Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

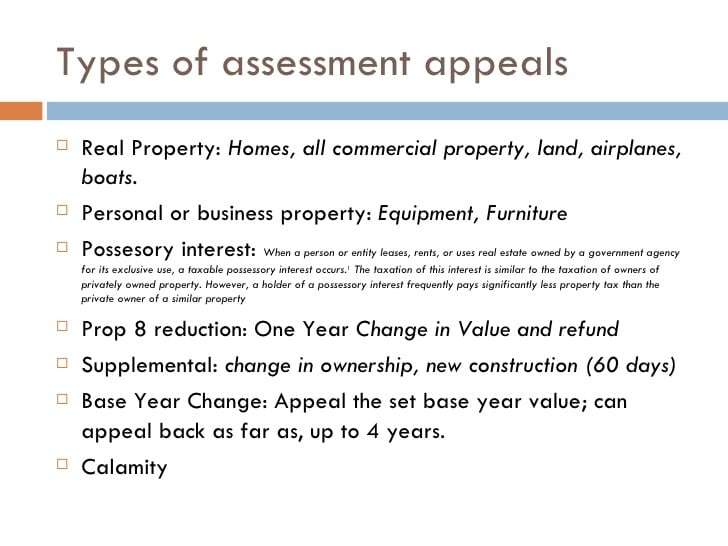

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

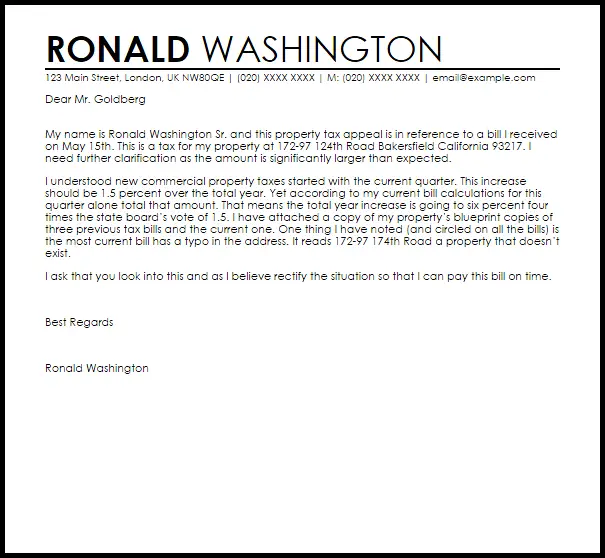

When Do You Send The Property Tax Appeal Letter

Typically, property owners have 30-45 days from the time they receive their valuation notice to send a property tax appeal letter. Thats a relatively small windowwhich means you wont have time to confirm your belief that the assessed value is too high before notifying the jurisdiction you intend to appeal. So if you do feel youve been assessed unfairly, send the letter to buy the time you need to research the matter properly. If it so happens that you discover the stated value is correct, you can always withdraw your appeal.

Your Valuation Includes Assets Or Real Property Owned By Someone Else

You shouldnt be on the line for personal property you possess but dont own. Leasing is a prime example. Assume you have a large copy machine youve leased for the officethe copier is in your possession, but its owned by the company you leased it from. That leasing company is likely responsible for paying taxes on the copier, not you.

Similarly, for real property, the assessors records may not be updated to reflect a change in ownership of a location. It may show youre still the owner of record and, therefore, still responsible for the taxes. A property tax assessment appeal letter can help bring this issue to the assessors attention.

Read Also: How To Track E File Tax Return

Find Out Your Homes Current Value

The first thing you need to know is the current value of your home. If homes similar to yours are selling for 250K and your appraisal value is at or less than 250K then you may not be able to make the case that your property value should be lowered.

To find out current value ideally you should get an appraisal from a licensed appraiser, but this will have a cost associated with it. Price will vary based on location and size of property but be thinking in the $300-$500 range.

You could get a Comparative Market Analysis from a competent REALTOR. It includes the same basic information as the appraisal, but doesnt carry the same weight before the appraisal review board. Offer to compensate the REALTOR for their time if you choose to go that route.

If your homes current tax appraisal is at or below its current appraised value then you probably would not win an appeal based on value. There may be an exception if your home has some major defect that negatively impacts its value, such as a foundation that needs to be repaired or a roof that needs to be replaced.

Who Is On The Board Of Property Tax Appeals

BoPTA members are private citizens appointed by the Multnomah County Board of County Commissioners. They are not professional appraisers, but have training, experience and knowledge in property valuation.

BoPTA members are not part of the Assessor’s Office and they play no role in setting any of the values on your property.

BoPTA may be thought of as a panel which decides the value of your property based on the evidence you present.

Also Check: Can You File Missouri State Taxes Online

Q: Appealing My Property Taxes Seems Overwhelming Where Do I Start

A: Each appraisal district has their own process and guidelines to help homeowners protest.

Texas Tax Protest takes all the guess work and uncertainty out of the protest process. Start by signing up with us. The process only requires three forms, which we fill out for you. All you need to do is review and sign. Its really that easy!

Appeal To The Local Independent Board

Again, while the process can vary between city and state, here is how the property tax appeal process typically works:

- A homeowner pays the small filing fee and files the formal appeal.

- There will be paperwork to fill out and the homeowner must provide supporting evidence and documentation as to why they are appealing the property tax assessment.

- Once documentation is submitted, the local board reviews the appeal.

While homeowners are made to file an appeal in a timely fashion, the decision-making time varies based on the local board and can take several months or up to a year.

Don’t Miss: How Much Is Sales Tax In New Mexico

How To Dispute Your Tax Assessment

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013. This article has been viewed 9,435 times.

Property taxes should be uniform and fair. If you feel that your property tax assessment is too high, then you can dispute it. Although the exact dispute process will vary from county to county, you will begin by contacting the tax assessment office. Then you will typically present your case ultimately to an appeal board.

Meeting With The Tax Assessor

You May Like: Where Do I Get Paperwork To File Taxes

Understand Your Tax Bill

If you feel you are paying too much, it’s important to know how your municipality reaches that figure on your bill. Sadly, many homeowners pay property taxes but never quite understand how they are calculated. It can be confusing and challenging, especially because there may be a disconnect between how two neighboring towns calculate their property taxes.

Property taxes are calculated using two very important figuresthe tax rate and the current market value of your property. The rate at which taxing authorities reset their tax rates is based on state lawsome change them annually, while others do so in different increments, such as once every five years. Municipalities set their tax ratesalso known as millage or mill ratebased on what they feel they need to pay for important services.

An assessor, hired by the local government, estimates the market value of your propertywhich includes both the land and structureafter which you receive an assessment.

The assessor may come to your property, but in some cases, an assessor may complete property assessments remotely using software with updated tax rolls. Your local tax collector’s office sends you your property tax bill, which is based on this assessment.

In order to come up with your tax bill, your tax office multiplies the tax rate by the assessed value. So, if your property is assessed at $300,000 and your local government sets your tax rate at 2.5%, your annual tax bill will be $7,500.

How To Dispute A Real Estate Tax Assessment Increase

If your local government tells you your property value has gone up–and therefore your property taxes–you can either pay the increased tax or challenge the assessment. You have the right to appeal any assessment you believe overprices your property in most counties, this will be done by going before a board of appeals and presenting evidence that the assessment was in error. Depending on the value of your home and the local tax rate, a successful appeal can save thousands of dollars.

1

Learn the appeals procedure for the county your property is located in. You can find the information on the county government or tax assessor’s website, and download the necessary forms. The timing of your appeal is particularly important: San Francisco, for example, accepts appeals of annual assessments only between July 2 and Sept. 15.

2

Contact your tax assessor and find how she determined your value. If you can show she wrote down the wrong square footage for your house or the number of bedrooms, or that she missed an exemption or deduction you’re entitled to under the law, that may be enough to win your case, the This Old House website states.

3

File your appeal according to county procedure. This will often include paying a fee. You’ll be notified when your appeals hearing is scheduled.

4

5

References

You May Like: How To Find Tax Lien Properties

The Value Of Your Real Property Increased More Than Is Reasonable Compared To The Previous Year

If your real property increased, say, 4% over last year, you may find this unreasonable , depending on the state your property is located in. For example, California law mandates that real property values not increase more than 2% per year, unless there is a change in ownership. In this case, a property tax appeal letter would certainly be warranted.

What Happens At The Hearing

Property tax appeal hearings are much less formal than anything you might see in court. That said, you should be prepared to make your argument to the ARB and present your evidence. If you are disputing the value assessed by the appraisal district, you should have information on comparable properties, or other information showing that the appraised value is too high. If you are arguing that the appraisal contains an error, you should bring evidence showing the mistake. This could include photographs, blueprints, or a floorplan of the property. Some counties may allow you to call witnesses.

If the ARB rules against you, you can appeal that decision. This could be in a court of law, or before another administrative agency, depending on the county.

Read Also: Do You Have To Pay Taxes On Retirement Income

Assessments And Tax Rates Are Adjusted Based On Fiscal Needs

What you should understand about assessments is that they are just a yardstick for a city or town to collect an appropriate amount of taxes to run the municipality fiscally yearly. Assessors adjust assessments typically on an annual basis in order to get an appropriate amount of taxes from the residents.

The tax rates and taxable value of properties will be adjusted appropriately, so the municipality gets what they need from each taxpayer. The tax roll is what allows each city to be fiscally responsible.

Most of the time, assessed values are more accurate on homes that have sold recently. You will often see the assessment of homes that have been sold years ago having a more considerable variation to current market value.

If your neighbors home is nearly identical to yours and is assessed much lower for no apparent reason, it could be because, in a prior year, they filed a challenge to the assessment with the town and were granted a reduction.

Their property now has a reduced assessment. You can count on the fact that the city will not decrease every other value of similar homes in the area. This is an excellent example of the squeaky wheel getting the grease. Understanding this information will go a long way in knowing how to appeal a high property tax.

If The County Assessor And I Have Agreed On An Assessed Value Prior To My Hearing Date Do I Need To Show Up For My Hearing

Yes, unless you, the county assessor, and county legal officer have signed a stipulation agreeing to the new value. A stipulation is a written agreement signed by the county assessor, county legal officer, and you or your agent when the value of your property is agreed upon after the Assessment Appeal Application has been filed, but prior to the hearing. The stipulation sets forth the full value and assessed value of the property and sets forth the facts upon which the reduction in value is premised. Please contact your county assessor for more details on stipulations.

Recommended Reading: How Much Taxes Do They Take Off Your Paycheck

Consider Hiring A Lawyer Too

Just because you like DIY projects doesnt mean youre qualified to tackle this one.

Property tax appeals have special rules and procedures that vary from state to state, cautions DellaPelle. The consequences of failing to adhere to them can be severe.

Plus, since there are several ways your appeal can get thrown out , a tax attorney can help you figure out whether you have a caseand help you win it.

What Is The Property Tax Deduction

State and local property taxes are generally eligible to be deducted from the property owner’s federal income taxes. Deductible real estate taxes include any state, local, or foreign taxes that are levied for the general public welfare. They do not include taxes charged for home renovations or for services like trash collection.

As noted below, the Tax Cuts and Jobs Act capped the property tax deduction, along with other state and local taxes, starting with 2018 taxes. The law capped the deduction for state and local taxes, including property taxes, at $10,000 . Previously, there was no limit on the deduction.

Recommended Reading: What Happens If I Forgot To File Taxes

Should I Appeal My Assessment

If the property characteristics listed on your assessment notice are incorrect, or if the estimated market value of your home is significantly more than what you believe your home could sell for in the current real estate market, you should file an appeal. The last date to file an appeal is printed on your notice. A good rule of thumb is this: If the property characteristics on this notice are correct and the estimated market value is within 10 percent of what you think your home is worth then it is unlikely that an appeal would change your propertys assessed value enough to significantly affect its property tax bill.

Q: Will The Appraisal District Inspect My House If I Protest

A: Never.

Texas Tax Protest never needs to inspect your home when representing you at a protest. In fact, most clients sign up for our service by phone and we never go in your home. We do advise that you provide us with pictures of the inside of you home if there is damage or areas of the home are in poor condition. However, the majority of the protest we settle are normal homes in good working order and we rely on comparable properties to reduce the assessed value, not on pictures.

Also Check: How Do I Paper File My Taxes

Get Clear On Your Property Taxes

You may or may not want to go to great lengths to appeal your property taxes. Everyones motivation level for saving money is different. But regardless of how much effort you want to put in, every homeowner should at least get educated on how their property taxes are calculated.

You can gather this knowledge in an afternoon and check your property card in the process. Who knows? You may save yourself thousands of dollars with just a little work on your part.

On the slip side, if you are buying a home where the assessed value is significantly higher than the market value, this should be adjusted during the next tax year. If this does not happen for some reason, you are now well-armed on how to challenge the assessed value!

Hopefully, this has given you a clear direction on how to do a property tax appeal! Appealing a high property tax assessments isnt easy, but it can be done.

Reasons To Submit A Property Tax Appeal Letter

It all starts when you open a valuation notice from the assessor and see a property valuation amount that you believe is too high. Here you have two options: 1) You can pay the too-high tax bill because you think you dont have time to stage an appeal. 2) You can appeal the valuation and possibly lower your tax bill.

But what are some underlying reasons for that high valuation? To help answer this question, you can request an itemized list of propertycalled work papersthe assessor used to determine your valuation. You may find that the assessors valuation is fair and no appeal is necessary. However, you may find mistakes or disagree with some of the criteria the assessor used to determine your valuation. In the latter case, the following are a few scenarios you may identify during your review of the list.

Recommended Reading: Can I File For Another Extension On My Taxes