Is Trading Foreign Currency Taxable

Traders can trade the forex market without paying taxes, thus making forex trading tax-free. Traders who stay with spread betting, however, do not have to pay taxes on their profits. It is possible that forex tax laws will be changed very soon because of several pieces of legislation currently being considered.

Day Trading Tax Software

Identifying and proving your trader tax status is far easier if you have technology on your side. Today there exists intelligent trading tax software that can store all the required information and data on your trades. Some software can even be linked directly to your brokerage.

This can make filling your taxes a straightforward process. It will also leave you more time for analysing the markets and generating profits.

How To File Forex Tax Returnhow To Report Forex Profits & Losses

I trade spot forex through forex. I have some losses and I would like to to know how do I file these losses on turbo tax. I printed out my trading transaction history for during , and on the transaction, it reported a loss for the year.

I spoke to a cpa through turbo tax and he said that they wouldn’t question if I filed my gains or losses through Box B short term , under Scheduled D. Am I still entitled to utilize capital loss carry over? Section taxes FOREX gains and losses like ordinary income, which is at a higher rate than the capital gains tax for most earners. Section gains or losses are reported on Form This default treatment of foreign currency gains is to treat it as ordinary income. View solution in original post.

To report forex trading under Section , then you can import the data from your broker directly with a program such as GainsKeeper. Be sure to indicate in the description that this is a total of your Forex trades and enter an amount for either a gain or a loss.

If you lost money, report it with a negative number. Be sure to keep your documentation regarding the forex trades if the IRS requests proof. Are you saying I have a choice either use sec or form ? I would not use to carry forwarding loss. Let me clear up some misconceptions as I read these various posts. Section trading gains or losses are ordinary gains and losses and is not treated like investment income thus is not reported on a schedule D.

- Get link

Also Check: Taxes Taken Out Of Paycheck Mn

Do You Pay Tax On Currency Gain

There is a possibility that your gains, losses, or disposal of foreign currency when getting the benefits for foreign currency, disposing of foreign currency or right to receive foreign currency will be counted toward CGT and forex. This basically means the gains or losses on foreign exchange are determined based on forex rules.

What Is Your Sentiment On Gbp/usd

1.33158Try Demo

If you trade CFDs, then you are subject to capital gains tax on gains from your trading activities. CGT is 10% for basic rate taxpayers, when total income is £12,571 to £50,270 .

If you are in the higher tax band then your profits will be subject to 20% CGT. But dont be deterred from trading CFDs immediately, because there is a CGT tax allowance for the first £12,300 and this threshold should not be neglected.

For filing your tax return, you can make a record of your transactions or ask for a PnL statement from your broker. Another important issue to keep in mind is that you can ask for tax relief if you incur losses from your trading activity.

You May Like: Reverse Ein Lookup

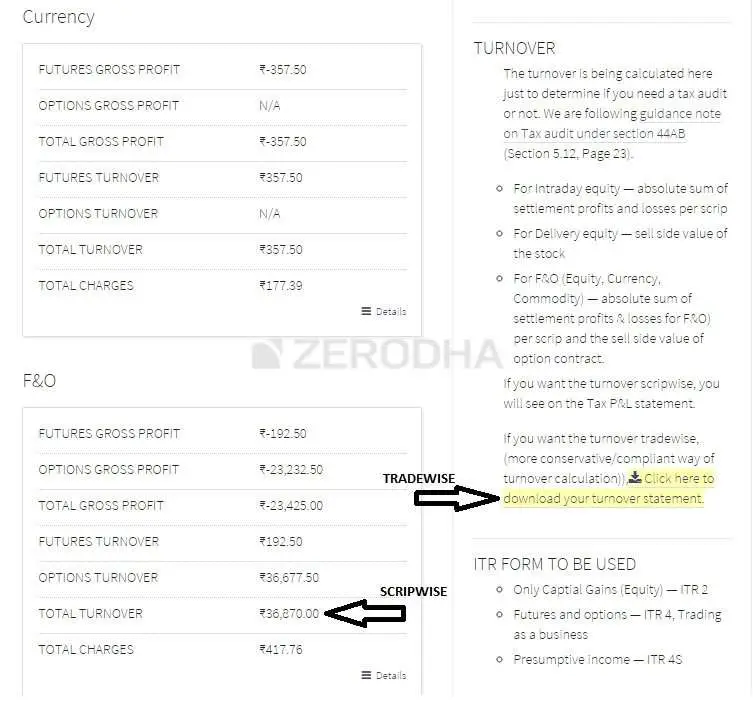

Tax Compliance Is Complex For Traders With Lots Of Different Tax Forms

The IRS hasnt created specialized tax forms for individual trading businesses. Traders enter gains and losses, portfolio income, and business expenses on various forms. Its often confusing. Which form should be used if the taxpayer is a forex trader? Which form is correct for securities traders using the Section 475 MTM method? Can one report trading gains directly on a Schedule C? The different reporting strategies for the various types of traders make tax time not so cut-and-dry.

Sole proprietor trading business

Other sole-proprietorship businesses report revenue, cost of goods sold, and expenses on Schedule C. But business traders qualifying for trader tax status report only trading business expenses on Schedule C. Trading gains and losses are reported on various forms, depending on the situation. In an entity, all trading gains, losses, and business expenses are consolidated on the entity tax return a partnership Form 1065 or S-Corp Form 1120-S. Thats one reason why we recommend entities for TTS traders.

Sales of securities must be first reported on Form 8949, which then feeds into Schedule D with capital losses limited to $3,000 per year against ordinary income . Capital losses are unlimited against capital gains.

Section 1256 contract traders should use Form 6781 . Section 1256 traders dont use Form 8949 they rely on a one-page Form 1099-B showing their net trading gain or loss . Simply enter that amount in summary form on Form 6781 Part I.

Topic No 429 Traders In Securities

This topic explains if an individual who buys and sells securities qualifies as a trader in securities for tax purposes and how traders must report the income and expenses resulting from the trading business. This topic also discusses the mark-to-market election under Internal Revenue Code section 475 for a trader in securities. In general, under section 475, the term security includes a share of stock, beneficial ownership interests in certain partnerships and trusts, evidence of indebtedness, and certain notional principal contracts, as well as evidence of an interest in, or a derivative financial instrument in, any of these items and certain identified hedges of these items. To better understand the special rules that apply to traders in securities, it’s helpful to review the meaning of the terms investor, dealer, and trader, and the different manner in which they report the income and expenses relating to their activities.

Recommended Reading: How Much Should I Save For Taxes Doordash

Do Currency Exchanges Report To Irs

If you report your gains or losses on your Federal income tax return in the United States, the difference between your adjusted basis in the virtual currency and the amount you received in exchange for it will be the difference between your adjusted basis in the virtual currency and the amount you received in exchange for the dollars.

Business Income And Losses

For day traders, any profits and losses are treated as business income, not capital.

As a result, you cant use the 50% capital gains rate on any profits. Instead, 100% of all profits are taxed at your current tax rate.

At the same time, 100% of any losses are deductible too that can be applied to other sources of income as well.

For example, if you report an annual trading loss of $15,000 this year and you also run a business, you can deduct your trading losses against other sources of income. This includes money made from your other business, which can significantly reduce the amount you pay in taxes.

If youre a full-time day trader, you can also claim expenses related to your trading.

Just like with any other business, you need to have receipts for all the items you declare on your tax returns.

The CRA will not accept these kinds of deductions without receipts.

Deductions can include anything from taking stock market trading courses, to educational resources, the purchase of a computer, and your monthly internet bill.

Disclaimer: This blog post is for general reference only. FBC recommends that you consult with a firm that specializes in providing tax consultation services for day trading.

Read Also: Irs Business Look Up

Which Contract To Choose

Now comes the tricky part: Deciding how to file taxes for your situation. While options or futures and OTC are grouped separately, the investor can choose to trade as either 1256 or 988. Individuals must decide which to use by the first day of the calendar year.

IRC 988 contracts are simpler than IRC 1256 contracts. The tax rate remains constant for both gains and losses, which is better when the trader is reporting losses. Notably, 1256 contracts, while more complex, offer 12% more savings for a trader with net gains.

Most accounting firms use 988 contracts for spot traders and 1256 contracts for futures traders. That’s why it’s important to talk with your accountant before investing. Once you begin trading, you cannot switch from one to the other.

The rules outlined here apply to U.S. traders with accounts at U.S. brokerage firms.

Most traders naturally anticipate net gains, and often elect out of 988 status and into 1256 status. To opt out of a 988 status, you need to make an internal note in your books as well as file the change with your accountant. Complications can intensify if you trade stocks as well as currencies because equity transactions are taxed differently, making it more difficult to select 988 or 1256 contracts.

How Are Taxable Earnings And Deductible Losses Calculated

Compensation for divestment of foreign currency or a receivable in a foreign currency is either the amount received in SEK, or the SEK value of an asset received in exchange . The acquisition cost is the price paid for the asset.

In addition to exchange rate changes, the capital gain calculation for a receivable includes any change in value of the receivable itself. For example, the value of an interest-bearing bond in USD increases if the US interest rate falls. When the bond is divested, the capital gain calculation will factor in both this increase in value and the exchange rate differences.

Example: currency exchange

On 1 May, Tess exchanges SEK 7,500 for NOK 7,000.

On 1 July, she exchanges NOK 7,000 for USD 1,000. The value of USD 1,000 on that date is SEK 8,000. The value of NOK 7,000 is also SEK 8,000. On 1 August, Tess exchanges USD 1,000 for EUR 1,000. The value of EUR 1,000 on that date is SEK 9,000. On 1 July, Tess makes an exchange rate gain of SEK 500 . On 1 August, she makes an exchange rate gain of SEK 1,000 .

Example: liability in foreign currency

Kalle borrows EUR 50,000 when the SEK-EUR exchange rate is 11.0. He repays EUR 20,000 when the exchange is 10.50.

Income: 20,000 x 11 = SEK 220,000

Deduction: 20,000 x 10.50 = SEK 210,000

Kalle makes an exchange-rate gain of SEK 10,000 on the repaid amount.

You May Like: Calculate Doordash Taxes

Cryptocurrency Taxation In The Uk

Because cryptocurrencies have become an important part of trading activities, we should also take a look into the basics of cryptocurrency taxation in the UK.

In accordance with UK tax law, individuals are liable to pay CGT when they sell cryptocurrencies for money, exchange one cryptocurrency for another, use the cryptocurrency to buy other types of assets and services, etc.

As it is the case with other types of assets taxed under CGT, taxable gains earned from cryptocurrencies represent the difference between the purchase price and the sale price. The tax rate is the one applied for CGT stated in the CFD section above. HMRC has implemented a tax framework for individuals as well as for businessses dealing with cryptocurrency and you need to know under which framework you will be taxed.

The mining of Bitcoin is also a taxable activity when you mine coins with a value above £1,000, but you can claim expenses on electricity and mining equipment such as rigs.

Forex Gains And Losses

A quick question.

I trade spot forex through forex.com. I have some losses and I would like to to know how do I file these losses on turbo tax. I printed out my trading transaction history for during 2014, and on the transaction, it reported a loss for the year. I spoke to a cpa through turbo tax and he said that they wouldn’t question if I filed my gains or losses through Box B, under Scheduled D.

Here is my questions.

#1-I would like to clarify if its proper for me to continue to file these gains/losses under schedule D since I was never sent a 1099-b form, rather a printout from the forex.com website?

#2- is trading spot currency through forex.com, or fxcm considered a foreign currency futures “contract” ?

#3-I’ve read over time that i should enter gains or losses under section 988. Am I still entitled to utilize capital loss carry over?

I just like to officially know how to file it properly on turbo tax.

Any help is much appreciated.

You May Like: How Do You Claim Doordash On Taxes

How To Decide Determine Your Pattern Of Trading

Factors that determine a trading pattern include:

- The frequency of your transactions

- The duration of your holdings

- Your knowledge and experience of the stock market and

- How much time you spend on the activity.

The type of securities you buy is also important. For example, lets say you focus mostly on blue chip stocks . These can produce dividends, and that might indicate youre purchasing them as an investment. If you invest more into penny stocks , those transactions would probably be considered business income.

One or more of these factors on their own wont necessarily determine how you should report your trading income. For example, the fact that you have a high volume of trades wont mean youre in business if your long-term intention is to build up your investment portfolio. On the other hand, a single transaction could be considered business income, especially if it was made in hopes of a quick profit. Collectively, however, this reveals a pattern of activity thats consistent with either an investment or business intention.

Description Of The Forex Income Worksheet

Transactions included on the Forex Income Worksheet are grouped by currency and each closing transaction is displayed on its own row.

Income and loss are displayed in USD for all 1099-eligible accounts. All non-1099 eligible accounts use the base currency specified in their IBKR accounts for the specific tax year.

The Forex Income Worksheet includes the following information:

| Column |

|---|

You May Like: Look Up Employer Ein Number

What Happens If You Dont Report Forex Income

Suppose you dont include your FOREX income while filing taxes because you assume that it is not taxable. And then, later on, you realize that the IRS requires you to account for it. In that case, you could file taxes later. But there will still be consequences.

Unfortunately, ignorance is not bliss. If you file your taxes late, you would not only owe the tax bill, but may also incur the failure to file and late payment penalties. The former will cost you five percent of your unpaid taxes for every month or part of the month your return is late until it reaches 25 percent of the total tax you owe.

If you file a tax return but dont pay taxes for the FOREX income you earned, you will likely incur the failure to pay penalty. That will cost you 0.5 percent of your unpaid taxes per month or part of the month you did not pay taxes, up to 25 percent of your pending bill.

In addition, you may be expected to pay an accuracy-related penalty for under-paying taxes on your reported income. Such penalties cost you 20 percent of the underpayment portion that occurred because of your disregard or negligence.

Read More:How to Calculate FOREX Margin

When To Calculate Gains Or Losses

- CRA says a foreign exchange gain or loss happens when a transaction occurs not when the currencys value fluctuates while on deposit. Examples of transactions include when:

- money is converted from one currency to another, or back into Canadian dollars

- foreign currency is used to make a purchase or payment or

- foreign currency is used to pay all or part of a capital debt.

Read Also: How To Calculate Sales Tax Backwards From Total

Statement Of Earnings And Deductions

Anyone who conveys a payment of more than SEK 150,000 to or from Sweden on behalf of a natural person, the estate of a deceased person, or a legal entity, must submit a statement of earnings and deductions regarding the payment. A statement of earnings and deductions must also be submitted for instalment payments when the total amounts to more than SEK 150,000. In the case of natural persons and estates of deceased persons, the obligation to disclose information applies only if the party in question has unlimited tax liability. In addition, a statement of earnings and deductions must be submitted for payments made within Sweden if one of the parties has unlimited tax liability and the other has limited tax liability.

A natural person with unlimited tax liability refers to all of the following:

- anyone resident in Sweden

- anyone staying in Sweden on a continuous basis

- anyone with significant connections to Sweden who has lived here previously

All other natural persons have limited tax liability, which means that only certain parts of their income are subject to taxation in Sweden. A statement of earnings and deductions includes details of the size of any payment made, the purpose of the payment, the country to or from which the payment was made, and the recipients name.

What Is Forex & Currencies Trading

The word forex, also known as FX, is an abbreviation for foreign exchange. Foreign exchange refers to an act of changing one currency from into another for various reasons grouped as trading or tourism. Hence, currencies are traded in the forex market. There is no central place for this market. Still, it is traded over-the-counter internationally and runs 24×7, not bound by time. The price quotes change regularly and it is one of the highly volatile markets. It must be noted that forex is one of the largest traded across the globe.

A typical example of forex trading is where an Indian importer wants to convert Indian rupees into US Dollars for paying the US supplier. More casually, a person travelling from India to the US must hold US Dollars during his stay in the USA.

There are multiple ways of trading in forex. It includes forward and futures markets, hedging, and speculation.

Read Also: How To File Taxes From Doordash