Fbr System Down On Last Day Of Filing Income Tax Returns

FBR logo

Thursday was the last date for filing of income tax returns but the FBRs online system has once again gone down leaving millions of filers in the lurch. The speed of the FBR system Iris has slowed down due to heavy traffic and millions of taxpayers and consultants were in a fix what to do amid calls for extension in the deadline, reported 24NewsHD TV channel.;

Reportedly, 36 tax bars of Punjab including Lahore have demanded of the FBR to extend the deadline.;

Earlier, the Federal Board of Revenue refused to extend the date of filing of income tax returns beyond September 30, 2021.;

Spokesman for the Bureau Asad Tahir has made it clear that all persons, associations of persons and companies will have to submit their returns on the due date. The taxpayers are asked to file their returns on the given date in order to avoid legal complications, he added.;

The notification issued by the FBR, however, has authorised the commissioners with extending the deadline for the taxpayers whose cases fall in the hardship category by 15 days.

The spokesman further said that the bureau was making the IRS system easier. Around 150, 000 recordincome tax returns were filed on September 28, he informed.

He said that just like the previous year, the FBR had enhanced its capacity to facilitate the taxpayers.

How Do I Send The Irs My Tax Payment

If you’re mailing your tax payment, you can elect to have the funds withdrawn directly from your bank account or include a personal check or money order. If you choose the latter, make it payable to “US Treasury” and include your name, address, phone number, Social Security number or Individual Tax ID Number. Under no circumstances should you ever mail cash to the IRS.

Read more:;How to handle cryptocurrency on your taxes

What Is The Last Day To Contribute To My Retirement Account For 2019

As with other elements of the extension, individuals can wait to make 2019 contributions to their retirement accounts normally due April 15, 2020 until July 15, 2020. Consider using this extra time to set aside more money in your retirement accounts if you’re able. You can contribute a maximum of $6,000 to an IRA for 2019, plus an extra $1,000 if you’re 50 or older.

You don’t need to wait to file your tax return to make this contribution, however. If you know how much you’ll contribute by the tax deadline, you can count this on your tax return and make the actual contribution by the new deadline.

Also Check: Is Doordash Worth It After Taxes

S Corporation And Partnership Tax Returns Due

Today is the deadline to file your S corporation tax return or Partnership return .

Note that S corporations and Partnerships do not pay taxes on their income. That tax is paid on the individual incomes of the shareholders or partners, respectively.

March 15 is also the deadline to file for an extension for S corp and partnership tax returns.

Forms:

Irs Provides Details On April 15 Postponement

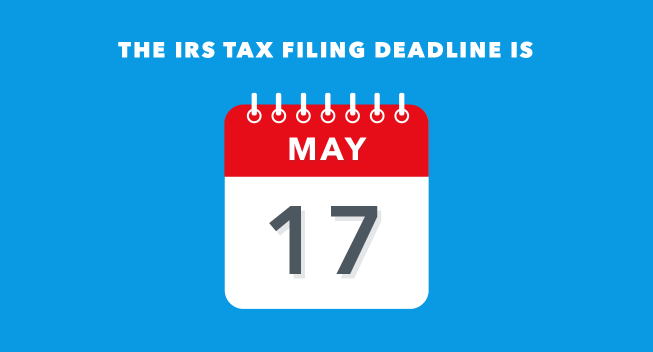

On Monday, the IRS issued guidance with details on its postponement of the April 15 tax deadline for individuals . The IRS had announced in a news release on March 17 that it was delaying the April 15 deadline for individuals until May 17, 2021. Mondays notice clarifies and adds details about the postponement. Like the news release before it, the notice does not extend the April 15 due date for estimated tax payments.

Under the notice, the postponement applies to any individual who files a federal individual income tax return on Form 1040, 1040-SR, 1040-NR, 1040-PR, 1040-SS, or 1040 or has a federal tax payment reported on one of these forms that would otherwise be due April 15, 2021. The IRS says the postponement also applies to the filing of all schedules, returns, and other forms that are filed as attachments to forms in the Form 1040 series or are required to be filed by the due date of the Form 1040 series. The IRS lists as examples Schedules H and SE, as well as Forms 965-A, 3520, 5329, 5471, 8621, 8858, 8865, 8915-E, and 8938. Also, elections that are made or required to be made on a timely filed form in the Form 1040 series will be considered timely if filed on such form or attachment, as appropriate, on or before May 17, 2021.

The notice also extends the postponement to claims for credit or refund of federal income tax that absent the notice would expire on or after April 15, 2021, and before May 17, 2021 .

Read Also: How To File 2 Different State Taxes

What Happens If I Miss The Tax Deadline

If you fail to file your income taxes by midnight on May 17, what happens next depends on your situation. If you are owed a refund, there is no penalty for filing late, though this may be different for your state taxes. But if you owe the IRS, penalties and interest will start to accrue on any remaining unpaid tax due in May. There’s also a $330 failure-to-file penalty under the;Taxpayer First Act of 2019.;

It’s best to file on time, even if you owe money that you can’t pay right now — in most cases, late filing penalties are higher than late tax payment penalties. If you can’t file on time, you can file for an extension, which automatically pushes back the tax filing deadline to Oct. 15 and protects you from penalties. In most states, taxpayers who are granted a federal extension to file automatically receive an equivalent extension to file their state income tax return.;

An important note: If you are owed a refund or if you file for an extension through Oct. 15, you still have to pay your taxes by May 17. If you owe money, you’re required to estimate the amount due and pay it with your;Form 4868. If you do that, you’ll automatically be granted an extension.;

Another caveat: If you’re serving in the military — in a combat zone or a contingency operation in support of the armed forces — you may be granted;additional time to file, according to the IRS.;

See also

File For An Extension By Tax Day

If you can’t finish;your return by the May 17 tax deadline, file IRS Form 4868. This will;buy;most taxpayers until Oct. 15 to file their tax returns. See more about how extensions work.Note:;A tax;extension gets you more time to file your return, not more time to pay your taxes. You still must pay any tax you owe, or a good estimate of that amount, by the tax deadline. Include that payment with your extension request or you could face a late-payment penalty on the taxes due.

» MORE:;See how to set up an installment plan with the IRS by yourself

Recommended Reading: Do I Have To Pay Taxes On Social Security Income

How Will The Tax Deadline Extension Affect Taxpayers

Whether youre filing as an individual, a business, a trust, an estate or anything else, your 2020 tax year federal tax filing and payment deadline is now May 17. You wont need to take any action in order to take advantage of this extension.

However, the federal government recommends that taxpayers file their taxes as soon as possible, particularly those who are expecting;tax refunds. Earlier in the year,;U.S. Treasury Secretary Steve Mnuchin said that he wanted those refunds to get into peoples hands as soon as possible. This influx of cash is a great way for people to cushion the financial hit from the pandemic.

Are Ador Offices Open

In light of COVID-19, the Arizona Department of Revenue has temporarily modified current services in an effort to protect the health and safety of its customers and employees while continuing to provide information and support to Arizona taxpayers.

Customers requiring in-person assistance can make an appointment with a department representative at ADORs locations in Phoenix and the Southern Regional Office in Tucson. They can do this by emailing;;or calling 716 ADOR .

A;drop-box;is available at the three ADOR locations for payments, forms, applications, and returns without an appointment. Items are collected throughout the day and taxpayers can receive a submission confirmation by including their email;address on the top of the envelope.

Online Filing and Call Center AssistanceADOR also offers a Live Chat feature, which is available online Monday through Friday from 7 a.m. to 6 p.m. to answer inquiries for general questions and offers navigational guides in real-time.

Customers seeking information on particular private taxpayer matters or confidential account information can speak to our Customer Care Center at 255-3381 or 800-352-4090.

Don’t Miss: What Form Do I Need To File My Taxes Late

Other States That Made Changes To Deadlines

- Alabamamade a sort of hybrid tax extension: The state will automatically waive late-payment penalties for payments remitted by May 17. However, interest on taxes owed will still accrue from April 15.

- Idaho introduced a bill;to push its state income tax filing deadline back to May 17, but the legislature did not come to an agreement before adjourning March 19. The legislature reconvenes on April 6.

Is Unemployment Compensation Taxable In Arizona

Taxpayers should have received a Form 1099-G from the Arizona Department of Economic Security that they will need in order to prepare their 2020 federal income tax return. The amount of unemployment compensation is reported on the federal income tax return. The American Rescue Plan of 2021 includes a subtraction from federal adjusted gross income of up to $10,200 in unemployment income per person for the 2020 tax year.

Also Check: Can You File Missouri State Taxes Online

What Happens If You Miss The Deadline

If you miss the tax filing deadline, the IRS recommends filing your late return as soon as possible to avoid a failure-to-file penalty. The IRS wont charge a failure-to-file penalty when a refund is due. However, there is a three-year statute of limitations on refunds. If you file more than three years after your deadline, then you wont get your money.

Individuals who miss the payment deadline may be subject to a failure-to-pay penalty along with interest charges on the amount due. An exception may be if youre experiencing hardship and file a special extension.

Try to file your taxes as early as possible to avoid missing the deadline. Start gathering your documents as soon as you receive them, and be sure to make an appointment if youre working with a tax professional. Even if the IRS extends the due date, it might be in your best interest to file early, especially if youre expecting a refund.

Individual Tax Returns Due

For 2021, the individual tax return date has been moved from April 15 to May 17. This is the deadline to file Individual tax returns . If your income is below $66,000 for the tax year, you can e-file for free using IRS Free File. If your income was above that, you can use the IRSâ free, fillable forms.

If youâre a sole proprietor filing Schedule C on your personal tax returns, the May 17, 2021 deadline applies to you too.

May 17 is also the deadline to file for an extension to file your individual tax return.

Don’t Miss: Do You Pay Taxes On Life Insurance Payment

Corporate Tax Deadline: When Are Corporate Taxes Due

If your business counts as a corporation, you must also navigate extra tax deadlines and forms.

Your corporate taxes will be due at different times depending on the structure of your corporation.

If you have a C-corporation , your deadlines are:

- if your corporation operates on a calendar year

- if you decide to use the extended deadline

If your corporation operates on a fiscal year, your tax deadline is the 15th day of the fourth month following the end of your fiscal year.

In all cases, file IRS Form 1120.

C Corporation Tax Returns Due

Today is the deadline to file C corporation tax returns . C corporations in Texas, Oklahoma, and Louisiana have until June 15 to submit their tax returns.

April 15 is also the deadline to file for an extension to file your corporate tax return.

Forms:

Further reading:What is Form 7004 and How to Fill it Out

Don’t Miss: How Is Capital Gains Tax Calculated On Sale Of Property

What If You Miss A Date

You’ll probably be hit with a financial penalty, if only an extra interest charge, if you don’t submit a tax return and make any payment that’s due by its appropriate deadline. The late-filing penalty for a 1040 return is 5% of the tax due per month as of tax year 2020, up to a cap of 25% overall, with additional fees piling up after 60 days. The IRS says you should file your return as soon as possible if you miss a deadline.

How Do I File My Taxes Online

CNET has rounded up the best tax software, featuring vendors such as TurboTax, H&R Block and TaxSlayer. These companies can make the tax filing process much easier, from reporting your taxable or self-employed income to setting up direct deposit to going through your itemized deductions.

That noted, the IRS provides a list of free online tax prep software;offered by many of those same providers. You can use this service if you meet certain criteria and have a relatively simple tax situation. Requirements include: You make less than $72,000 annually, you don’t itemize deductions and you don’t own a business. This will likely be helpful for people who do not typically have to file taxes but need to do so this year to claim missing stimulus money.

If you want to itemize deductions or have a more complex financial situation — you run a business, have investments or generate rental income — you’ll have to pay for a higher tier of service, which can run a couple hundred dollars. Still, for most people, even the most deluxe online package is far less expensive than hiring an authorized tax pro. And if you prefer to keep it old-school, the IRS’ online tax forms handle some but not all of the calculations for you and still allow you to e-file or print and mail.

A number of online tax software providers will help you file for free.

Don’t Miss: Do You Have To Report Roth Ira On Taxes

Are Inheritance Taxes Due On The Date Of Death Or When The Inheritance Is Received

While some states do impose an inheritance tax, the federal government only imposes an estate tax. Estate taxes are imposed on the estate itself rather than on the individuals inheriting assets from the estate. Estate taxes aren’t necessarily imposed on the date of death, but they will have been assessed by the time an heir officially receives assets.

Does A Retired Person Pay Arizona Income Tax

It depends on your gross income. In the state of Arizona, full-year;resident or part-year;resident;individuals must file a tax return if they are:

- Single, married filing separately or head of household and the Gross Income is at least $12,400;

You can find information on where your refund is at .

Read Also: How To Get Stimulus Check 2021 Without Filing Taxes

Is There Any Extension To Make Tax Payments

Yes, the Arizona Department of Revenue has moved the deadline for filing and paying state individual income taxes for the 2020 tax year from April 15 to May 17, 2021. For making electronic payments, select the day you want the payment to be withdrawn. Payments made on AZTaxes must be completed before 5:00 p.m. Mountain Standard Time the Arizona business day prior to the due date, in order for the payment to settle the next business day.

Don’t Wait If You’re Owed A Tax Refund

If you have all your paperwork in order, tax experts recommend that you don’t wait another month to file your tax return.;

The IRS has received 93.2 million individual tax returns through April 2, down 4.3% from the same year-to-date period in 2020.

The IRS processed 83.7 million individual tax returns through April 2, down 9.5% from a year ago.

So far, the IRS has issued 62.3 million income tax refunds down 15.9% from a year ago. The average refund of those issued through April 2 was;$2,893.;

The IRS did not start the tax season and begin processing tax returns until Feb. 12 a bit more than a two-week delay from last year.

Some tax refund delays might be attributed to the extra time that the IRS needs to correct mistakes that are being made when people claim the Recovery Rebate Credit. Other factors could be at play, too.;

Some people who lost jobs in 2020 could see even more money than their initial income tax refund, too.;

The IRS said in late March that it would;take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent tax break for jobless benefits was put into place as part of the American Rescue Plan.

The first special refund payouts;will likely be;made in May, and they will continue into the summer.

More:Receive jobless benefits in 2020? IRS to send tax refund payouts to some in May

Read Also: How Much Is Sales Tax In Illinois