Which States Expect Refund Delays In 2020

Below is each state, a link to its Wheres My Refund tool, and the general timeline of issued refunds:

Alabama Refunds are processed starting March 1 every year. Please wait until then to check the status of your refund.

Alaska No state income tax

Arizona The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Arkansas Identity theft has been a growing problem nationally and the state is taking additional measures to ensure tax refunds are issued to the correct individuals. These additional measures may result in tax refunds not being issued as quickly as in past years.

California E-filed returns will take up to 3 weeks. Some tax returns need extra review for accuracy, completeness, and to protect taxpayers from fraud and identity theft. Extra processing time may be necessary.

Colorado Fraud detection, along with verification that claims made on an individual income tax return are valid and that documentation is submitted with the returns, could delay individual income tax refunds up to 60 days beyond the time frames of prior years.

Connecticut No specific timeline provided for delivery of tax refunds.

Delaware Expect 46 weeks from filing for your refund to be delivered.

Florida No state income taxes

Hawaii It will likely take 910 weeks after you e-file your tax return.

Illinois No specific timeline provided for delivery of tax refunds.

Nevada No state income tax

Need More Tax Guidance

Whether you;make an appointment;with one of our knowledgeable tax pros or choose one of our;online tax filing;products, you can count on H&R Block to help you get the support you need when it comes to filing taxes.

Need to check the status of your federal refund? Visit our Wheres My Refund page to find out how soon youll receive your federal refund.

Related Topics

Can you claim someone as a dependent on your taxes, even if they’ve never lived with you? You may be surprised.

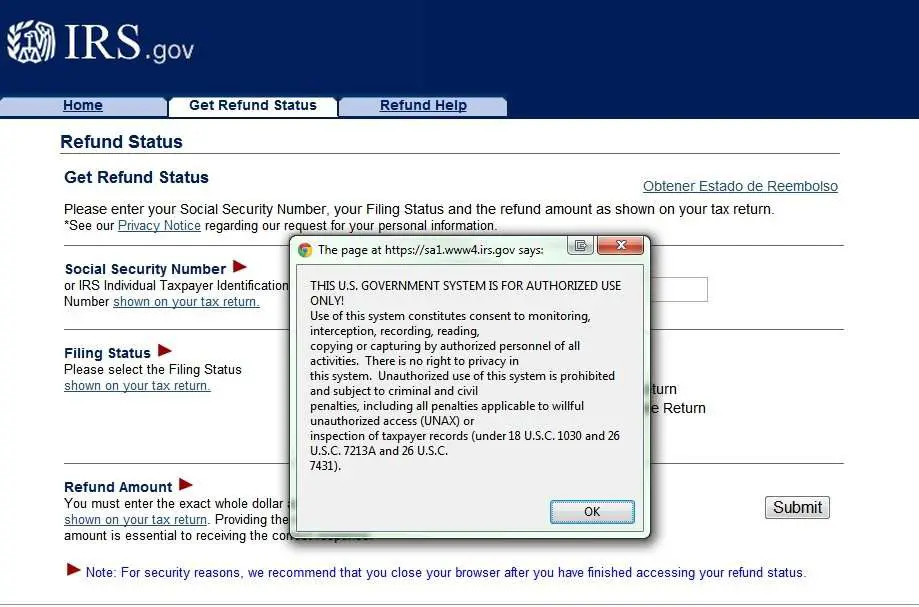

An Irs App Is Another Option

There is an IRS internet application that can help get you current information on your refund. You can access the app online or using your mobile device. Go online to the IRS.gov website to this page.;There, youll find IRS2Go, which is the official mobile app of the IRS that you can download to your phone through Google Play, amazon.com or Apple.

The app will show you your refund status.;You can also use the app to file your tax return for free if you havent done so yet.;The app has an English and a Spanish version.

Don’t Miss: How To Get Social Security Tax Statement

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund.;But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Have You Filed Your Ga Tax Return Want To Check The Status Of Your State Tax Return

ATLANTA In an effort to combat fraud, the Georgia Department of Revenue pushed the date back on accepting individual tax returns.

The DOR began accepting individual tax returns on January 27.

The deadline to file 2019 individual income tax returns, without an extension, is Wednesday, April 15, 2020.

Also, DOR has implemented new distribution of 1099-Gs and 1099-INTs.

For Individuals, the 1099-G will no longer be mailed.

The Department has built a new tool for taxpayers who receive Form 1099-G and the 1099-INT statement .

DOR officials report most refunds will be issued within 21 days, but it might take more than 90 days for the date of receipt by DOR to process a return and issue a refund.

Also, all first-time Georgia income tax filers, or taxpayers who have not filed in GA for at least five years, will receive their refund in the form of a paper check.

Want to check the status of your state tax return? Click:;

To check the status of your federal tax return, click:;

You May Like: What Do I Do If I Owe Taxes

Are Refunds Delayed This Year

The IRS is experiencing delays processing returns this year.;This may be a result of the IRS reconciling the return with the economic impact payments sent during the last year.;

Before the IRS releases the refund, they will review each return that has indicated they did not receive a payment. Those returns will be compared to the payments sent to ensure another payment is not issued to a taxpayer that has already received payment. This could cause a delay in the processing of those returns.;

The IRS is working as quickly as possible to issue refunds to the taxpayers.;

Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for;previous years tax returns or amended returns.

You May Like: What Does Agi Mean For Taxes

Wheres My State Tax Refund Nebraska

Its possible to check you tax refund status by visiting the revenue departments Refund Information page. On that page you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the;Check Your Individual Tax Refund Status page;to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that;your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take;an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states;Department of Taxation.

Don’t Miss: How To File Federal Taxes For Free

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 4 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks;

The Wheres my Refund application;shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.;

See how our;return process works:

Taxpayers Are Asking Irs: Where Is My Refund And Where Is My Stimulus Payment

Many taxpayers are still waiting for their tax refunds or stimulus checks, while the IRS works … through a backlog of tax returns.

getty

Ive received a number of letters from readers of this forbes.com column asking for help with both tax refunds and stimulus payments.;They want to know, whats going on?; I have some answers, but, unfortunately, no advice to each reader, as each delay could be situational, that is, unique to the person experiencing the delay.

You May Like: How To Pay Llc Taxes

How Can I Check The Status Of My Refund

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the first social security number listed on your tax return along with the exact amount of your refund shown on line;34 of Form D-400, Individual Income Tax Return. You can also call our toll-free refund inquiry line at 1-877-252-4052, 24 hours a day, 7 days a week. Refund checks are written weekly. If you contact our refund inquiry line and you are advised that your check has not been written, please wait 7 days before calling the refund inquiry line again.

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax Return. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

You May Like: How To Pay Federal And State Taxes Quarterly

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See;Review of your tax return;;by CRA for more information.

If you use direct deposit, you could get your refund faster.

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund.; If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund.; The Department will notify the debtor of the set-off and will refund any balance which may be due.; The agency receiving the amount set-off will also notify the debtor and give the debtor and opportunity to contest the debt.; If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund.; For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.

You May Like: Where Do I Get Paperwork To File Taxes

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Remote Work Arrangements: Payroll And Income Tax Issues For Employers And Employeesyour Browser Indicates If You’ve Visited This Link

Having an employee working from home in a state that is not the same as where the employer is based creates several issues: where to withhold state and local income tax and whether the remote workforce creates nexus such that the employer owes income or franchise tax to the remote state.

Also Check: Do I Have To File Taxes If I Receive Unemployment

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status;using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

Point Park Lookout Mountain And Chattanooga Battlefieldsyour Browser Indicates If You’ve Visited This Link

Title: Point Park Lookout Mountain and Chattanooga Battlefields Produced by: Stephen Hutcheson and the Online Distributed Proofreading Team at *** START OF THE PROJECT GUTENBERG EBOOK POINT PARK LOOKOUT MOUNTAIN AND CHATTANOOGA BATTLEFIELDS *** The National Park System,

Project Gutenberg

Recommended Reading: How To Pay My Federal Taxes Online

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For; U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

Read Also: How To Do Taxes Freelance

Wheres My Georgia State Tax Refund

Find information about your Georgia state income taxes below.;Check your filing status and refund for any state.

Wheres My Georgia State Tax Refund?

The Georgia State Department of Revenue is where you can find your GA state tax refund status. Use the following resources to find where your Georgia state tax refund using these resources.

State:;;GeorgiaHours: Mon. Fri. 8am 5pmOnline Contact Form:;;2020 State Tax Filing Deadline:; May 17, 2021

Note: Please wait at least 90 days before checking the status of your refund.

Wheres My State Tax Refund Montana

Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. From there you will need to enter your SSN and the amount of your refund.

The processing time for your tax return and refund will depend on when you file. The;Montana Department of Revenue says that if you file your return in January, it may process your refund within a week. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns.

Read Also: Can I Use Bank Statements As Receipts For Taxes

Business Return General Information

Due Dates for Georgia Business Returns

Corporations – April 15, or same as IRS -;Returns are due by the 15th day of the fourth month following the close of the corporation’s;tax year if the entity is on a fiscal year.

S-Corporations – March 15, or same as IRS -;Returns are due by the 15th day of the third month following the close of the corporation’s;tax year if the entity is on a fiscal year.

Partnerships;– March 15, or same as IRS

Fiduciary & Estate – April 15, or same as IRS

Business Extensions

Corporation – Corporations that have obtained a federal;extension by filing Form 7004 with the Internal Revenue Service are also extended six-months to file their Georgia return. A Corporation that is only seeking to extend the filing of the Georgia tax return must file;Form IT-303 Application for Extension of Time For Filing State;Income Tax Returns, by the due date of the original return. To access Form IT-303, from the main menu of the Georgia return select Additional Forms > GA Extension of Time to File. This form cannot be e-filed and must be mailed to the address on the form.

Amended Business Returns

Georgia Amended Business Returns can be e-filed.

Corporation – Business taxpayers must complete a Georgia Form 600 with the amended box checked. To mark Georgia Form 600 as an amended return, from the main menu of the Georgia return, select Heading Information > Type of Return selected > Amended Return.