Who Isnt A Good Fit For H& r Block

If youre looking to get the cheapest tax preparation software you can find, H& R Block isnt your best choice. Youll likely give up a smooth interface and support options with cheaper competitors, but you will save money.

Those looking for advice from a CPA or EA may get lucky with H& R Blocks Online Assist options, but help from a CPA or EA isnt guaranteed. H& R Block says some of the help may come from tax professionals, which means they dont have a designation. However, TurboTaxs Live products only use CPAs and EAs so if thats important to you, you might want to choose that service over H& R Block.

Filing taxes with H& R Block was straightforward and manageable, even for beginners. The easy-click buttons, informative live links, and the simplified progress bar streamline the process, and having the ability to ask questions through the live chat or find additional information was useful. The written content on the site was also just clever enough without being too much.

Overall, this is a solid option for homeowners or those with slightly more complicated tax situations who still prefer to do most things online. You get a slightly lower price than the most well-known online tax preparation option while still getting a good user experience.

Yeah Yeah Yeah But Is It Worth It To Take The Course

Honestly, that depends on what you are hoping to get out of it. Lets take a look at some of the Pros and Cons and see if it might be worth it for you.

Pros:

- Opportunity to earn commissions after the first year

- You can do your own tax return for free

- Access to advanced tax classes year-round

- Social interaction a lot of tax preparers that have been around a while see the same clients year after year and enjoy catching up with them

Cons:

- Costs $150 for course materials

- Big time commitment

- Not guaranteed to be hired by H& R Block

- Required to sign an agreement that you will not work for a competitor after taking the class

- If you work at H& R Block:

- Pays minimum wage for the first year

- In subsequent years, can take tests to increase certification level, which increases commissions. Total compensation is the greater of hourly pay or commissions. Excluding people who have worked there for 10+ years, many people I spoke with had compensation very close to their hourly pay rate.

- Unpaid 18 hours continuing education requirement each year $35 Annual Fee to access H& R Blocks continuing education classes

For all of those reasons, I wouldnt recommend the course if:

Read Also: How Much Can You Get Back In Taxes

To Itemize Or Not To Itemize

You might not have to torture yourself over the decision between itemizing and claiming the standard deduction. The Tax Cuts and Jobs Act effectively doubled the standard deduction for all filing statuses when it went into effect in 2018.

As of the 2020 tax yearthe return you would file in 2021you’d need more than $24,800 in itemized deductions to make itemizing worthwhile if you’re married and you file a joint tax return. You’d be taxed on $4,800 more in income if you itemized and have only $20,000 in itemized deductions. That’s not even to mention the additional tax prep fee.

The standard deductions for other filing statuses are $12,400 if you’re single or if you’re married and filing separately, and $18,650 if you qualify as head of household.

Recommended Reading: Can I Pay Quarterly Taxes Online

H& r Block Is Especially Good For

- Businesses looking for an inexpensive way to file corporate and partnership returns: With H& R Blocks desktop software, you can file partnership and C corporation and S corporation federal tax returns for only $89.95.

- Filers seeking to bundle individual and business returns: Whether your business is a partnership or corporation, the Premium & Business software includes everything you need to file both your personal and business tax returns.

- Best for taxpayers wanting desktop software: With its desktop software, you can prepare as many returns as you like and e-file five of them for no additional cost.

- Individuals and businesses who need the help of a tax professional: H& R Block offers an assisted service, where a tax professional will file for you.

What Bank Does Hr Block Use For Tax Refunds

Axos BankThis transition will cover any H& R Block-branded account you currently have at Axos Bank, including H& R Block Emerald Prepaid Mastercard®, H& R Block Emerald Advance®, Refund Transfer, Refund Advance, H& R Block Emerald Savings®, and other H& R Block-branded accounts including credit cards, gift cards and rewards cards.

Recommended Reading: How Much Percent Is Tax

How To Negotiate A Fair Price

Call various tax preparation firms and get a feel for their price ranges if you’re searching for the lowest price. The business might not be able to give you an exact price quote, but they should be able to quote you either an average price or a price range for your tax situation.

Some firms might charge higher prices during their busiest days, like the weeks right after W-2 forms are mailed out or just before the April tax filing deadline. You might be able to obtain a lower price quote during a less hectic time of the tax season.

They Charge An Hourly Rate

If your tax advisor charges by the hour, make sure you find out how much they charge and how much time they expect to spend on your taxes. Usually, a tax pro will charge an hourly fee between $100200 per hour, depending on what kind of tax forms you need to file.6 If they can get your taxes done in less time, you wont get stuck with a high bill at the end.

Also Check: How To Get Out Of Paying School Taxes

Read Also: How To Save Money On Taxes

You Have Other Options

You can save considerably by purchasing tax preparation software instead if your tax situation isn’t very complicated. These programs have evolved considerably over the years and are set up to ask you specific questions, then prepare your return based on your answers and the data you input.

Prices start as low as $29.95 for the H& R Block basic tax software and $49.99 for a basic TurboTax programs for 2020 returns, and there could be steeper discounts during tax season. There might be an extra cost for preparing state returns, however.

You can have your return prepared and filed for free through IRS Free File if your tax situation is very simple and basic, subject to some income limits. You can’t have more than $69,000 income, and some of the participating providers’ limits are even less than this. The Free File website can guide you to what’s available.

The IRS Volunteer Income Tax Assistance Program also provides free tax preparation for low-income taxpayers, as well as for the elderly, disabled, Native Americans, rural citizens, and those for whom English is a second language. There are more than 9,600 volunteer program sites across the U.S. as of 2020.

H& r Block Customer Service

Customer support is available around the clock during prime tax filing seasonJanuary 13 to April 19. And its available during extended business hours the rest of the year. You can access support through online chat, phone, and email.

As with most tax services, the free customer service option is for technical issues with the product. But if you need actual help with your taxes beyond very basic questions, youll need to pay for the additional services to access a live CPA to help with your taxes.

Read Also: How Do You Report Bitcoin On Taxes

Recommended Reading: How To Pay Back Taxes Online

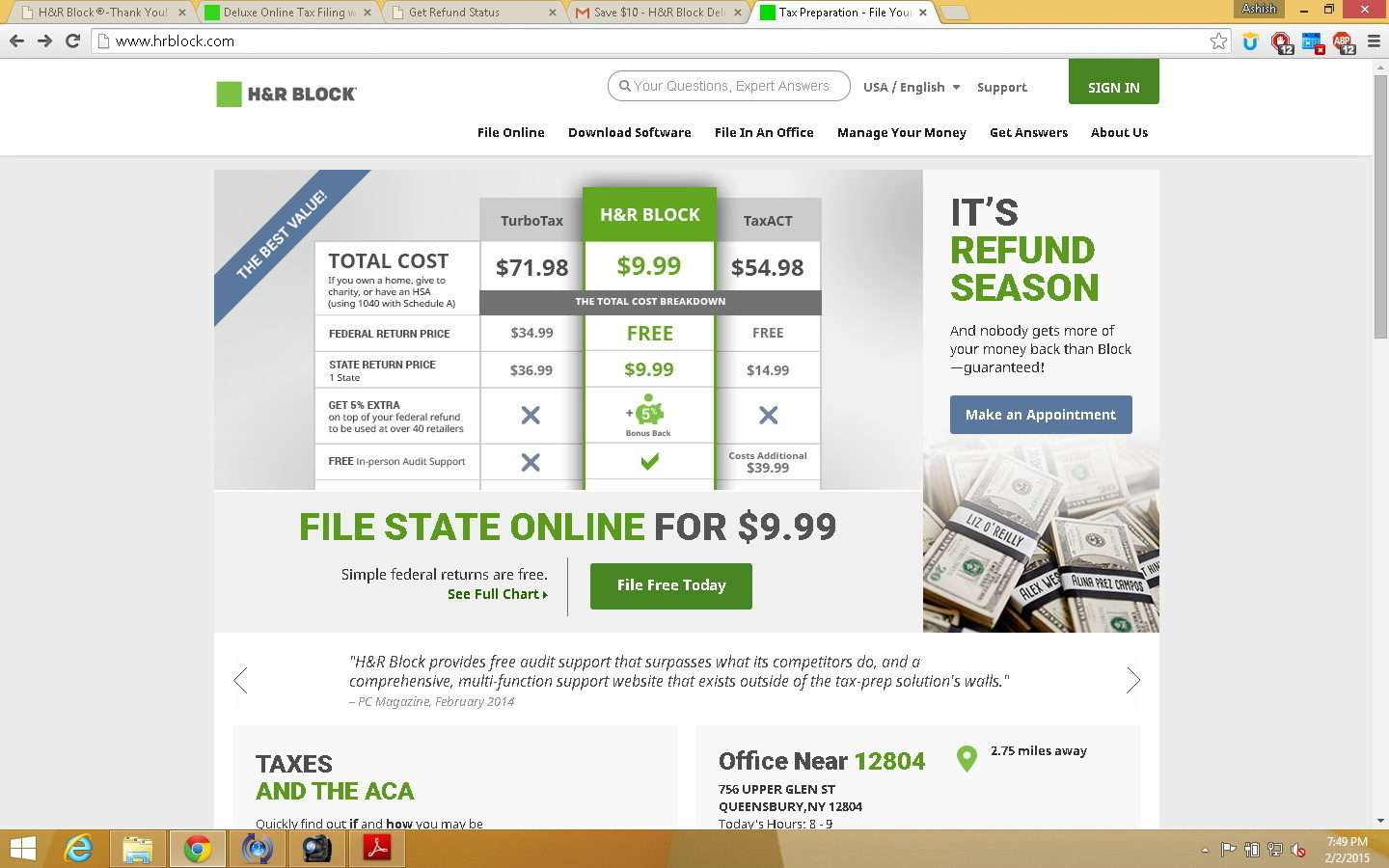

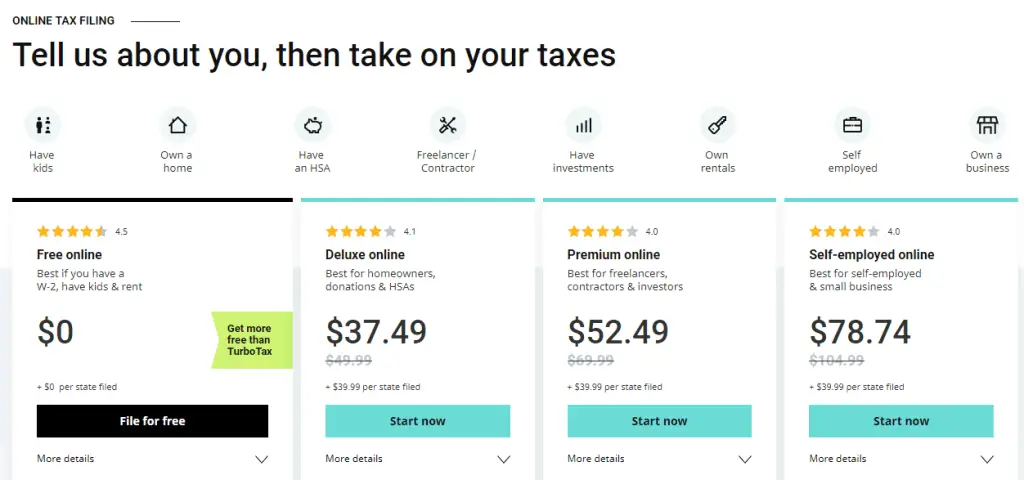

How Much Does It Cost To File Taxes With H& r Block

Depending on the services you decide to purchase, the costs of using H& R Block may vary.

| DIY online filing |

| $54.99 -$89.95 + $19.95 for e-filing |

H& R Block offers these packages within the following plans:

- Free Online: Includes EITC, student tuition, loan payments, and reporting retirement income.

- Deluxe: Includes everything in Free, plus tax preparation software, digital tracking up to 6 years, live support, HSA, and mortgage deduction.

- Premium: Great for investments and rental income. Includes everything included in Deluxe, plus stocks and bonds reports, as well rental and income tax deductions.

- Self-employed: Great for small business owners. Includes all the features from the other packages, plus small business expense claims and asset depreciation reports.

Tips For Choosing A Tax

- Tax season is a good time to take stock of your overall financial picture. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- TurboTax and H& R Block are two of the most well-known tax-filing services. There are other great services to consider, though, so make sure to shop around. Check out our list of the best tax filing software, as well as the best free online tax software.

Recommended Reading: What Form Do I Need To File My Taxes Late

How Does Jackson Hewitt Stack Up

Jackson Hewitt keeps things simple, with just three available packages. The free option is truly free, but its only really useful if your tax affairs are simple. You can also file your state taxes, but this will still cost you the same $36.95, regardless of which service you choose.

Other services, such as H& R Block and TurboTax, offer similar services and features.

Either way, its definitely cheaper than hiring a private tax preparer.

When Should I Consider Hiring A Tax Professional

As a CPA and former IRS agent, there are certain filing situations that I believe should be left to the professionals. I have seen many âdo it yourselfâ tax returns that landed in the hands of an IRS auditor. Here are some scenarios where you should consider hiring a tax pro:

- You just started a business in the 2020 tax year or have a complex business structure, such as an S-corporation, partnership or corporation

- You have employees or youâre self-employed

- You experienced a recent change in your tax situation

- You sold a property in the 2020 tax year

- You worked in multiple states

You May Like: How Much Taxes Do They Take Off Your Paycheck

What You Get From H& r Block’s Free Version

Like the free tax software from most of its competitors, H& R Block Free lets you file the Form 1040, take the earned income tax credit and the additional child tax credit. And this year, it can also handle unemployment income.

H& R Blocks free version also lets you file schedules 1 and 3 of Form 1040, which is a big bonus because many taxpayers need to file those forms in order to report things such as deductible student loan interest, business income, certain retirement contributions, alimony, the credit for dependent care expenses, the Lifetime Learning Credit and the Savers Credit. You may need to upgrade if you don’t know how much to claim for those things and want the software to calculate it for you.

While H& R Block’s free version has expanded capabilities, if you plan to itemize deductions, were a landlord, freelanced or ran a small business, youll probably need to upgrade to one of its paid packages.

Who Should Use H& r Block

If you’re doing your own taxes this year and, like me, willing to pay for convenience, you’ll find an option that suits your needs at H& R Block. Anyone who hasn’t filed taxes solo before or recently experienced significant life changes would benefit from the guidance H& R Block provides.

My situation is pretty simple I have W-2 income, a health savings account, and interest income from a high-yield savings account. I don’t own a home, have any dependents, or invest outside of my retirement accounts. I use the Deluxe Online package to prepare and file both my federal and state returns .

The tax form import and upload capabilities are a big time saver, but if you’re OK with entering the numbers on your own and want to save some money, there are cheaper options out there.

You May Like: When’s The Last Day To Do Taxes

Customer Service And Ease Of Use

While H& Rs Blocks user interface is not as simple as some other online programs like TaxSlayer, it is still seamless and easy to navigate. Every page includes clear instructions for the next steps, and you can skip some pages and go back to complete them later. To get started, you need to answer a series of questions about your life, income, deductions, and other information:

H& R Blocks interview process.

Once you log in, you can view the status of your refund and check your past tax history. You can also instantly access the calculator to estimate your tax refund:

H& R Blocks tax history page.

There is an in-software help center including extensive online customer support, including a database of frequently asked questions , blogs, and communities of experts. If you need unlimited live chat support and the ability to call and talk to a person, you will need to purchase a paid version. Finally, you can visit an H& R Block agent in any of its 12,000 offices.

Deluxe Online $2999 Plus $3699 Per State Filed

The Deluxe Online program from H& R Block was created for homeowners who have more deductions to take on their taxes, including deductions for contributions to Health Savings Accounts, or HSAs. This program includes six years of access into your tax returns, a special deduction feature meant to help you maximize tax deductions youre eligible for, and technical support by chat or the phone.

This plan works best for anyone who deals with real estate or real estate income, mortgage interest, and contributions to an HSA during the tax year. Youll get special guidance for homeowners, free storage and access, transparent pricing and more.

You May Like: Why Does It Cost So Much To File Taxes

What Is The Time Commitment

The course generally meets 6 hours a week either on weeknights or weekends. I went two nights a week from 6-9 pm.

This included 50 hours of instructor-led sessions and 10 hours of self-study. The 10 hours of self-study is a little misleading because in addition to that there is homework for the instructor-led sessions.

The homework consists of reading the chapter for the next class, completing questions/exercises, and preparing case study tax returns by hand. The homework took me roughly 6 hours a week, bringing my total time commitment to 12 hours per week . You could probably get away with spending less time on the homework but probably wouldnt get as much out of the class.

H& r Block Review & Guide

Tax time can often be a painful process, as organising and lodging your claim can be a long process, particular if you dont know much about tax. Add into the mix the wide variety of accountants and tax agencies who claim maximum refund guarantees and the whole experience can be confusing, as well as potentially costly.

With more than 470 offices around Australia, H& R Block is one of the nations most well-known tax accountancy companies. With humble beginnings in the US back in the 1940s, H& R Block has expanded to become a global brand, offering a range of financial services for both individuals and businesses. With tax time fast approaching, check out H& R Blocks range of tax services below.

Read Also: How To Find Tax Lien Properties

Which Is Cheaper H& r Block Or Jackson Hewitt

Although slightly more expensive than H& R Blocks, Jackson Hewitt fees are still cheaper than what CPAs and professional accounting firms normally charge for doing tax returns. Although Jackson Hewitt Online is a self-service option, you may find yourself in a situation where you may need some expert advice.

What It Looks Like

H& R Blocks interface is visually simple, straightforward and easy to use, and it steps up to explain concepts as you go. Skipping around to specific spots can be a little tricky, but a banner across the top keeps track of where you stand in the filing process.

Embedded “learn more” links provide more information without having to wander around, the help menu updates according to where you are and you can click to access the chat support portal throughout.

A Price Preview button up top tells you which package youre buying, whether youve also selected add-ons and how much your total software bill is so far.

Don’t Miss: Can You File Past Taxes On Turbotax

Pricing Methods Used By Tax Preparers

You can ask up front how the firm determines its prices if you’re comparing tax professionals or accountants. Ask for an estimate of what their services might cost you, although you probably won’t get an answerat least not a firm, definitive oneuntil you’ve met with the professional and they have a firm grasp of your tax issues.

Some accountants offer free consultations, so you might get an answer at the end of this initial meeting.

Otherwise, the firm would have to base its number on your personal summary of your situation, and this might or might not provide an accurate picture of your tax situation. After all, you probably wouldn’t be seeking a professional’s services if you were exceptionally savvy about tax matters.

Some of the methods used by tax professionals to set prices include:

- A set fee for each tax form or schedule

- A fee based on last year’s fee plus an additional fee for any changes in a client’s tax situation

- A minimum tax return fee, plus an additional fee based on the complexity of the client’s situation

- A value-based fee based on the subjective value of the tax preparation service

- An hourly rate for time spent preparing the tax return and accompanying forms and schedules

- A set fee for each item of data entry