I Checked The Status Of My Refund And I Was Told That All Or A Portion Of My Refund Has Been Applied To My Indebtedness With The Nc Department Of Revenue I Was Not Aware That I Owe The Department Who Can I Call To Get More Information

You can call toll-free at 1-877-252-3052 to get information about your balance with the Department.

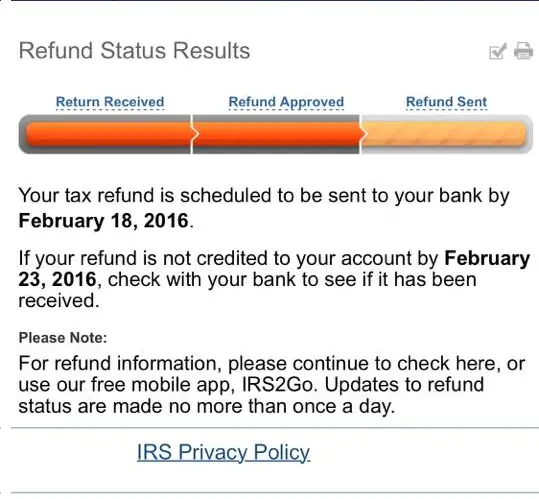

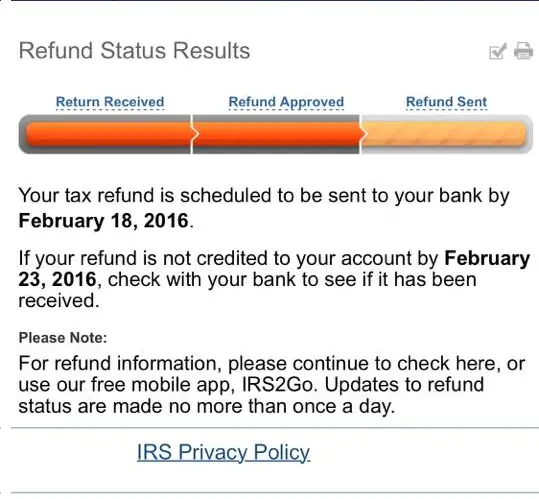

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

So My Tax Refund Was Accepted When Will It Be Approved

Accepted implies that the tax return has been received by the government and has undergone an initial inspection . The next move after approval is for the refund to be accepted by the government.

The government will explore back taxes and unpaid child support. Please note that a personal refund can be significantly reduced if there are any debts found. Once the government is sure you dont have any unpaid loans, they will initiate the approval, and then you will get a refund.

Accepted also confirms the fact that a refund has been issued, and the details seem to be in order . Once the IRS checks more deeply, they will quickly accept the refund.

Get Help With Your DEBT

Read Also: How Much Does H& r Block Charge To Do Taxes

How To Correct An Electronic Return

If we have accepted and processed your client’s T1 return, you may be able to amend and retransmit the T1 return using the ReFILE service. Also, your client can use My Account’s Change my return option. Alternatively, if you are an authorized representative for your client and you have a level 2 authorization on their account, you can also use Represent a Clients Change my return option.

We conduct a review on each return transmitted to us. If there are problems which will prevent processing, the system will indicate the fields you will have to correct. This means the electronic tax return was not accepted for processing and your client’s return is not considered to be filed.

Before signing off the system, print the EFILE web service response screen which contains the error messages. Review these messages or codes to determine what problems exist with the return.

For example, you may receive the following:

2037There is an entry on line 30300 on page 5 of the return for the spouse or common-law partner amount and, if applicable, on line 58120 on the provincial or territorial Form 428. Where your client was married or living common law during the year but on December 31st the marital status was other than married or living common law, enter 1 on line 55220.

You can usually get the full text description of each error clue from your tax calculation software package or by accessing chapter 2 of the RC4018 Electronic Filers Manual.

Monitor Your Tax Return Status

Once you know that your return has been accepted, its just a matter of waiting. According to the IRS, it takes 21 days or less for the agency to process most tax returns. However, there are instances in which the agency may require more time to deal with an individual return. For instance, tax returns that have numerous errors or are incomplete may take longer to process. If the IRS suspects you were a victim of identity theft, or if youve applied for an earned income tax credit or an additional child tax credit, it could take longer to process the claim. Fortunately, if youre expecting to get a refund, theres a place on the internet you can go to track your returns status. The IRSWheres My Refund feature will show you when to expect your refund.

Recommended Reading: How To Look Up Employer Tax Id Number

Reasons Your Tax Refund Might Be Delayed

Although youre probably eager to receive your refund, it might take longer than 21 days for the IRS to process your return. Several issues might cause a delay, including:

Dont Stress You Wont Miss This Flight

Have you ever walked into an airport and realized you and everyone around you seem to be in a rush? Well, tax filers tend to mimic the same anxious energy, especially those trying to figure out their tax refund status.

We understand that like the airport checking luggage-security-shoes-off whirlwind, tax filing is also something you dont do every day and can be pretty stressful. Actually, filing your taxes is the hardest part though so give yourself a pat on the back, sit back and await your refund.

Read Also: Can You Change Your Taxes After Filing

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax Return. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

Why Would The Irs Deny Your Tax Return

Probably the most common reason that the IRS will reject a tax return is because of errors that are discovered during e- filing. You ll be able to resubmit your corrected return, and well tell you when its accepted by the IRS. When you mail a paper copy of your tax return, the IRS reject codes arent applicable.

Recommended Reading: Www Michigan Gov Collectionseservice

What Does It Mean When The Irs Says Your Tax Return Has Been Received And Is Being Processed

shows the status of my refund is Return Received? This means the IRS has your tax return and is processing it. Your personalized refund date will be available as soon as the IRS finishes processing your return and confirms that your refund has been approved. Most refunds are issued in less than 21 days.

How Long Does It Take To Go From Accepted To Approved 2020

Nine out of 10 direct deposit e-filed tax returns are handled within 21 days of acceptance by the IRSs e-file department. One should anticipate a transition period from six to eight weeks starting from the day the tax return was issued by the IRS when you filed your tax return on paper via standard post.

Read Also: Tax Lien Investing California

How Does The Wheres My Refund Tool Work

To use the IRS tracker tools to check the status of your 2020 income tax refund, youll need to provide the following information: your Social Security number or Individual Taxpayer Identification Number, your filing status , and your refund amount in whole dollars . Also, wait at least 24 hours before beginning to monitor your refund.

Go to the Get Refund Status page of the IRS tool Wheres My Refund, input your SSN or ITIN, filing status, and precise refund amount, then click Submit. If you submitted your information properly, you will be sent to a page that displays the status of your refund. If you dont, you may be prompted to validate your personal tax information and try again. If everything appears right, youll need to input the date you filed your taxes, as well as whether you did it online or on paper.

The IRS now offers a smartphone app called IRS2Go that allows you to check the status of your tax refund it is accessible in both English and Spanish. You will be able to check if your return was accepted, authorized, and delivered. Youll need certain information to log in, including your Social Security number, filing status, and anticipated return amount. The IRS refreshes the data in this tool nightly, so if you havent seen a status change after 24 hours or longer, return the next day. Once your return and refund have been authorized, you will be given a customized date to anticipate your money.

How Should You Approach The Irs For Assistance

This tax season, the IRS got 167 million calls, which is four times the amount of calls received in 2019. According to a recent study, just 7% of callers reached a telephone representative for assistance. While you could contact the IRS to verify your status, the agencys live phone help is now very restricted since the IRS is working hard to clear the backlog. You should not submit a second tax return or inquire about the status of your return with the IRS.

For additional information, see the IRSs Let Us Help You page on its website. It also suggests that taxpayers seek in-person assistance at Taxpayer Assistance Centers. You may contact your local IRS office or call 844-545-5640 to schedule an appointment. If you are qualified for help, you may also contact the Taxpayer Advocate Service at 877-777-4778.

Though the odds of receiving live help are low, the IRS advises calling the agency directly only if it has been 21 days or more after you filed your taxes online, or if the Wheres My Refund feature directs you to do so. During normal business hours, you may reach us at 800-829-1040 or 800-829-8374.

Don’t Miss: How Can I Make Payments For My Taxes

If Your Tax Return Is Accepted Does That Mean The Irs Is Finished Processing It

If you submit your tax return electronically, the Internal Revenue Service will notify you once it’s received and accepted it. This doesn’t mean the agency is done with it, only that IRS hasn’t spotted any obvious problems that require rejecting it. However, the agency still has to finish processing your documents and going over your figures.

Tips

-

Once you receive notice that the IRS has accepted your return, you can be confident the IRS has begun processing it. It will still take time before the return is fully processed and any refunds are sent.

Ways To Get Your Refund Faster

Theres no magic wand that will make your refund arrive instantly. But there are a few steps you can take to potentially speed up the process.

Also Check: Efstatus Taxact Com Return

What Is The Irs Refund Schedule

The IRS typically sends out refunds on a schedule. This schedule varies by the method you sent your return in, when you file, and what credits you claim. See an estimated schedule in the chart below.

| Filing method and refund delivery method | How long it takes to receive your refund from the time your return is accepted |

| E-file and direct deposit |

| May 10 | May 17 |

Please note that the IRS issues your tax refund not TaxSlayer or any other filing service. This means that your filing service cant say for sure when youll get your refund. But you can use the IRSs Wheres My Refund tool to see exactly where your refund is.

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days.

It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Recommended Reading: Where’s My Tax Refund Ga

How Long Will It Take For You To Get Your Federal Refund

The IRS typically delivers tax refunds within three weeks, but some people have been waiting for months. If there are any mistakes, or if you submitted a claim for the earned income tax credit or the child tax credit, you may have to wait a long time. If there is a problem that is delaying the processing of your return, the resolution depends on how quickly and accurately you respond, as well as the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,according to the IRS website.

The date on which you get your tax refund is also dependent on how your return was submitted. For instance, if you get refunds through direct deposit, it may take an extra five days for your bank to transfer the cash to your account. This implies that if the IRS takes the entire 21 days to issue your check and your bank takes five days to post it, you may be out of money for a total of 26 days. If you sent your tax return, the IRS estimates that it will take six to eight weeks for your refund to arrive after it is processed.

Submit The Correct Application Form

Make sure you are using the correct extension application form for your business type: Form 4868 for small businesses and individual filers, and Form 7004 for partnerships and corporations.

Also make sure you are using the form for the current year. The revision year is on the upper right-hand corner of the first page. The revision year must match the year of the return. For example, if you are filing an application for your 2020 tax return, the revision date on Form 4868 must be for 2020.

Read Also: How To Buy Tax Lien Properties In California

Make Sure Your Information Is Correct

Did your business or personal information change? For example, if you changed your address since your last communication with the IRS, the agency might not be able to match your tax information to the extension application information. If your business or personal information changed, you must notify the IRS in a specific way, using Form 8822.

Income Tax Refund Information

You can check the status of your current year refund online, or by calling the automated line at 260-7701 or 1-800-218-8160. Be sure you have a copy of your return on hand to verify information. You can also e-mail us at to check on your refund. Remember to include your name, Social Security number and refund amount in your e-mail request.

If you’re expecting a tax refund and want it quickly, file electronically – instead of using a paper return.

If you choose direct deposit, we will transfer your refund to your bank account within a few days from the date your return is accepted and processed.

Electronic filers

We usually process electronically filed tax returns the same day that the return is transmitted to us.

If you filed electronically through a professional tax preparer and haven’t received your refund check our online system. If not there, call your preparer to make sure that your return was transmitted to us and on what date. If sufficient time has passed from that date, call our Refund line.

Paper filers

Paper returns take approximately 30 days to process. Keep in mind that acknowledgment of the receipt of your return takes place when your return has processed and appears in our computer system.

Typically, a refund can also be delayed when the return contains:

- Math errors.

- Missing entries in the required sections.

- An amount claimed for estimated taxes paid that doesn’t correspond with the amount we have on file.

Check cashing services

Splitting your Direct Deposit

Don’t Miss: Www.1040paytax

Do I Have To File An Extension Application If I Don’t Owe Anything

If you don’t owe taxes or you are getting a refund, the penalty for filing late is $0, so you won’t have a penalty for failing to file or for underpayment. Technically, you don’t have to file an extension application in that case. But what if it turns out that you made a mistake, and you do owe money? Then the late-filing penalty will kick in. Just to be sure, file the extension application anyway.

An Application Extension Isn’t A Payment Extension

You can extend the time for filing your tax return, but you still must pay the taxes you owe by the tax due date. If you can’t pay your taxes, the IRS has several tax payment relief options.

Small businesses file business taxes on Schedule C as part of the owner’s personal tax return. These businesses are sole proprietors and single-member limited liability companies . The extension application, using Form 4868, covers both the business and personal parts of the tax return.

File an extension application for your corporation or partnership tax return using IRS Form 7004. The corporate taxes must be paid by the due date, but the partnership return is an information return, so no payment is due.

Owners of partnerships, multiple-member LLCs, and S corporations include information from the business tax return in their personal tax returns. In addition to filing the extension for the business, these individuals may need to file an extension on their personal tax return if information from the business is delayed.

If you are filing a corporate or partnership tax return, the extension application is automatic. But you still need to file the application before the deadline and pay taxes due.

The IRS extended the tax due date and filing deadline for personal tax returns and those paid by taxpayers with self-employment income to May 17, 2021. Quarterly estimated taxes for 2021 are still due on April 15.

You May Like: How Do I Get My Pin For My Taxes