Farmers Fishermen And Merchant Seamen

Farmers, fishermen and merchant seamen who receive 2/3 of their estimated Virginia gross income from self-employed farming or fishing have special filing requirements, which allow them to make fewer payments. If you meet the qualifications of a farmer, fisherman or merchant seaman, you only need to file an estimated payment by Jan. 15. If you file your income tax return on or before March 1 and pay the entire tax at that time, you are not required to file estimated tax payments for that tax year.

Who Should Pay Quarterly

Most freelancers or independent contractors are required to pay quarterly estimated taxes. This is especially true if your freelancing income is your sole source of income.

There are some exceptions to the rule that can exempt you from paying quarterly taxes. However, this is where things can get confusing. So when in doubt, pay quarterly folks!

When Are Quarterly Taxes Due For 2021 And 2022

To avoid an Underpayment of Estimated Tax penalty, be sure to make your payments on time for tax year 2021:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

For tax year 2022, the following payment dates apply for avoiding penalties:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

Also Check: How Much Does H&r Block Cost To File Taxes

How Do You Minimize Taxes In Retirement

The best way to minimize taxes in retirement is by planning ahead. Ideally, you would meet with a financial advisor specializing in retirement planning well before your retirement date. A retirement planner can help you strategize about the vehicles you’ll use to fund your retirement and minimize taxes. Even if you’re close to retirement, or already retired, it doesn’t hurt to consult a professional for advice.

How Much Estimated Tax Do You Have To Pay

Ideally, the four estimated tax payments you make each year will add up to your tax liability for the year. However, if your income varies substantially from year to year, it can be hard to estimate how much you must pay during the year.

So, itâs easy to end not paying enough estimated tax to cover all you owe. Unfortunately, if you donât pay enough estimated tax, the IRS will impose an underpayment penalty.

Fortunately, there is a way to avoid having to estimate how much youâll earn this year. No matter what your income for the current year turns out to be, you wonât have to pay any penalties if the estimated tax you pay is at least the smaller of:

- 90% of your total tax due for the current year, or

- 100% of the tax you paid the previous year or 110% if youâre a high-income taxpayer

Many self-employed people establish separate bank accounts to save up for taxes into which they deposit a portion of each payment they receive from clients. This step gives them some assurance that theyâll have enough money to pay their taxes.

The amount you should deposit depends on your federal and state income tax brackets and the number of your tax deductions. Depending on your income, youâll probably need to deposit 15% to 50% of your pay in the highest tax brackets. If you set aside too much, of course, you can always spend the money later on other things.

Recommended Reading: When Do You Get The Child Tax Credit

How To Pay Quarterly Taxes

Once you’ve calculated your quarterly payments,

- You can submit them online through the Electronic Federal Tax Payment System.

- You can also pay using paper forms supplied by the IRS.

- When you file your annual tax return, you’ll pay the balance of taxes that weren’t covered by your quarterly payments.

You have other options as well when you show an overpayment of tax after completing Form 1040 or 1040-SR. You can apply for part or all of your overpayment to go toward your estimated tax for the current tax year rather than be refunded.

Consider this amount when estimating your tax payments for the current tax year. You can treat the overpayment credited toward your estimated taxes as a payment made on April 15 for the first quarter of the current tax year.

You can use your new total annual income to estimate your quarterly payments for the next tax year. You can also use software like QuickBooks Self-Employed to track your income, expenses, and deductions throughout the year, which will help with estimating your quarterly payments.

Dont worry about knowing which tax forms to fill out when you are self-employed,;TurboTax Self-Employed;will ask you simple questions about you and your business and give you the business deductions you deserve based on your answers.;TurboTax Self-Employed;uncovers industry-specific deductions. Some you may not even be aware of.

Heres How And When To Pay Estimated Taxes

IRS Tax Reform Tax Tip 2018-140, September 10, 2018

Certain taxpayers must make estimated tax payments throughout the year. Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated tax payments or a combination of the two. If they dont, they may owe an estimated tax penalty.;

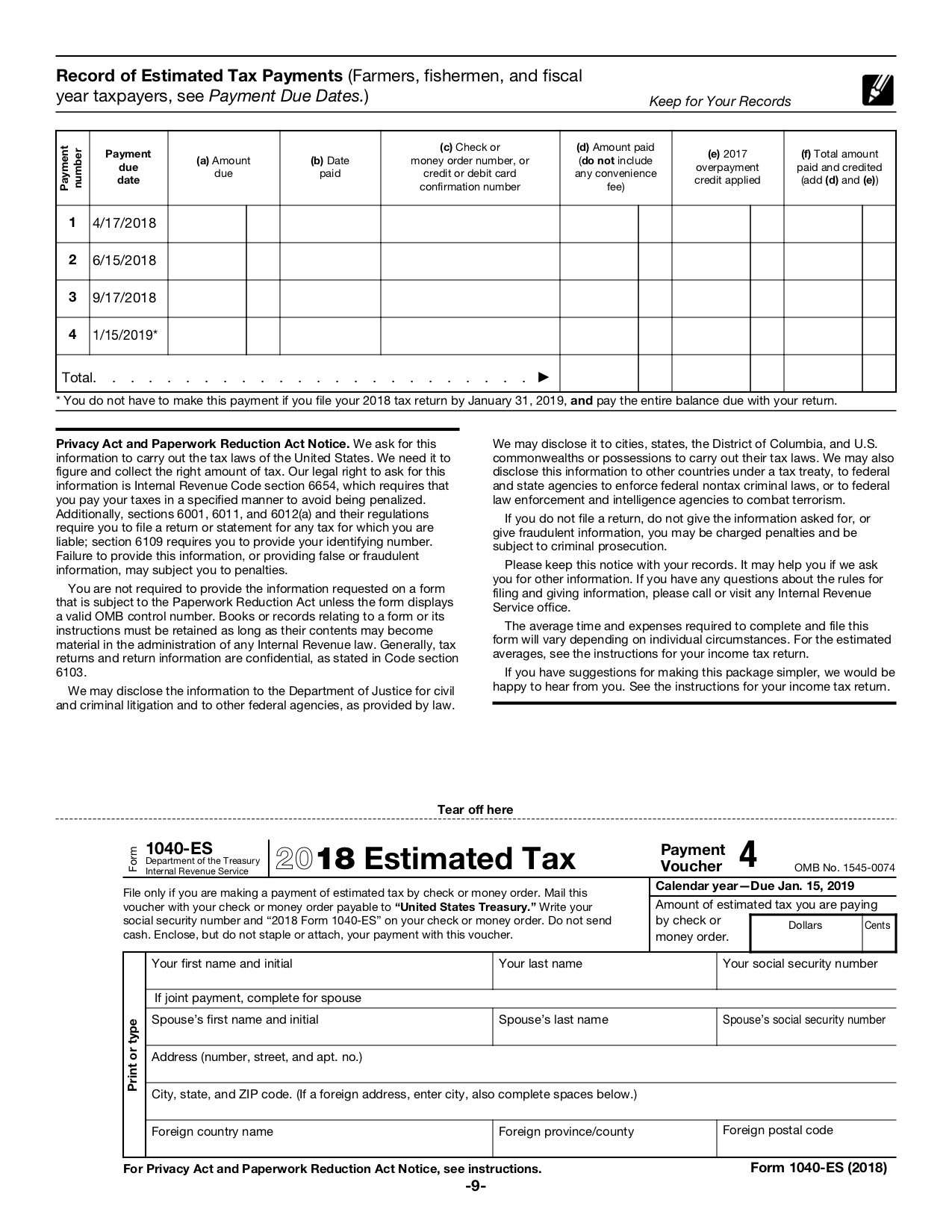

For tax-year 2018, the remaining estimated tax payment due dates are Sept. 17, 2018 and Jan. 15, 2019.

Estimated tax is the method used to pay tax on income that is not subject to withholding. This income includes earnings from self-employment, interest, dividends, rents, and alimony. Taxpayers who do not choose to have taxes withheld from other taxable income should also make estimated tax payments. This other income includes unemployment compensation and the taxable part of Social Security benefits.

The IRS urges everyone who works as an employee and who also earns or has income from other sources to perform a Paycheck Checkup now. Doing so will help avoid an unexpected year-end tax bill and possibly a penalty when the taxpayer files their 2018 tax return next year. They can do a checkup using the Withholding Calculator on IRS.gov.

Here are some things to know for taxpayers who make estimated payments :

You May Like: How To Register For Tax Id

Ready For A Payroll Service Or Payroll Software

If all of this work seems overwhelming, you might want to consider either a payroll service or payroll software.

Payroll software can help you with all the details and can make the deposits for you, by connecting with your payroll account. Be sure the software can remind you when payments are due.

A payroll service is an outside company that takes over all of your payroll functions, including sending out reports and payments when they are due, for both federal and state payroll taxes.

Having payroll software or a payroll service doesn’t give you a pass on knowing your responsibilities as an employer. You still need to be aware of what reports and payments are due and when.

Calculating Taxable Income Using Exemptions And Deductions

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The new tax plan signed by President Trump in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

Recommended Reading: How To Track Your Taxes

Use The Safe Harbor Rule

The Safe Harbor Rule provides that the IRS will not penalize you for underpaying your quarterly estimated taxes if your payments are over 90% of your tax bill from the prior year. To calculate how much to set aside under the Safe Harbor Rule, take 100% of the amount of taxes you paid last year and divide by four, and you have your quarterly payment.

Of course, if you end up owing more taxes at the end of the year, you still must pay them. Therefore, some people set aside 30% of their expected income each quarter.

What Are Quarterly Taxes

There are all kinds of days we look forward to throughout the yearlike birthdays, the Friday before a three-day weekend and National Pancake Day. Then there are some days wed rather skip altogether. Were looking at you, Tax Day.

But the irony is we dont really pay our taxes on Tax Day.;In fact, by the time the tax deadline rolls around, most U.S. workers will have already paid their taxes in full. Thats because their employers withhold taxes from their paycheck before it ever hits their bank accounts.

But what if youre a freelancer or a contract worker with no employer to withhold those taxes? Yes, you still have to pay taxes just like everyone else. But now its your responsibility to make sure you pay them. And that means theres a chance you might need to pay quarterly taxes to the IRS.

What all does that mean? Read on to find out.

Don’t Miss: How Do I Pay My State Taxes In Missouri

How Do I File My Annual Return

To file your annual tax return, you will need to use Schedule C to report your income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C Instructions;may be helpful in filling out this form.

In order to report your Social Security and Medicare taxes, you must file Schedule SE , Self-Employment Tax. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare;taxes you should have paid during the year. The Instructions;for Schedule SE may be helpful in filing out the form.

When Are The Quarterly Estimated Tax Payments Due

Quarterly tax payments are due April 15, June 15 and September 15 of the tax year, and January 15 of the next year. Your income tax liability accrues on income as it is earned, rather than being due on April 15 of the next year.

If you receive income unevenly during the year you may annualize your income. Complete the MI-2210 Annualized Income Worksheet to determine what quarter your payments are due.

You may make estimated tax payments using Michigan Department of Treasury’s e-Payments system or mail your estimated payment with a Michigan Estimated Tax voucher .

To ensure your estimated tax payment is received timely, allow 3 to 5 days for an electronic payment to be received and;2 weeks to post to your account.; Allow 2 weeks for a mailed payment to be received and 8 weeks to post to your account.

Note: Payments that are not received by the due date will be applied to the following estimated tax quarter.

Penalty is 25% for failing to file estimated payments or 10% of underpaid tax per quarter.;Interest is 1% above the prime rate.

Read Also: Are Taxes Due By Midnight May 17

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Reduce Income Tax

Let Tax Software Do The Work

If you usually use tax software or an online tax service such as those offered by TurboTax or H&R Block, estimation should be easy. Tax software will estimate your freelancer quarterly taxes for you based on the previous year and any new information you input. You can then complete Form 1040-ES within the software as you do with your other tax forms.

File Your 1099 Contractor Quarterly Estimated Tax By These Deadlines

The deadlines for filing quarterly estimated taxes are

If your tax year doesnt begin on January 1 or if you are a farmer or a fisherman, see Chapter 2 of Publication 505.

Some of the filing dates for quarterly estimated taxes were extended for tax year 2019 due to the Covid-19 pandemic, so you may want to doublecheck with the IRS website before paying in case there are any extensions for tax year 2020. Please note that state, municipal and county taxes are not necessarily due on the same dates as federal taxes.

Read Also: How To Buy Tax Lien Properties In California

What If I Blow It Off And Just Deal With It Later

The IRS will charge penalties if you didnt pay enough tax throughout the year.;The IRS can charge you a penalty for late or inadequate payments even if you’re due a refund when you file your tax return.

The IRS might give you a break on penalties if:

-

You were a victim of a casualty, disaster or other unusual circumstance, or

-

Youre at least 62, retired or became disabled this year or last year, and your underpayment was due to reasonable cause rather than willful neglect

Some tax rules have changed due to coronavirusLearn more about what’s different for taxpayers as part of the federal government’s response to the coronavirus.See the changes

When To Pay Estimated Quarterly Taxes

For 2021, here’s when estimated quarterly tax payments are due:

|

If you earned income during this period |

Estimated tax payment deadline |

|---|

» MORE:Learn about important changes to this year’s tax-filing deadline

These dates dont coincide with regular calendar quarters, so plan ahead. And you dont have to make the payment due in mid-January if you file your tax return and pay what you owe by the end of the month.

You can make payments more often if you like, Kane says.

I think it’s easier to make 12 smaller payments than four larger payments,” she says. “If you owe $1,200 for the year, I would rather pay $100 a month than $300 four times a year. And if we’re talking bigger numbers, it gets pretty extreme.

You May Like: How To Do Taxes Freelance

How To Determine What You Should Pay

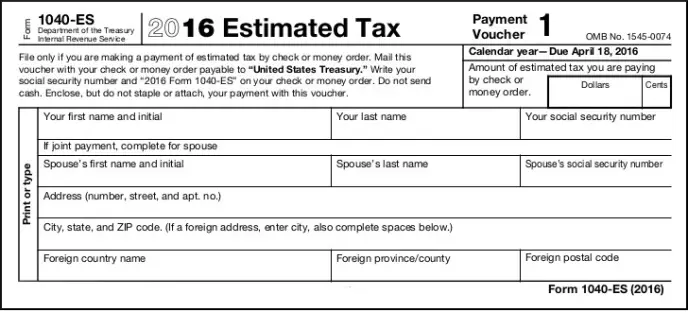

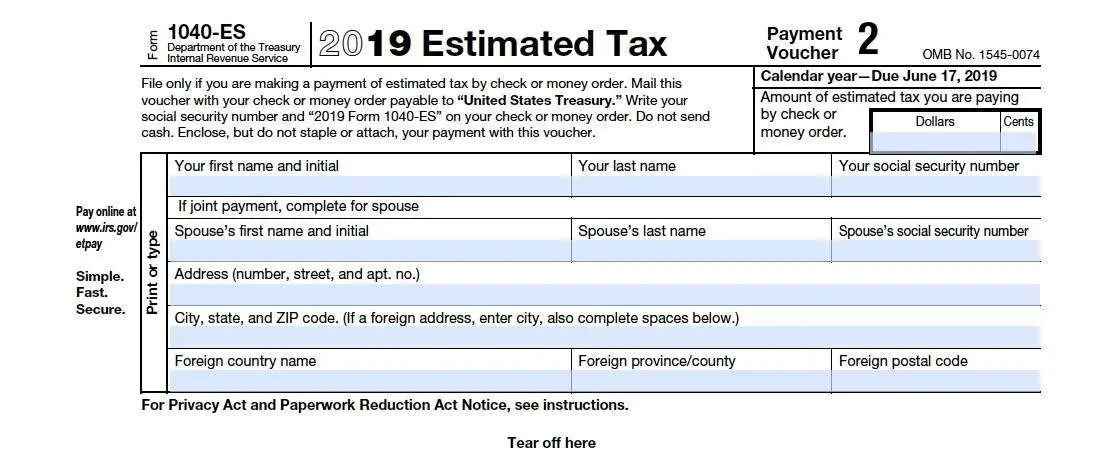

Form 1040-ES helps you figure your estimated taxes and provides vouchers to send along with your estimated tax amounts if you opt to pay by check or money order. Tax preparation software or your accountant can do the calculations for you. To determine how much you owe, check the income claimed and deductions taken on the previous years federal tax return to see if it will be comparable in the current year.

Dont forget to check if youve applied your previous years tax refund to this years taxes.

High earners, defined as those making $150,000 or more if single or married filing jointly , should pay 110 percent of last years tax liability to meet safe harbor rules.

Example: If your tax bill last year was $30,000, this year you would pay $33,000 in estimated and withholding taxes to avoid paying any underpayment penalties.

Why Are Quarterly Estimated Tax Payments Required

Our tax system is a âpay as you earnâ system, meaning that taxes must be paid as you receive income during the year. The government wants steady income throughout the year and quarterly payments are a way to ensure that they are getting it. Therefore, taxes must be paid either through withholding or estimated tax payments.

However, as a freelancer or independent contractor, you donât get income withheld from your payments. So when tax season rolls around, you do not get a tax refund. This often makes you liable to make quarterly payments on your taxable income. Before you stress eat that entire pint of ice cream, letâs talk through the mechanics of how to file quarterly taxes.

Also Check: How Can I Make Payments For My Taxes

S To Estimate Quarterly Income Tax For 1099 Contractors

Author: George Birrell

Being a self-employed 1099 contractor or freelancer has its perks. You can work flexible hours and enjoy deductions unavailable to those who get a W-2 instead of 1099s. But with its advantages come responsibilities. Among these are paying quarterly estimated taxes.

People in business for themselves usually need to make estimated tax payments, and this includes contractors and freelancers. You will need to pay not only income tax, but also other taxes, the most notable of which is self-employment tax.

Should you neglect to pay your quarterly estimated taxes, you will face penalties and interest. Long story short, if you are working the gig economy, you need to learn how to estimate quarterly income tax for 1099 contractors. Even if you only have a part-time gig and a full-time job, its unlikely your employer is withholding enough tax to cover your side business.

Following are the 5 steps to estimate quarterly income tax for 1099 Contractors.