Exclusion For Wrongful Incarceration

The PATH Act has an exclusion that gives an eligible wrongly incarcerated person a one-year window to make refund claims for restitution or monetary judgments received and reported in a previous tax year.

According to the IRSs Wrongful Incarceration FAQs, the PATH Act exempts wrongfully incarcerated individuals from having to report any monetary awards related to their wrongful incarceration as income.

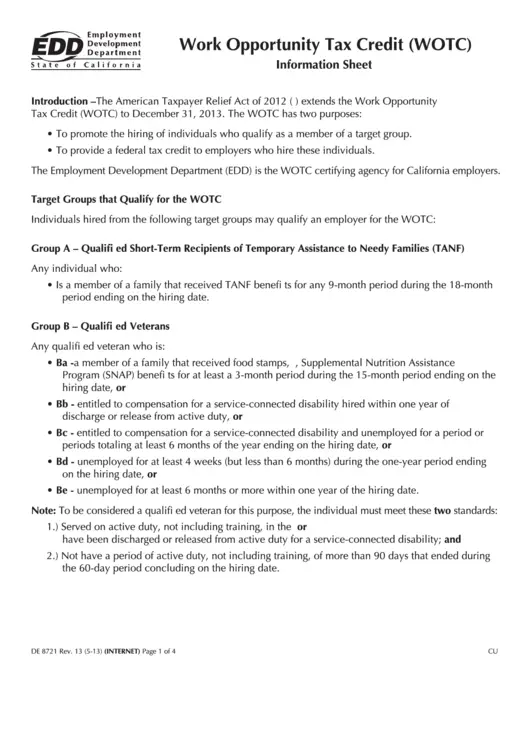

What Is A Wotc Screening

WOTC screening is the process employers use to determine if a potential hire qualifies to be included in the calculations for the employer’s tax credit. The employee must meet requirements based on the hours they work and whether they are members of a qualifying category of worker.

The employer and applicant complete IRS Form 8850, a pre-screening form for the state workforce agency, and Dept. of Labor Form 9061 for federal tax credit eligibility purposes. When the state agency sends back its determination that the employee is qualified, the employer may then apply to the IRS for the tax credits for all employees.

How Much Does An Employer Save

Employers can claim up to 40% of the first $6,000 in qualified first-year wages for a maximum credit of $2,400 per new hire.

Calculation of WOTC tax credit

- The tax credit for WOTC new hires except LTFA is:

- 25%, for those employed at least 120 hrs & semi

- 40%, for those employed at least 400 hrs & semi and

- No credit allowed for second-year wages

For Long-Term Family Assistance — tax credits can be earned for the first two years of employment, wages are capped at $10,000:

- 40%, for those employed at least 400 hours the first-year & semi

- 50%, for those employed at least 400 hours the second year & semi

- Maximum creditof $9,000& semi

For Disabled Veterans discharged within a year, wages are capped at $12,000:

- 25%, for those employed at least 120 hrs but less than 400 hours & semi

- 40%, for those employed at least 400 hours & semi

For Unemployed Disabled Veterans — wages are capped at $24,000:

- 25%, for those employed at least 120 hrs but less than 400 hours & semi

- 40%, for those employed at least 400 hours & semi

For Unemployed Veterans — wages are capped at $14,000:

- 25%, for those employed at least 120 hrs but less than 400 hours & semi

- 40%, for those employed at least 400 hours & semi

- No credit allowed for employees who work less than 120 hours.

You May Like: What States Are Tax Free

How Big Are These Incentives

Tax credits are available for both part-time and full-time new hires and are calculated based on a percentage of the wages earned and hours worked. As of 2021, the maximum tax credit per new Hire was $9,600. This highest level of incentive would apply to hiring a disabled veteran who had been out of work for at least six months out of the one year before the date of Hire.

At the low end of the scale, a WOTC-certified new hire working at least 120 hours in the year could qualify you, as the employer, to claim 25% of the first years wages for a tax credit of as much as $1,500. Thats a lot of money compared to the short amount of time it takes to screen new hires. With Efficient Hire, it takes nearly zero effort!

How Adp Can Help Employers Navigate The Work Opportunity Tax Credit Program

ADPs web-based WOTC screening system improves screening compliance rates and simplifies data collection. It uses plain language and automatically skips sections of the WOTC questionnaire that may be irrelevant, helping applicants complete the form quickly and correctly. We also offer benchmarking and analytics tools that can help employers forecast their tax credits.

Don’t Miss: What Are Itemized Tax Deductions

Carrying Forward The Wotc

While you cannot go below zero, you can carry the WOTC back one year on your taxes or forward up to 20 years according to the Tax Foundation. That means if you drop your taxes owed down to zero in one year and use the rest of the credit for the next years taxes. That can continue until you use all the tax credits or hit the 20-year mark.

Is The Wotc Tax Credit Refundable

In a previous post, we talked about the difference between a tax credit and a tax deduction. When it comes to a tax credit, if you have enough of them, they can drop the amount of money that you owe to the IRS below zero. This means the IRS could owe you a refund.

The Congressional Research Service lays out all the details, but the bottom line is that the WOTC is non-refundable except in certain, very specific circumstances. Non-refundable means that once you hit zero with your tax bill, thats it for the year.

You May Like: How To Pay My Federal Taxes Online

The Accounting Solution To Present The Wotc Tax Credit Forms With Your Annual Business Tax Returns

If you or someone you know is contemplating to present the WOTC, Interactive Accountants can assist you in preparing the WOTC tax credit forms with your annual business tax returns, should your company be eligible. So give us a call or schedule a free consultation with our owner Matthew Shiebler, CPA. Hes been practicing accounting for over 25 years now and is a business owner, just like you!

Get 5 FREE Tax Saving Tips from Our Tax Experts

How To Apply Electronically

You can now apply electronically by registering and following these simple steps:

Recommended Reading: How To File State Taxes By Mail

Timeframe For Submitting Form Irs 8850 Eta 9061 Or 9062

The IRS 8850 and ETA 9061/9062 must be submitted to the WOTC Center no later than the 28th day after the applicant starts work. Applications postmarked later than 28 days after the Start Date will be considered Untimely and will be denied. If the 28th day falls on a weekend, Federal holiday, or California State holiday, the final date for submission will be the next immediate business day.

Group G Qualified Food Stamp Recipient

Any individual who:

- Is age 18 through 39 on the hiring date and is a member of a family who received food stamps/Supplemental Nutrition Assistance Program benefits for a consecutive six-month period ending on the hiring date, or

- Qualifies under federal law as an able-bodied adult without dependents , is 18 through 39 years of age on the hiring date, and

- Received SNAP benefits for at least three months out of the five-month period ending on the hiring date and is no longer receiving SNAP benefits on the hiring date.

Also Check: Can You File Missouri State Taxes Online

Understanding The Work Opportunity Tax Credit

The work opportunity tax credit is administered jointly by the Department of Labor and the U.S. Treasury through the Internal Revenue Service . The DOL provides grant funding and policy guidance to state agencies that oversee the certification process while the IRS is responsible for managing tax-related requirements for claiming the credit.

The Protecting Americans from Tax Hikes Act of 2015 allows eligible employers to claim the WOTC retroactively for eligible employees from targeted groups who were hired between Dec. 31, 2014, and Dec. 31, 2020. Whether a business can claim the credit is based on the category of workers it hires, the wages those workers are paid in their first year of employment, and the number of hours they work.

Designating A Wotc Agent

If an employer wishes to authorize an intermediary, such as an accountancy firm or management consultant, to act on their behalf in the WOTC certification process, they must provide the EDD a notarized Power of Attorney. The Internal Revenue Service Form 2848, Power of Attorney and Declaration of Employer Representative, may be used for this purpose.

Also Check: What Cars Qualify For Federal Tax Credit

Adp Saves Time And Reduces Stress For Work Opportunity Tax Credit Clients

Switching from a manual Work Opportunity Tax Credit screening process to ADPs automated solution can help minimize the workload of hiring managers. It works on most mobile devices, so theres less paperwork and it has applicant-friendly features that make it more likely for applicants to complete the WOTC questionnaire.

How To Qualify A Worker

During the hiring process, before or on the day the employee begins work, the employer and the applicant must complete two forms. If you don’t complete the forms during the hiring process, you won’t be able to get the tax credit.

First, you and the applicant must complete IRS Form 8850, the IRS pre-screening form. When the job offer is made, the applicant completes the first page showing their eligibility. When the applicant is hired, you as the employer complete the second page giving your information and information on the person hired.

You and the applicant must also complete DOL Form 9061. The applicant completes the form and the employer verifies the identification documents the person submits. Some applicants may have already completed Conditional Certification DOL Form 9062 instead.

As soon as the person is hired, you must submit Form 8850 and Form 9061 to the state workforce or employment agency for a determination on the eligibility of this worker for WOTC credit. The forms must be submitted no later than the 28th calendar day after the person begins work.

Some states allow employers to submit a WOTC application online, Check with your state workforce or employment agency for details on how to submit applications.

When the state agency certifies the worker’s eligibility status, it sends a determination letter to the employer.

Recommended Reading: How To Prepare Business Taxes

Make The Switch To Paperless Wotc Screening

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

Federal Empowerment Zones Enterprise Communities And Rural Renewal Counties

These designations refer to an area or combination of areas meeting certain population, size, and poverty criteria. These areas can be characterized as having pervasive poverty, unemployment, and general distress. California has a number of EZs. These include, but are not limited to:

- Desert Communities Empowerment Zone

- Santa Ana Empowerment Zone

At this time, California has no active ECs or RRCs.

Because only certain census tracts within a ZIP Code are in an EZ, EC, or RRC, not every Summer Youth or Designated Community Resident who resides in the areas indicated above are eligible for WOTC certification.

For more information on EZs in California, or to look up an applicants address within these areas, visit the Housing and Urban Development website.

You May Like: How To Get Out Of Paying School Taxes

Eligibility For Former Employees Or Family Members

Employers may not request certification on former employees who have been rehired. The employee must have been WOTC-qualified and certified as such only the first time they were hired by the employer. No tax credit can be claimed for wages paid to relatives. The tax credit is not valid for a son or daughter, stepson or stepdaughter, brother or sister, stepbrother or stepsister, father or mother, stepfather or stepmother, niece or nephew, uncle or aunt, son-in-law or daughter-in-law, father-in-law or mother-in-law, brother-in-law or sister-in-law, descendants of any of the aforementioned, or if the employee resides in the home of the employer.

Questions regarding how to claim the Work Opportunity Tax Credit on the federal income tax return should be directed to the regional office of the IRS.

What Is The Process For Applying For Wotc

The first step is pre-screening to determine eligibility. The job seeker or the employer must complete the Individual Characteristics Form, Work Opportunity Tax Credit, ETA 9061. The employer and the job seeker must complete the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credits, IRS Form 8850 and sign under penalty of perjury, attesting that the job seeker is a member of a target group. The employer may request certification for the WOTC by submitting the Form 8850 and the ETA 9061 to the EDD, either online or by mail. The Form 8850 and the ETA 9061 must be submitted online or postmarked no later than the 28th day after the job seeker begins work.

Note: If the job seeker has indicated that they might be eligible for target group L ETA Form 9175 â Long-Term Unemployment Recipient Self Attestation Form â may be submitted with IRS Form 8850 and ETA Form 9061.

There are two ways employers or their agent/consultant can submit their WOTC Requests for Certification:

1. Online with Work Opportunity Tax Credit Online

- : If you have already enrolled, log in to use eWOTC.

2. By Mail

Also Check: Where Can I Get 1040 Tax Forms

What Workers Are Not Eligible

Even if they might otherwise make your business eligible for the tax credit, you can’t get the tax credit for hiring the following people:

- Your relatives or dependents, including children, stepchildren, spouse, parents, siblings, step-siblings, nephews, nieces, uncles, aunts, cousins, or in-laws

- Majority owners of your business

How Does The Work Opportunity Tax Credit Work

The Work Opportunity Tax Credit program is a federal tax credit available to employers if they hire individuals from specific targeted groups. The employee groups are those that have had significant barriers to employment. This tax credit program has been extended until December 31, 2025.

Read Also: How Much Is Tax In Alabama

Individual Taxpayer Identification Number Renewal

Beginning in October 2016, the PATH Act requires certain taxpayers to renew their Individual Taxpayer Identification Number .

In order to use their ITIN, taxpayers who have not used it on a federal tax return at least once in the prior three years must renew it.

Using an expired ITIN may result in a delay in receiving a refund or in being ineligible for tax credits.

You Might Read :

How The Wotc Affects Business Taxes

A business may apply the credit to its income tax liability for the year, along with other tax credits, in a specific order. Which tax form is used to claim the tax credit depends on the business type. Pass-through businesses in which the income and loss of the business are passed through to the owners include WOTC tax credit applications on their Form 1040 or 1040/SR .

The amount of the WOTC credit is limited to the amount of the business income tax liability or Social Security tax owed.

Recommended Reading: How To Get Your Old Tax Returns

Can Family Members Qualify Employers For The Tax Credit

No tax credit can be claimed for wages paid to relatives. The tax credit is not valid for: son or daughter, stepson or stepdaughter, brother, sister, stepbrother or stepsister, father or mother, stepfather or stepmother, niece or nephew, uncle or aunt, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, sister-in-law, descendants of any of the aforementioned, or if the employee resides in the home of the employer.

Claiming The Work Opportunity Tax Credit

Once an employee is certified, employers can claim the work opportunity tax credit on their income tax returns. This requires filing:

- IRS Form 1040, 1040-SR, 1041, 1120, etc.

To calculate the credit, employers must determine the number of hours worked by the employee and their wages for the first year of employment. The amount of credit an employer can claim is limited to the amount of the business income tax or Social Security tax owed.

Read Also: How Much Taxes Do You Pay On Slot Machine Winnings

Work Opportunity Tax Credit Program

WOTC is a Federal tax credit incentive that employers may receive for hiring individuals from certain groups who have consistently faced barriers to employment.

The main objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they earn a steady income and become contributing taxpayers, while participating employers are compensated by being able to reduce their federal income tax liability.

Work Opportunity Tax Credit Till December 31 2025

The Consolidated Appropriations Act of 2021 has now extended the Work Opportunity Tax Credit till December 31, 2025. So what does this mean for you? If you are hiring, be sure to use form 8850 “Pre-Screening Notice and Certification Request for the Work Opportunity Credit”. You can give this form to potential new hires to complete when they apply for a job. If you hire someone that completes this form, the next step is to submit it to your local designated agency and get the certification. This has to be done within 28 days of hire, but if you didn’t do that in 2021 already, because you were under the impression that the credit expired in 2020, now’s the time to get it done.

The WOTC can offer employers a tax credit of up to 50% of qualified wages. The following are targeted groups that the WOTC applies to:

- Qualified IV-A Recipient

- Long-term Family Assistance Recipient

- Qualified Long-Term Unemployment Recipient

See for more information on the WOTC, as this newsletter doesn’t present all the data related to this tax topic.

Read Also: How To File Taxes Doordash

What Is The Wotc

The Work Opportunity Tax Credit offers a tax credit to employers who hire employees from certain target groups that have historically faced barriers to employment, including ex-felons, veterans and people on long-term unemployment.

This credit is based on qualified wages paid to these employees during their first year of employment. For long-term temporary assistance for needy families recipients, the credit is extended to their second year of employment as well.

To claim the Work Opportunity Tax Credit, you will complete Form 5884 and include it with Form 3800 when you file your business taxes.