Adding 20% Vat Is A Straightforward Calculation But Reverse Vat Can Be Tricky

Adding 20% VAT to a price is easy,

e.g. to add 20% VAT to £100.00 simply multiply £100.00 x 1.2 = £120.00

But calculating what is the VAT portion of £120.00 is not as simple as taking 20% of £120.00 .

Notice how adding 20% VAT is not the same as removing 20% VAT

Calculating VAT backwards or calculating VAT in reverse can sometimes be tricky as you cant simply take 20% off the VAT included price to calculate the VAT portion.

To help you out we have developed this handy little VAT Calculator, that calculates VAT backwards or forwards or in reverse, if you prefer.

Calculate The Combined Sales Tax Rate

Collect an additional $31.92 from the customer for sales tax. Then, remit the sales tax to the appropriate government. Many states provide a day or weekend where consumers can shop without paying sales tax.

Because sales tax can vary by state and by item, it can be difficult to predict exactly how much youll pay, but not nearly as hard to get a general idea. First of all, if youre shopping in New Hampshire, Oregon, Montana, Alaska, or Delaware, the sticker price will be the total price. If your business has nexus in several locations, you might need to collect and remit sales tax for other states, too.

How Businesses Calculate Sales Tax With Examples

Anyone who uses your calculator must enter an email address or phone number. Well send you an email report with contact information each time your calculator is used. This field should already be filled in if you are using a newer web browser with javascript turned on. If its not filled in, please enter the web address of the calculator as displayed in the location field at the top of the browser window . If you have a question about the calculators operation, please enter your question, your first name, and a valid email address. If the price you entered above includes sales tax, move the slider button to the « Yes » position.

These are the current rates for the date and time you submitted the address, but may change at any time with new tax legislation. Returns for small business Free automated sales tax filing for small businesses for up to 60 days. After running transactions, follow the steps below to manually back out the estimated tax from each departments total sales.

Don’t Miss: What Does It Mean To Grieve Taxes

How Do You Find The Original Price Before Tax

How to find original price before tax?

Add 100 Percent To The Tax Rate

Add 100 percent to the sales tax rate. The 100 percent represents the whole, entire pre-tax price of the item in question when you add it to the tax rate, you get a total percentage that represents the pre-tax price plus the tax. So if the sales tax in your area is 8 percent, you have:

100 + 8 = 108 percent

Also Check: Tsc-ind Ct

What Is Sales Tax

Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Wondering how to report your childs foreign accounts? Let the experts at H& R Block explain the forms required for reporting this information.

It has now become easier to understand and determine the cost margin for consumers and the buyer. Keeping an insight and know-how regarding the sales track may facilitate retailers and buyers to check on the standard sales tax or value-added tax.

In most cases, services are not taxable, though some states have changed that in recent years. If you are a service provider, such as a graphic designer or plumber, double check with your state to ensure that you arent required to collect sales tax. A laptop has a listed price of $790 before tax. If the sales tax rate is 6.5% find the total cost of the laptop with sales tax included. Round your answer to the nearest cent as necessary. The Sales Tax Institute keeps an updated list of the range of sales taxes in every US state. While you can go down an online rabbit hole trying to figure out whether youll owe 3% or 3.5% sales tax, you might want to just use the high end of the tax range.

How To Calculate Sales Tax Backwards From Total

Whether you’re trying to get back to the pre-tax price of an item as part of a word problem or calculating the sales tax backwards from a receipt in your hand, the math is the same. You’ll need to know the total amount paid and either the amount of tax paid, which will let you calculate the tax rate, or the tax rate, in which case you can calculate the amount of tax paid.

Also Check: Doordash 1099 Nec

Sales Tax By States In 2021

To demonstrate the diversity of sales taxes in the United States, you can find more details about the applied sales taxes in U.S. states in the following table. Besides, you can check when the different states introduced the sales tax and if there is an exemption or reduced rate on sales of food.

| State |

|---|

How Do You Calculate Sales Tax Backwards From A Total

How to Calculate Sales Tax Backwards From Total

Don’t Miss: When Do You Do Tax Returns

How To Calculate Sales Tax Before

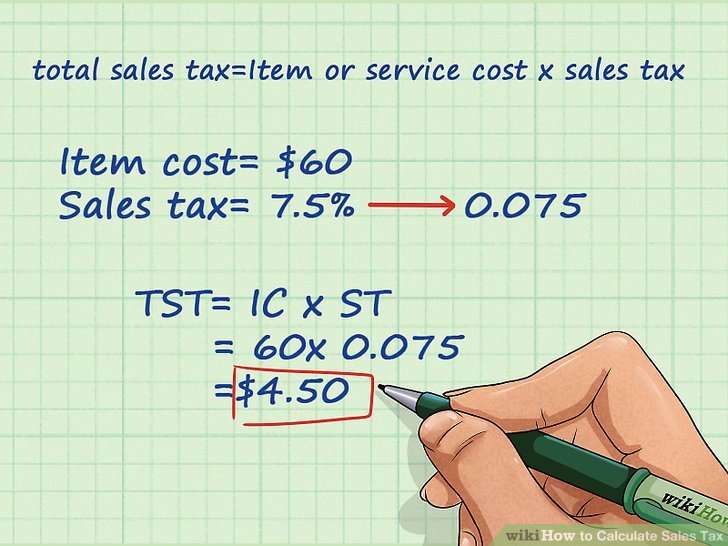

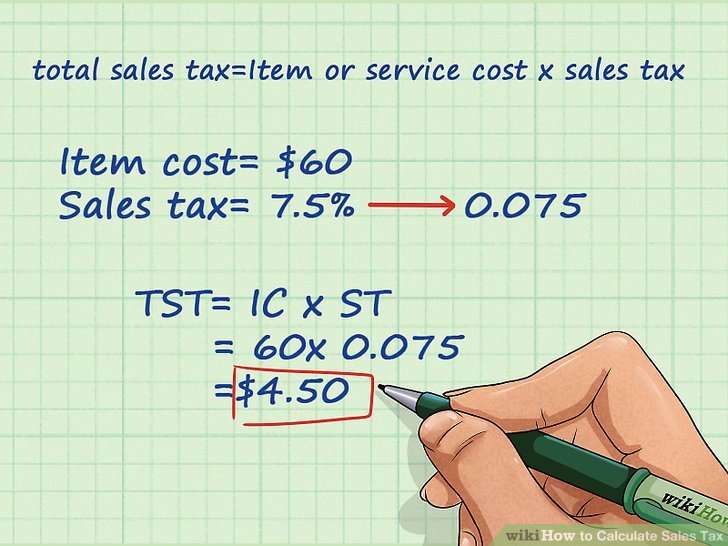

How to Calculate Sales Tax

In case you are interested in doing the calculation manually, here is how to calculate sales tax:

How to Calculate The Before-Tax Price When Tax Is Included

If you know the sales tax rate and the price with tax included, here is how you calculate the before-tax price:

To save you from doing the calculations manually, I have included the following reverse sales tax calculator for calculating the before-tax price and sales tax amount from the final amount paid.

How to Calculate the Sales Tax Rate From a Purchase Receipt

If you know the base price and the price paid after tax, but not the rate itself, here is how you calculate the rate:

Sales Tax In The United States

As mentioned before, most of the states in the U.S. apply a single-stage retail sales tax with different rates and scopes: there are 46 different sales taxes with distinct exclusions. As Schenk and Oldman pointed out, the relatively high diversity in the enacted tax law in various states have several economic implications:

- Business conducted on a nation-wide scale need to devote substantial resources to comply with many states and local sales taxes. It increases the complexity and administrative costs related to businesses.

- As most of the services are not subject of sales taxes, the total tax base is shrinking due to the expanding trend of electronic services and the increase in the sharing economy .

- Tax evasion is expanding as the current sales tax system inefficiently tax most cross-border and mail order shopping by consumers.

These issues become more relevant if we take into consideration the significant contribution of sales taxes to state revenues and the current transformation of the economy. It is not surprising then that recent studies have begun to address these problems and examine the possibility of a nation-wide introduced federal VAT or another consumption-based tax which may coexist with the state-level sales tax.

You May Like: Www.1040paytax.com

Set Up A Sales Tax Calculation Formula

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized.

You would pay $39.00 plus $2.83 in sales tax for a total of $41.83. Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 . Determine how elasticity is related to the revenue from a sales tax. Because sales tax can vary by state and by item, it can be difficult to predict exactly how much youll pay, but not nearly as hard to get a general idea.

Income Taxes In Canada

Therefore various entities and companies ask for a slender deduction in monetary compensation, often equitable to sales tax. Convert tax percentage into a decimal by moving the decimal point two spaces to the left. Quarterly newsletter to keep up with changes in calculations / rates and improvements. AccountEverything you need to grow your business and operate internationally without the high fees, hefty admin, and headache of a local bank. For purchases by mail, phone, or the Internet, input the shipping City & Zip Code, unless your states taxation policy is origin-based. For purchases in person from your store, input the store City & Zip Code. When readers purchase services discussed on our site, we often earn affiliate commissions that support our work.

Read Also: Is Freetaxusa Legitimate

Ast Groupes Returns Have Hit A Wall Simply Wall St

AST Groupes Returns Have Hit A Wall.

Its important for businesses to know how to use the sales tax formula so that they can charge their customers the proper amount to cover the tax. For consumers, its good to know how the sales tax formula works so that you can properly budget for your purchases. There is another uncomplicated way to determine the sales tax.

Replicons Time Intelligence platform is a new way of analyzing and tracking employees time. It provides one trusted hub for time and work, performs intelligent processing based on AI and Machine Learning. Learn more on how to optimize your companys most valuable asset Time.

The register total for March 16 is $10,400. Make the entry to record sales taxes payable and sales.

Because ShopKeep does not officially support tax-inclusive pricing or VAT, you will need to manually calculate the estimated amount of tax collected at the register. When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized.

Author: Barbara Weltman

Not EXACTLY what you need? We specialize in custom and semi-custom display solutions. Contact us about creating something that fits your exact specifications.

Reverse Sales Tax Formula:

If you file your taxes jointly with your spouse, you are required to add all of your income together to determine the total. You can combine your deductions, and you pay your taxes jointly. Learning how to calculate your taxable income involves knowing what items to include and what to exclude. Youll need to know your filing status, add up all of your sources of income and then subtract any deductions to find your taxable income amount. Find the total amount of $150.00 item with a 10% sales tax assessed. When calculating tips, you add the amount back to the total of the bill for the final cost of the meal.

Read Also: H& r Block Early Access W2

Add 100% To The Tax Rate:

The first thing that you need to do is to add 100% to the sales tax rate. The 100 percent represents the whole, entire pre-tax price of the item in question. This means that when you add it to the tax rate, you get a total percentage that represents the pre-tax price plus the tax.

Lets say that the sales tax in your area is 8%. So. you will need to:

100 + 8 = 108 percent

How To Calculate Reverse Percentage

If you have a starting amount and you want to add a percentage, simply multiply the percent by the original amount to find the amount that gets added. For example, if you need to calculate how much sales tax or tip to add to the bill. But if you only have the final amount know the percentage added, you need to work in reverse to find the original amount. For example, if you had the final cost and the percentage of sales tax and you want to know the cost before tax.

Divide the percentage added to the original by 100. For example, if a sales tax of 6 percent was added to the bill to make it $212, work out

Add 1 to the percentage expressed as a decimal. In this example,work out

Divide the final amount by the decimal to find the original amount before the percentage was added. In this example, work out

The amount before the sales tax was added is $200.

Subtract the original amount from the final amount to find the amount added. In this example, work out

Also Check: Plasma Donation Taxes

How To Use The Sales Tax Formula

Conditions and exceptions apply see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Fees apply to Emerald Card bill pay service.

Case company suggested retail price/Assessed price includes tax amount and freight value. The suggested material prices are region wise based on customer registered 17% tax and non-registered meaning 20% tax status. Now client requirements are to first calculate the freight and GST from suggested retail price.

- In this case, you may collect a state sales tax rate, but also a percentage set by the county or city.

- Sales tax is a consumer tax, so businesses need to charge the sales tax amount at the time of purchase.

- What if I receive another tax form after Ive filed my return?

- Figuring sales tax rates can be complicated due to tricky sales tax laws.

- Nailing down the rates is much more complicated than the actual math used to determine how much sales tax youll be paying thats just a simple percentage.

- Some states exempt certain items from their sales tax.

This article has been viewed 1,826,992 times. Include your email address to get a message when this question is answered.

How Do You Do Discount In Math

The basic way to calculate a discount is to multiply the original price by the decimal form of the percentage. To calculate the sale price of an item, subtract the discount from the original price. You can do this using a calculator, or you can round the price and estimate the discount in your head.

Don’t Miss: Pastyeartax Com Reviews

Subtract The Tax Paid From The Total:

The first thing you need to do to calculate sales tax backwards is to subtract the amount of tax that you paid for the product from the total price that you paid.

Lets imagine that you paid $26.75 in total for two books, and you know from looking at the receipt that $1.75 of that was the tax. So, according to this information, the pr-tax cost of the books was:

$26.75 $1.75 = $25

States Without Sales Tax

In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid. The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. In Texas, prescription medicine and food seeds are exempt from taxation. Vermont has a 6% general sales tax, but an additional 10% tax is added to purchases of alcoholic drinks that are immediately consumed. These are only several examples of differences in taxation in different jurisdictions.

All prices are subject to change without notice. Your total gross income is determined by adding up all types of income that you have received during the calendar/tax year. There are different lines on the front of the Form 1040 and Schedule 1 for different types of income, but by the time you get to the end, you will have added it all up.

You May Like: Doordash Mileage Calculator

How To Calculate Tax Percentage

To calculate tax percentage, you need to subtract the tax paid from the total, divide the tax paid by the pre-tax price, and finally convert the tax rate to a percentage. Please follow these steps:

- Deduct tax paid from the total amount

You can withdraw the amount of tax you have paid from the total amount, which will be the goods post-tax price. This will take you to the items price before the tax allocation therefore, you will get the items pre-tax price. For example, if you have paid $26.75 for two things and $1.75 was the amount of tax applied as mentioned in the receipt, then the items cost before the tax was $25. This amount has been derived after dividing the total cost for two things and the tax amount.

- Divide the paid tax amount by the pre-tax number

You can also determine the sales tax by dividing the total amount of tax you have paid as a buyer by the items price before the tax. The resulting amount will be the percentage tax rate which will be highlighted in a decimal form. For example dollar, 1.75÷25 dollars is equal to .07. Therefore you have paid .07% of the tax amount.

- Conversion of the tax rate to percentage form

How to find the price before sales tax? To find the price before sales tax, you need to do the reverse tax calculation described below: