Capital Gains Taxes On Property

If you own a home, you may be wondering how the government taxes profits from home sales. As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller’s basis.

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains. When you sell your primary residence, $250,000 of capital gains are exempted from capital gains taxation. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale.

If you inherit a home, you don’t get the $250,000 exemption unless you’ve owned the house for at least two years as your primary residence. But you can still get a break if you don’t meet that criteria. When you inherit a home you get a “step up in basis.”

Nice, right? Stepped-up basis is somewhat controversial and might not be around forever. As always, the more valuable your family’s estate, the more it pays to consult a professional tax adviser who can work with you on minimizing taxes if that’s your goal.

When You Might Be Taxed

If you’re a new trader and are worried you might be hit with a tax bill next year, the first thing to do is to make sure you know where your gains and losses are reported in your brokerage account, said Gorman.

Then, you should also assess what your total adjusted gross income will be at the end of the year.

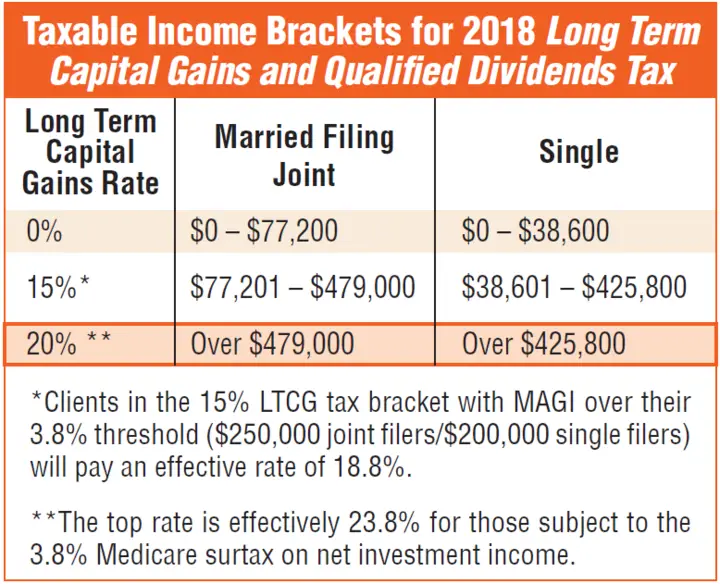

The capital gains tax can be anywhere between zero and 37%, depending on your income and how long you held the asset, according to Wilson. Taxes on short-term capital gains, or assets held less than a year, are taxed at the same rate as your ordinary income and are generally larger than levies on long-term gains.

For assets held more than a year, capital gains are taxed between 0% and 20% depending on income. The tax rate that most taxpayers see on long-term capital gains is 15% or less, according to the IRS.

Those who have lower incomes, generally $45,000 or less, may not owe the IRS anything, as their capital gains rate will be 0%. People who make more, however, may want to see where they stack up against the next threshold individuals who have AGI of $80,000 or more may be subject to a 15% capital gains tax rate.

The highest earners, generally those who make more than $440,000 annually, may be subject to a 20% capital gains rate, plus a 3.8% net investment income tax.

How Long Do You Need To Hold A Stock To Avoid Capital Gains Tax

If you sell shares of stock for a price greater than the amount you paid for the shares, you will be subject to capital gains no matter how long you have owned the shares. If youve held the shares for less than one year, the gains will be considered short-term. If youve held the shares for at least a year, they will be considered long-term. The advantage of paying long-term capital gains taxes is that the rates are lower than short-term capital gains taxes for most taxpayers.

Also Check: Do You Need To Claim Unemployment On Taxes

Keep Records Of Your Losses

One strategy to offset your capital gains liability is to sell any underperforming securities, thereby incurring a capital loss. If there arent capital gains, realized capital losses could reduce your taxable income, up to $3,000 a year.

Additionally, when capital losses exceed that threshold, you can carry the excess amount into the next tax season and beyond.

For example, if your capital losses in a given year are $4,000 and you had no capital gains, you can deduct $3,000 from your regular income. The additional $1,000 loss could then offset capital gains or taxable earnings in future years.

This strategy allows you to rid your portfolio of any losing trades while capturing tax benefits.

Theres one caveat: After you sell investments, you must wait at least 30 days before purchasing similar assets; otherwise, the transaction becomes a wash sale.

A wash sale is a transaction where an investor sells an asset to realize tax advantages and purchases an identical investment soon after, often at a lower price. The IRS qualifies such transactions as wash sales, thereby eliminating the tax incentive.

Plan Ahead To Pay Your Taxes

You can adjust your withholdings as you receive dividends, capital gains, and interest from your investment portfolio. This should help lessen the blow of your tax bill.

Another option is to put aside the money that you will owe in taxes on dividends, interest, and capital gains as you earn them.

If your current tax rate is 25%, you may earmark a quarter of any capital gains you received on short-term holdings to cover your taxes the following year.

You can also talk to your accountant about the best way to prepare for tax season if you have an investment portfolio, so you can be prepared to pay your tax billand still stick to your monthly budget.

You May Like: How Much Is New York State Sales Tax

Paying Taxes On Investments

As an investor, it is important to consider the tax efficiency of an investment. Different types of investments are taxed differently by the Canada Revenue Agency . The tax treatment of an investment can affect your return over the long-term. Holding investments in a tax-sheltered account like your Registered Retirement Savings Plan or Tax-Free Savings Account minimizes tax; interest income held in a non-registered account is taxed at your marginal tax rate, making it the least tax efficient.

Ask An Accountant Or Financial Adviser

How much you will pay in taxes on your investments will vary depending on the number of investments you have, if they made or lost money last year, your current income, and other financial factors. It is important to consult with your accountant and financial advisor about how much you need to save to cover your taxes each year.

If you are just starting to invest, what you earn may not be enough to make a big impact on your tax bill.

As your investments grow, so will your taxes, and you need to be prepared to handle the changesand subsequent tax bills.

In most cases, the changes will come gradually, and you should be able to adjust as your tax burden increases. When you reach a point where you are earning a significant amount in investments each year, its best to hire an accountant to help you come up with a workable tax strategy.

Read Also: Do You Have To Claim Social Security On Taxes

Taxes On Stock Dividends

For investments you own, you may receive periodic payments, called dividends, for them. A dividend occurs when a company generates a profit, and the earnings are distributed to shareholders. Going back to the ACME example, if each share of their stock generates $2 in after-tax profit, the board may deliver a percentage of that profit back to the shareholders in cash. If you have 100 shares, and the dividend yield is $1.50 per share you own, youd get $150.

Hold Onto It Until You Die

This might sound morbid, but if you hold your stocks until your death, you will never have to pay any capital gains taxes during your lifetime. In some cases, your heirs may also be exempt from capital gains taxes due to the ability to claim a step-up in the cost basis of inherited stock.

The cost basis is the cost of the investment, including any commissions or transaction fees incurred. A step-up in basis means adjusting the cost basis to the current value of the investment as of the owners date of death. For investments that have appreciated in value, this can eliminate some or all of the capital gains taxes that would have been incurred based on the investments original cost basis. For highly appreciated stocks, this can eliminate capital gains should your heirs decide to sell the stocks, potentially saving them a lot in taxes.

Don’t Miss: How To Buy Tax Lien Properties In California

Capital Gains Tax On Sale Of Property

Real estate property includes residential properties, vacant land, rental property, farm property, and commercial land and buildings. If you have sold real estate property, you will have to report any capital gains or losses on Schedule 3, the capital gains and losses form. If you sold both the property along with the land it sits on, you must determine how the sale price is distributed between the land and the building and report them separately on theTax Form Schedule 3. For example, you just sold a property for proceeds of disposition less outlays and expenses of $500,000. The Municipal Property Assessment Corporation appraised the land at $125,000, meaning that the land is worth 25% of the property value. Your adjusted cost base was $400,000, so your total capital gains is $100,000, and your taxable capital gains is 50% of that, or $50,000. The taxable capital gain for the land would be $12,500 and the taxable capital gain for the building would be $37,500.

How To Avoid Paying Taxes When You Sell Stock

One way to avoid paying taxes on stock sales is to sell your shares at a loss. While losing money certainly isn’t ideal, at least losses you incur from selling stocks can be used to offset any profits you made from selling other stocks during the year. And, if your total capital losses exceed your total capital gains for the year, you can deduct up to $3,000 of those losses against your total income for the year.

I know what you’re thinking: No, you can’t sell a bunch of shares at a loss to lower your tax bill and then turn around and buy them right back again. The IRS doesn’t allow this kind of “wash sale” — called by this term because the net effect on your assets is “a wash” — to reduce your tax liability. If you repurchase the same or “substantially similar” stocks within 30 days of the initial sale, it counts as a “wash sale” and can’t be deducted.

Of course, if you end the year in the 0% long-term capital gains bracket, you’ll owe the government nothing on your stock sales. The only other way to avoid tax liability when you sell stock is to buy stocks in a tax-advantaged account.

Recommended Reading: Where To Find Real Estate Taxes Paid

Do You Need A Social Insurance Number

A SIN is a nine-digit number issued by Service Canada. You are usually required to have a SIN to work in Canada, and your SIN is used for income tax purposes under section;237 of the Income Tax Act. You must give your SIN to anyone who prepares information slips for you.

For more information, or to get an application for a SIN, visit Service Canada or call;1-800-206-7218 ).

If you are outside Canada and the U.S., you can write to:

Service;Canada CANADA

or call;506-548-7961.

If you are not eligible to get a SIN,;you can apply for an individual tax number by completing;Form T1261, Application for a Canada Revenue Agency Individual Tax Number for Non-Residents. Send it to the CRA as soon as possible. Donot complete this form if you already have a SIN, an individual tax number, or a temporary tax number.

If you have requested but not yet received a SIN or an ITN, and the deadline for filing your return is near, file your return without your SIN or ITN to avoid any possible late-filing penalty and interest charges. Attach a note to your return to let the CRA know.

Places With The Savviest Investors

SmartAssets interactive map highlights the places in America with the savviest investors. Zoom between states and the national map to see where in the country the best investors live.

| Volatility | Post-Tax Return |

|---|

Methodology Our study aims to find the places in the country with the savviest investors. We wanted to find where people are not only seeing good returns on their investments but where they are doing so without taking too much risk.

In order to find the places with the savviest investors we calculated investment returns and portfolio volatility over the last year. We focused on data of user portfolios provided by our partner Openfolio.

We calculated the risk-adjusted return of the stocks using the Sharpe Ratio. The Sharpe Ratio is the stock return minus the risk-free rate divided by volatility.

We indexed and ranked each of the locations based on this risk-adjusted return to find the places where people were seeing the best returns for the least risk.

Finally, we calculated the amount of money investors were taking home after paying both federal and state capital gains taxes.

Sources: Openfolio – “Openfolio is a free and open network that lets people share their portfolios – but no dollar amounts, only percentages. The idea is that sharing will help everyone be better informed, like with this map.”

Recommended Reading: How To Appeal Property Taxes Cook County

Monitor Mutual Fund Distributions

If youre a mutual fund investor, you could be subject to capital gains taxes at the end of each year. Mutual funds acquire capital gains and income distributions throughout the year as they trade in and out of investment positions. Some years, a mutual fund may have sufficient losses to take to cover realized gains. In other years, capital gains will need to be passed through to shareholders; this can be more common when markets continually hit new highs over a prolonged period.

Toward the end of the year, investors can check a mutual fund companys estimates for capital gains distributions. If the distributions are significant for a fund you hold, it may be worthwhile to swap into another fund to try to sidestep that capital gain distribution.

How To Avoid Capital Gains Taxes

Unfortunately, both short- and long-term capital gains taxes are simply the entry price of playing the stock market game. If you hope to benefit from the historic substantial growth of the U.S. stock market, youll be hard pressed to avoid them entirely. That said, you may be able to minimize them a few ways: with retirement accounts, tax-loss harvesting and tax-exempt investments, like municipal bonds.

Recommended Reading: Can You Change Your Taxes After Filing

Tax On Taxable Income

Certain types of income you earn in Canada must be reported on a Canadian tax return. The most common types of income include:

- income from employment in Canada

- income from a business carried on in Canada

- the taxable part;of Canadian scholarships, fellowships, bursaries, and research grants

- taxable capital gains from disposing of taxable Canadian property

You may be entitled to claim certain deductions from income to arrive at the taxable amount. You can also claim a credit for any tax withheld at source or paid on this income.

If there is a tax treaty between Canada and your country or region of residence, the terms of the treaty may reduce or eliminate the tax on certain types of income. To find out if Canada has a tax treaty with your country or region of residence, see Tax Treaties. If it does, contact the CRA to find out if the provisions of the treaty apply.

Tax Ramifications Of Trading As A Business

Compared to individuals, trading businesses can usually write off greater losses, claim broader business-related expenses related and worry less about wash sale rules.

If you meet the following broad criteria, talk with a tax professional about if you should consider establishing your trading as a business:

- You seek to profit from daily market movements of securities, not just dividends or capital appreciation

- Your trading is substantial

- Your trading activity is conducted with continuity and regularity

Read Also: What Is The Tax In Georgia

Canada Revenue Agency: How To Pay Zero Taxes On Stock Market Gains

Andrew Button| December 16, 2019|More on: SHOPSHOPXIU

Did you know that the easiest way to maximize stock market gains doesnt involve picking stocks at all?

Studies show that the vast majority of mutual fund managers fail to outperform the market, and if that holds for professionals, it probably holds for the average Joe. In light of this, trying to maximize gains by beating the market may be a difficult feat to pull off.

However, theres one way to maximize your stock market returns thats so easy anybody could do it:

Minimizing your tax burden.

By holding your stocks in registered accounts, you dramatically reduce the taxes you ultimately pay on them. As a result, you ultimately realize a higher return. While it may sound hard to believe, theres one way to actually pay zero capital gains taxes on your entire portfolio.

This strategy does leave you with dividend taxes , but it can completely eliminate the need to realize capital gains.

Capital Gains Inclusion Rate

Thecapital gains inclusion rateof 50% determines how much of your total capital gains that will be subject to tax. Investments in registered plans such as aRegistered Retirement Savings Plan , Registered Retirement Plan , or Tax-Free Savings Account are considered tax-sheltered and capital gains tax will not be charged on investments while they are held in these accounts. The disadvantage with a registered investment account is that you will also not be able to carry forward any capital losses. For more information on registered and non registered investment accounts, seeCapital Gains on Investment Accounts.