What Is Bad About Reducing The Capital Gains Tax Rate

Opponents of a low rate on capital gains question the fairness of a lower tax on passive income than on earned income. Low taxes on stock gains shifts the tax burden onto working people.

They also argue that a lower capital gains tax primarily benefits the tax sheltering industry. That is, instead of using their money to innovate, businesses park it in low-tax assets.

Chapter 1 General Information

This chapter provides the general information you need to report a capital gain or loss.

Generally, when you dispose of a property and end up with a gain or a loss, it may be treated in one of 2 ways:

- as a capital gain or loss

- as an income gain or loss

When you dispose of a property, you need to determine if the transaction is a capital transaction or an income transaction. The facts surrounding the transaction determine the nature of the gain or loss.

For more information on the difference between capital and income transactions, see the following archived interpretation bulletins:

For information on how to report income transactions, see Guide T4002, Self-employed Business, Professional, Commission, Farming, and Fishing Income.

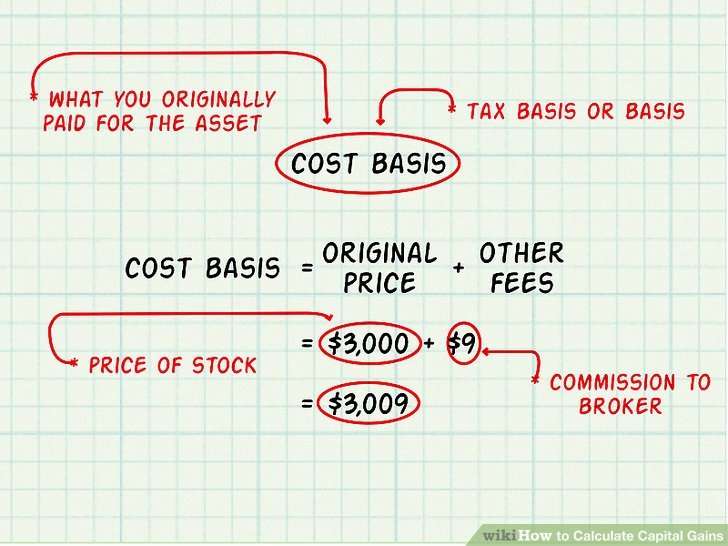

How Do I Calculate My Basis In A Capital Asset

For most assets, your basis is your capital investment in the asset. For example, it is your purchase price plus additional costs that you incurred, such as commissions, recording fees, or transfer fees. Your adjusted basis can then be calculated by adding to your basis any costs that youve incurred for additional improvements and subtracting depreciation that youve deducted in the past and any insurance reimbursements that have been paid out to you.

You May Like: How To Do Taxes For Door Dash

What Is A Capital Loss

A capital loss is when you sell an asset or investment for less than what you bought it for, after your cost base are taken into consideration.

If you make a capital loss, you will not be charged with any tax because you didnt make a profit. The good thing here is that losses can be offset against capital gains. Net capital losses in a tax year may be carried forward indefinitely. However, these losses cannot be offset against your income.

To illustrate this: Let’s assume that you made a capital loss of $20,000 last year. This year, you managed to record a capital gain of $25,000 on selling your property. When computing for your taxes this year, only $5,000 will be charged with CGT.

Given this advantage, you have to ensure that you keep all the relevant paperwork that would prove your capital loss during the previous years.

How To Address Volatility In Capital Gains

Capital gains income and thus capital gains tax revenue can rise or fall rapidly in response to economic changes. States can manage this volatility by, for example, relying on a variety of taxes, some of which respond less dramatically to swings in the business cycle.

The best way to address volatility in capital gains and other taxes is to establish a rainy day fund and make deposits when strong economic growth boosts revenues, so these funds can smooth out revenue downturns. States can tie these provisions directly to capital gains taxes, if desired. For example, Massachusetts deposits all capital gains revenue above a specific threshold into its rainy day fund. Similarly, in Connecticut, when income taxes collected through quarterly payments from taxpayers and at the time of filing exceed a specified threshold, the surplus is deposited into the states reserves. These are mainly taxes on investment income.

Read Also: 1040paytax.com Safe

Capital Gains Tax Calculator

Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. High net worth individuals and investors may need to consider the implications of capital gains tax on their personal finances and individual wealth management.

Our free tool allows you to check your capital gains tax and then connect directly with specialist wealth managers, who can offer free consultations to advise you on your own individual situation.

We are not a financial advisor and the information on this website should not be construed as financial advice. Thats why we partner with globally renowned specialist financial advisors, helping connect high net worth individuals to them.

Donate Assets To Charity

When you make a donation to a registered charitable institution, you receive a tax receipt which allows you to deduct a portion of your donation from income tax owing. Instead of making a donation in cash, you can transfer ownership of stocks to the registered charity. . It’s a way of rebalancing your portfolio without triggering a capital gain because you are not selling the stock, you are simply transferring ownership. You will receive a tax receipt for the current fair market value . Consult a tax professional before you do this so you follow the correct procedure.

Also Check: What Is The Sales Tax In Philadelphia

Can You Be Exempt From Paying Capital Gains Tax

There are several instances where you may be exempt from paying CGT.

If you make a capital loss you dont have to pay CGT because you didnt make a capital gain.

You also dont have to pay CGT on your principal place of residence . Your property will qualify as a PPOR if it satisfies the following conditions:

- You and your family reside in it Personal belongings are inside the property

- It is the address where your mail is delivered to

- It is the address you use on the electoral roll

- Services such as gas, phone, and power are connected to it

A special rule applies when you turn your main residence into a rental property. In such cases, you will still be exempt from paying CGT when you sell the property within six years of it being rented out. However, this will only be the case if you did not own another main residence during the time the property is rented out.

The six-year rule resets when you reoccupy the property as your main residence.

It is important to note that when your primary residence is also your principal place of business, you will be charged with CGT for the portion of the property that is set aside to produce income.

Capital Gains Tax Rates

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50% capital gains inclusion rate. Your income tax rate bracket is determined by your net income, which is your gross income less any contributions to registered investment accounts. Thecapital gains tax rates for each provinceis listed below based on tax bracket:

| Lower Limit |

|---|

| 25.69% |

Read Also: How To Take Out Taxes For Doordash

Working Out Your Capital Gain

To quickly figure out how much capital gains tax youâll pay – when selling your asset, take the selling price and subtract its original cost and associated expenses . The remaining amount is your capital gain .

If youâve made a capital gain and you’ve held an asset for greater than 12 months , you can apply the 50% discount to work out your net capital gain .

Companies and individuals pay different rates of capital gains tax. If youâre a company, youâre not entitled to any capital gains tax discount and youâll pay 30% tax on any net capital gains. If youâre an individual, the rate paid is the same as your income tax rate for that year. For SMSF, the tax rate is 15% and the discount is 33.3% .

Have confidence in your future with help from a financial adviser.

Adjusted Cost Base For Real Estate

For real estate properties, the adjusted cost base includes the purchase price of the property, closing costs, and capital expenditures on the property.

Closing costsare the fees that a buyer pays to acquire the real estate property and include one-time fees such as theland transfer taxes, lawyer and legal fees, home inspection fee, and property survey fee. It is important to differentiate between capital expenditures and current expenses on your property.

Current expenses cannot be included in the adjusted cost base while capital expenditures should be included in the ACB, irrespective of when the capital expenditures were made during the entire duration of your ownership of the home.

Some examples of capital additions and improvements to your home include installing a new HVAC system, waterproofing your basement, installing a hot tub, etc. Meanwhile, current expenses are monthly costs incurred by the homeowner or a tenant, such as electricity bills, hydro bills, restorations, and short term repairs such as painting the wall or replacing broken light bulbs.

TheCanada Revenue Agency guidelines on current expenses and capitalexpenses indicate that capital expenditures are improvements that provide a long term benefit, significantly increase the value of the home, and contribute to extending the useful life of your property.

Also Check: Doordash Take Out Taxes

Understanding Capital Gains And Tax

A capital gain or loss is the difference between what you paid for an asset and what you sold it for. This takes into account any incidental costs on the purchase and sale. So, if you sell an asset for more than you paid for it, thatâs a capital gain. And if you sell it for less, that is considered a capital loss.

Capital gains tax applies to capital gains made when you dispose of any asset, except for specific exemptions .

Being organised is key when trying to quickly calculate and pay capital gains tax. And a good way to be organised is to keep up to date records by holding on to things like:

- initial sale contracts and other receipts for other expenses

- interest paid on related borrowings

- receipts for ongoing expenses

Dealing With Capital Loss

You can use any capital losses to offset or reduce capital gains. And if you have more capital losses than you need to reduce your capital gain to zero, or if you only have capital losses, you are allowed to carry forward that capital loss into future years, OR, you can carry it back up to three previous years to amend a capital gain you declared.

Also Check: Can You File Taxes With Doordash

Disposing Of Your Principal Residence

When you sell your home or when you are considered to have sold it, usually you do not have to pay tax on any gain from the sale because of the principal residence exemption. This is the case if the property was solely your principal residence for every year you owned it.

Reporting the sale of your principal residence

If you sold your property in 2020 and it was your principal residence, you have to report the sale and designate the property on Schedule 3, Capital Gains , in addition, you also have to complete Form T2091, Designation of a Property as a Principal Residence by an Individual . Complete only page 1 of Form T2091 if the property you sold was your principal residence for all the years you owned it, or for all years except one year, being the year in which you replaced your principal residence.

Why you have to report the sale

For the sale of a principal residence in 2016 and subsequent years, the CRA will only allow the principal residence exemption if you report the disposition and designation of your principal residence on your income tax and benefit return. If you forget to make this designation in the year of the disposition, it is very important to ask the CRA to amend your income tax and benefit return for that year. The CRA will accept a late designation in certain circumstances, but a penalty may apply.

Example

Note

This situation could occur, for example, where the property is used as a home day care.

Example

Note

What Is The T: Calculation Of Capital Gains Deduction Form

The maximum Lifetime Capital Gains Exemption depends on the type of property disposed. For 2020, the maximum LCGE for qualified farming/fishing property is $1,000,000. Qualifying small business corporation shares carry a LCGE of $883,384. Since 50% of capital gains are taxable, the LCGE cap for each type of disposal is one half of the maximum .

You will use this form if you disposed of qualified farm property or qualified small business corporation shares in the current taxation year or in a previous year, or if you disposed of qualified fishing property after May 1, 2006.

Don’t Miss: Florida Transfer Tax Refinance

An Example Of How The Capital Gains Tax Works

Say you bought 100 shares of XYZ Corp. stock at $20 per share and sold them more than a year later for $50 per share. Lets also assume that you fall into the income category where your long-term gains are taxed at 15%. The table below summarizes how your gains from XYZ stock are affected.

| How Capital Gains Affect Earnings | |

|---|---|

| Profit after tax | $2,550 |

In this example, $450 of your profit will go to the government. But it could be worse. Had you held the stock for one year or less , your profit would have been taxed at your ordinary income tax rate, which can be as high as 37% for tax year 2021. And thats not counting any additional state taxes.

Third Exemption: Selling Properties That Were Purchased Before 1995

In this last case, if you are thinking of selling a property that you bought before 1995 then you will be able to enjoy a tax reduction. Nevertheless, there are two things to consider:

- This relief will only be applicable to the proportion of the gains produced until . Any gains in the assets value made after this date won´t include reductions and will be taxed at the normal rate.

- In addition, to be able to enjoy from this reduction, the property in question must have been purchased for 000+.

If your property meets these requirements, then could enjoy a reduction of 11%.

Also Check: How To Get Tax Information From Doordash

How Do I Become Exempt From Capital Gains Tax

Certain joint returns can exclude up to $500,000 of gain. You must meet all these requirements to qualify for a capital gains tax exemption: You must have owned the home for a period of at least two years during the five years ending on the date of the sale.

Disposing Of Your Shares Of Or Interest In A Flow

When you dispose of your shares of, or interest in, a flow-through entity, calculate the capital gain or loss in the same way as with any other disposition of capital property .

Report these dispositions on Schedule 3 as follows:

For more information, see Property for which you filed Form T664or T664.

Certain circumstances may create a special situation for a flow-through entity described in items 1 to 6 of What is a flow-through entity?. This happens if you dispose of your remaining shares of, or interest in, such an entity in the 1994 to 2020 tax years and have filed Form T664. If this is the case, in the year you dispose of the shares, use the ECGB available for the entity immediately before the disposition to increase the ACB of the shares or interests.

The ACB adjustment will either reduce your capital gain or will create or increase your capital loss from disposing of the shares or interest in the flow-through entity.

Also Check: Does Doordash Send A 1099

Chapter 2 Completing Schedule 3

This chapter gives you information about how and where you should report some of the more common capital transactions on Schedule 3, Capital Gains in 2020. Schedule 3 is included in the Income Tax Package.

Schedule 3 has five numbered columns and is divided into several sections for reporting the disposition of different types of properties. Report each disposition in the appropriate section and make sure you provide the information requested in all columns. Complete the bottom portion of the schedule to determine your taxable capital gain or your net capital loss. If you have a taxable capital gain, transfer the amount to line 12700 of your income tax and benefit return. If you have a net capital loss, see Chapter 5 for information on how you can apply the loss.

Watch Your Holding Periods

Remember that an asset must be sold more than a year to the day after it was purchased in order for the sale to qualify for treatment as a long-term capital gain. If you are selling a security that was bought about a year ago, be sure to check the actual trade date of the purchase before you sell. You might be able to avoid its treatment as a short-term capital gain by waiting for only a few days.

These timing maneuvers matter more with large trades than small ones, of course. The same applies if you are in a higher tax bracket rather than a lower one.

Don’t Miss: Is Doordash 1099

How Do I Avoid Capital Gains Tax On Investment Property

Are there ways to avoid capital gains tax?

Adjusted Cost Base For Financial Instruments

For financial instruments such as stocks, the adjusted cost base is calculated as the number of shares multiplied by the share price at the time the shares were bought. For instance, if 100 shares of XYZ Company were purchased at a price of $30 each, then the ACB would be $3,000. If more shares of the same corporation are purchased in the future, the adjusted cost base would be the total cost of all the shares purchased at their respective prices. The adjusted cost base per share would be the average purchase price for all the shares. For instance, if you purchased 50 more shares of XYZ Company at a price of $35, the ACB per share would be $31.67. The adjusted cost base also includes any costs incurred to acquire the stock, such as trading commissions.

Read Also: What Can I Write Off As A Doordash Driver