Why Might You File Your Taxes Twice

There are a couple of different reasons why somebody might file their taxes twice.

Often, double-filing taxes is simply an accident caused by forgetfulness or confusion. With all the stresses of everyday life, its not unheard of for someone to submit their tax form for a second time, forgetting that theyve already done so.

Another common reason for filing taxes twice is trying to rectify an error on the first tax form. For example, if youve realized that youve made a mistake on your tax return, it might seem intuitive to submit a second form with the correct information.

However, submitting your tax returns twice is not the recommended course of action in the case of an error, and doing so can actually cause more problems, as well explain shortly.

Regardless of the reason behind a double tax return submission, filing two tax return forms under the same social security number will ultimately complicate matters.

The Power Of The Extension

Obviously, a tax extension extends your time to file your tax return. You get a whole six additional months to gather documentation and fill out all the forms. Thats a lot of time, but it can slide by quickly. Youd better make good use of it. Just make sure you send in Form 4868 by the original tax deadline, but preferably as early as possible — the moment you know you arent going to make Tax Day.

So, you filed for your tax extension, and you get six more months to file. Guess what you dont get. You dont get an extension on paying your taxes. Thats right. Payment is still due April 15. If you dont pay then, anything left starts accruing interest. If you dont pay any at all or make a plan to pay, you also get hit with a failure to pay penalty.

Oh, and if you didnt file for an extension and just let Tax Day blow by, you get a failure to file penalty, which is much harsher, believe it or not, than the one for failure to pay. By the way, there is no failure to file penalty if you are owed a refund. But, if you dont file, you wont get the refund. Fail to file for more than three years, and you can kiss that refund goodbye.

Your Online Efile Account

Use your EFILE number and password to:

- Maintain your account

Note: For an electronic record to be deemed a return of income filed with the Minister in prescribed form:

-

a confirmation number must be generated by the EFILE web service.

All returns filed with the Canada Revenue Agency are processed in cycles. Accepted returns are entered in the next available cycle. Cycle processing usually begins in mid-February and Notices of Assessment for returns processed in the first cycle should be issued by the end of that month.

Don’t Miss: How Does Doordash Do Taxes

Will I Be Fined I Accidentally File My Federal Taxes Twice

I filed my federal tax through credit karma but at the end, after submitting my federal return I noticed that they don’t file state taxes. I got my return and tried to file my state taxes through Tubo Tax but it had me file both federal and state taxes. I only wanted to file my state taxes. Can I cancel the federal tax submission so that only my state taxes get filed. or am I going to get in trouble for accidentally filing my taxes twice. Can I call someone to fix this?

When Tax Returns Are Due In 2021

Once again in 2021, the IRS has provided an extension on the normal date when taxes are due. Instead of April 15, Americans have an extra month to complete the tax filing process, with a new deadline of May 17, 2021. Tax season started later than usual this year as well .

The deadline extension only applies to filing federal taxes. It doesn’t necessarily apply to filing state income taxes. So far, 34 states have extended state filing and payment to May 17 to correspond with the federal tax extension.

Also Check: 1040paytax Irs

Finding Your Tax Amendment Options

The IRS doesn’t put a limit on the number of times that you can amend any particular year’s tax return, as long as you’re filing within the statute of limitations. The time allotted for a tax amendment is the longer of three years from when you filed the return or two years from when you paid the tax, whichever is longer.

If you’re using the filing date, remember that any return filed early is counted as being filed on the due date. For example, if you file your return on March 1 even though it’s not due until April 15, your three years starts on April 15.

How Can I Amend My Tax Return

Fortunately, if youve made an error on your tax return and need to amend it, dont worry, there are a few ways to do so that youll find quite simple.

First and foremost, if you need to amend your tax return, do not file another return for that year.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Amendments can be made for 10 previous years, so if you are filing this years , you can only amend back to 2010.

There are three ways to make amendments to your tax return: through CRA My Account, ReFile using your tax solution, or . There are rules and limitations for each one, and well take you through them so you have a better understanding of which one to choose.

For Quebec residents If you need to amend your provincial return, please click here for instructions directly from Revenu Quebec.

Requesting an Amendment Online through CRA My Account

Requesting an amendment to your tax return online simply requires you to log in to your CRA My Account and click Change my return. You select the line that needs to be corrected and input the corrected value.

Do keep in mind that you cannot request an amendment to change any of the following:

Requesting an Amendment using ReFILE and your tax software

- Making or amending an election

- Applying for certain benefits

- Applying for the disability tax credit

- Have a current reassessment in progress

- Have not yet received the original return assessment

- If you have to change personal information

Recommended Reading: Efstatus Taxact Com 2016

What Happens If I Refile My Taxes

You should approach the IRS if there is a mistake on your tax return. Should an error be found with your return, you should contact the IRS and amend the return. An amended return can either be filed by yourself or is prepared by a professional after careful consideration. If it isnt prepared well, you will be charged penalties and interest.

How To File Taxes If You Lived In Two States

If youve moved your permanent address from one state to another during the tax year, take heart. The tax situation isnt all that complicated if you keep good records. Write down the exact date of your move and tuck the information in a safe place until tax time.

At the end of the year, youll have to file taxes in both your old and new state as a part-year resident. States make it very easy to do this. Most have a line on the return where you can mark whether you were a full or part-year resident. If you specify that you were a part-year resident, you will have to list which dates you lived where and pro-rate your income.

If you deal with states that all enjoy reciprocity agreements, nothing will change but your address. Lets say you work in Maryland but live in West Virginia. Thanks to reciprocal agreements, you would pay your taxes to West Virginia where you live.

Now lets say you move to Pennsylvania but keep your job in Maryland. Because Pennsylvania and Maryland also have a reciprocity agreement, you would now pay your tax to Pennsylvania. If you moved halfway through the year, youll pay 6 months worth of tax to West Virginia and 6 months to Pennsylvania.

Recommended Reading: Do I File Taxes For Doordash

Can You Go Back And Refile Your Taxes

In case a taxpayer discovers a mistake on his or her tax returns after filing, the taxpayer is able to amend the return to correct the error. Form 1040-X, Amended U.S. tax returns can be completed and mailed by filing on Form 1040-X, Amended. This is the form for individuals filing their individual income tax return. Whether a taxpayer uses paper or electronic filing, an amended return must be filed on paper.

The Canada Revenue Agency

We permit only approved participants to electronically file income tax returns.

Personal and financial information must be transmitted to us in an encrypted format. Encryption is a way of encoding information before it is transmitted over the Internet. This ensures that no unauthorized party can alter or view the data.

We also ensure that all personal and financial information is stored securely in our computers. We use state-of-the-art encryption technology and sophisticated security techniques to protect this site at all times.

We have made every possible effort to ensure the safety and integrity of transactions on our Web site. However, the Internet is a public network and, as a result, is outside our control.

You May Like: How Does Doordash Do Taxes

Ask The Taxgirl: Filing The Same Return Twice

Tax laws change all of the time.

This post seems to be older than 14 years. A lot could have changed since then. Check with a tax professional if you’re not sure if it applies to you.

Taxpayer asks:

Hi Kelly,

I have a quick question.I used e file and IRS rejected it on 15th, so I sent my documents via postal mail.Meanwhile on my second attempt to e file with paper sign. IRS accepted my return. Does it create any problem as everywhere it says do not file if you are e filing.

Please help me here.

Taxgirl says:

Hmm Ive never had this happen before. I have had clients that filed twice on paper because they werent sure that they had mailed it already .

I am not sure what would happen with the case of efile and paper returns but heres my hunch: assuming that the returns are the same, the IRS will ignore the second one. Youll probably get a letter saying that theres a problem with your return and it will go on to say that they have received two copies of your return and that only one can be processed.

Id hold tight and see. I definitely wouldnt lose any sleep over it unless the returns are different, you sent payment with both or something similar. If any of those situations is the case, Id follow up with IRS.

If anyone else has experience with this situation, by all means, chime in!

Before you go: be sure to read my disclaimer. Remember, Im a lawyer and we love disclaimers.If you have a question, heres how to Ask The Taxgirl.

What Happens If You File Taxes Twice

Its tax season for Americans. Every year, plenty of people have questions about how and when to file their taxes. The usual tax filing deadline is April 15 and it looked like the IRS was going to stick to that deadline. However, the IRS extended the tax filing deadline to May 17, 2021.

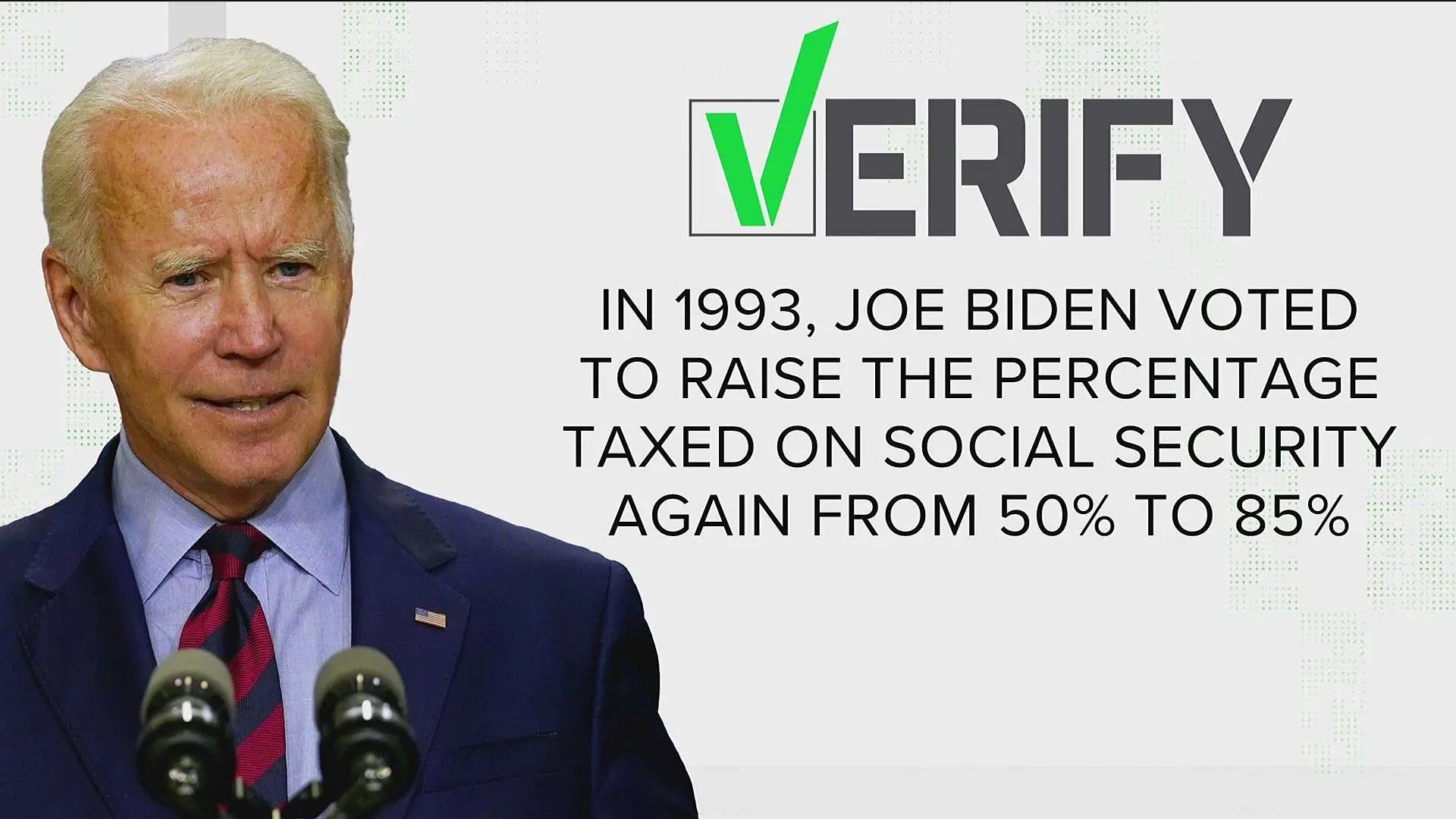

Tax forms and submission can be confusing for many people. Sometimes, people unintentionally file their tax returns twice. Filing two federal tax returns isn’t allowed. Once your Social Security Number has been used to file a return, the IRS will automatically flag and reject any additional return filed with that SSN.

Recommended Reading: Buying Tax Liens California

Contributing To Your Spouses Registered Retirement Savings Plan

Contributions you make to your spouses RRSP can be deducted from your taxable income. This is advantageous if you have a higher net income, which is taxed at a higher rate than your spouse. However, the contributions you make to a spouses RRSP reduce your own deduction limit. The total amount you can deduct for contributions you make to your RRSP or that of your spouse cannot be more than your own deduction limit. If you cannot contribute to your RRSP because of your age, you can still contribute to your spouses or common-law partners RRSP until the end of the year when your spouse or partner turns 71. For more on RRSP, please click here.

Commuting To Another State To Work

You would have to file a resident tax return in your home state and a nonresident state tax return in your work state if you commute to another state to go to work. All your income from all sources goes on your resident tax return, even the income you earned in your “work” state. But you would only include the wages you earned in your work state on your nonresident state tax return.

Pursuant to the Wynne decision, many states provide tax credits on resident returns for taxes you pay to other jurisdictions. The taxes you pay to your work state are effectively subtracted from any taxes you owe to your home state, so you won’t take a double tax hit.

Also Check: 1040paytaxcom

Looking For Additional Amendment Opportunities

If you find an error that causes you to owe more taxes, file an amended return and pay the additional taxes as soon as possible to avoid additional interest and penalties from accruing. For example, say you find a mistake that means you owe an extra $2,000 in taxes. If you’re filing the amended return one year after it was due, you also owe a year’s worth of interest. However, if you act quickly enough and submit the amended return before your filing deadline, you won’t owe any interest because it’s considered to be filed on time.

For example, suppose you filed your original return in February, but realized your mistake and filed the amended return before April 15. Since you amended and paid before your filing deadline, you won’t owe any interest or penalties. Even if your amended return is processed first, the original return will eventually get processed, too, and when the IRS sorts it out you will have minimized your liability for interest and penalties because you filed the amended return sooner rather than later.

Avoid Paying Taxes Twice On Retirement Funds

Not adjusting the tax basis of retirement funds can lead to tax being paid twice on money from IRA accounts. This can happen when after-tax amounts are deposited into an IRA, distributions are made that include after-tax dollars or 401 accounts that contain after-tax money are rolled over into IRAs.

It is up to the taxpayer to keep track of their IRA account tax basis, and they can do this by attaching a Form 8606 to their tax return. This is the form the IRS uses adjust the tax basis of an IRA to reflect after-tax deposits and withdrawals.

Recommended Reading: Appeal Property Tax Cook County

Refile For Efile Service Providers

You can use ReFILE if the following conditions apply:

- You are an EFILE service provider in good standing with the CRA. This means you were accepted to use EFILE, or your EFILE privileges have not been suspended or revoked. Learn more about EFILE.

- You use certified EFILE software with ReFILE.

- Your client first filed their return online.

- You are not discounting on the ReFILE submission.

What Happens If You Submit Your Tax Return Twice

When attempting to file your return again, you will get an error code and explanation on the return, so the IRS rejects it. For instructions on how to contact the IRS, the IRS typically uses a statement like Error Code-0515 or Error Code-515 in order to inform senders that taxpayer is already preparing their taxes for same year.

Recommended Reading: Doordash How To File Taxes

How Long Do You Have To Live In A State To File Taxes

Continuing with our Pennsylvania and New Jersey example, lets again pretend that you live in Pennsylvania and work in New Jersey. There is a public transportation system that runs buses between the two states, but theyve really cut back their service during COVID. To combat this, you go and stay with your cousin in New Jersey temporarily to be closer to work.

Because you live in Pennsylvania, and because of the reciprocity agreement, you usually dont pay tax to New Jersey. But how long can you live there before New Jersey wants your tax money instead of seeing it go to Pennsylvania?

Although it can vary by state, its common for a state to want taxes from you if youve stayed there for more than half the year, or for 183 days. These days dont necessarily need to be consecutive. You can bounce back and forth between one state and another, but once youve been around for more than 6 months most states want their cut of your money. Other states use different criteria to decide when to tax you.

Some allow you to work in the state anywhere from 2 to 60 days before they start withholding tax. Others will start taxing you after you earn a certain dollar amount. Some use both criteria. In Georgia, for example, you must have state taxes withheld from your pay after youve worked more than 23 days, earned more than $5,000 or earned 5 percent or more of your income for the year in Georgia.

Correcting A Ct Income Tax Return

ALERT: RECENTLY ENACTED FEDERAL LEGISLATION MAY IMPACT CERTAIN CONNECTICUT TAXPAYERS – for more information, .

If corrections are necessary, you must file Form CT-1040X, Amended Connecticut Income Tax Return. Do not submit a second Form CT-1040 or Form CT-1040NR/PY.

ON-LINE – Amend your return using the TSC-IND, our free, online filing system. Login to your account, select the CT-1040X filing option and choose the period you wish to amend. On-line amendments can only be filed after the original return has processed.

PAPER – If you cannot use the TSC-IND, download the amended return from our website, complete it, and then mail it to DRS.

NOTE: Amended returns do not have the option to choose direct deposit.

When must an amendment be filed in order to claim a refund?

Purpose: Use a Form CT-1040X to amend a previously filed Connecticut income tax return for individuals. Visit the DRS Taxpayer Service Center at portal.ct.gov/TSC to file Form CT-1040X online.

You must file Form CT-1040X in the following circumstances:

Do not file Form CT-1040X

Financial Disability

Also Check: How To Get A License To Do Taxes