How Soon Will I Be Able To Check My Status

If you e-file your return, you should be able to check the status of your return as little as 24 hours after you file.

If you filed a paper return, the status of your tax return should take about four weeks to appear in the IRSâs system.

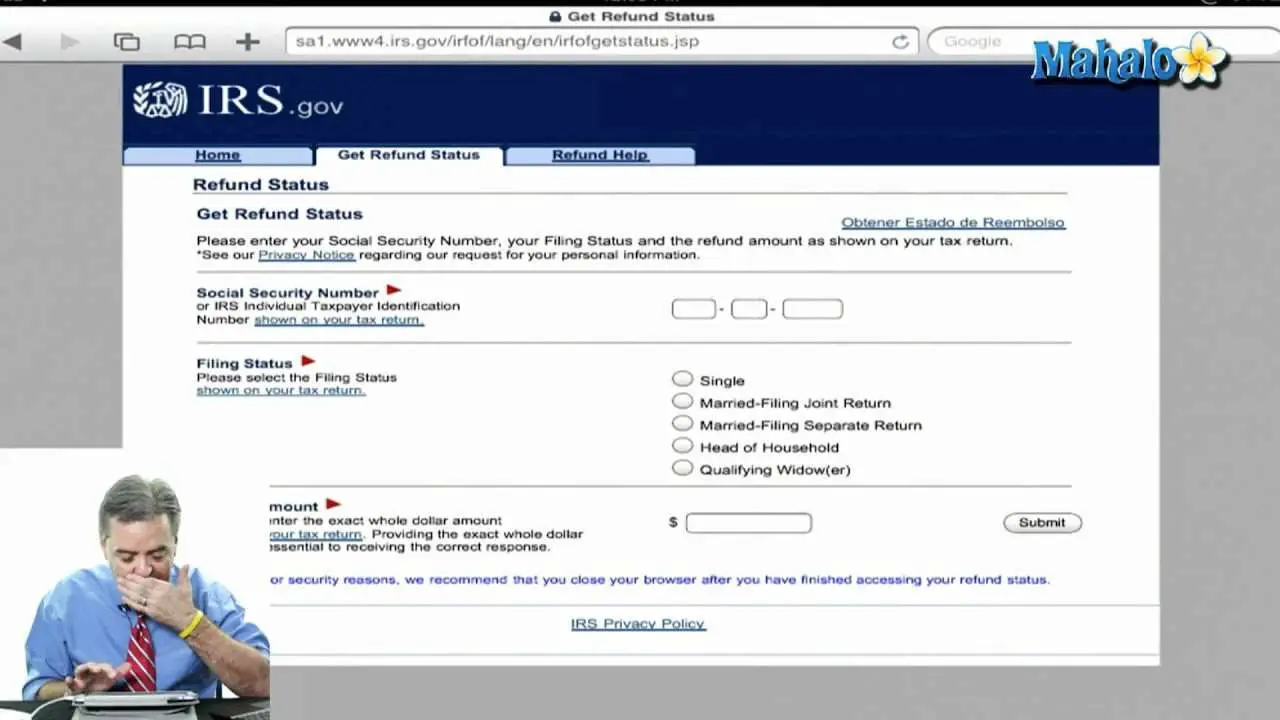

Hereâs what the Whereâs My Refund? Portal looks like before the IRS receives your return:

What A ‘math Error’ Notice From The Irs Could Mean

Millions of Americans have received confusing “math-error notices” from the IRS this year — letters saying they owe more taxes. Once they get the notice, they have a 60-day window to respond before it goes to the agency’s collection unit.;

From the start of the year to August, the IRS sent more than 11 million of these notices. According to the Taxpayer Advocate Service, “Many math error notices are vague and do not adequately explain the urgency the situation demands.” Additionally, sometimes the notices “don’t even specify the exact error that was corrected, but rather provide a series of possible errors that may have been addressed by the IRS.”;

The majority of the errors this year are related to stimulus payments, according to the Wall Street Journal. They could also be related to a tax adjustment for a variety of issues detected by the IRS during processing. They can result in tax due, or a change in the amount of the refund — either more or less. If you disagree with the amount, you can try contacting the IRS to review your account with a representative.

Is It True That The Irs Pays Rewards For Turning In Tax Cheaters

Yes, but you don’t get the reward until the IRS collects from the cheater. There are two different programs depending on the amount of money involved. For cases involving less than $2 million or individual taxpayers with gross incomes of less than $200,000, the maximum amount that can be awarded is 15% of the amount collected. These awards are discretionary and the informant cannot dispute what the IRS decides. If the case involves someone whose gross income exceeds $200,000 or the amount involved is over $2 million, the IRS will pay 15% to 30% of the amount collected.

Typically, you will never know what action, if any, is taken on your tip, but if you want to try it, submit IRS Form 211.

You May Like: Can You File Missouri State Taxes Online

What To Know About The 2020 Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in;adjusted gross income;and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.;

The $10,200 tax break is the amount of income exclusion for single filers,;not;the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds are averaging more than $1,600.;

However, not everyone will receive a refund. The IRS can seize the refund to cover a;past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.;

Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as;IRS TREAS 310 TAX;REF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.;

Reasons For A Tax Refund Delay

Theres no singular reason for a tax refund delay through the IRS. Instead, a multitude of different scenarios can affect how long it takes for you to get your refund back from Uncle Sam. For example, you may have made a mistake on your return, entered the wrong bank account information for the refund, filed early or a number of other situations. Below, we break down several common reasons why your tax refund could be delayed.

Also Check: How Much Is New York State Sales Tax

What Not To Do To Try To Get Answers From The Irs

Being persistent when you call the IRS and even trying some of the tips for navigating the automated system may help you get what you need in due time. Just remember that youre not the only taxpayer in this frustrating situationyoure one of millions trying to get answers.

With routine taxes this year on top of three stimulus rounds and the enhanced child tax credit, Thats a lot to put on any system, from an infrastructure and manpower standpoint, Bell says.

What not to do? Dont put the IRS on blast on social media , and dont ask your friends friend who works for the IRS to look into your case for you.

They cant help you. You dont want to get them in trouble, Bell says.

How Long Should I Keep My Tax Papers

At least three years, but six years is preferable. The IRS has three years after you file a tax return to complete an audit. The IRS can audit you for up to six years if it suspects that you underreported your income by 25% or more. If the IRS suspects fraud, there is no time limit for an audit, although audits beyond six years are extremely rare.

1-800Accountant can prepare and file your application for the SBA disaster loan. Get a free consultation to see if you qualify.

Also Check: Do You Have To Do Taxes For Doordash

Checking The Status Of A Federal Tax Return Over The Phone

Was Your Refund Supposed To Go Directly To Your Bank Account

There are a few things that could have happened:

- The bank account information you put on your tax return was incorrect.

- The IRS isnt responsible if you made an error on your tax return. Youll need to contact your bank or credit union to find out what to do.

- If you already contacted your bank or credit union and didnt get any results, file Form 3911, Taxpayer Statement Regarding Refund with the IRS. The IRS will contact the institution and try to help, but the IRS cant require the bank or credit union return the funds.

Also Check: Where To Find Real Estate Taxes Paid

Mistakes On Your Return

If you file an incomplete return or if you have any mistakes on your tax return, the IRS will spend longer processing your return. This will slow down any potential refund. Mistakes could include mathematical errors or incorrect personal information.

Using a tax filing service, such as;TurboTax, will likely eliminate mathematical errors from your return. The software will do the math for you. However, its still possible to make a mistake if you are inputting any information manually For example, lets say you manually input the information from your W-2. If you earned $50,000 over the year but you accidentally input $51,000, you may run into problems.

The IRS will contact you if there are any issues with your return. In some cases, the IRS will correct small mathematical errors. That could save you the work of having to file an amended return.

Incorrect personal information will also slow down your return. As an example, lets say you file a joint return and incorrectly input your spouses Social Security number . The rest of the information on your return could be correct, but the IRS may not be able to confirm that because it cant match your spouses SSN.

How Legitimate Are The Claims By Tax Experts That You Don’t Have To Pay Income Taxes

Not at all. These con artists can be convincing, but they are not legit. Constitutional arguments against the tax laws are routinely dismissed by courts, and their proponents are fined or jailed. More sophisticated scams involve multiple family trusts, limited partnerships, and credit cards issued by offshore banks. While these schemes can confuse and slow down the IRS, they are bogus, period.

Also Check: What Is The Tax In Georgia

Can I Check On The Status Of My Tax Refund

Refund information does not become available until it has been six weeks since you filed your tax return . After this period, you can use this online tool or you can call the Refund Hotline at 829-1954. Be sure to have a copy of your current tax return available because you will need to know your Social Security number shown on your return, the filing status and the exact whole dollar amount of your refund.

Stage : Refund Approved

This means the IRS has processed and approved your return. This usually happens about three weeks after the IRS indicates theyâve received your return.

Once the IRS processes your return, youâll see an estimated date for when the money will be deposited into your bank account, like so:

If you donât receive your refund by the date mentioned on this page, the IRS suggests contacting your bank first, to make sure there arenât any problems with your account.

Don’t Miss: Where Can I Find My Real Estate Taxes

Payment Schedule For Unemployment Tax Refunds

With the latest batch of payments in July, the IRS has now issued more than 8.7 million unemployment compensation refunds totaling over $10 billion. The;IRS announced it was doing the recalculations in phases, starting with single filers with no dependents and then for those who are married and filing jointly. The first batch of these supplemental refunds went to those with the least complicated returns in early summer, and batches are supposed to continue for more complicated returns, which could take longer to process.;

According to an igotmyrefund.com forum and another discussion on;, some taxpayers who filed as head of household or as married with dependents started receiving their IRS money in July or getting updates on their transcript with dates in August and September. No other official news from the IRS has been issued regarding payment schedule for this month.;

More About Unemployment Refunds

The IRS has provided some information on its website about;taxes and unemployment compensation. But we’re still unclear on the timeline for payments, which banks get direct deposits first or who to contact at the IRS if there’s a problem with your refund.;

Some states, but not all, are adopting the unemployment exemption for 2020 state income tax returns. Because some fully tax unemployment benefits and others don’t, you might have to do some digging to see if the unemployment tax break will apply to your state income taxes. This chart by the tax preparation service;H&R Block;could give some clues, along with this state-by-state guide by Kiplinger.;

Learn smart gadget and internet tips and tricks with our entertaining and ingenious how-tos.

Here is information about the child tax credit for up to $3,600 per child and details on;who qualifies.

Recommended Reading: How To Get Tax Exempt Status

How To Check The Status Of Your Income Tax Refund

Waiting for your tax refund from the Canada Revenue Agency can seem like an eternity.; Instead of checking your mailbox daily, or looking at your bank account online every day, the CRA has other options you might want to consider.; Before going through them, however, we must look at the NETFILE process to ensure you have successfully filed your tax return the first time around.

No filed return means no tax refund! You can usually expect your refund within two weeks after you successfully NETFILE, but may take longer if your return is selected for a review. For more information on your refund status, please see this CRA link: Tax Refunds: When to expect your refund.

Got More Tax Refund Questions We Have Answers

One way is to qualify for more tax deductions and tax credits. They can be huge money-savers if you know what they are, how they work and how to pursue them. Here’s a list of 20 popular ones to get you started.

But beware of big tax refunds. They’re a direct result of overpaying your taxes all year, and that often happens because you’re having too much tax withheld from your paychecks. Get that money in your hands now by adjusting your Form W-4 at work. Here’s how to do it.

Yes. Simply provide your direct deposit account information on your Form 1040 or 1040-SR when you file. If you file IRS Form 8888 with your tax return, you can even tell the IRS to split the money up and deposit it into as many as three different investment accounts. Here’s how to do it.

Yes. Simply provide your direct deposit account information on your Form 1040 or 1040-SR when you file. If you file IRS Form 8888 with your tax return, you can even tell the IRS to split the money up and deposit it into as many as three different investment accounts. Here’s how to do it. Note that you’ll need to have an IRA account first. Here’s how to do that, too.

If you’re behind on your taxes, the IRS will withhold what you owe from your federal tax refund. You’ll get a letter from the IRS explaining what it adjusted.

You can fix it by filing an amended tax return using IRS Form 1040X. Here’s how to do it.

Recommended Reading: What Is California State Tax Rate

How Do I Check The Status Of My Federal Refund

Federal Refund Status:;If you need to check the status of your refund, you can use the IRS online application by clicking on the following link:;“Where’s My Refund?“. You can also check the status of your federal refund by phone by calling the IRS Refund Hotline at 1-800-829-1954. For video assistance with tracking your Federal refund, please click here.

Netfiling Your Tax Return

- To avoid losing your tax return in the mail, consider Netfiling your tax return instead.

- When you NETFILE your tax return, you receive a confirmation number instantly from the CRA as proof that your tax return was received.

- Processing your tax return is a lot faster if you NETFILE; you also receive your tax refund a lot sooner.

You can also use the CRAs My Account to double check that your return was transmitted OK.

You May Like: Did The Tax Deadline Get Extended

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Before You Call Do This:

This is probably obvious, but before you decide to call the IRS and mentally prepare yourself to not go crazy waiting on the line for an agent, you should check out the online resources on IRSs website to see if you can find an answer to your questions there. You can find resources on several popular topics on the IRSs website here.

You May Like: Do You Have To Claim Social Security On Taxes

Reasons Why Your Tax Return Processing And Refund Has Been Delayed

To understand why processing has been delayed you need to understand the refund process. It starts with the submission of your final tax return. After your tax return has been accepted by the IRS they will start processing it over several days until finalized and a tax refund, if eligible, is disbursed . A refund payment date will then be available on the IRS Where is my Refund once sent out . If there are issues with your refund you may see an extended delay in moving to the next processing status and an applicable IRS message/code will be displayed once available.

The IRS and tax experts have said that there could be dozens of reasons when it comes to delays in processing tax returns that can then affect the timing of your refund. Some are in your control, but others may be purely do IRS processing delays that you cannot do much about. But common causes for tax return processing and refund delays include:

- Includes errors or is incomplete, which means the IRS cannot validate or match your data to their records. Especially for key items like your or your spouses SSN, dependent data or missing fields needed to process your return

- Is affected by identity theft or fraud. You will see a message if this is the reason and receive a letter in the mail to confirm identity and next steps. You need to ensure you follow instructions and provide required information to confirm your identity with the IRS.

Stay In the Know:or follow us on , ;and