How Do I Get My Corporation Tax Transcript

How To Receive a Tax Transcript From the IRS

Subsequently, one may also ask, how do I get a corporate tax transcript?

To get a transcript, people can:

Additionally, how can I get my tax transcript online immediately? You can get your free transcripts immediately online. You can also get them by phone, by mail or by fax within five to 10 days from the time IRS receives your request. To view and print your transcripts online, go to IRS.gov and use the Get Transcript tool. To order by phone, call 800-908-9946 and follow the prompts.

Beside this, why is my tax transcript not available?

If you didnt pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. Refer to transcript availability for more information.

How do I get my transcript from 1120s?

Paper Request Form Irs Form 4506t

ONLY the Tax Return Transcript can be obtained using the 4506T-EZ. If you require other IRS documents, as well, and you need or choose to use a paper request form, use the IRS Form 4506-T, instead, as all of the IRS documents may be ordered together on that one form.

NOTE: If any information does not match IRS records, the IRS will notify the tax filer that it was not able to provide the transcript.

Why You Might Need An Irs Transcript

You might need your transcripts for any number of reasons. Maybe you just need your AGI, or you want to track and confirm payments youve made to the IRS. Most taxpayers access their transcripts because they must verify their income information for some reasonsuch as loan and student aid applications. You might also need transcripts to apply for housing assistance or federal health care programs.

Maybe youve just realized that your record-keeping habits arent all that they should be, and you have no record of your relationship with the IRS. In any case, getting transcripts isnt usually a prohibitive process for most taxpayers.

Also Check: Irs Employee Search

Is A Transcript The Same As A W2

A transcript will include information reported on Form W-2, Form 1099 series, Form 1098 series, and Form 5498 series. If a full transcript is not required, taxpayers have the option to request only a copy of Form W-2. In this case, taxpayers must request full copies of their tax returns for the year needed.

How To Get An Irs Transcript Of Llc Partnership 1065

spouse and i have an LLC . we filed form 1065 with IRS. the 1065 creates K-1’s that we then used to complete our personal 1040’s . .. BUT IRS is saying the LLC owes fed taxes?!?

I want to get a copy of the tax transcript .

1. is it true that i cannot create an online account and download the transcript?

2. if not, i am ready to complete form 4506-T .. I assume I put the name and address of the LLC business location and not my personal info?

3. do i have to pay for this?

wrote:

3. but that begs a more fundamental question… could the amt the irs is asking me for be solely due to the fact that i filed it late?

Yes. The penalty is $210 for each month or part of a month the failure continues, multiplied by the total number of persons who were partners in the partnership.

Don’t Miss: Do I Pay Taxes On Plasma Donations

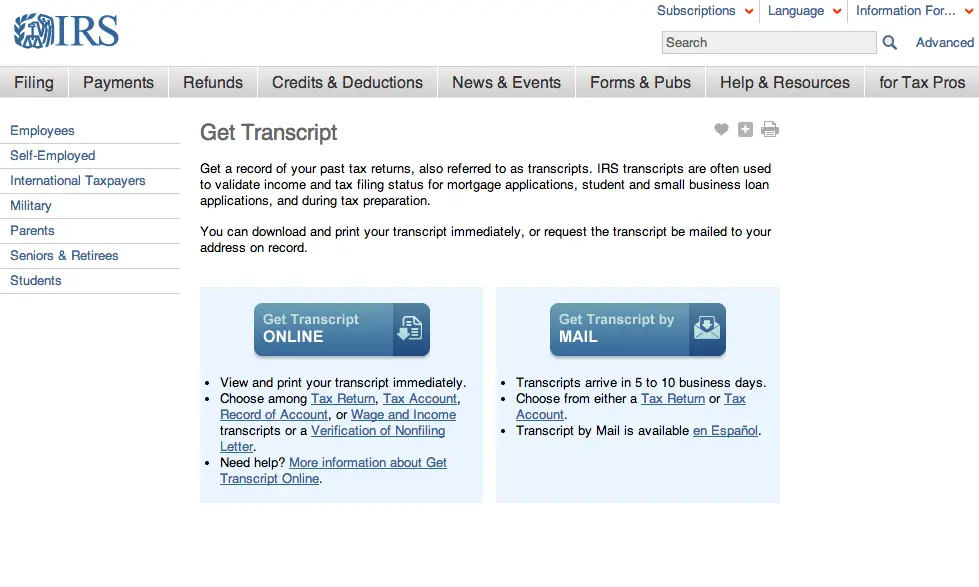

How To Obtain Irs Tax Transcripts

Its easy to get your IRS tax transcript. You can obtain reports going back as far as three years. All transcripts are free, and you have several options for requesting a copy. The IRS2Go mobile app allows users to easily access their tax transcripts. If the IRS can verify your identity online, you can instantly access your transcripts through IRS2Go or the Get Transcript feature on IRS.com.

Unfortunately, you have to request a transcript by mail if you cant prove your identity online. You can request a tax transcript by mail using the IRS website and mobile app too. However, if youre not technically inclined, you can request a tax transcript the old fashioned way using an IRS form. You can use Form 4506-T to request your tax return transcript through the mail.

You can also use your phone to request your IRS tax transcripts. The IRS has a toll-free phone line that handles these requests, and you can call it at .

If you order your transcript online or via phone, it typically takes about 15 days to arrive. It can take up to 30 days to receive a transcript with a mailed request.

Also Check: How To Appeal Property Taxes Cook County

Irs Get Transcript For Business

The Internal Revenue Service offers various tools for taxpayers to make their life easier. As a business owner, one of the few tax tools youre going to use often when necessary is the Get Transcript online tool.

When youre applying for a new credit line or a mortgage for your business, lenders oftentimes require business owners to present their tax transcripts. Although a tax transcript doesnt include detailed information compared to a copy of a tax return, it still provides enough to let the financial institutions know whether or not youre responsible for your payments.

Your tax transcript will show your adjusted gross income, which is what most lenders are after as your income is a good determination point for them to see if youre going to be able to make your payments on time. You can also notice other relevant basic information that went into your federal income tax return. The best part about tax transcripts is that youll be able to get them not only for the most recent tax season but previous tax seasons as well. The IRS generally generates tax transcripts for as far back as the mid-2000s.

Don’t Miss: Is Donating Plasma Taxable Income

How Do I Download Previous Years Tax Returns

It is summed up in the following steps.

How Can You Get Your Tax Transcript

There are two main ways get your tax transcript from the IRS:

Don’t Miss: Do You Pay Taxes On Donating Plasma

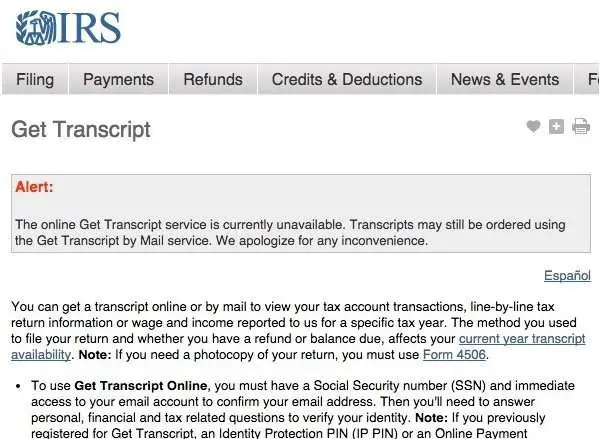

Q4 I Got A Message That Says The Information I Provided Does Not Match What’s In The Irs Systems What Should I Do Now

Verify all the information you entered is correct. It must match what’s in our systems. Be sure to use the exact address and filing status from your latest tax return. If youre still receiving the message, you’ll need to use the Get Transcript by Mail option or submit a Form 4506-T, Request for Transcript of Tax Return.

Reviewing Before The End Of The Year

You should always review your IRS tax transcript at the end of the fiscal year to ensure your numbers line up. This information can help you ensure that your tax filings are correct. Sometimes, you can even find information that will help you reduce your tax bill. If youre unfamiliar with proper tax planning procedures, you should speak to a professional. A tax advisor can help you review your tax transcript and ensure that your filings match up with the data the IRS has on file. This can help you avoid the mistake that could result in expensive IRS penalties. Plus, a certified tax pro can help you find every available discount so you can minimize your tax bill.

Search

Recommended Reading: H& r Block Early Access W2

Requesting A Transcript By Phone

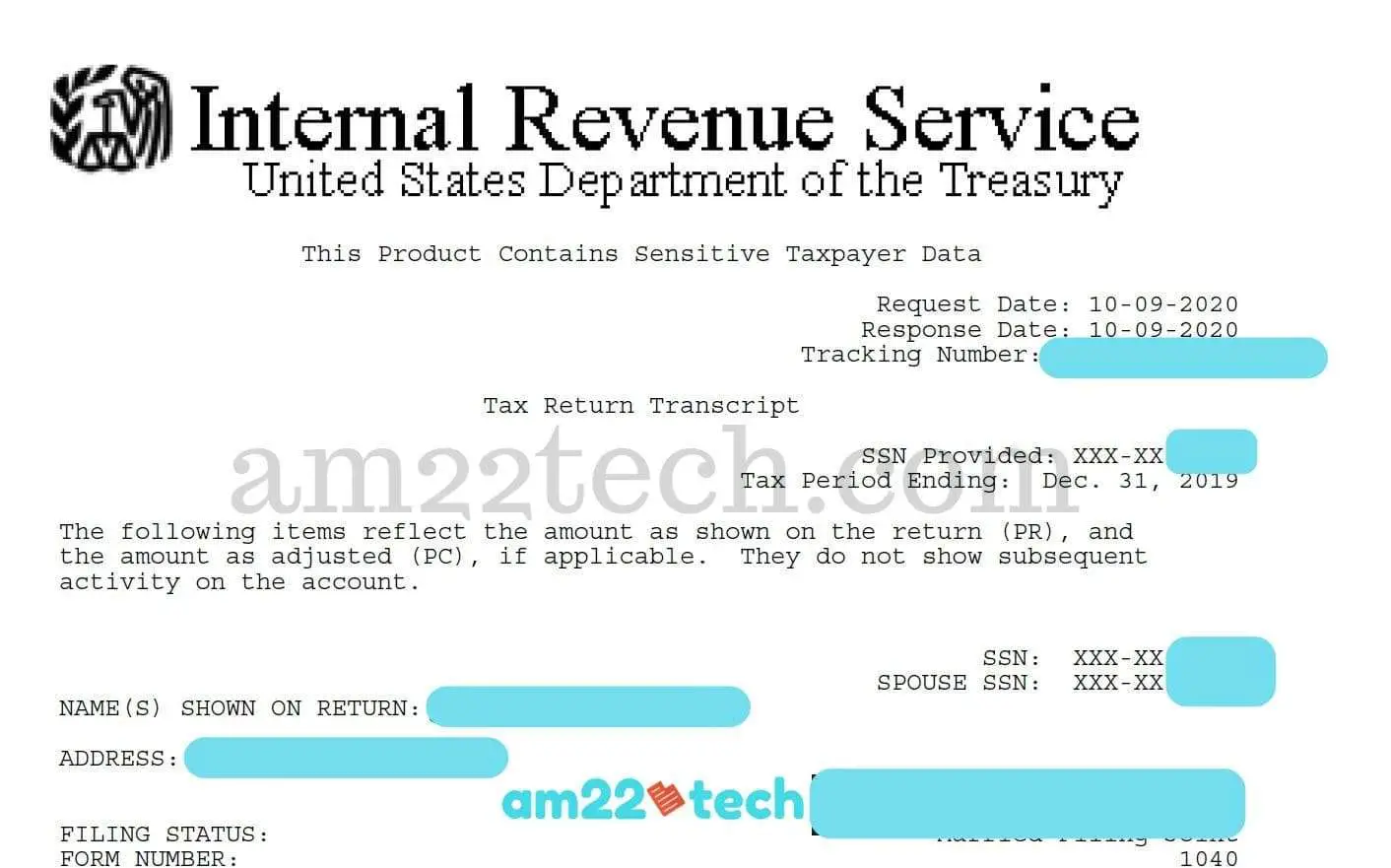

What Is A Tax Transcript

The IRS tax transcript, you will receive a document that has all of the information you provided on your tax return, including your income, your filing status and the deductions and credits you claimed.

Because these types of tax return transcripts can be a gold mine of data for identity thieves and other fraudsters, the IRS will mask your personal information like your telephone number, complete account number and the first five digits of your Social Security Number. However, you already have that information you wont need it to make your tax filing easier.

All of the information that you do need, such as your financials, will all be fully displayed.

If you work with an accountant and you want them to access the transcript, they must complete IRS Form 4506-T, the Request for Transcript of Tax Return. There, they will need to designate a customer file number, which must be different than your Social Security number. This number will be added to the IRS transcript database.

You May Like: Stripe Doordash 1099

Copies Of Tax Returns

Taxpayers who need an actual copy of a tax return can get one for the current tax year and as far back as six years. The fee per copy is $50. A taxpayer will complete and mail Form 4506 to request a copy of a tax return. They should mail the request to the appropriate IRS office listed on the form.

Taxpayers who live in a federally declared disaster area can get a free copy of their tax return. More disaster relief information is available on IRS.gov.

Also Check: 1040paytax.com Official Site

How Can I Get My Tax Transcripts Immediately

You can get your free transcripts immediately online. You can also get them by phone, by mail or by fax within five to 10 days from the time IRS receives your request. To view and print your transcripts online, go to IRS.gov and use the Get Transcript tool. To order by phone, call 800-908-9946 and follow the prompts.

You May Like: Appeal Cook County Property Taxes

Question: What Tax Transcripts Can Be Obtained From The Irs And What Are Some Specific Circumstances In Which Tax Transcripts Prove Useful

There are a variety of tax transcripts. Tax transcripts contain the information that taxpayers transmit to the IRS by filing a tax return, filing information returns, filing elections, submitting correspondence, or making payments. The IRS synthesizes that information in a database known as the Integrated Data Retrieval System . This information is divided into the Individual Master File , the Business Master File , the Employee Plans Master File , and the Individual Retirement Account File.1

How a taxpayer or practitioner obtains tax transcripts has changed in recent years due to steps the IRS has taken to modernize its information technology systems and safeguard sensitive taxpayer information. To obtain tax transcripts, those seeking taxpayer information must meet specific authorization requirements, because the IRS is legally bound to protect taxpayer information and as a result will not release information if authorization procedures are not successfully followed.

What If You Need Your Actual Tax Return

If your tax transcript won’t meet your needs, you can still access your tax return in other ways. If you used TurboTax Online to prepare your taxes, you can access your tax return by signing in to your TurboTax account and navigating to the “Your tax returns & documents” section.

If you prepared your taxes in another way, you need to complete IRS Form 4506 and mail it to the IRS along with a $43 fee for sending you a copy of your tax return . These requests can take up to 75 days to process. So, you’ll want to make sure a tax transcript won’t cut it before starting this process.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Recommended Reading: Irs Employee Lookup

Q6 My Transcript Information Doesn’t Appear To Be Correct What Should I Do

In some cases, we may have changed the reported figures on the original return you filed due to input errors or incomplete or missing information. If we changed the figures on your return during processing, a tax return transcript will show your original figures, labeled “per return,” and the corrected figures labeled “per computer.” It won’t show amendments or adjustments made to the account after the original return has posted. If you filed an amended return or we adjusted your account after it was processed, request a record of account transcript. If the transcript obtained doesn’t appear to be correct or contains unfamiliar information due to possible identity theft, call us at .

Its A Simple Process And You Can Do It Online

You probably know youre supposed to keep copies of your filed tax returns for a period of years, but life happens. The Internal Revenue Service provides tax transcripts if you need to lay your hands on an old return that you lost or didnt save. The IRS is also glad to provide you with other forms and information about your tax history, free of charge.

Keep reading to learn more about the documents the IRS can provide you with, and how to get them.

Also Check: Claiming Home Improvement On Taxes

Q3 What If I Can’t Verify My Identity And Use Get Transcript Online

Refer to Transcript Types and Ways to Order Them for alternatives to Get Transcript Online. You may use Get Transcript by Mail or you may call our automated phone transcript service at to order a tax return or tax account transcript be sent by mail. Please allow 5 to 10 calendar days from the time we receive your request for your transcript to arrive. The time frame for delivery is the same for all available tax years.

Requesting A Transcript For A Business

Also Check: Cook County Appeal Property Tax

You May Like: Appeal Cook County Taxes