Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What About Adopted Children

Adopted children change the situation. They must be issued a Social Security Number before they can be counted towards earned income. If they dont have one of these numbers theyll be given an Adoption Taxpayer Identification Number. This isnt the same and cant be used. Youll need to file an amended return after the child has their Social Security Number.

Download And Prepare New Schedules And Attachments

When you prepare an amended return, the IRS only wants you to update figures that change. It doesn’t require you to complete an entire tax return. However, if any of the original schedules you filed will change because of your amendment, then those schedules must be prepared again and attached to your Form 1040X.

Also Check: How To Get Tax Exempt Status

How Do I File Returns For Back Taxes

OVERVIEW

When would someone file back taxes, and what does this process typically look like?

Should you file back taxes? It may not be too late to file a previous year’s tax return to pay what you owe or claim your refund. Learn more about why one may choose to file back taxes and how to start this process.

Answer The Guided Questions

TurboTax is known for their guided question format which asks you a series of questions to find the most deductions for your tax return. Youll answer questions like:

- Are you married or single?

- Do you have any children?

- Did you purchase a home this year?

- Did you earn self employment income?

These questions may seem a bit personal, but certain deductions and credits only apply for certain individuals and situations.;

What Ive learned in using TurboTax for the past 12 years is that you can almost always find an answer to your question online in their forum or through their customer service team.;

Don’t Miss: Where Can I Find My Real Estate Taxes

Support For Multiple Platforms And Devices

TurboTax is available via the internet and can also be downloaded and installed on your personal computer. Both online and download options offer varying levels of benefits and features depending on the version you choose.

So, you can choose to download and install on your Windows or Mac PC, or if you prefer, choose one of the many online versions and access it on the web anywhere using your PC, tablet, or phone.

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2020 electronic filing season.;Because;Arizona electronic income tax returns are processed and accepted through the IRS first,;Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember,;the starting point of the Arizona;individual income tax;return is the;Federal;Adjusted Gross Income.;The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Taxpayers can begin filing;individual income tax;returns through Free File partners and;individual income;tax returns will be sent to the IRS starting mid-February. Tax software companies also are accepting tax filings in advance;of the IRS’ launch date.

Please refer to the;E-File Service;page;for details on the e-filing;process.

Read Also: Do You Pay Taxes On Coinbase

Mailing Address For Back Taxes

| Your residence |

|---|

Kansas City, MO 64999-0002 | Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214 || Alaska, California, Hawaii, Washington | Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002 | Internal Revenue Service

P.O. Box 7704

San Francisco, CA 94120-7704 || Arizona, Colorado, Idaho, Kansas, Montana, Nebraska, Nevada, New Mexico, Oregon, North Dakota, South Dakota, Utah, Wyoming | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501 || Connecticut, District of Columbia, Maryland, Rhode Island, West Virginia | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000 || Delaware, Maine, Massachusetts, New Hampshire, New York, Vermont | Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002 | Internal Revenue Service

P.O. Box 37008

Hartford, CT 06176-7008 || Florida, Louisiana, Mississippi, Texas | Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002 | Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214 || Illinois, Michigan, Minnesota, Ohio, Wisconsin | Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002 | Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501 || Pennsylvania | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

Turbotax Has Tax Refund And Tax Credit Calculators

TurboTax offers a variety of tax tools and calculators to help you manage your money. You can find out how much money you should back in your tax refund or how much you might owe.

You can find deductions and credits, your tax bracket, calculate your W-4 withholding, and expenses to write-off as self-employed.

These tax refund and tax credit calculators will also help you to determine your eligibility and how much you qualify for.

Recommended Reading: When Will The Child Tax Credit Payments Start

Paying Debts And Collecting Tax Refunds

Paying any tax due on each completed return is relatively simple. The IRS wants your money, so it doesnt make the process challenging. You can go to its Direct Pay website to pay by electronic debit from your checking or savings account, and the IRS accepts credit card payments on its website, as well.;

Keep in mind that there are time limits for refunds, audits, and debt collection. In most cases, your refund “expires three years from the date your tax return was due. But if you owe other tax debtsbecause you have a balance due from another year, for exampleyour refund will typically be applied to offset that debt.;

Create a plan for paying off your tax debts if it turns out that you owe the IRS money. You might also want to plan on how to protect yourself from an IRS investigation, assessment, federal tax lien, or possibly a levy. You may have a few options, such as setting up an installment agreement with the IRS for a monthly payment plan or asking for an offer in compromise.

The IRS can and will impose penalties and interest on tax liabilities that aren’t paid in full by the deadline for the tax return.

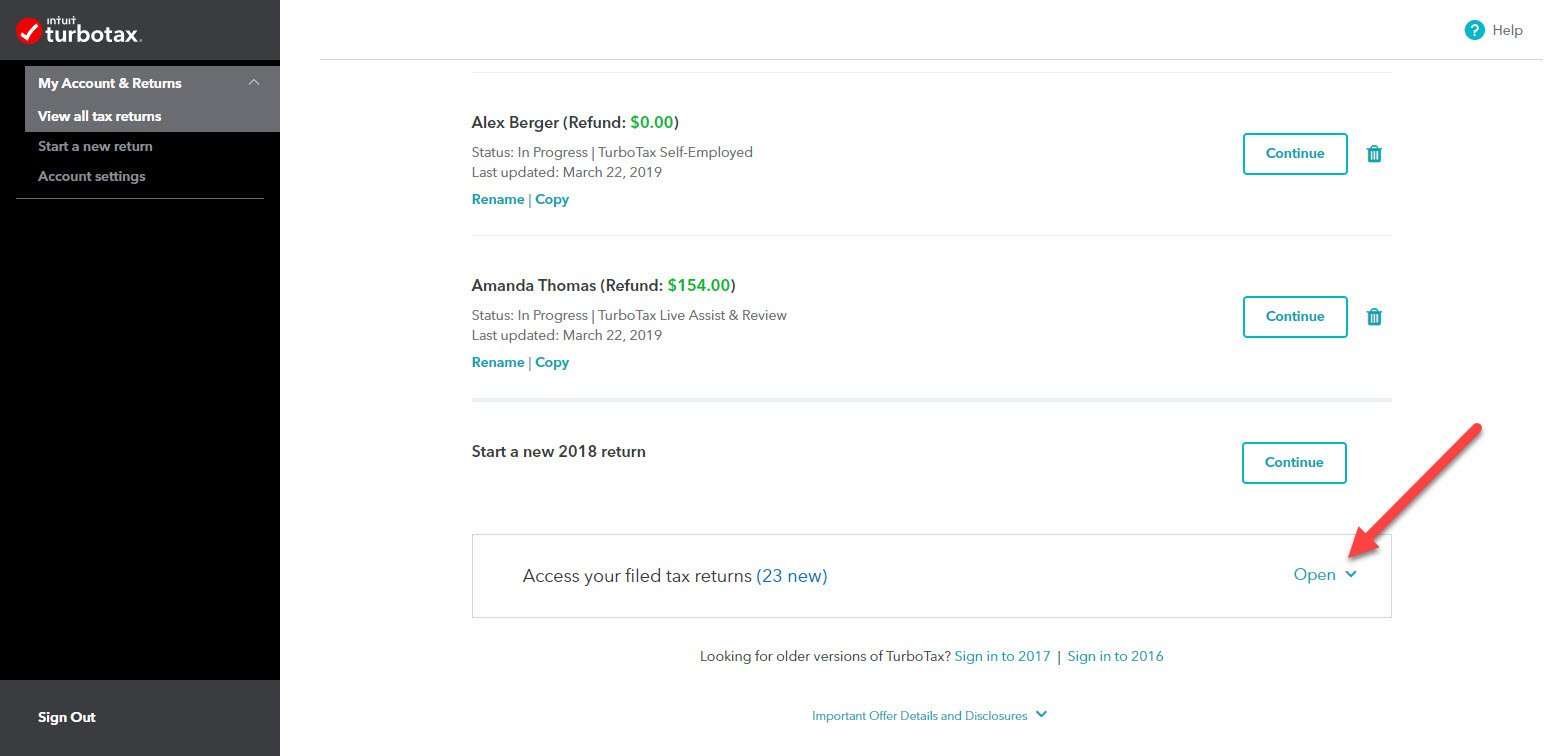

If You Preparedyour Taxes Online

You’ll have to use your TurboTax login if you used the online version of the product. Make sure you sign in to the same account you used to prepare your return. From there, it’s a simple matter of clicking on the “Documents” tab, then on the tax year you want, then finally on “Download PDF.”

TurboTax suggests using the “Account Recovery” tool if you can’t find the return you’re looking for. It’s possible that you’re not signed in under the same account you used to prepare it.

Don’t Miss: How To Pay Llc Taxes

Gather Your Tax Documents

The key to stress-free tax filing is to be as organized as possible.; If you earned income through an employer, youll receive either a W2 or a 1099 tax form. Other tax documents to gather may include:

- 1098 E Student Loan Interest form

- 1098 Mortgage interest deduction form

- 1099 DIV report of dividend income;

- 1099 INT report on interest income youve earned from investment accounts

- 1099-MISC any self employment earnings or income from royalties, commissions or rent.;

Irs Transcripts Are Free

Your other option is to order a tax transcript from the IRS rather than an actual copy of your return. The IRS makes two types of transcripts available: a tax return transcript and a tax account transcript, and both are free. A transcript is more or less a summary of the information included in your return and your payment and refund histories.

Mail in Form 4506T-EZ if you want a tax return transcript, or Form 4506T if you want a tax account transcript. You can also request a transcript online from the “Get Transcript Online” page of the IRS website, or even call the agency, although the IRS isn’t taking phone calls in spring 2020 due to the coronavirus pandemic.

It will take from five to 30 days to get the transcript, depending on whether you make the request online or via USPS mail, and they’re only available for four years the current year and the previous three.

Recommended Reading: What Is Form 8995 For Taxes

Cryptocurrency Taxes With Turbotax Desktop Edition

The above steps outlined the process for reporting your cryptocurrency taxes within the online version of TurboTax. The desktop version of TurboTax doesnât officially support crypto. For this reason, it’s recommend you use the online version for your crypto tax reporting.

However, there still is a way to get your cryptocurrency tax information into the Desktop version of TurboTax. We outline that step-by-step process in this article here.

Time Matters With Tax Refunds

May 17, 2021 is the last day to file your original 2017 tax return to claim a refund. If you received an extension for the 2017 return then your deadline is October 15, 2021.

If you miss the deadline, any excess in the amount of tax you paid every paycheck or sent as quarterly estimated payments in 2017 goes to the U.S. Treasury instead of to you. You also lose the opportunity to apply any refund dollars to another tax year in which you owe income tax.

Under certain conditions the IRS will withhold your refund check. It can be used to pay:

- past-due student loans,

- child support and

- federal tax debt you owe.

The IRS can also hold refund checks when the two subsequent annual returns are missing. That means you should file returns for 2018 and 2019 as soon as possible. For the 2018 tax year, with a filing deadline in April of 2019, the three-year grace period ends April 15, 2022.

Don’t Miss: What Is K 1 Tax Form

Select All Transactions As Taxable

You should see all of your cryptocurrency gains and losses imported. Only taxable transactions get imported from your CryptoTrader.Tax TurboTax Online file, so simply âSelect Allâ on this step .

Once you finish, click ‘complete’ and you will see a summary of your cryptocurrency transactions within TurboTax.

Identify The Error Or Amendment You Wish To Make

If you are correcting an error on your original tax return, you will need a blank copy of that particular form from the same year. This will allow you to recalculate your tax and to see which numbers on the original tax return will change as a result of the amendment. You can find IRS forms from prior years using TurboTax’s prior-year returns function, or you can search through the IRS website for it.

Read Also: How To Do Taxes Freelance

How The Irs Pays Refunds For Back Taxes

Like other tax returns, the IRS can pay refunds to you via either direct deposit or a check. Make sure to choose the appropriate option on your tax return when you file. If you opt for direct deposit, always double check your account number before filing. You may not be able to get your money back of the IRS sends your refund to the wrong place.

An important exception to note is that the IRS only pays refunds via check for amended returns, which are tax returns you file to fix a mistake from a previous yearâs return. Also keep in mind that it may take about six weeks just for the IRS to process your prior-year tax return .

Electronically File Your Arizona 2020 Income Tax Returns For Free

Free File;Alliance is a nonprofit coalition of industry-leading tax software companies partnered with ADOR and the IRS to provide free electronic tax services.;Free File is the fast, safe and free way to do your tax return online.

Individuals who meet certain criteria can get assistance with income tax filing. Taxpayers can file for free if they meet the following criteria:

Also Check: Are Debt Settlement Fees Tax Deductible

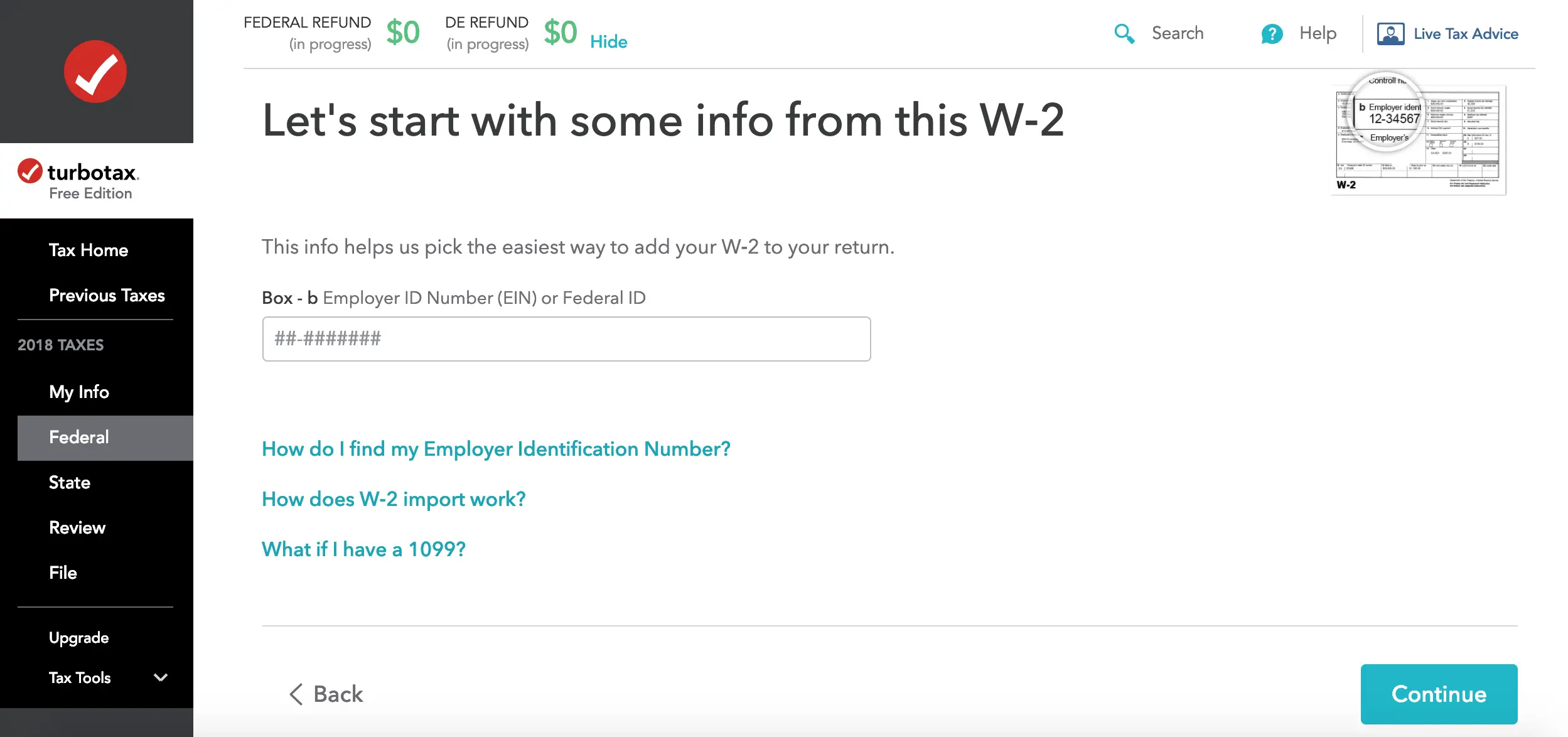

Snap And Autofill On Your W

Save time and energy if you are an ordinary employee by having your W-2 imported directly from your payroll provider. Alternatively, take a photo of your W-2 and the data will be verified and pulled directly from the image onto your tax form.

TurboTaxs importation process supports millions of employers across the nation already.

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didn’t file?

You can request copies of your tax documents from the IRS if youre missing anything by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.;

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2020 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

Read Also: Can I Pay Quarterly Taxes Online

How To File Your Taxes Simply And Easily

We recommend TurboTax as the number one tax preparation platform for the average American. If you want to file your taxes for free and you have relatively simple tax affairs, theres no better alternative.

With a guarantee of accuracy and perfection, you can have peace of mind when you file your taxes this year.

Do I Even Need To File Taxes At All

If you are under age 65 and youre filing single or married filing separately, you need to file taxes if your income is over $12,200 from an employer.; If you are self employed, you need to file your taxes regardless of the amount you earned. Sound complex? Dont worry! Thats why TurboTax asks you a series of questions to make sure you dont miss anything!

Also Check: When Do You Get The Child Tax Credit

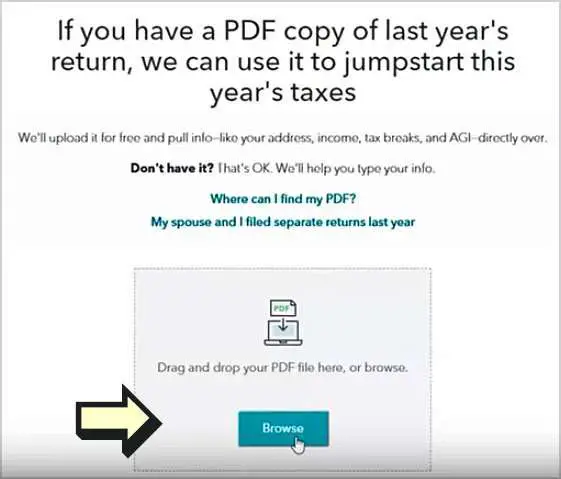

How To Use Turbotax To File Your Taxes For Free In 2018

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, but our reporting and recommendations are always independent and objective.

- TurboTax offers a free online tax filing service for eligible taxpayers.

- The;final tax deadline is April 17 this year.

- The IRS recommends e-filing your taxes and requesting your refund via direct deposit.

- Business Insider decided to try the free version of TurboTax’s service.

Tax Day is here.

The final tax deadline this year is;April 17. That means you have to file your tax return or request an extension by the end of the day.

On the bright side, it also means you can pick up Tax Day freebies from many of your favorite restaurants.;

Another bonus: If your income was less than $66,000 in 2017, many online tax services offer the option to file for your federal taxes and sometimes state taxes for free. You can check your options using the IRS Free File Lookup tool.

TurboTax, an offshoot of tech company Intuit, is one such software offering free services to eligible taxpayers.;

The IRS also says the fastest way to get your tax refund is the method already used by most taxpayers: filing electronically and selecting direct deposit as the method for receiving your refund. Your refund should hit your bank account within three weeks of filing online. Often, you’ll get your money even faster.

Here’s how it works:

Can I File My Taxes For Free With Turbotax

TurboTax free file service is aimed at the average American with simple tax affairs.

More complex tax affairs will require you to purchase the upgraded service. There are two paid packages you can take advantage of.

Furthermore, youll be able to enjoy the benefits of specialist support and the chance to take advantage of filing your state taxes at the same time.

However, even with the free service, you get the guarantee of 100% accuracy with no mistakes. Plus, you can still take advantage of the live chat feature, which is run by professional tax preparers who know what theyre doing. You always have a limited amount of support, even with the free service.

Read Also: Where To File Quarterly Taxes