Irs Identity Protection Pin : How To Get A Pin And Use

An Identity Protection PIN is a six-digit code you use to confirm your identity when submitting your tax return. This additional layer of authentication makes it harder for someone else to use your Social Security Number to submit a fraudulent return.

The IRS gives IP PINs to taxpayers who have experienced tax-related identity theft. If you are eligible for an IP PIN, you will receive a notice by mail in December of January with your new IP PIN number.

Why Am I Being Asked For An Ip Pin Reject Code Ind

If you have been notified by the IRS that you, your spouse, or your dependent;have been a victim of identity theft, they will issue an IP PIN or identity theft pin.

When it comes to federal taxes, taxpayers may not be aware they have become victims of identity theft until:

- they receive a letter from the Internal Revenue Service stating more than one tax return was filed with their information

- their tax return is rejected as a duplicate filing

- or IRS records show wages from an employer the taxpayer has not worked for in the past.

Irs Agi And Eftps Pins

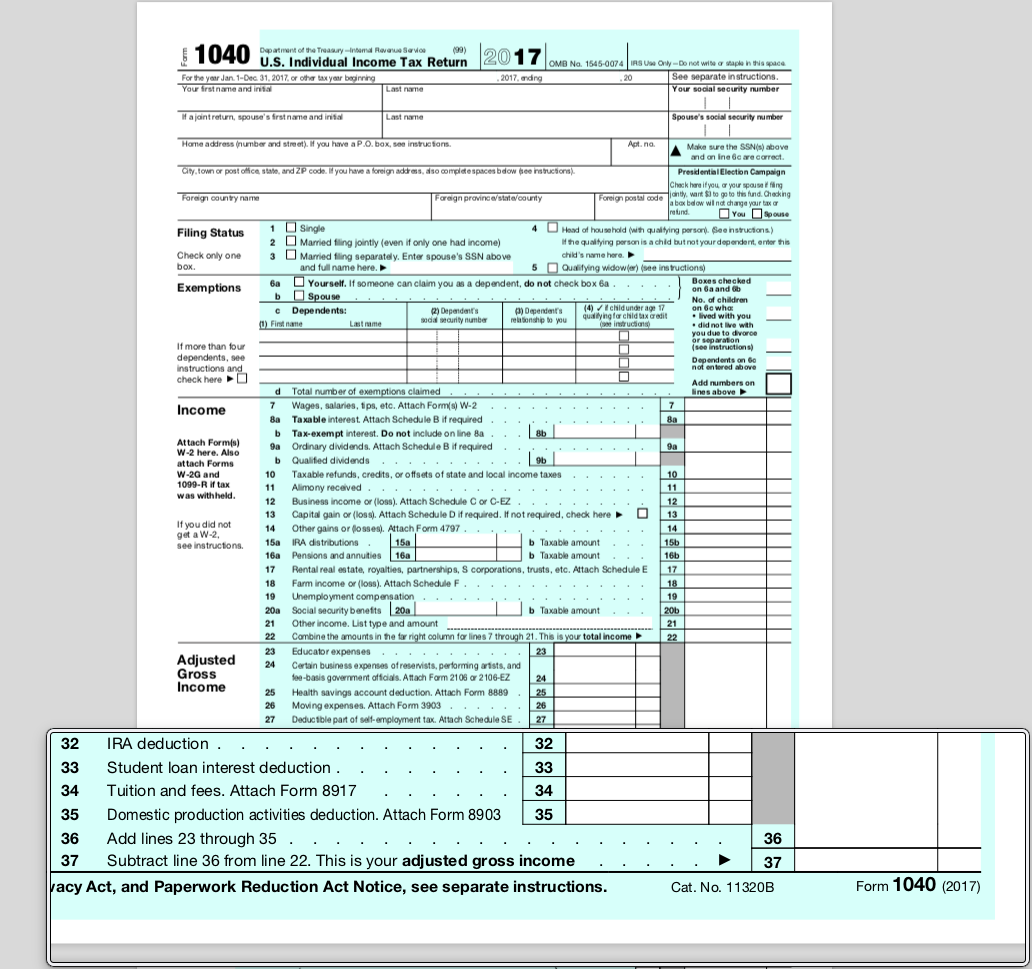

If you don’t have an IP PIN, you can often simply use your adjusted gross income from the previous year to authenticate yourself and verify your identity when you file taxes online. If you use the same tax prep software from year to year, it may handle this for you automatically. Otherwise, consult your previous year’s return to find your IRS AGI and enter it when prompted.

If you’re using the treasury department’s Electronic Federal Tax Payment System to make tax payments, you will use a separate PIN to identify yourself. You can use this system to pay various business taxes or use it as an individual to pay taxes, including federal quarterly estimated taxes.

You can enroll in EFTPS online and you will receive a PIN in the postal mail that you can use to log in to the system. If you lose your PIN, call to request a new one. You may be able to make a payment over the phone in the meantime. Your EFTPS PIN is separate from any identity protection PIN.

Some states may have their own PINs for taxpayers to use for various circumstances. These are separate from IRS and EFTPS PINs.

Read Also: When Is The Final Day For Taxes

Why Do I Need Tax Clearance Certificate

A Tax Clearance Pin Certificate is issued by SARS as proof that a person/business is in the clear with them. This means the person/business is 100% compliant with no overdue payments. A Tax Clearance Pin Certificate is often a prerequisite for Tenders, Contracts, RFQs or Funding applications.

Can I File My Taxes Online For Free

In Canada, TurboTax makes it simple for anyone with any tax situation to file their taxes for free. These are just a few of the tax situations you could have and use TurboTax Free to file your taxes with the CRA:

- Youre working for an employer and/or are self employed

- Youre a student looking to claim tuition, education, and textbook amounts

- You were unemployed for part or all of 2020, including if you claimed CERB

- Your tax situation was impacted by COVID-19, including if you had to work from home and want to claim related expenses

- You have dependants and want to ensure you claim all related credits and deductions

- Youre retired and receive a pension

- You have medical expenses to claim, including amounts related to COVID-19

- Its your first time filing your taxes in Canada

There are a few situations where youll need to print and mail your return instead of filing online using NETFILE. Dont worry though, you can still enter all your tax info online and well guide you through the process of mailing your return to the CRA.

Also Check: Do You Pay State Taxes On Unemployment

How To Avoid This Forever

Organizing your companys payroll;information can distract you from what you love about your business. Get back to the important work, and let us take care of the heavy lifting with our full-service payroll program! With no month-to-month contract, low rates, and great customer service what are you waiting for?

Article updated from original post of 6/14/11.

How Can I Find My Parcel’s Property Index Number

- Your property’s deed

- Your property tax bill

- Your Assessment Notice – the blue card that the Assessment Office sends property owners each year as notification of new assessment of property.

Read Also: How To Get Stimulus Check 2021 Without Filing Taxes

Irs Pin To File Taxes

If you’ve had identity theft issues in the past, you may be invited by the IRS to apply for an identity protection personal identification number, or IP PIN. This is to prevent someone from filing a fraudulent return with your Social Security number, since returns with your Social Security number but no PIN or an incorrect IP PIN will be automatically rejected by the IRS.

If you are a victim of identity theft, especially involving fake tax returns, notify the IRS as soon as possible. The IRS can provide you with identity theft assistance, including enrolling you in the IP PIN program. You may be required to file an identity theft affidavit asserting that you were a victim of the crime. If you can’t file online because someone fraudulently filed in your name, file on paper and include the affidavit on IRS Form 14039 with your tax return.

If you last filed your taxes using a Georgia, Florida or District of Columbia address, you may be eligible to apply for an IP PIN even without a prior history of fraud. Contact the IRS for details.

If you were invited by the IRS to get an IP PIN, you should receive it on a form called CP01A. You will generally receive one of these forms each December with a new six-digit IP PIN to use in filing that year’s taxes the following year. If you’re filing your taxes online, your tax prep software should prompt you for your current IP PIN if you have one. If you’re filing on paper, write the IP PIN in the appropriate box.

How To Get An Ip Pin

The fastest way to receive an IP PIN is by using the online Get an IP PIN tool. If you wish to get an IP PIN and you dont already have an account on IRS.gov, you must register to validate your identity. The IP PIN tool is generally available starting in mid-January through mid-November. Select the button to get started

Read Also: When Is Sales Tax Due

Alternatives To The Online Tool

If you want an IP PIN but cant successfully validate your identity through the Get an IP PIN tool, there are alternatives. Please note using an alternative method to the online tool takes longer for an IP PIN to be assigned to you.

If your income is $72,000 or less and you cant use the online tool, you have the option to use Form 15227, Application for an Identity Protection Personal Identification Number. You must have:

- A valid Social Security number or Individual Taxpayer Identification Number

- Access to a telephone

- An adjusted gross income of $72,000 or less

We will use the telephone number provided on the Form 15227 to call you and validate your identity. After your identity has been validated, youll be placed into the IP PIN Program and assigned an IP PIN for the next filing season. You will receive your IP PIN via the U.S. Postal Service the following year and in the future.

Requesting in-person authentication for an IP PIN

If youre unable to verify your identity online or with the Form 15227 process or you are ineligible to file Form 15227, you may make an appointment for an in-person meeting at a local Taxpayer Assistance Center. Please bring one current government-issued picture identification document and another identification document to prove your identity. Once we verify your identity, you will receive your IP PIN via the U.S. Postal Service usually within three weeks. You will then receive your IP PIN annually through the mail.

How Do I Get My Ip Pin

The IRS issues IP PIN to anyone that has had their social security number compromised with the IRS. This means that someone else has filed a fraudulent return using someone else social security number. The IP PIN is issued annually for the duration of you filing your tax returns. If you feel your social security number has been compromised, notify the IRS immediately. Fill out IRS form 14039 and get it to them as soon as you become aware of the compromise. The process could take up to 180 days to process.

If you need assistance in obtaining your IP PIN, read on well give you info at the bottom of this page on how to connect with an ATC IP PIN expert to resolve the issue and prepare your tax return with zero out of pocket fees!

Q & A:

What is an IP PIN?

A 6 digit number issued by the IRS for anyone who has encountered identity theft with the IRS. The number assigned is associated with your social security number and will come from the IRS on form CP01A.

Do I need an IP PIN?

If your social security number has been used to file taxes by anyone other than yourself, then yes, you would need an IP PIN.

Do I use the same number each year?

What if I lose my IP PIN, what do I need to do?

If you lose your IP PIN, you should visit your nearest ATC Tax Office so one of our IP PIN Tax Experts can assist you with obtaining a new one.

Can I file without my IP PIN?

Will the IRS ask me for my IP PIN?

ATC Tax Support

Recommended Reading: Where Can I Get 1040 Tax Forms

How Do I Get A Pin For Tax Clearance Certificate

Once your request is approved by SARS, you will be issued with an overall tax compliance status and a PIN. You can request that the PIN be sent to you via SMS and you can view it on your Tax Compliance Status Request dashboard on your eFiling profile. The PIN can also be printed in the form of the TCS result letter.

How To Use Your Pin

- You must use your Virginia PIN and Social Security number on all Virginia individual income returns you file during the calendar year.;

- If youre filing electronically through Free File or other approved tax preparation software, your tax software will prompt you to enter your PIN.;

- If youre filing on paper or using Free Fillable Forms, enter your current PIN in the ID Theft PIN”;box.;

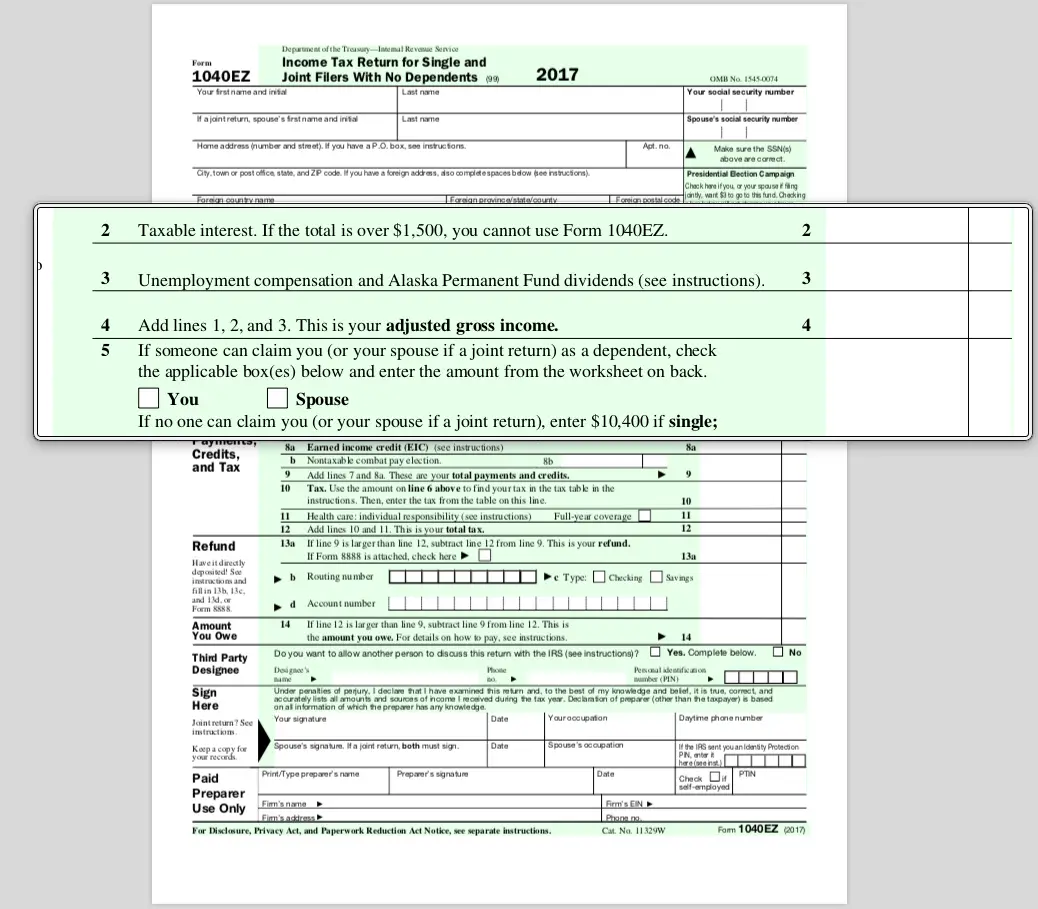

- You must file prior year returns on paper. For tax years after 2017, enter your PIN in the ID Theft PIN”;box. For earlier tax years, enter your PIN;in the “Office Use Only” box.;

- You only need to use one PIN on a joint tax return, even if you and your spouse were both issued a PIN. Either PIN is acceptable.;

You May Like: Should I Charge Tax On Shopify

What Is The Meaning Of Tax Clearance

Tax Clearance Certificate, also known as Tax Form Z, is an official document issued by the relevant tax authority to a taxpayer, certifying that, the tax assessed on the income from all sources of the taxpayer for the three years immediately preceding the current year of assessment has been fully paid.

Select Your Form Of Payment

When your earnings reach the payment method selection threshold, you can select your form of payment. Depending on your payment address, there may be several forms of payment available to you, including Electronic Funds Transfer , EFT via Single Euro Payments Area , wire transfer, etc. Learn how to set up your form of payment.

Read Also: How To Know If You Filed Taxes Last Year

What To Do If You Lose Your Pin Or Didnt Receive A New One In The Mail

- If we issued you a PIN and you lost it or you didn’t receive a new one in the mail, call customer services at . We will verify your identity and mail you a replacement PIN within 15 days. ;

- If we issue a new PIN, any previously issued PINs will be deactivated. If you find your original PIN after requesting a new one, you should discard the PIN and wait for the new one to arrive.

- If you use an old or incorrect PIN on your return, it will cause a delay in processing.;

Forgot My 5 Digit Pin

If you have a copy of last year’s return, the;5 digit self-selected efile Pin will be included in the Federal Information Worksheet, ;The worksheet is included in the PDF of the 2018;tax return that you can download if you used the online editions. If you filed a return with Turbo Tax in 2018, you can download and print the return, unless you filed using the free version on Turbo Tax.;

Recommended Reading: Are Debt Settlement Fees Tax Deductible

Irs Can Send You A Pin Number To Protect Your Tax Refund

Recommended

Tax filing time is around the corner. If youre not careful, your refund could end up in someone elses bank account.

Crooks could try to steal your identity to try and get your tax refund.

How it works: Someone files your taxes using your name and social security number in order to get your refund sent to them.

These types of scammers typically file very early before most people get around to it themselves. By the time you do, a bad guy could have your money.

The IRS has a solution. Its called an identity protection pin . Its a unique 6-digit number that will confirm your identity.

The IRS is in the process of sending those to confirmed victims of identity theft. But anyone can ask for one before they file their taxes.

Typically, a normal client doesnt bother to get an number unless they have had some kind of fraud perpetrated on them, said Charles Massie, a CPA in Southwest Florida. But in the case that they have typically, the IRS will supply them with this number.

Massie added its not a bad idea for those using various software and filing on their own to get an IP pin. Its fairly easy to apply for one online. You can use it when you file, or you can give it to your tax preparer when he or she files your taxes.

The pin is only good for one year. The IRS will continue to send an IP pin yearly to people who used them in the past.

Visit the IRS website for a good explanation of why you might need one as well as instructions to apply online.

MORE:

How To Get Your Ip Pin Reissued

If you’re unable to retrieve your IP PIN online, you may call us at 800-908-4490 for specialized assistance, Monday – Friday, 7 a.m. – 7 p.m. your local time , to have your IP PIN reissued. An assistor will verify your identity and mail your IP PIN to your address of record within 21 days.

Exceptions:

- If youve moved since January 1 of this year, or

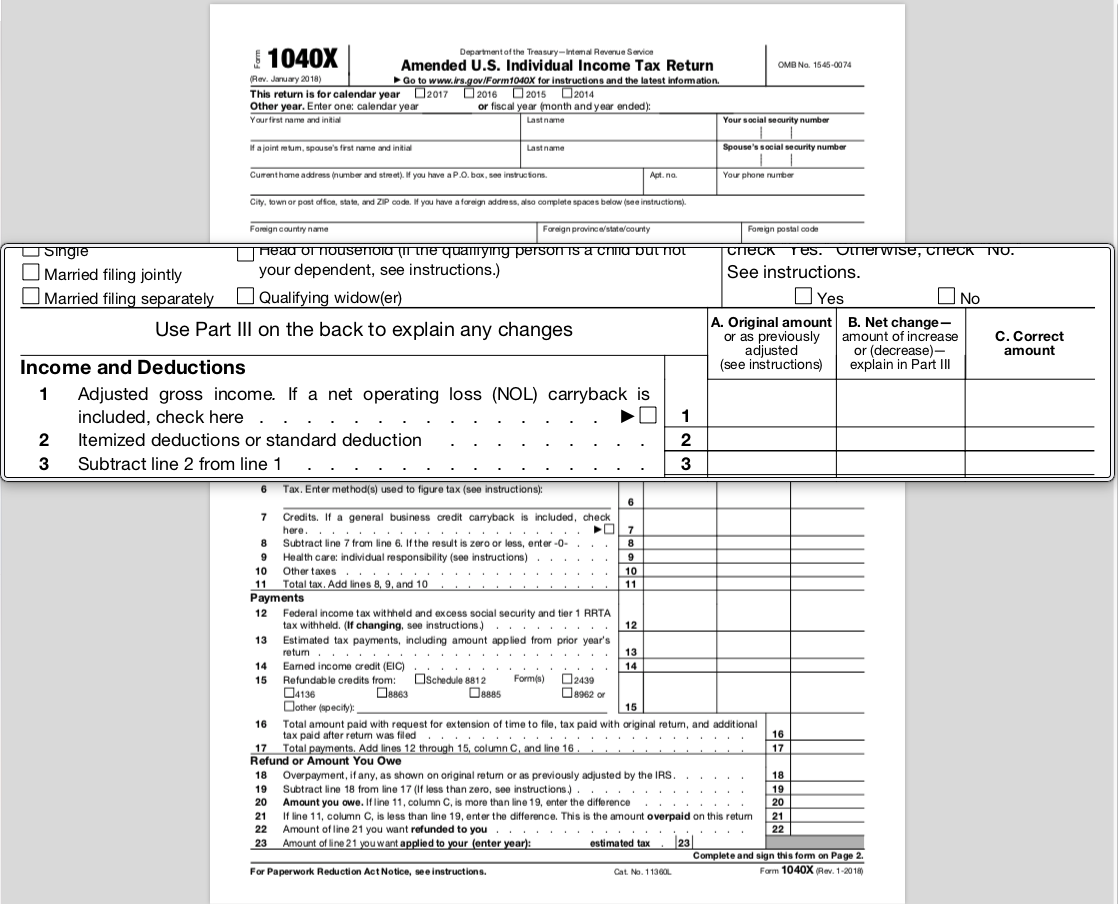

- Its after October 14 and you havent filed your current or prior year Forms 1040 or 1040 PR/SS.

If you fall under the exceptions and if;you cannot access the Get an IP PIN online tool, your best alternative at this time is to file your tax return by paper without your IP PIN.

Youll need to complete and mail a paper tax return without your IP PIN. Well review your return to confirm its yours, but this may delay any refund youre due.

Existing IP PIN users seeking to retrieve their numbers should not apply for a new IP PIN with Form 15227. The Form 15227 application process is only for taxpayers who are newly opting into the program and do not already have an IP PIN requirement.

Don’t Miss: What Is The Federal Inheritance Tax

Get An Identity Protection Pin

An Identity Protection PIN is a six-digit number that prevents someone else from filing a tax return using your Social Security number or Individual Taxpayer Identification Number. The IP PIN is known only to you and the IRS. It helps us verify your identity when you file your electronic or paper tax return. Even though you may not have a filing requirement, an IP PIN still protects your account.

If you are a confirmed victim of tax-related identity theft and we have resolved your tax account issues, well mail you a CP01A Notice with your new;IP PIN each year.

If you don’t already have an IP PIN, you may get an;IP PIN;as a proactive step to protect yourself from tax-related identity theft.

If you want to request an IP PIN,;please note:

- You must pass a rigorous identity verification process.

- Spouses and dependents are eligible for an IP PIN if they can pass the identity verification process.

Security Changes For 2018

The IRS is trying to reassure taxpayers that theyre taking steps to secure their information and that its safe to e-file. They notify you if they receive duplicate filings under your Social Security number. Theyve also published Form 14039 for you to use if your e-filing is rejected because someone already filed a return with your Social Security number on it. A fillable version of this form is available on their website. After youve filled it out, you have to print it and attach it to your paper return. When the IRS receives the paper return, theyll do an investigation to identify which return is fraudulent and they will process the legitimate one. Yes, this takes a long time.

Don’t Miss: How To File School District Taxes In Ohio