Providing Tax Fraud Information

With the exception of the international program, all other tips and information can be offered anonymously.

Confidentiality

- Even if you do not make anonymous tips, the CRA is obligated to keep your identity private.

- Since any action taken by the CRA against fraudulent taxpayers is also confidential, the CRA will not inform you of any investigation, assessment or other action made as a result of your information.

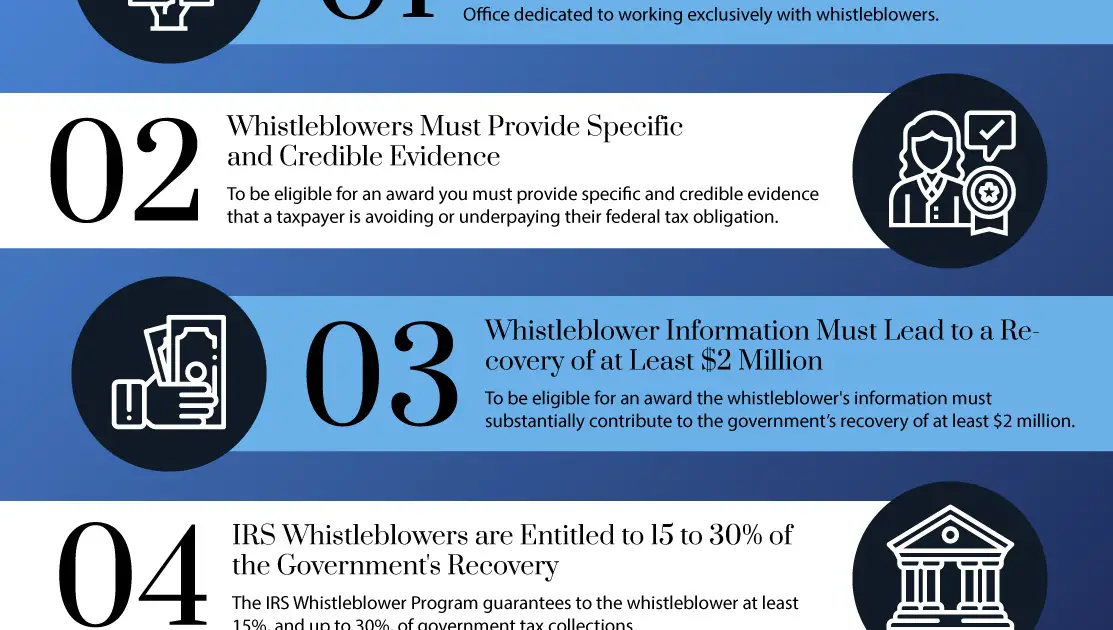

The Irs Whistleblower Program

If you know of a significant tax cheater, you should certainly consider filing an IRS whistleblower complaint. The IRS whistleblower program allows individuals to report tax fraud. In return, the IRS whistleblower office may offer a financial reward of up to 30% of the amount collected to the people who blow the whistle on those committing tax fraud. Keep in mind that if you want to claim a reward, you have to complete Form 211.

The IRS is stringent in protecting the whistleblowers identity, and it is unlikely that you will be identified.

The IRS takes a while to investigate these matters, and you may not hear from them for weeks or even months.

Read Also: How Much Is New York State Sales Tax

The Voluntary Disclosures Program

The CRA allows for the voluntary declaration of unpaid taxes, inaccurate information, and even unfiled returns through the Voluntary Disclosures Program . The VDP allows a taxpayer to proactively correct his taxes, potentially avoiding penalties or prosecution. Use Form RC199, the Taxpayer Agreement Voluntary Disclosures Program, to make a declaration.

- You must take action before the CRA does, to qualify for any relieving provisions under such a disclosure.

- The declaration must be complete and not attempt to hide additional irregularities.

- The VDP is only used in cases where new information prevents a tax penalty.

For example, if you miss reporting a T slip, voluntary disclosure is unnecessary, as this would only lead to a reassessment rather than punitive action.

References & Resources

Recommended Reading: What Is Premium Tax Credit

What Is Tax Evasion

Tax evasion occurs when an individual or business intentionally ignores Canadas tax laws. This includes falsifying records and claims, purposely not reporting income, or inflating expenses.

Combatting tax evasion and other financial crimes is important financially and socially. The quality of life that all Canadians enjoy is supported by the taxes we pay. Revenues collected help to fund programs and services such as health care, childcare, education, and infrastructure projects that benefit all Canadians.

Why Report Tax Fraud

Mississippi relies on a voluntary compliance tax system to fund its state and local governments. This includes schools, roads, bridges, fire protection, police protection, hospitals, libraries, parks, courts and many other services that the citizens of this state need and enjoy. However, some businesses and individuals deliberately evade their tax responsibility. This practice hurts honest taxpayers who pay their fair share.

The Department of Revenue actively pursues businesses and individuals to collect the taxes due the state and its citizens. Your help is invaluable for making sure taxes are collected and remitted fairly, and that everyone pays their fair share. Individual and computer-aided review, along with our Criminal Investigation Division, work to ensure taxpayers comply with MS tax law and to keep the playing field level for all.

Private citizens can help by reporting suspected illegal activity.

You May Like: How To Pay Car Taxes Online Sc

Farber Tax Solutions Can Help You Successfully Deal With Cra Problems We Utilize The Experience Of Our Tax Experts To:

- 1| Offer a comprehensive solution that is focused on achieving the most favourable possible outcome for your tax issue

- 2| Communicate with the CRA on your behalf and navigate the entire CRA dispute process and

- 3| Offer a complete solution to your tax problems, including ex-CRA professionals and tax lawyers from Farber Tax Law.

FREE Consultation With A Tax Expert

We Handle The CRA On Your Behalf

Your Tax Problem Is Solved Effortlessly

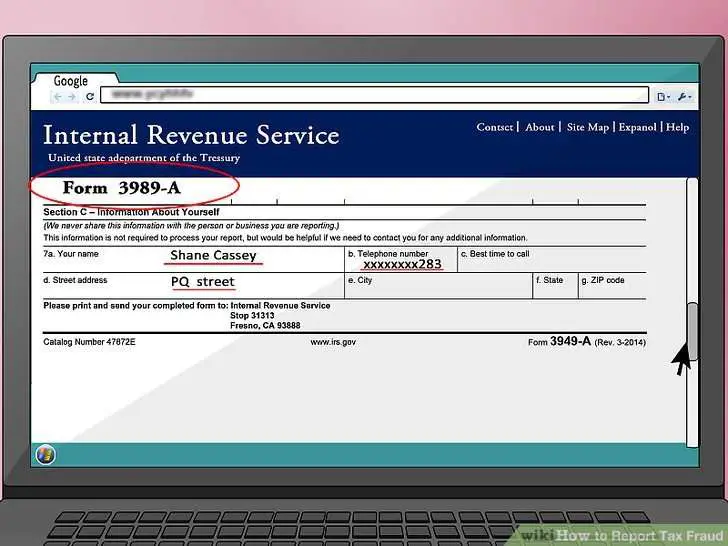

How Can We Report Tax Fraud To The Irs

Method 1 of 2: Reporting Suspected Tax Fraud Gather evidence of the fraud. The more evidence you can share with the IRS, the better. Identify the correct form to use. You will report suspected fraud to the IRS by filling out a form. Read the instructions. Complete the form. Choose whether to report anonymously. Submit the form.

Read Also: What Is The Pink Tax

Reporting Washington State Tax And License Fraud

Washington State relies on businesses and citizens to voluntarily pay their fair share of taxes to fund state services. Unfortunately, some businesses and citizens either don’t understand, or purposely evade, their tax responsibility.

Our tax discovery staff actively pursues businesses and individuals to collect the taxes due to the state and its citizens.

Tax and license fraud includes:

- not registering an operating business,

- collecting, but not remitting, retail sales tax, or

- registering a vehicle, vessel, or plane out-of-state if the vehicle is used in this state and use tax was not paid.

If you have questions about our residency requirements, review our residency definition.

Your help is invaluable for making sure taxes are collected fairly and everyone pays their fair share as we continue to work together to fund Washington’s future.

How To Report Tax Fraud In Canada

You can report a lead on suspected tax or benefit cheating in Canada through the CRA Leads Program. Leads can be submitted online, by phone or fax, or mailed to the address found here.

As well, each year the CRA loses tax revenue due to illegal international tax shelters. The CRA encourages anyone, no matter where they are in the world, to come forward if they have information about major international tax non-compliance. The CRA Offshore Tax Informant Program allows for financial rewards to be made to individuals who provide information related to major international tax evasion and aggressive tax avoidance that leads to the collection of taxes owing.

You May Like: What Tax Bracket Are You In

All Information Provided Is Kept Confidential

You remain anonymous if you report someone for tax fraud. You do not have to give us your name, phone number or any other identifying information. However, it is helpful for the investigator to be able to contact the person reporting the fraud if they need more information. If you choose to provide your contact information, your identity remains confidential.

Tax Evasion Complaint Online

So how do I report tax evasion In India? Or how to inform the income tax department about black money?

On the Departments e-filing website, the Central Board of Direct Taxes has established a dedicated online e-portal to receive and handle tax evasion claims, foreign hidden properties, and Benami property complaints.

You May Like: When Will I Get My Tax Refund

Different Types Of Fraud

There are many types of fraud and fraud schemes. Below are the most popular types of tax fraud that people and corporations commit.

Unreported Income

People often try to avoid paying taxes by not reporting income. Unreported income is when someone illegally excludes mentioning their income in their tax return.

Tax Refund Scam

A tax refund scam involves identity theft, forged W-2 forms, and illegally filing a tax return using another persons name to receive a tax refund in your bank account.

You can know if you are a victim of a tax refund scam when the IRS sends you a letter stating that there are multiple returns submitted in your name. Or when you try to file your return online and the IRS rejects it mentioning that a tax return using your Social Security number has already been filed.

Tax Evasion

Tax evasion is when a person or business entity illegally avoids paying or underpays their tax liability. Tax evasion is a criminal charge subject to penalties. However, be careful not to confuse tax evasion with tax avoidance. Tax avoidance is a legal procedure that helps reduce taxpayer obligations.

IRS Impersonation Scam

To help people from being victims of such scams, the IRS has released a statement saying that the government doesnt conduct or send unsolicited emails, text messages, or phone calls to discuss tax issues. Moreover, the IRS stated that it doesnt use social media to get in contact with taxpayers.

How Do I Report Possible Tax Fraud

As long as there are rules and regulations, there will probably be those who break them. Each year, a small percentage of people attempt to cheat on their taxes in an effort to owe less and/or receive a larger refund. Sometimes people do make mistakes on their tax returns, but mistakes are generally not considered fraud. Tax fraud is the intentional attempt to avoid paying the amount of taxes required, reporting income, and/or filing returns.

Some people may wonder whether they should report tax fraud, thinking it a victimless crime. However, the failure to meet tax obligations can have a harmful effect on the economy. It is considered a crime in the United States as well as in some other countries.

Before you can report tax fraud, its wise to learn the types of offenses you can report. You can report a person for claiming deductions to which hes really not entitled, hiding or transferring assets or income, and intentionally changing the amount of income on his tax forms to an incorrect amount. Tax fraud also includes over-reporting deductions, keeping false books and records, and having two sets of bookkeeping records with differing figures in them. Even such things as claiming personal expenses as business expenses count as tax fraud.

Don’t Miss: Are Nonprofit Organizations Tax Exempt

Can I Report State Tax Fraud

The IRS deals with federal income taxes. If you suspect a person or business of committing tax fraud at the state level, you should contact the states department of revenue or other taxing body to learn how to report the information. States have their own forms and rules for reporting fraud.

For example, Colorado allows citizens to report suspected tax fraud online or by mail. South Carolina accepts its fraud complaint forms via email or mail. And New York accepts reports of tax evasion and fraud via an online submission form, phone, fax or mail.

Also Check: Www.1040paytax.com.

How You Make A Difference

The information you provide in your lead could help the actions the CRA is already taking to fight tax cheating. The CRA uses the information that you provide to make sure that the Canadian tax system is fair and everyone pays their fair share. This ensures greater resources are available for public facilities, such as schools, roads and hospitals, as well as for the delivery of services and programs to Canadians.

Also Check: Where Is My California State Tax Refund

Report Suspected Tax Fraud Activity

At the California Department of Tax and Fee Administration we have an Investigations team whose job it is to identify tax evasion problems, identify new fraud schemes, and actively investigate and assist in the prosecution of crimes committed by individuals who are violating the laws administered by the Department. Tax fraud hurts everyone, so help us help you.

How To Make A Report

Fill in the online form to tell HMRC what you know about the person or business.

You do not have to give your name or contact details unless you want to. Any information you give will be kept private and confidential.

Do not send supporting information. You can tell HMRC if you have any when you make your report. HMRC will only ask for more information if needed, as long as youve given your contact details.

For your own safety you should not try to find out more or let anyone know youre making a report.

You May Like: How Much Inheritance Tax Do You Have To Pay

How To Report Tax Fraud In Massachusetts With The Help Of Donotpay

With DoNotPay, it is easy to report someone for tax fraud, and you can do it completely anonymously, so you are protected from any vindictive behavior from your boss or landlord.

If you want to report tax fraud but don’t know where to start, DoNotPay has you covered. Create your own cancellation letter in 5 easy steps:

Most Americans Agree That Its Everyones Duty To Pay Their Fair Share Of Taxes According To A 2018 Irs Survey Yet Not Everyone Does

While nearly 84% of federal income tax gets paid on time, a gap does exist aptly dubbed the tax gap between how much tax all Americans owe in any given year and how much tax gets paid to the Internal Revenue Service. After factoring in late payments and IRS enforcement efforts, the net tax gap for tax years 2011 through 2013 was estimated at $381 billion per year, according to a September 2019 release from the IRS.

The tax gap matters. The IRS said a 1-percentage point increase in voluntary compliance would bring in about $30 billion in additional tax receipts.

As IRS Commissioner Chuck Rettig noted in a September 2019 IRS news release, Those who do not pay their fair share ultimately shift the tax burden to those people who properly meet their tax obligations.

But honest taxpayers can help the IRS narrow the tax gap. If you suspect that an individual or business has been committing tax fraud, you can report it to the IRS. Doing so can help the IRS enforce tax laws. And you may even be eligible for a cash reward in some cases.

The IRS fraud hotline is one tool to help Americans give the agency information about suspected tax cheating. Lets look at possible signs of tax fraud and some things to know about how the IRS fraud hotline works.

- Fake or altered tax returns

Dont Miss: Www.1040paytax.com Official Site

You May Like: How Do You Calculate Your Tax Bracket

What Is Tax Evasion How To Report Tax Evasion In India

Paying taxes is a burden for many, individuals often come up with ways to escape or reduce the burden. But do you know that failing to pay taxes accurately can lead to criminal charges? Tax evasion occurs when a person or corporation unlawfully stops paying its tax or pays a partial amount of taxes. Tax evasion is a criminal activity and, as per Chapter XXII of the Income Tax Act, 1961, those who are found evading taxes are liable to face criminal charges and fines.

Tax avoidance includes hiding or fake revenue, without documentation of exaggerated deductions, without disclosing cash transactions, etc.

Activities considered as Tax Evasion according to the Income Tax Act

Say, for example, a person claims for depreciation when there is no asset in the company or claims for depreciation of properties used for residential purposes. It is simply a dishonest tax obligation avoidance process.

The following are main practices that are deemed to be tax evasion:

1. Concealing the Income6. Storing wealth outside the country7. Filing false tax returns8. Fake documents to claim exemption

How to file complaints regarding tax evasion?

The Central Board of Direct Taxes has introduced an online dedicated e-portal on the Departments e-filing website to accept and process tax evasion allegations, foreign hidden properties, as well as Benami property complaints.

Types of Penalties for different types of Tax Evasion in India:

GoodReturns.in

Blowing The Whistle On A Tax Cheat

The IRS may pay awards in exchange for valuable information that leads to the collection of taxes, penalties, interest, or other amounts from the noncompliant taxpayer. There are various types of awards granted, depending on the evader’s income level and classification .

The IRS likely chooses to focus its efforts on these larger cases because they have a higher payoff. It has also been suggested that higher income individuals have been found to cheat more frequently and for higher sums of money, mostly because they tend to earn more self-reported income.

Also Check: Is Aaa Membership Tax Deductible

How To Report Tax Evasion In India

There are myriad reasons people evade paying their taxes. The ways that people find to evade their taxes are numerous as well. The Central Board of Direct Taxes has an e-portal designed to encourage citizens to report and halt tax evasion. This article is about how to report tax evasion in India.

The Ministry of Finance, in an official statement, said Taking another step towards e-governance and encouraging participation of citizens as stakeholders in curbing tax evasion, the Central Board of Direct Taxes has launched an automated dedicated e-portal on the e-filing website of the Department to receive and process complaints of tax evasion, foreign undisclosed assets as well as complaints regarding benami properties.

What Is Tax Fraud

Tax fraud is when a person or business intentionally falsifies information on their return to pay fewer taxes. Falsifying your tax return is a felony crime that can cost you huge fines, time behind bars, or both. Also, attempting to evade your taxes is about as serious as fraud offenses go.

If someone knowingly doesnt pay all of their taxes and gets caught, they will be sentenced could be looking at up to five years of jail time, a penalty of up to $250,000, or both.

On the other hand, those starting a business or even established corporations face a fine of up to $500,000, three years behind bars, or both when caught falsifying a return, lying about their income, making false deductions, or reporting dishonest charity contributions.

Also Check: How Many Years Late Can You File Taxes

How To Report Tax Evasion In Massachusetts By Yourself

There are a variety of ways to report tax fraud in Massachusetts. For example:

The truth is all of these actions can be difficult, and you may not have the time to do them. Furthermore, you aren’t an accountant and may not know how to answer the complex questions so that you can report the crime. If only there were an easier way to report tax evasion in Massachusetts.