Commercial Property Tax Consultants

If youre like most business owners, you have your strengthsand weaknesses all combined with heavy demands for your time. By hiring aprofessional property tax consultant, youll save time while benefiting from expertisein all things property taxes.

By simply filling out one quick form and answering a few follow-up questions afterward, you can trust the matter will be handled with the utmost care and thoroughness. Our team will investigate the property value, gather evidence, and attend your appeal hearing on your behalf. With over 40 years of combined experience assessing property values and providing appropriate evidence to prove when valuations are inaccurate, our commercial property tax experts are your best choice for protesting your Houston property valuation.

If you missed the deadline but still would like to protest your property valuation, we urge you to choose a consultant. The correction appeal process is much more complex and a tax consultant is your best option.

We are confident we can help. Call today to get started. 281-880-6500

S To Protesting And Reducing Your Property Value Annually

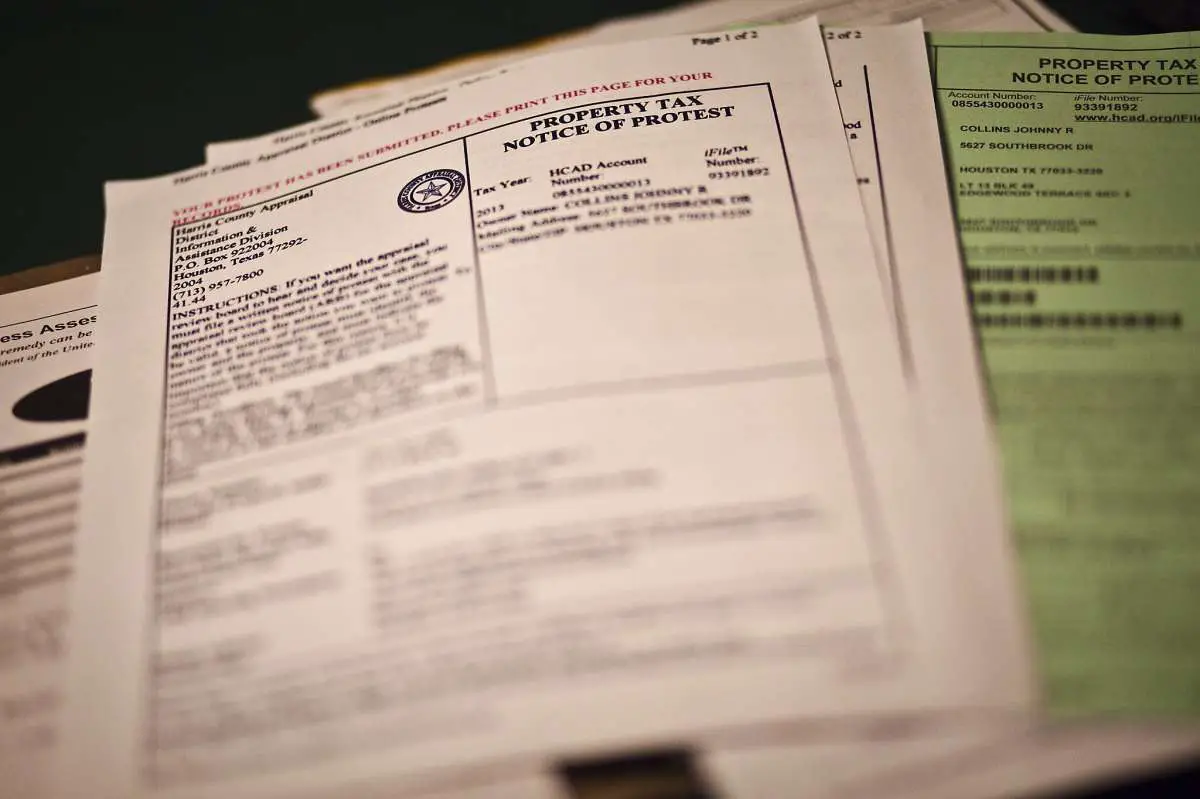

Step 1. File a ProtestTexas property tax appeals can be filed using the form provided by the appraisal district, or click here to download the form to file a Texas Property Tax Appeal in the property tax resources section. Otherwise, send a short letter to the chief appraiser at the central appraisal district stating that you are protesting your property taxes. You should indicate the basis is both assessed value over market value and equal appraisal. The deadline to file a protest is May 15, or 30 days after notice of your assessed value is mailed to you, whichever is later. Protest annually to minimize your property taxes.

Step 2. Research the Central Appraisal Districts Record CardThe appraisal district in your county has a record card for each property it assesses. This card contains information such as lot size, building size, amenities, and much more. You will need to go to the district office to obtain the complete record card and there may be a nominal charge. However, you can probably review much of the basic information on the appraisal districts website. Ask the staff if you have questions about the information. Errors in the record card are a sound basis for a protest. It is impossible to maintain correct data for every property in the county.

Step 4. Journey through the Legal Avenues

Find Out Your Homes Current Value

The first thing you need to know is the current value of your home. If homes similar to yours are selling for 250K and your appraisal value is at or less than 250K then you may not be able to make the case that your property value should be lowered.

To find out current value ideally you should get an appraisal from a licensed appraiser, but this will have a cost associated with it. Price will vary based on location and size of property but be thinking in the $300-$500 range.

You could get a Comparative Market Analysis from a competent REALTOR. It includes the same basic information as the appraisal, but doesnt carry the same weight before the appraisal review board. Offer to compensate the REALTOR for their time if you choose to go that route.

If your homes current tax appraisal is at or below its current appraised value then you probably would not win an appeal based on value. There may be an exception if your home has some major defect that negatively impacts its value, such as a foundation that needs to be repaired or a roof that needs to be replaced.

You May Like: What Is The Sales Tax In Arkansas

Q: Appealing My Property Taxes Seems Overwhelming Where Do I Start

A: Each appraisal district has their own process and guidelines to help homeowners protest.

Texas Tax Protest takes all the guess work and uncertainty out of the protest process. Start by signing up with us. The process only requires three forms, which we fill out for you. All you need to do is review and sign. Its really that easy!

Preparing For Your Arb Hearing:

If you decline the appraisal districtâs offer after the informal process, your next step is to present your evidence in front of the ARB. It is important that you know exactly how to prepare for your ARB hearing. I recommend that you carefully review The Homeownerâs Guide to Presenting Your Case at an ARB Hearing.It outlines the process in detail including what to expect , exactly how to prepare your evidence, approaches to take, burden of proof and what to do if you are still not satisfied after your ARB hearing. You have a right to obtain copies of all information that the appraisal district used to appraise your property. If you arenât able to access it online, make sure that you request this information, study it and find comps to refute it. Under the law, the appraisal district has the burden of establishing the value of your property. If they fail âto prove your homeâs value by a preponderance of the evidence, the ARB must rule in your favor.â

Recommended Reading: What If I File Taxes Late

How To Protest Commercial Property Taxes

To protest your property taxes directly go to the HCAD website and file yourappeal before the May 15thdeadline.

Once you have filed for an appeal, you will need to do somehomework to preparefor your review board hearing.

- Gather documentation to support the claim thatyour commercial property valuation was unfairly high. This can includereceipts, photos, and other business documentation supporting the lower value.

- Investigate and collect evidence of the value ofcomparable properties.

Attend your scheduled appraisal review board hearing to present your documentation. Your new valuation will be determined on the same day as your hearing.

How Protest Property Tax In Harris County Appraisal District

If you own a property in Harris County, should have received yourproperty appraised from the HCAD in the mail by now. There has definitelybeen a rise in values in Texas cities, but that doesnt mean the value thecounty appraisal district has for your property is correct. Those who areinterested in reducing their property taxes ought to discover what is involvedin property tax protest. Here are a few tips on how to win your property taxprotest.

HCAD Propertytax protest:

Property owners must file a protest against property taxincreases. Its not enough just to file your protest, you need to remember toshow up to the hearing. The HarrisCounty Appraisal District may offer property owners the chance to settle theircase before the hearing. It can be tempting to accept the offer, especially ifthe taxing unit is willing to reduce the property value. However, it is muchbetter to attend the hearing and present the entire case, since property ownersmay receive an even lower valuation.

Get help fromproperty tax consultant:

Approach a property tax consultant with the experienceof attending thousands of hearing. They can help you make these types of difficultdecisions. Since the process of appealing property taxes involves a great deal of preparation and expertise, property owners may benefitfrom hiring professional assistance to reduce property taxes.

Performonline investigation:

Beon-time for hearings:

Justify yourpoints:

Meet yourNeighbors

Why We Fight:

Most CommonMisconceptions:

Also Check: How Much Is Tax In Washington State

Harris County Appraisal District

Street Address: 13013 Northwest Frwy. Houston, TX 77040-6305Mailing Address: P.O. Box 920975 Houston, TX 77292-0975Phone: 713-812-5800Website:www.hcad.orgMajor Cities: Atascocita, Barrett, Baytown, Bellaire, Bunker Hill Village, Channelview, Cloverleaf, Crosby, Deer Park, El Lago, Friendswood, Galena Park, Hedwig Village, Highlands, Hilshire Village, Houston, Humble, Hunters Creek Village, Jacinto City, Jersey Village, Katy, Klein, La Porte, League City, Missouri City, Morgans Point, Nassau Bay, Pasadena, Pearland, Piney Point Village, Seabrook, Sheldon, Shoreacres, South Houston, Southside Place, Spring, Spring Valley, Stafford, Taylor Lake Village, Tomball, Webster, West University Place

Property Tax Bill Sticker Shock In Harris & Fort Bend County:

You are not alone if you are still reeling from the sticker shock of your recent yearâs Property Appraisal Notice. A few years ago, the majority of Houstonians’ started to notice that the era of the appraisal districts underestimating your home value was rapidly changing. In 2016 we started to see the local real estate market drastically come to a halt, however the appraisal districts property values did not follow suit. In the last couple years Harris County Appraisal District and Fort Bend County Appraisal District came under hot water for not lowering the home evaluations to correlate with the local real estate market.

Iâm not a property tax protest expert, but I can send you comparables to use and outline the steps to protest your property taxes. There are also a slew of companies in the area that will protest your taxes for you . Whether you decide to do it yourself or hire a company to do it for you, it is important to understand the process so you can make an informed decision.âââââââIn this Blog post, I am going to focus on protesting your taxes on your own using the appraisal districts online system and making your case in front of the Appraisal Review Board in Harris and Fort Bend County.

Read Also: How Do I Pay My State Taxes In Missouri

Harris County Property Tax Background

Harris Countys property taxes are put to a variety of uses. Like most counties in Texas, Harris County earns the bulk of its revenue through these taxes and uses them to fund many of its most expensive programs and services. These programs and services include:

- Law enforcement and fire protection

- Public schools and extracurricular educational programs

- Park maintenance and public works projects

- Road maintenance in cities and unincorporated areas

You should not feel bad about protesting your property tax assessment. As one of the largest counties in the United States, Harris County has an enormous operating budget and funds a wide variety of programs and services for its citizens. You should not feel obligated to honor an obviously inflated property tax bill without protesting it.

Instructions For Using Ifile & Isettletogether:

Recommended Reading: What Age Can You File Taxes

Why Is The Appraised Value Of My Home Important

The assessed value of your property multiplied by the tax rate is what determines your property tax bill. Considering that, each year, hundreds of thousands of Texans protest these valuations in hopes of reducing what they will owe in taxes. But many others do not bother to contest the assessments, possibly because the process may seem intimidating or a lost cause.

What Is Fair Market Value

You May Like: What Is Low Income Tax Credit

How To Protest Your Property Taxes In Texas

Your property tax appraisal arrived in the mail. You opened it up, and nearly passed out. Texas home values are going up, but how could your property value have increased so much? This might be great for the economy, but youre a homeowner. Is it the best thing for you?

Now youre mad and ready to fight. You need a simple plan that will protect your homeowner rights and lower your Texas property taxes.

What Is An Improvement

Also Check: How Much Taxes Get Taken Out Of Your Paycheck

An Offensive Vs Defensive Approach

If you disagree with your appraisal, dont get mad. Get educated. Crouch said there is a defensive and offensive approach you can take.

The defensive side is to ask the appraisal district for the evidence that theyre going to use against you, he told the Jasons. And you get that evidence in advance. You can see which properties theyre comparing against yours. You can drive around and go look at those properties, take pictures of them and bring reasoning to the table.

Should you decide to go on offense, then Crouch said the goal is to argue that the condition of your property isnt what the appraisal district says it is.

Document condition issues with photos or get estimates from contractors showing that your house is in need of repair, Crouch advised. And also get comparable sales from a realtor just showing what other types of sales there that you would suggest they use as evidence to support a lower valuation for your home.

The timetable is important. Crouch said the value notice you receive is based on home sales all the way back to the first day of the previous year. So, he says the appraisals that just came out are based on sales from January 1, 2020 through around March 31, 2021, meaning you should ask for comps over a lengthy period of time.

Another expert tip: Crouch said there is a chance you could deduct some value from your home if you suffered damage from a natural disaster, such as the February power catastrophe in Texas.

Find your appraisal district:

File Notice Of Protest:

Submit a written Notice of Protest form by May 15th. Detailed instructions of how to file online can be found in the resources section below. You will need to identify the property being appealed and the basis for your appeal. Pay close attention to the boxes you check off stating the reason for your protest. Your choices will affect the kind of evidence you can submit down the road. If you are appealing because the value is too high, I strongly recommend appealing on both âAssessed value is over market valueâ and âValue is unequal compared with other properties.â Checking both boxes will allow you to present the widest types of evidence. If the square

Read Also: What Is Tax Liabilities On W2

Appear Before Appraisal Review Board

At least 14 days before your protest hearing you will receive a packet of information that includes a description of the ARBs procedures. Read and follow them carefully. Arrive early for your hearing. And when its your turn stick to the facts.

Tip: Appraisal Review Board Meetings are public. Find out their schedule and attend one in advance to give you a better idea how the process works.

The only thing ARB members can consider is the valuation of your property. The following have no bearing on your case:

- Tax rate

Six Steps For Successfully Protesting Your Property Value

For many, spring is a busy time of the year. Its as if everyone got together and said, Lets cram everything we possibly cangraduations, weddings, etc.into just a handful of weekends.

Spring is also a busy time of year for the McLennan County Appraisal Review Board. This 16-member, independent board hears and resolves disputes in which property owners believe they were assessed an incorrect property value. And, believe it or not, there are actually people who are willing to serve on this boardI used to be one of them.

If youve never protested your property value before, there are a few things you can do that will better your chances of achieving your desired outcome.

1. You catch way more bees with honey than vinegar.

Lets face it. No one likes to pay more in taxes. Well, I dont exactly know if thats true, but Ive yet to meet anyone who has said, Id love to pay more taxes.

So, its only natural to be frustrated when you submit your protest and, if necessary, go before the review board. However, please remember that your frustration is with the appraisal district, not the review board.

Also, keep in mind that, while your appraisal may or may not accurately represent market value, the district does employ many good people who are simply trying to serve the county and do a good job. The vast majority of them are good at what they do. And, just like you, they are there to do a job and then go home to their families.

2. Stick to the facts.

6. Stick to your guns.

Also Check: Can You File Missouri State Taxes Online

Appraisal Protests And Appeals

Translation:

One of your most important rights as a taxpayer is your right to protest to the appraisal review board . You may protest if you disagree with the appraisal district value or any of the appraisal district’s actions concerning your property.

If you are dissatisfied with the ARB’s findings, you have the right to appeal the ARB’s decision. Depending on the facts and type of property, you may be able to appeal to the state district court in the county in which your property is located to an independent arbitrator or to the State Office of Administrative Hearings .

If the appraisal district appraises your property at a higher amount than in the previous year, Tax Code Section 25.19 requires the appraisal district to send a notice by May 1, or by April 1 if your property is a residence homestead, or as soon as practical thereafter.

If you are dissatisfied with your appraised value or if errors exist in the appraisal records regarding your property, you should file a Form 50-132, Notice of Protest with the ARB. In most cases, you have until May 15 or 30 days from the date the appraisal district notice is delivered whichever date is later.

The Comptroller’s office is prohibited from advising a property owner, agent or appraisal district about a matter under protest and from intervening in a protest.

Under specific situations, you may protest after the deadline for filing a protest has passed.