Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made electronically before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.

Do Corporations Pay State & Federal Taxes

Corporations are required to pay taxes and the IRS sets a tax rate that depends on the corporation’s taxable income, taking into account deductible expenses, exempt income, and tax credits. The business structure and state it’s located in affect the tax rate.

For tax purposes, corporations can be either S or C, with S corporations passing on net income to shareholders and C corporations paying taxes on their business net income.

A limited liability company may choose how it wants to be taxed. The IRS allows LLC partners to report their earnings as passive income to avoid paying Medicare and Social Security taxes. If the LLC files as a C Corporation, it pays income taxes at corporate rates.

Companies rely on different methods to lower their taxes or to avoid them altogether, which is why Congress passed a law requiring an alternative minimum tax with a base rate of 20 percent of net income. Corporations must calculate this AMT and regular taxes, and pay the higher amount.

How State Income Tax Rates Work

In general, states take one of three approaches to taxing residents and/or workers:

No tax income at all.

Flat tax. That means they tax all income, or dividends and interest only in some cases, at the same rate.

Progressive tax. That means people with higher taxable incomes pay higher state income tax rates.

If, like most people, you live and work in the same state, you probably need to file only one state return each year. But if you moved to another state during the year, lived in one state but worked in another or have, say, income-producing rental properties in multiple states, you might need to file more than one. And because the price of most tax software packages includes preparation and filing for only one state. Filing multiple state income tax returns often means paying extra.

Recommended Reading: How To Report Ppp Loan Forgiveness On Tax Return

Payment For A Tax Due Return

You may choose a from a checking or savings account when the return is e-filed and supported by the software. A direct debit is a tax payment electronically withdrawn from the taxpayer’s bank account through the tax software used to electronically file the individual income tax return. Submitting the electronic return with the direct debit information provided, acts as the taxpayer’s authorization to withdraw the funds from their bank account. Requesting the direct payment is voluntary and only applies to the electronic return that is being filed.

Payments can be made by using the Michigan Individual Income Tax e-Payments system.

- If you have received an assessment from the Michigan Department of Treasury’s Collection Services Bureau, use the Collections e-Service payment system.

- Payments for 2020 tax due returns can be made using this system. Prior year payments are currently not accepted electronically.

- Any payment received after April 15th will be considered late and subject to penalty and interest charges. However, you may submit late or partial payments electronically.

- Estimate penalty and interest for a tax due return.

Payment can also be made by check or money order with your return. Make checks payable to “State of Michigan,” print your complete Social Security number and appropriate tax year on the front of your check or money order.

Can You Pay Taxes Online

Taxpayers can also pay their taxes by debit or credit card online, by phone or with a mobile device. The IRS does not charge a fee, but convenience fees apply and vary depending on the card used. Installment agreement. Before applying for any payment agreement, taxpayers must file all required tax returns.

You May Like: Pastyeartax.com Reviews

Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return, IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

- Washington

- Wyoming

You May Like: Is Plasma Donation Money Taxable

Adjusted Gross Pay For Social Security Wages

When you determine the gross wages, you need now to calculate adjusted gross income from pay stub. You may need to pay closer attention to these calculations. Before calculating the income tax and FICA withholding, there are some payments to employees you must remove. Notably, the type of payments excluded in Social Security wages may differ from those removed from the federal income tax.

You can check IRS Publication 15 pages 3842 to see the complete list of payments to employees. Youll also be able to tell which ones are included in the Social Security wages and which ones are subject to income tax withholding by the federal government.

How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

States With Reciprocal Tax Agreements

What if you live in Milwaukee but you commute every day by Amtrak to Chicago? It just so happens that Wisconsin and Illinois share what is known as a reciprocal tax agreement. Reciprocal agreements allow residents of one state to work in neighboring states without having to file nonresident state tax returns in the state where they work. As a result, your employer would deduct only Wisconsin state taxes from your paycheck, and none for Illinois. Likewise, if you live in Chicago but work in Wisconsin, your employer would only deduct Illinois resident state income taxes from your paycheck. In both instances, you would only be required to file one state income tax return.

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 238,000 electronic payments in 2020. The Department also received more than 2.6 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Recommended Reading: How Do I Protest My Property Taxes In Harris County

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

My Employer Hasnt Been Withholding Any Taxes From My Paychecks At Alldo I Still Have To File A State Return For My Employers State

In this case, your resident state and employers state probably have a deal between them called a reciprocity agreement. Reciprocity means that your employer doesnt have to withhold anything for state taxes, and all you have to do is file a state return for your resident state.

That said, you should check and make sure your resident state and your employers states have a reciprocity agreement. If not, your employer may have dropped the ball. You are still responsible for filing correctly, though, so you should check the residency rules for your employers state to make sure you arent required to file a tax return there.

To play it safe, consider filing a tax return for any state youre not sure about.

Don’t Miss: Have My Taxes Been Accepted

Attributes Of Corporate Income Taxes

Corporate income tax has many attributes:

- It primarily affects the state’s most affluent residents

- The tax is exported to other states and even countries since corporations have shareholders around the country

- Most income of wealthy Americans would go untaxed without the corporate tax, since they would treat personal income as being corporate

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B-NRA reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

Also Check: How Can I Make Payments For My Taxes

State Taxes On Social Security

Thirteen states tax Social Security benefits in some cases. If you live in one of those statesâColorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, or West Virginiaâcheck with the state tax agency. As with the federal tax, how these agencies tax Social Security varies by income and other criteria.

My Company Has Been Withholding Taxes For The Wrong State Will I Get That Money Back Or Will They Send It To The Correct State

If your employer state cant claim you through residency or the Convenience of Employer rule, you wont owe taxes to that state. If you did live in the state for part of the year, youd likely only owe taxes for the months you were a resident.

However, getting the withheld money to the correct state is not as simple as your employer saying, whoops, Ive been withholding taxes for the wrong placelemme just send that over.

First, youll have to file a tax return for both states. For your employer state, youll file a nonresident or part-year resident return .

Once you do, either your employer state will send you a refund for the taxes withheld, or the states will settle up with each otherin that case, your resident state will give you a tax credit for the withheld amount.

You May Like: Www Aztaxes Net

States With Flat Tax Rates

Among the states that do have income taxes, many residents get a break because the highest rates don’t kick in until upper-income levels. But this isn’t the case in the ten states that have flat tax rates as of 2021. The flat-tax states and their rates, from highest to lowest, are:

- North Carolina: 5.25%

- New Hampshire: 5.00%

- Illinois: 4.95%

- Pennsylvania: 3.07%

Individual Income Tax Return Payment Options

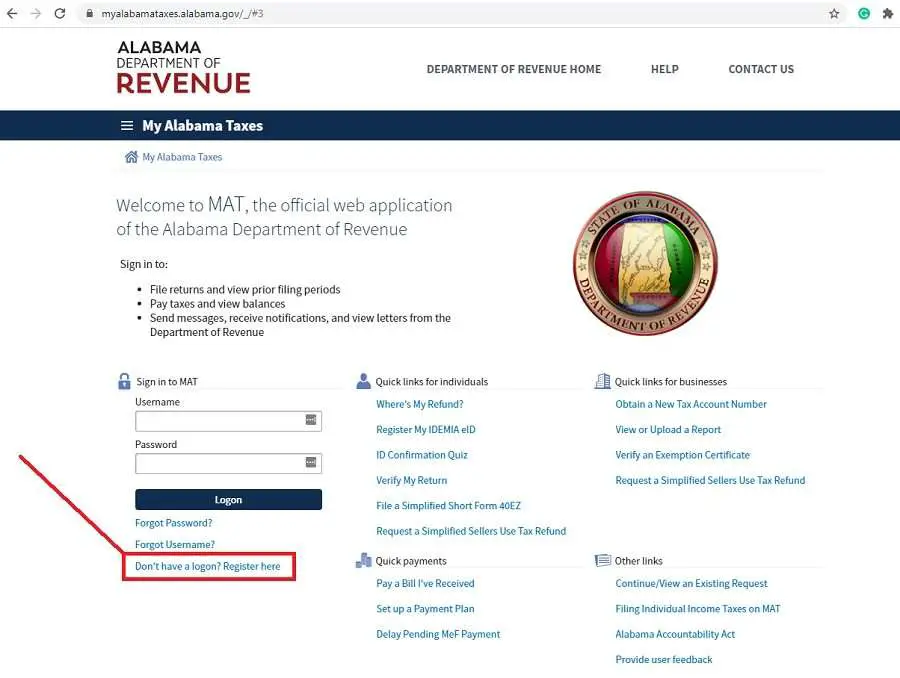

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

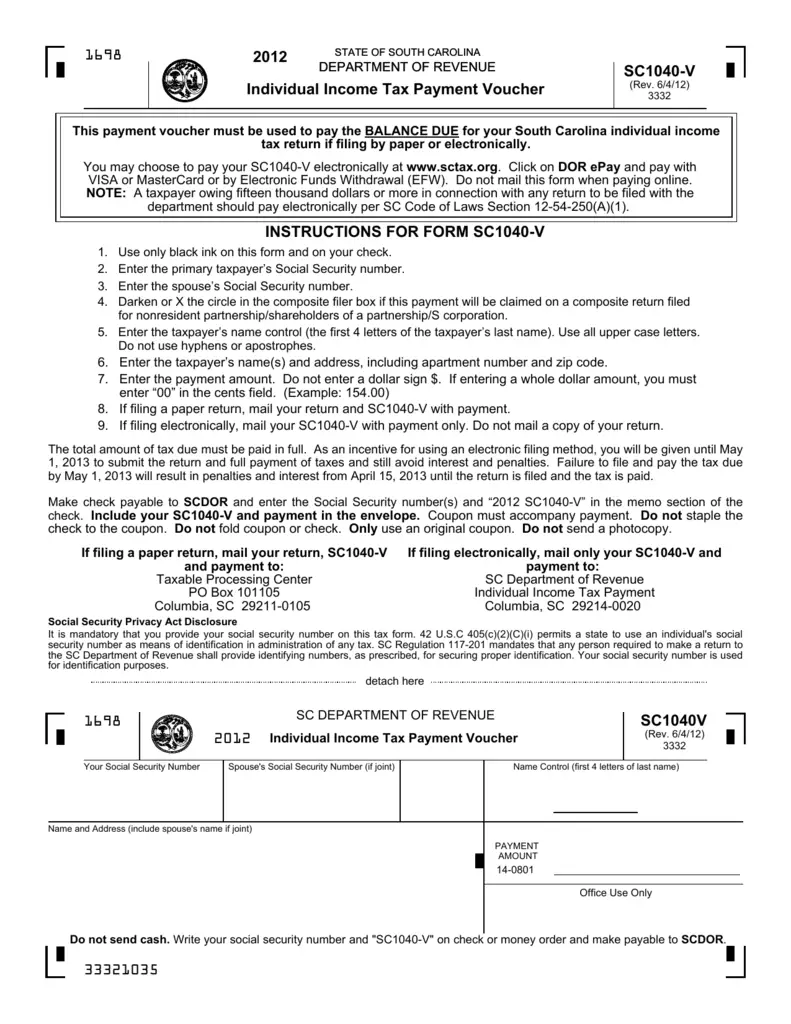

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.

Don’t Miss: How To Buy Tax Lien Properties In California

How To Withhold State Income Tax From Employee Pay

Unless your business location is in a state which has no state income tax, you have a responsibility as an employer to deduct income taxes from employees who work in your state and to submit these taxes to your state department of revenue. The states with no state income tax are Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

These responsibilities are the same as employer responsibilities for payroll taxes, including federal income taxes.

How To Pay Pay Your Personal Income Tax

Online

Department of Revenue recommends using MassTaxConnect to make tax payment online. You can make your personal income tax payments without logging in. You can use your credit card or Electronic Fund Transfer from either your checking or saving account. Note that there is a fee for credit card payments.

You can send us a check or money order through the mail to make your income tax payment.

When you make a payment by sending a paper check, be sure to enclose your payment voucher with it.

You can find your payment voucher attached to your tax bill.

If you’re making estimated tax payments, be sure to include an estimated tax payment voucher. The correct mailing address will be printed on your payment voucher.

Estimated payments:

Also Check: 1040paytax.com Official Site