How Do Solar Loans Affect The Solar Tax Credit

There are two types of solar loan in relation to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to the lender to buy down your principal and secure that monthly payment. If you do not put your tax credit back into your loan, this will initiate another loan, in the amount of your tax credit, at the same APR.

The second type of solar loan is one in which there is a different payment amount for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit, youll have the option to use it to re-amortize your loan to secure lower monthly payments. You can also keep the federal tax credit, and your payments will remain the same. Solar.com can help figure out which solar financing option is best for you.

The Commence Construction / Safe Harbor Clause

With residential solar installations, our general guidance , is that to qualify for the ITC in a certain year, a project must both be fully installed and receive its permission to operate from the utility. With commercial installations, on the other hand, theres the commence construction and safe harbor clause of the ITC, both of which allow you to claim the full ITC for a certain tax year even if you have not yet completed the installation and interconnected it to the grid.

The commence construction clause states that the construction of the project must have started by the end of the year to qualify under that tax year. In other words, if youve started your installation by December 31, 2021, you can claim the full 26 percent ITC when you file your 2021 taxes during 2022. But in the case of a residential property, you would have to wait to claim the ITC until you file your 2023 taxes in this scenario.

Notably, in each of these scenarios, there is a limit to how far out you can push the construction youll need to complete the project within the next five years or so. But if your goal is to lock in a higher rate of ITC for a certain tax year but move to install right after the start of the new year, this shouldnt be a problem.

What Is The Solar Tax Credit

The Solar ITC is a 26% tax incentive on your gross solar system cost.

The only requirements are that you:

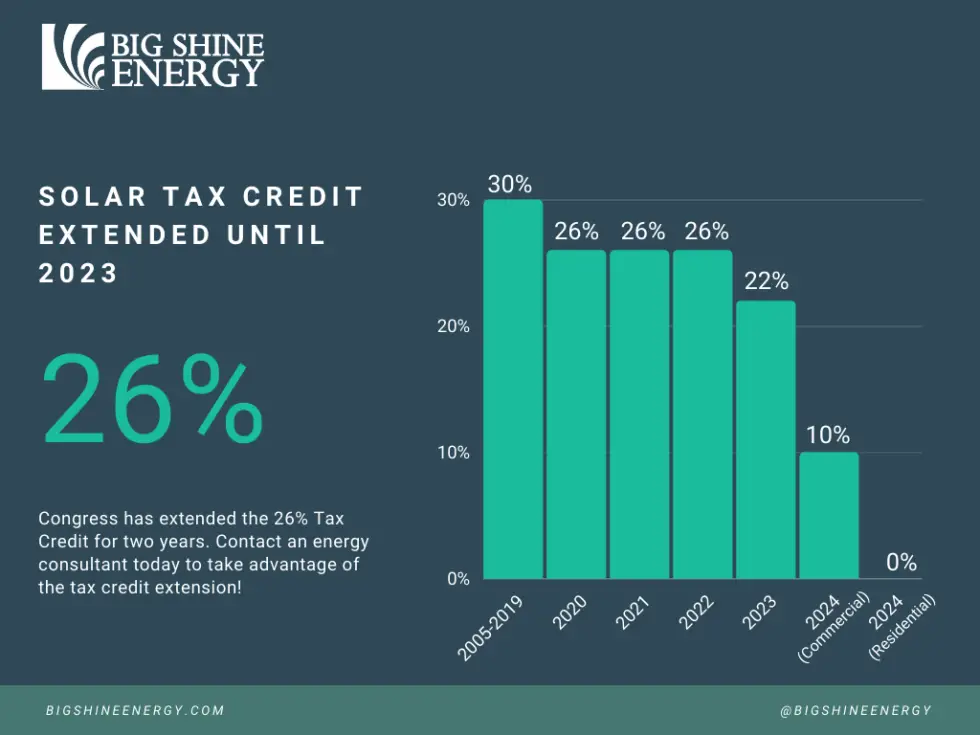

Note, if your 26% tax credit is $6,000 total, and you only have $5,000 in personal income taxes one year, you can rollover the remaining $1,000 credit to your next years taxes. The federal government has already extended the incentive expiration date three times before. The most recent extension in 2020 added a 26% extension until 2022 and step down schedule that gradually phases out the credit over a few years. As of January 2021, we are now in the first slab of the tax credit step down with a 4% reduction from 30% to 26%.

You May Like: Did The Tax Deadline Get Extended

How Other Solar Incentives Affect How Much You Can Get Back

Along with the federal solar tax credit, there are a number of rebates, programs and state tax incentives that you may be eligible for depending on where you live. In some cases, these other financial incentives may impact your federal tax credit. Here’s what you should know:

- Rebates from your utility company: Typically, subsidies from your utility company are excluded from income tax returns. In these situations, the rebate for installing solar must be subtracted from your system cost before you can calculate your tax credit.

- Rebates from state-sponsored programs: Rebates from the state government generally do not reduce your federal tax credits.

- State tax credits: Any state tax credits you get for your residential solar system will not decrease federal tax credits. With that said, getting a state tax credit means the taxable income you report on your federal returns will be higher, as you now have less state income tax to deduct.

- Payments from renewable energy certificates: Any payments you receive from selling renewable energy certificates will likely be considered taxable income. As such, it will increase your gross income, but will not reduce your tax credit.

How To Claim Your Tax Credit

To claim the ITC you will need to file under IRS Form 5695. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. If you dont qualify for the entire tax credit in the first year you can roll over the amount for up to 5 years.

Now that you have your very own solar system, the solar Investment Tax Credit is yours for the claiming. How exactly do you go about it?

Well walk you through the exact, step-by-step process of filing for the federal solar tax credit.

Of course, we recommend talking to a tax professional to make sure youre not missing anything. But if youre a do-it-yourselfer who knows your way around a tax form , this guide walks you through basic filing.

Recommended Reading: Does New Mexico Have State Income Tax

Federal Solar Tax Credit

These days, one of the best incentives most people can get to help reduce the cost of installing solar is the Federal Solar Tax Credit, also known as the Investment Tax Credit . The ITC is a 26 percent tax credit for solar systems on residential and commercial properties. There is no dollar amount cap amount on the ITC, but it is important to note that it is a non-refundable tax credit, meaning the amount of credit you are eligible for is tied to your tax liability. Weve said it before and well say it again, talk to a tax expert.

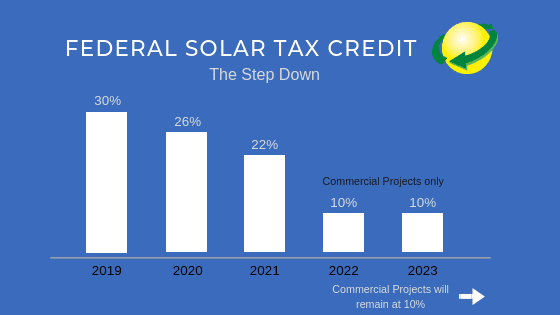

Important Dates! The Federal Solar Tax Credit is phasing down. Starting in 2023, the commercial and residential tax credits will step down.

Qualifying for the Federal Solar Tax Credit: Eligibility for the ITC is slightly different for residential and commercial solar installations. Residential solar installations must be placed in service in order to receive the tax credit, whereas commercial installations receive an incentive based on the date they commence construction. This means that installations must be complete by the end of 2019 to be eligible for the full 30% tax credit. Alternatively, commercial customers must commence construction to qualify. The Solar Energy Industry Association has a helpful outline that explains the requirements taxpayers must meet to claim the ITC.

What Exactly Is A Solar Energy Credit

A solar energy credit, or more formally a solar investment tax credit , is not a tax rebate and is not a deduction. While a rebate pays you back, a credit offsets the balance of tax due on your tax return. So, if you owe little to no federal taxes there is little to nothing to offset, and you wont be able to take full advantage of the credit.*

Read Also: What Is Wotc Tax Credit

How Do I Claim These Tax Credits

For small businesses filing their business taxes as part of their personal tax return, follow these steps:

- First, find the credit application form for the specific tax credit and complete the form.

- Then add the information from the form to Form 3800, the General Tax Credit.

- Finally, add the information from Form 3800 to your tax return.

Partnerships and S corporations must file the form to get the tax credit .

To get the energy investment tax credit, you must file an application Form 3468, along with your business tax return. This is a complicated form, so save your receipts and give them to your tax preparer.

Deductions are a bit easier. This deduction can be included in the “Other Deductions” section of your business tax return. Don’t forget you will need a certification, either before or after you complete the upgrades.

Note: As with all things IRS, there are many restrictions, qualifications, and limitations to these tax credits and tax deductions. The information in this article is intended only as general information, and not tax advice. Check with your tax professional before attempting to take advantage of any of these tax savings.

Can I Count The Cost Of A Roof Replacement In Calculating The Deduction

Although solar panels can be installed in many locations, the roof is usually the optimum spot to capture the most sunlight. Your roof must be strong enough to support the panels and have enough life left in it to be practical after all, you dont want to have to remove the panels in a few years for a roof replacement.

Before installing solar panels, ask a qualified, licensed roofing contractor to inspect your roof and assess its condition. If you do need to replace the roof, you will be wondering whether you can deduct a percentage of its cost on your federal taxes.

If you do need to replace your roof and are wondering if these costs count in the overall installation cost, the answer is yes and no. Consult with a tax professional for help in understanding your specific situation. However, take the following into consideration.

Don’t Miss: Are Donations To Churches Tax Deductible

Getting Help With Your Federal Solar Tax Credit Paperwork

Do you usually file your own income taxes?

If so, you may need a little extra help the year you install your DIY solar kit. If you make a mistake, you may not qualify for the full solar ITC. Consulting a CPA or tax professional is always a wise idea, especially considering the significant value of the ITC.

However, if you just need assistance with the Residential Energy Credits form itself, Solar GOODs can help.

We know how to make sure that you get the maximum federal solar tax credit for your DIY photovoltaic system installation. And thats why we offer assistance with document preparation for your federal Residential Energy Credits paperwork.

Solar GOODs is the premier do-it-yourself online superstore. We have everything you need in one secure, easy-to-use website. Visit us today to learn more about saving money with a DIY solar kit.

How Can I Claim The 26% Solar Tax Credit

To be eligible to claim the 26% tax credit, your solar energy system must be installed, paid for, and commissioned by your power utility in the year you wish to claim it on your taxes. Only purchased systems apply. If you’re leasing, the tax credit goes to the lease holder. To file your taxes claiming this incentive, you’ll need to complete the IRS form 5695 – Residential Energy Credits. We strongly recommend speaking with an accountant to cover the intricacies of filing and claiming your 2021 solar tax credits to ensure you’ve completed it properly.

Also Check: How Much Do I Need To Make To File Taxes

Tax Deductions Vs Tax Credits

Tax deductions, like the mortgage interest deduction, reduce your taxable income, resulting in a smaller tax liability.

Tax credits, on the other hand, provide a dollar-for-dollar reduction in the amount of income tax you owe.

| Tax deduction | |

| Figured at the beginning of your return | Figured at the end of your return |

| Reduces the amount of income you have for tax purposes | Directly reduces the amount of money you owe in taxes |

Find out: Mortgage Refinance Tax Deductions Every Homeowner Should Know

Federal Solar Tax Credit Filing Step

Fill in Form 1040 as you normally would. When you get to line 53, its time to switch to Form 5695.

Step 1: Find out how much your solar credit is worth.

- Enter the full amount you paid to have your solar system installed, in line 1. This includes costs associated with the materials and installation of your new solar system. As an example, well say $27,000.

- For this example, well assume you only had solar installed on your home. Enter 0 for lines 2, 3 and 4.

- Line 5 Add up lines 1 through 4. Example: 27,000 + 0 + 0 + 0 = 27,000

- Line 6 Multiply the amount in line 5 by 26% Example: 27,000 x .26 = 7,020

- Line 7 Check No. Again, for this example, were assuming you didnt have any other systems installed, just rooftop solar.

- Lines 8, 9, 10 and 11 Dont apply to you in this example for the same reason. You can fill each with 0 and skip down to line 12.

Step 2: Roll over any remaining credit from last years taxes.

- Line 12 If you filed for a solar tax credit last year and have a remainder you can roll over, enter it here. If this is your first year applying for the ITC, skip to Line 13.

- Line 13 Add up lines 6, 11 and 12 Example: 7,020 + 0 + 0 = 7,020

Step 3: Find out if you have any limitations to your tax credit.

Read Also: How To Get The Most Money Back On Taxes

What Qualifies For The Solar Tax Credit

- The entire bill for a qualified system, minus the sales tax. That includes solar panels labor costs for on-site preparation, assembly, and installation of the system and piping or wiring to connect the system to your house.

- Installation of a solar system in a primary or second house.

- Systems purchased outright or with a loan.

- Solar roofing tiles, like those being sold by Tesla.

- Solar installed in a property that you live in for at least part of the year. That could cover, for instance, a second home that you rent out when youre not there. The credit is prorated based on how much time you spend in the residence. For a multifamily home in which you live but also collect rent, you may be eligible for either the residential or business tax credit, depending on how much of the property is used for business. Check with a tax expert for details.

Other Incentives For Going Solar

The federal credit is the easiest solar tax incentive to qualify for but you might qualify for state and local solar tax incentives as well.

Most state and local credits and rebates wont reduce your federal credit but may increase your federal taxable income since youll have less state and local income tax to deduct. These homeowner tax benefits make it easier to recoup the upfront costs of installing solar panels.

Don’t Miss: How To Get Tax Preparer License

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesn’t pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Tax Deduction For A Green Building

The Section 179D commercial buildings energy efficiency tax deduction is only available until December 2020. You must have built the systems and building and placed them in service by December 31, 2020.

If you want to revive your business building and turn it into a “green” building, you can get a tax deduction for this purpose. This Section 179D deduction is for incorporating high energy systems into your building, such as high-efficiency interior lighting, HVAC or hot water systems, of efficient building envelopes.

You can get a deduction of up to $1.80 per square foot for building floor areas that have these new systems if they achieve a 50% reduction in energy and power costs.

To qualify:

- You must be the owner or lessee of the commercial building.

- You must get a certification that the required energy savings of 50% will be achieved, in order to get the deduction. It’s best to get this certification, from a qualified engineer, ahead of time. You can get a partial deduction of $.60 per square foot if you can certify a 16 2/3% reduction in energy and power costs.

Read Also: How To Contact The Irs About My Tax Return

If You Are Looking For The Sitc Form Or Instructions Then You Have Come To The Right Place

This is a one-time federal tax credit that can be taken in parts over a few years if it is too large to obtain at once. The credit is based on the cost of the solar system at a percentage determined by the year purchased. The SITC was scheduled to be 22% this year and it would have been the last purchase year available. The one good thing that COVID-19 has done for Americans who own solar is that it increased and extended the SITC to 26%.

We are not accountants, nor do we claim to be. We ARE able to answer general questions and point you to one of our associated accountants if necessary.

Unfortunately, too many accountants dont understand the solar tax paperwork. If you purchased/financed solar and it is installed then YOU QUALIFY FOR A FEDERAL TAX CREDIT of potentially TENS of THOUSANDS OF $$! Check out our FREE, downloadable, guide below where I show you how. Please feel free to call our NEW JERSEY OFFICE You can also EMAIL us with questions. Just click the appropriate button.

Q What Improvements Qualify For The Residential Energy Property Credit For Homeowners

A. In 2018, 2019, 2020, and 2021, an individual may claim a credit for 10% of the cost of qualified energy efficiency improvements and the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year .Qualified energy efficiency improvements include the following qualifying products:

- Energy-efficient exterior windows, doors and skylights

- Roofs and roof products

- Insulation

You May Like: How Do I File My Missouri State Taxes For Free