tax-free pay each pay day , if you are paid weekly, £242 and so on.

Essentially PAYE spreads your tax bill over the tax year, rather than you having to pay it in one lump sum. HMRC use a tax code to tell your employer or pension provider what tax-free allowances you are entitled to so that they can calculate tax at the appropriate rate on the balance. The standard tax code in 2022/23 is 1257L .

If you live in Scotland and are a Scottish taxpayer, the standard tax code in 2022/23 is S1257L. If you live in Wales and are a Welsh taxpayer, the standard tax code in 2022/23 is C1257L.

Where HMRC need to collect a little extra tax from you for whatever reason, they essentially reduce the amount of tax-free pay that you are allowed meaning that your employer calculates tax on slightly more money. The opposite happens where HMRC need to collect a little less tax from you. In such cases, you will see a non-standard tax code, for example 1202L or 1084L.

You can find out more about the PAYE system, including some examples of non-standard tax codes and how they are made up on our page How do I check my coding notice?.

Recommended Reading: How Do I Calculate Capital Gains Tax