Register For A Permit If The Sale Of Goods Or Services Are Taxable

This is a combined business application form, which means you can register for one or more of the following:

- Sales Tax

If you will be selling;, you will;need to obtain a separate HHM permit.

Keep a copy of the form. You may begin to collect tax immediately; your proof of registration is your copy until we send you your permit number in about 4-6 weeks. The sales tax permit itself is free of charge.

A sales tax permit is not a license to buy tax-free. It is a license to collect tax. For your exempt purchases, you must use exemption certificates; see below.

Minnesota Unemployment Insurance Employer Account Number

All business entities, other than sole proprietorships, single member limited liability companies, partnerships without employees or corporations and limited liability companies with no employees other than owner/officers with 25 percent or more ownership share, must register with the Department of Employment and Economic Development, Unemployment Insurance Program.

The Unemployment Insurance Program issues identification numbers that are different from those issued by the Minnesota Department of Revenue and the Internal Revenue Service. Register at Employers and Agents. Employers may contact the Unemployment Insurance Program at 651-296-6141, option 4. The UI Program requests that businesses not register for a UI Employer account number until wages have actually been paid.

Where To Go If You Need Help Registering For A Sales Tax Permit In Maine

If you are stuck or have questions, you can either contact the state of Maine directly or reach out to us and we can register for a sales tax permit on your behalf.;

How to contact the State of Maine Revenue Services if you have questions: You can contact Maine Revenue Services by calling 207-624-9784.

How to contact TaxValet if you want someone to handle your permit registration for you: You can learn more about our sales tax permit registration service by .

Read Also: How To Buy Tax Lien Properties In California

Special Events And One Time Sales

Special event – Any person or company that is selling goods to a final consumer is required to collect and remit Missouri sales tax and must register for retail sales tax by completing a Missouri Tax Registration Application Form 2643.

One time sale – If you already have a sales tax license, file and pay on the preprinted forms and you make a one time sale at a different location, you can add that location on your preprinted form and indicate âone time saleâ.

For Employers: How To Register For An Employer Id Number

If you are an employer and you wish to register your company with the SSS, you will need to visit the nearest SSS branch, fill out the Employer Registration Form and the Specimen Signature Card , and prepare the original and photocopy of the following documents for submission:

- Approved Articles of Partnership from Incorporation from the Securities and Exchange Commission ,

- Approved Articles of Incorporation from SEC,

- Approved Articles of Incorporation from SEC,

- License to Transact Business in the Philippines from SEC,

- Approved Articles of Incorporation from SEC,

- Agency Agreement between the manning agency and foreign principal,

- Approved Articles of Cooperation from the Cooperative Development Authority ,

- Articles of Cooperation from CDA; and

- Accreditation from the Department of Labor and Employment

You May Like: Are Property Taxes Paid In Advance

Apply For Other Tax Ids Business Licenses And Permits

Not all businesses have to pay state and local taxes. For example, income tax is one of the most common small business taxes, but seven states dont require it. That means youll need to do some research to determine whether you need a state or local tax ID number. Your state government website can answer specific questions and outline application steps.

Businesses need federal, state, and local licenses and permits to operate. The SBA has a helpful list of industry types regulated by the federal government.

In general, local governmentyour county or citysets permit and licensing requirements. This includes guidelines for getting professional and occupational licenses, like a cosmetology license or liquor license.;

You’ll also need to apply for specific permits to get up and running, like a sign permit to display your business name on your store. Search your local government website to make sure you’re on the right track.

What If I Need My Business To Be Federally Incorporated

If you intend to incorporate your business federally, the Business Number is supplied by;Innovation, Science and Economic Development Canada when your incorporation is approved. To apply for federal incorporation you can visit;Corporations Canada;and be sure to learn the difference between federal and provincial incorporation beforehand. After receiving the Business Number from ISED, you can apply for any of the above-mentioned tax ID program accounts through the CRA.

Read Also: Do You Have To Pay Taxes On Plasma Donations

Ready To Register Now

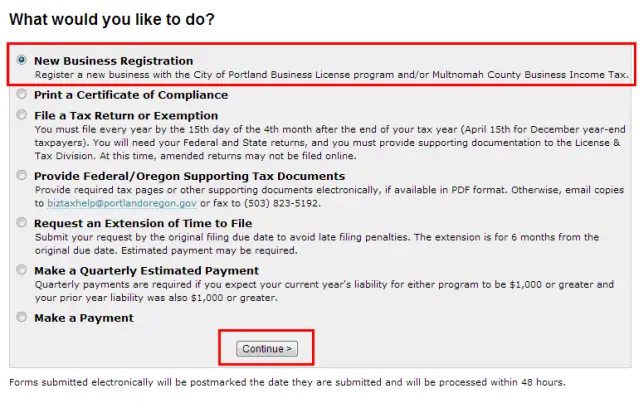

You can register with the Department using one of the following avenues:

- Online – you can apply online with both the Missouri Department of Revenue and the Missouri Department of Labor. Online applicationNOTE: if registering for retail sales / vendorâs use, you will need to submit your bond via mail.

- Paper application –

- Download the Missouri Tax Registration Application Form 2643 and complete it online, print it off and mail it to Missouri Department of Revenue, P.O. Box 357, Jefferson City, MO 65105-0357

- Have the Missouri Tax Registration Application Form 2643 mailed to you call 1-800-877-6881, complete and mail it to Missouri Department of Revenue, P.O. Box 357, Jefferson City, MO 65105-0357

When You Are First Registering In Germany

If you had this information before hand, you probably asked to get one during your Anmeldung process. In this case, the information was shared with the central tax office which will send it to you by post.

In case you didnt receive your German tax ID, do wait 2 weeks;or so before going to the Finanzamt . The administration needs that time to update your case/files first. If you still havent received your Identifikationsnummer anything, you may request a new copy of from the Federal center for taxes directly on this page. Just enter your personal information that is displayed on your Meldebescheinigung and you are good to go. You can only receive a new copy of this document per post, so wait a few days after this.

If you have any other questions, you can also directly book an appointment at your local Finanzamt or call them. There are 2 offices you can go to for this; your local Bürgeramt, or the Finanzamt. I strongly advise you to choose the second option. There are;far less people there, avoiding long waiting times.

Read Also: Who Can I Call About My Tax Refund

Register Your New Business & Create A Tax Account

For new businesses, the Vermonts Department of Taxes, the Secretary of States office, and the Department of Labor have partnered to bring you an;Online Business Service Center;where you can;register your business and apply for the licensing and insurance you will need to conduct business in Vermont.;

After youve registered your new business online with the Secretary of State, you will be given the option to register for a business tax account with the Department to collect:

- Sales and Use Tax

How To Register A Business And Legal Name In 5 Steps

You have a promising idea, youve done the market research, and now youre ready to start your business. The next step is to register your business entity with the correct government agencies and get all the documentation squared away. Every founder will go through a slightly different process, depending on your business location and which business structure you select.;

How you register your new business will determine how you file taxes and apply for lines of credit. While certain business structures protect your personal assets from risk if the company struggles or fails, others do not.

Youll also need to give your business a clear and compelling name. This guide covers how to register a business nameor several. As you’ll see, there are some advantages to using different names for legal, financial, and branding purposes.

We’ve distilled the complex guidelines on how to register a business down to five key steps.;

Don’t Miss: How To Pay My Federal Taxes Online

Select And Register Your Business Name

Among all the stresses of starting a business, choosing a name is one of the more exciting moments. Your business name is your most significant identifier. Once youve deliberated and landed on one that feels right, you dont want a competitor to take it. As you learn how to register a business name, keep in mind that requirements differ by state, county, and city. Your state governments website is your best resource.;

In most cases, you automatically register your business name when you file registration documents with the state. Search your states name database to make sure the name isnt already registered. Then, submit a name registration form and pay any filing fees.;

At that point, your business name is legally protected, and no other business in the state can use it. But you may not want to use your legal business name. Most states require that you add a suffix to your legal business namealso called an entity name or registered business namethat indicates the type of business structure. A corporation, for example, might have to attach Inc. or Incorporated. An LLC, on the other hand, must add LLC, Limited Liability Company, or another approved title.;

You may need to explicitly describe your goods or services, naming your company Green Thumb Lawn Care & Home Maintenance LLC instead of the catchier Green Thumb LLC.

Correcting Business Information Where A Nominee Was Used

In the event a nominee was used to obtain an EIN you are required to correct the information. Otherwise, information regarding an entity could be disclosed to someone who is not authorized to receive such information. The IRS is considering several ways to identify the responsible parties of entities. However, by updating the information itself, an entity can establish that it is a reliable partner of the IRS in complying with the Federal tax laws.

To update the information, complete Form 8822-B, Change of Address or Responsible Party Business, and send to the address shown below that applies to you.

| If your old business address was in: |

Send Form 8822-B to: |

|---|---|

| Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia or Wisconsin | Internal Revenue Service |

Don’t Miss: What Is California State Tax Rate

Decide How To Want To Obtain Your Ein

Once you have a legal business structure, you have a few options to get a tax ID number:

- Your accountant or financial institution may be able to help you obtain one

- You can use the IRS Business & Specialty Tax Line listed above

- You can manually fill out Form SS-4 and mail it to the IRS

- You can submit an online application for a tax ID number yourself

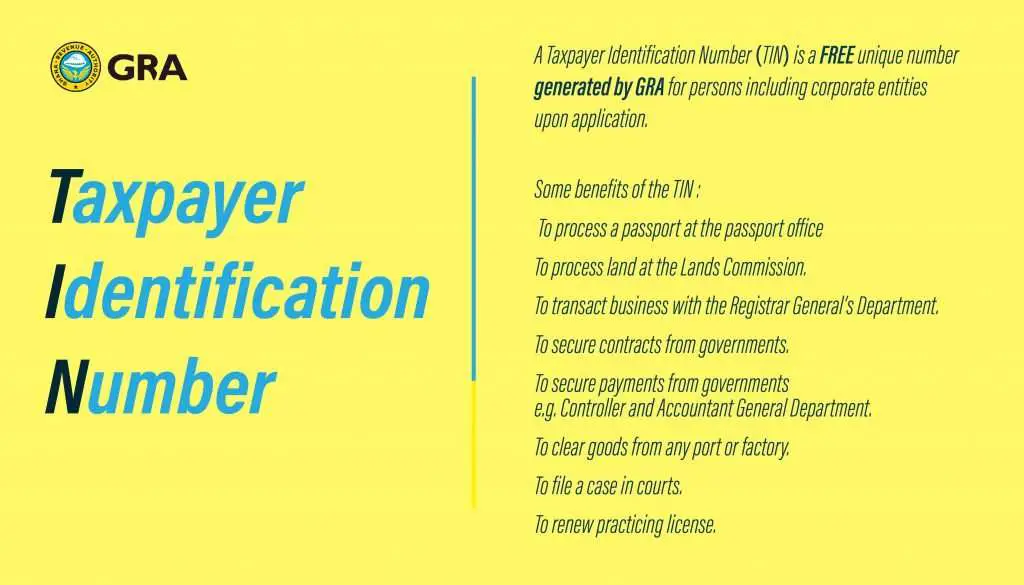

Obtain A Federal Employer Identification Number From The Irs

Most businesses are required to register with the IRS to receive a Federal Employer Identification Number . This is also sometimes referred to as an Employer Identification Number , or a Federal Tax ID Number. Some reasons for obtaining a FEIN include, but are not limited to:

- Paying federal and state taxes

- Obtaining a Maryland Tax ID Number from the Maryland Comptrollers Office

- Opening a business bank account

- Hiring employees

You can apply for a FEIN online or download the form through the IRS website, or can call them at 1-800-829-4933. Remember, you must have a Maryland SDAT Identification Number in order to apply for a Federal Employer Identification Number. Once approved, your FEIN will be a nine-digit number.

Stay Consistent

When filing with different agencies for the same business, it is important you keep your business information consistent. For example: make sure the business name submitted to the IRS is identical to the business name registered with SDAT, including punctuation.

Also Check: Can I File Old Taxes Online

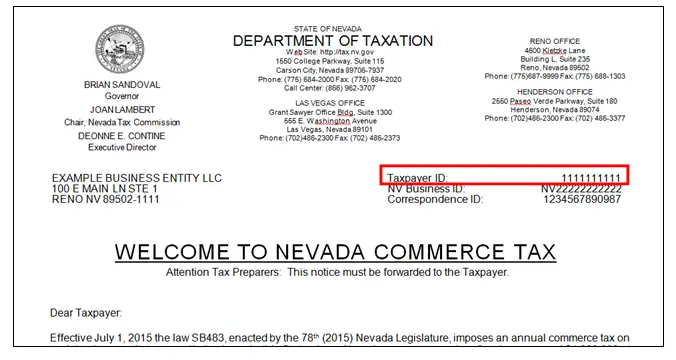

How Will I Know The Department Has Received My Business Registration Application

Once you submit your completed application, the system will provide you with a confirmation page. If the system is able to complete the registration process, a confirmation number and the issued account ID number will display on the page along with the name of your business. A notice that includes your account ID number will also be mailed to you within;five business days.

If the system is unable to complete the registration process at the time of submission, a tracking number will display on the page. Your account ID number will be issued within;ten business days and a notice that includes your account ID number will be mailed to you.

You should retain the confirmation or tracking number for your records until you receive your account ID number information by mail. These numbers will be helpful if you contact the Department with questions about your business registration application.

Register For A Business Tax Account

Most businesses operating in Vermont must first register with the Vermont Department of Taxes. For Sales and Use, Meals and Rooms, or Withholding you will need a separate business tax account for each of these respective taxes.

Eligible exempt organizations must also register prior to using an;exemption certificate. Learn more about registering a nonprofit organization.

Recommended Reading: What Can I Write Off On My Taxes For Instacart

Who Can Access My Account Information

- The owner listed on your account from your initial registration application and any additions that have occurred since then can access your account information.

- Persons / companies who the owner have completed a Missouri Power of Attorney Form 2827 for can access the information/years that are specified on the Power of Attorney.

- Checking the authorization box on a return will allow that person to discuss that particular return only with the Department.

- Confidentiality – Missouri Statute 32.057, RSMo ensures that your tax records are protected and confidential – the Department will not release tax information to anyone who is not listed on the Department’s records as owner, partner, member, or officer for your business. If the owner of your business changes, you must notify the Department to update your account information.

Confirming A Gst/hst Account Number

Businesses cannot charge HST/GST unless the business is registered. ;The HSt/GST Account number is supposed to be displayed on all invoices rendered by the business. ;If you have some concerns that the business you are dealing with is charging HST/GST without being registered there is a way of finding out if the business is registered. ;Refer to this page for how to look up a business and determine if they are registered:

Don’t Miss: How To Get Tax Exempt Status

What Accounts Can Be Opened Under The Federal Business Number

Accounts can then be opened up under this Business Number for GST/HST, Payroll, Import/Export and Income Tax.

Each GST/HST, Payroll, Import/Export and Income Tax account can have more than one account for different businesses. ;Refer to the following Revenue Canada Agency Guide for more information about all of the accounts: ;The Business Number and Your Canada Revenue Agency Program Accounts.

Buanyone Who Engages In Business In New Mexico Must Register With The Taxation And Revenue Department

Engaging in business means carrying on or causing to be carried on any activity with the purpose of direct or indirect benefit. For a person who lacks physical presence in this state, including a marketplace provider, engaging in business means having, in the previous calendar year, total taxable gross receipts from sales, leases and licenses of tangible personal property, sales of licenses and sales of services and licenses for use of real property sourced to this state pursuant to Section 7-1-14 NMSA 1978, of at least one hundred thousand dollars

We may make an exception if your business is exempt from any of these taxes by state law.

After registering you will receive a New Mexico Business tax identification number. You will receive individual state tax ID numbers for the following accounts:

- Compensating Tax

- Interstate Telecommunication Gross Receipts Tax

- Leased Vehicle Gross Receipts Tax and Surcharge

- Non-wage Withholding Tax

- Wage Withholding Tax

Each Business Tax Identification Number is used to report and pay tax collected on the above programs from business conducted in New Mexico.

Also Check: Should I Charge Tax On Shopify

How To Register For An Ein In Washington

Quick Reference

One of several steps most businesses will need to take when starting a business in Washington is to register for an Employer Identification Number and Washington state tax ID numbers.; These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes, payroll taxes, and withhold taxes from employee wages.

Lets review in more detail what this number is used for when it is required, the cost, and how to register.

Registering A Domain Name

In addition to the above steps, you need to buy a domain name to register a business for ecommerce. This will be your businesss URL, the web address where youll send customers.;

Visit an accredited domain name registrar, such as GoDaddy or Namecheap, to purchase one. It may be a challenge to get a domain name that perfectly matches your business name, so start looking soon.

Also Check: Can You Refile Your Taxes