What You Have To Pay: Unemployment Taxes

Unless your organization isexempt, you need to pay into federal and state unemployment insurance overand above what you pay each employee.

Unemployment insurance provides financial assistance to workers who:

- Are unemployed for reasons they dont have control over .

- Meet their states minimum requirements for time worked or wages earned.

Federally, contributions are governed by theFederal Unemployment Tax Act .Each state runs its own unemployment insuranceprogram, and your location can impact both yourSUI rateand potential tax credits. Heres why:

FUTAs maximum taxable earnings, whats called a wage base, is $7,000 anything an employee earnsbeyond that amount isnt taxed. The standard FUTA tax rate is 6%, so your max contribution per employeecould be $420. However, you can also claim a tax credit of up to 5.4% . Employers cantypically claim the full credit, as long as their unemployment taxes are paid in full and on time.

If you get the full credit, your net FUTA tax rate would be just 0.6% , plus whatever you owe to your state government.

But theres another way your location can impact your tax rate. If your state doesnt have the money topay out UI benefits, it may need to get an Unemployment Trust Fund loan, becoming whats called a.If your state doesnt pay off that loan in time, you could see your FUTA tax credit slowly carved back by 0.3% every year the loan is outstanding.

Who Will Shoulder The Increase In Sss Contributions In 2023

The employer will shoulder the 1% increase in SSS contributions.Specifically, employers will have to pay 9.5% and employees will be deducted 4.5%. Before the increase, employer share is at 8.5%.

According to the SSS, the higher contribution rate will result in more SSS benefits for members and pensioners. Moreover, the SSS said that the contribution hike will help in making sure that the SSS will have a longer fund life. The SSS funds life got shorter from 2042 to 2032 in 2017, following the P1000 pension increase in 2017 and 2022. With the higher contributions, the agencys fund life will be extended until 2045.

Federal And State Unemployment

When it comes to unemployment taxes, employers may pay State Unemployment Tax Act and Federal Unemployment Tax Act taxes, also known as SUTA and FUTA. SUTA is required to be paid by the employer. This money is added to the state unemployment fund. All employers contribute to this, allowing their employees to collect from the funds if they need to apply for unemployment.

FUTA covers unemployment on a federal level. If unemployment is high, for example, during 2020, states can borrow from the FUTA fund to help with state unemployment needs. The FUTA and SUTA are based on employee wages. The current FUTA tax rate ranges from 0.6% to 6%.

Don’t Miss: Where Do You Mail Federal Tax Returns

How Do You Determine How Much Income Tax You Should Withhold

Your employees make a lot of the decisions here. They’ll use Form W-4 to decide how much they want to have withheld, based on their household and personal financial circumstances. You’ll need every new worker to fill out a Form W-4 then, you can use that information and the employee’s earnings to calculate how much tax to deduct.

Even though you’re not paying the employees tax for them, it is important to manage the withholding correctly and ensure that the proper amount is sent to the IRS. Check out the IRS’s Publication 15, Employer’s Tax Guide, for more information about payroll and income taxes and your responsibilities as an employer. You can also use the online Tax Withholding Assistant tool on the IRS website to help you create a spreadsheet that calculates the right amount of federal income tax to deduct for each employee.

Quarterly Tax Payment Due Dates

Quarterly FUTA taxes are due if you owe more than $500 in taxes each quarter.

The due dates are:

- Quarter Three: Oct. 31

- Quarter Four: Jan. 31

However, SUTA tax due dates vary by state. For example, in Michigan, the taxes are due on the 25th of the month instead of the end of the month: April 25, July 25, Oct. 25, and Jan. 25.

Failing to meet the deadline may result in a penalty or late tax payment interest assessment. Therefore, you not only have to know what taxes to withhold and pay but also when and how to pay itby state.

Recommended Reading: When Are Taxes Accepted 2021

What Percentage Do Employers Pay To Health Insurance

According to Kaiser Family Foundation , employers paid83% of employees-only health plans and73% of employees’ family health insurance in 2021. The employees-only package costs $7,739, while the family plan costs $22,221 annually.

There’s no standard for how much employer contributions go into the employees’ health plan. Some employers contribute over 50% and deduct the remaining amount from the employees. At the same time, some employers pay only a small amount and deduct a big portion from the taxable income.

The pay stub has the tax statement, and you can easily check how many deductions were made to the health plan by the employers and employees.

Payroll Tax Vs Income Tax

Employers do not contribute to income tax, as they do for payroll tax. Therefore, you could think of payroll tax as a tax of your wages that you share with your employer.

The difference between income and payroll tax is often a misunderstood topic. From a quick glance at a paystub, one might overlook the different taxes involved in calculating the take home pay. But not all taxes are the same. From the employer perspective, it is especially important to know the difference and the impact they can have on your business and employees.

Letâs cover income tax first.

Don’t Miss: How To Track My Tax Refund 2020

Determine Your Gross Pay

You must be aware of your gross pay in order to determine how much net pay you will receive. Most workers are aware of their salaries, but you can divide this sum by 12 to get your monthly gross pay. You can refer to your paycheck or speak with your human resources department if you are unsure of your gross pay.

Estimate Your Tax Liability

Once youve determined youre required to pay quarterly taxes and when you need to pay them, its time to calculate how much youll owe.

The potentially huge number of inputs used in your final tax return can take hours to put together using tax prep software, depending on the complexity of your finances. Fortunately, the quarterly tax process is much simpler.

Its better to estimate a little high than estimate low, as any excess taxes paid will come back in your refund. But if you underpay, you may end up facing underpayment penalties.

Read Also: How Do I Make An Amendment To My Tax Return

You May Like: How Do I File My Taxes Electronically

Determine The Sum Of Your Deductions

The next step is to determine which deductions will be made from your gross salary. Your monthly deductions will be listed on your paycheck. They could consist of a variety of required and optional deductions, such as taxes, health plan costs, or 401 deductions. To determine the total amount of your monthly deductions, add all of these together.

Federal Unemployment Tax Act

The federal government doesn’t pay unemployment benefits but does help states pay them to employees who’ve been involuntarily terminated from their jobs. To fund this assistance to the states, there’s FUTA, which is a tax created by the Federal Unemployment Tax Act. The tax applies only to the first $7,000 of wages of each employee. The basic FUTA rate is 6%, but employers can receive a credit for state unemployment tax of up to 5.4%, bringing the net federal rate down to 0.6%, or a maximum FUTA payment of $42 per employee.

However, the credit is reduced if a state borrows from the federal government to cover its unemployment benefits liability and hasn’t repaid the funds. Then such state becomes a “credit reduction state” and the credit reduction means the employer pays more FUTA than usual.

Recommended Reading: Is Property Tax Tax Deductible

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

There are numerous other credits, including credits for the installation of energy-efficient equipment, a credit for foreign taxes paid and a credit for health insurance payments in some situations.

How Do Small Business Owners Pay Taxes

Most small businesses are owned by individuals.

Partnerships, LLCs, and sole proprietorships pay no business tax, but the income is passed through to the owners, who report it on their personal tax returns. Because of this, it can be difficult to separate the tax paid on business income from the tax owed by the individual for all forms of income.

To figure your income tax rate, you must calculate your taxes for Form 1040 or 1040-SR, by adding up all your sources of income, including your business’s net income. You’ll also have to include tax credits and deductions to compute a net taxable income.

When you have your total taxable income, you can use the IRS tax tables to figure out your tax, though tax prep software or an accountant may be better to ensure you maximize your credits and deductions.

You May Like: How Do I Fix My Rejected Tax Return

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employeeâs wages.

Do any of your employees make over $147,700? If so, the rules are a little different, and they may owe additional Medicare tax. Read more at the IRS.gov website.

What Does It Mean To Have 1099 Income

Any income thatâs reported on a 1099-NEC or 1099âK is considered âself-employment income.â

Self-employment income is just code for ânon-W-2.â It can come from running a small business, freelancing, or just working a casual side hustle.

When you work as a standard employee, your employer automatically withholds your income and FICA taxes and pays them to the IRS.

Self-employed individuals, on the other hand, have to calculate and pay these taxes themselves.

Tax filing for freelancers and side hustlers

Most tax software isn’t built for you. Keeper is. We know every form you need and every deduction you can take to pay less this year.

Recommended Reading: When Is The Tax Deadline For 2021

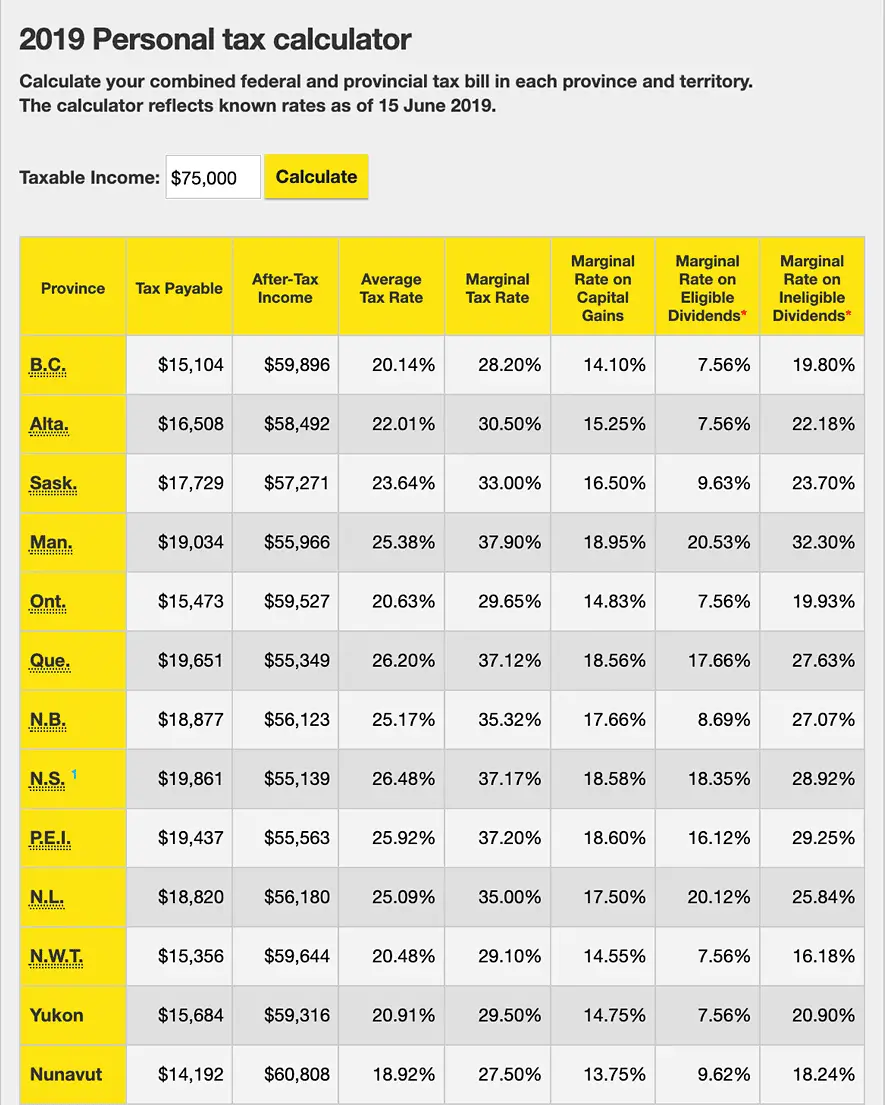

Which Provincial Or Territorial Tax Table Should You Use

Before you decide which tax table to use, you have to determine your employee’s province or territory of employment. This depends on whether or not you require the employee to report for work at your place of business.

If the employee reports for work at your place of business, the province or territory of employment is considered to be the province or territory where your business is located.

To withhold payroll deductions, use the tax table for that province or territory of employment.

If you do not require the employee to report for work at your place of business, the province or territory of employment is the province or territory in which your business is located and from which you pay your employee’s salary.

For more information and examples, go to Chapter 1, “General Information” in Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

Forms That Independent Contractors File

The main form that all of your numbers will go on is a regular 1040. Regardless of your background and type of earnings, everyone in the U.S. submits this form. Where the paperwork veers off a little, however, is the point when you start working with the supporting schedules.

The income that you report for your independent contracting must come from a Schedule C. Furthermore, to account for the self-employment tax, you need to include a Schedule SE. If you made any estimated tax payments, which will be discussed shortly, you need to ensure that those accompany your return as well.

The best starting point is Schedule C. You begin by adding all of your earnings in Part I on lines one through seven. After that, you go through lines eight through 28 to derive the total expenses. Finally, you will get your net profit or loss on line 31. That number will go directly on line 12 of your form 1040. Also, do not forget to calculate your qualified business deduction from section 199A of the new tax law from 2017, which will amount to 20% of the net income that you made. That is, of course, as long as you satisfy certain requirements that most independent contractors do. To find out more about them, review the overview provided by the IRS.

Read Also: How Do I Track My Tax Refund

Tip #: Dont Miss Your Business Write

Most write-offs are missed because people donât keep track of what they buy for work. In the frenzy to pull everything together before taxes are due, eligible write-offs tend to fall through the cracks.

Do yourself a favor and start keeping up with your expenses now. More of your purchases count as business expenses than you might realize, and they could significantly lower your taxable income. Here are a few examples of business tax deductions you can take:

- ð³ Bank and credit card fees on accounts you use for work

- ð Computers and electronic accessories

- ð» Platform fees, from Shopify to Patreon

If youâre wondering where to start with this, youâve come to the right place. The Keeper app is specifically designed for gig and freelance workers.

The app will find and sort all of your business write-offs automatically. When youâre ready to file, all you have to do is upload your 1099s, and weâll handle the rest.

The Ins And Outs Of Payroll Taxes

It can be a little daunting when its time to get out that calculator and run payroll. Chances are, itsthe last thing you want to think about, but getting it right is something that really matters to both youremployees and your friendly neighborhood tax. To make it easier to understand, weve broken down theprocess into a few easy steps.

Also Check: How To Track Your Taxes Online

Deducting Tax From Income Not Subject To Cpp Contributions Or Ei Premiums

We have built the tax credits for CPP contributions and EI premiums into the federal and territorial tax deductions tables in this guide. However, certain types of income, such as pension income, are not subject to CPP contributions and EI premiums. As a result, you will have to adjust the amount of federal and territorial income tax you are deducting.

To determine the amount of tax to deduct from income not subject to CPP contributions or EI premiums, use the Payroll Deductions Online Calculator, available at canada.ca/pdoc. On the “Salary calculation” and/or on the “Commission calculation” screen, go to Step 3 and select the “CPP exempt” and/or “EI exempt” option before clicking on the “Calculate” button.

How To Calculate And Report Deductions

Maddy Price / The Balance

Employers calculate payroll taxes using an employee’s gross or total wage earnings and various deductions to arrive at net or take-home pay. This seems simple enough on the surface, but calculating the deductions requires attention to detail and extreme accuracy.

Read Also: What Tax Type Is My Business

Pay As You Go So You Wont Owe: A Guide To Withholding Estimated Taxes And Ways To Avoid The Estimated Tax Penalty

The IRS has seen an increasing number of taxpayers subject to estimated tax penalties, which apply when someone underpays their taxes. The number of people who paid this penalty jumped from 7.2 million in 2010 to 10 million in 2015, an increase of nearly 40 percent. The penalty amount varies, but can be several hundred dollars.

The IRS urges taxpayers to check into their options to avoid these penalties. Adjusting withholding on their paychecks or the amount of their estimated tax payments can help prevent penalties. This is especially important for people in the sharing economy, those with more than one job and those with major changes in their life, like a recent marriage or a new child.

There are some simple tips to help taxpayers.

Pensions And Automatic Enrolment

Pensions are a way of helping you to save up to pay for your living costs during retirement.

The government want to encourage you to provide for your own retirement, rather than rely on the state so have introduced automatic enrolment.

You can find out more information about automatic enrolment in our website guidance.

Growth on pension savings is generally free of tax. When pensions are paid out to you they are taxable, but you should be able to take some part of the pension as a tax free lump sum.

There is more information about pensions generally, including the state pension in the tax basics section and further information in relation to pensions and employees on our page Pensions and employees.

You May Like: How To Pay Doordash Tax