This Is Not Tax Advice

Understand that this is not professional or legal or any kind of tax advice. You should seek out your own tax professional if you need advice directly related to your individual situation.

In fact, if I were to give out any advice at all here, it’s exactly that: Get a tax pro. If you’re not real sure how things work with your taxes, it’s so easy to miss so many things. Find a good tax person who understands how it works for a 1099 contract worker and for the self-employed. You’ll find it’s worth the extra money.

I’ll repeat myself: this is not to provide tax advice. It’s to educate and inform. This is part of my series of articles on Doordash taxes. The purpose here is to provide the information to help you understand how taxes work. It is designed to give you an idea what to expect, and why things are like they are.

If you’re armed with knowledge, you’re better prepared for what comes at the end of the year. You have an idea whether you need to save each quarter.

Going forward, we’ll talk about the Doordash tax calculator. We’ll explain why we’re doing things this way and what this calculator will provide. The calculator won’t tell you will owe or if you’ll get a refund as a contractor for Doordash, Uber Eats, Grubhub, Instacart or others. But it will help you get a feel for how your income from those apps will affect your final tax bill.

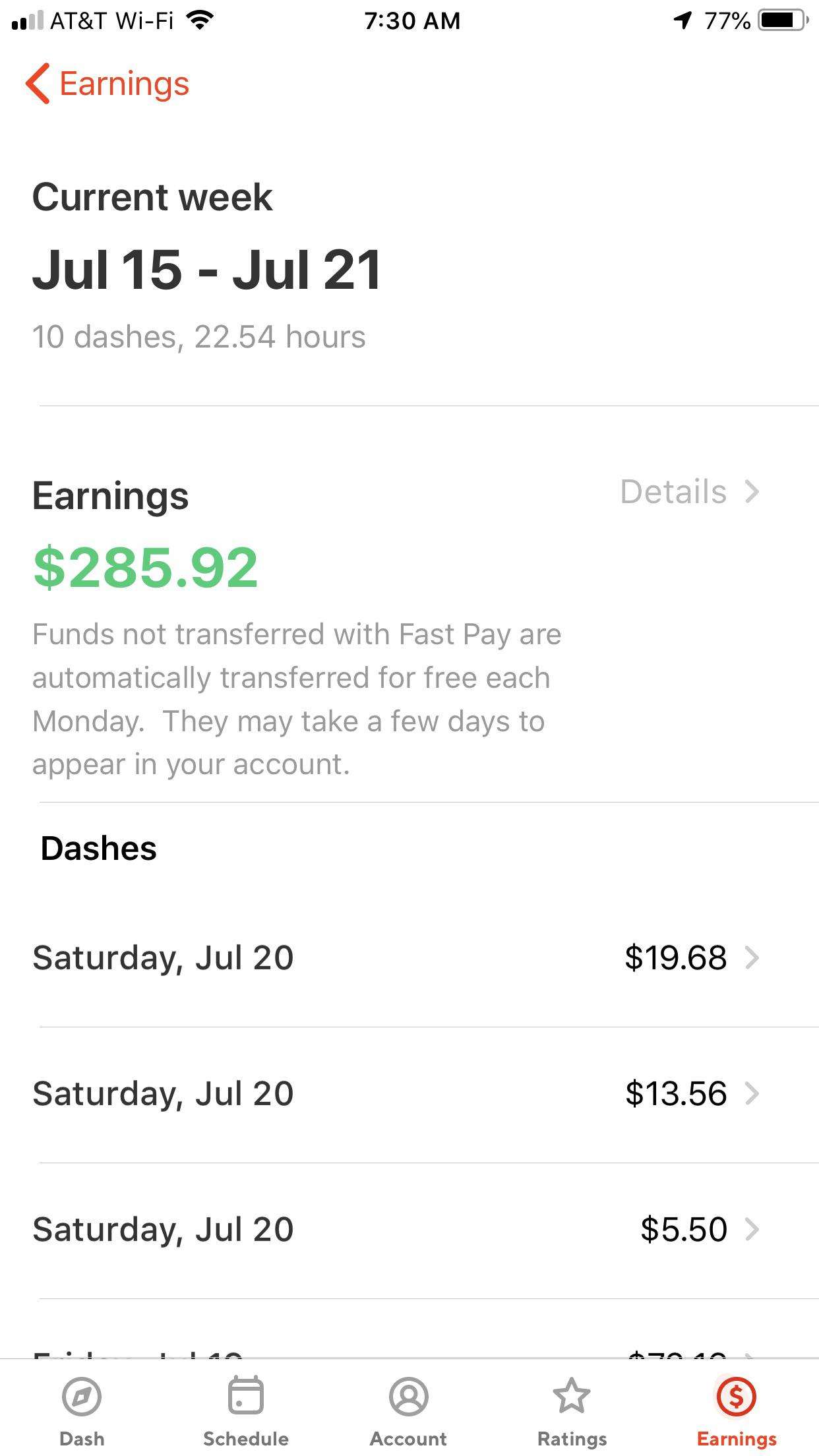

How Much Does Doordash Pay

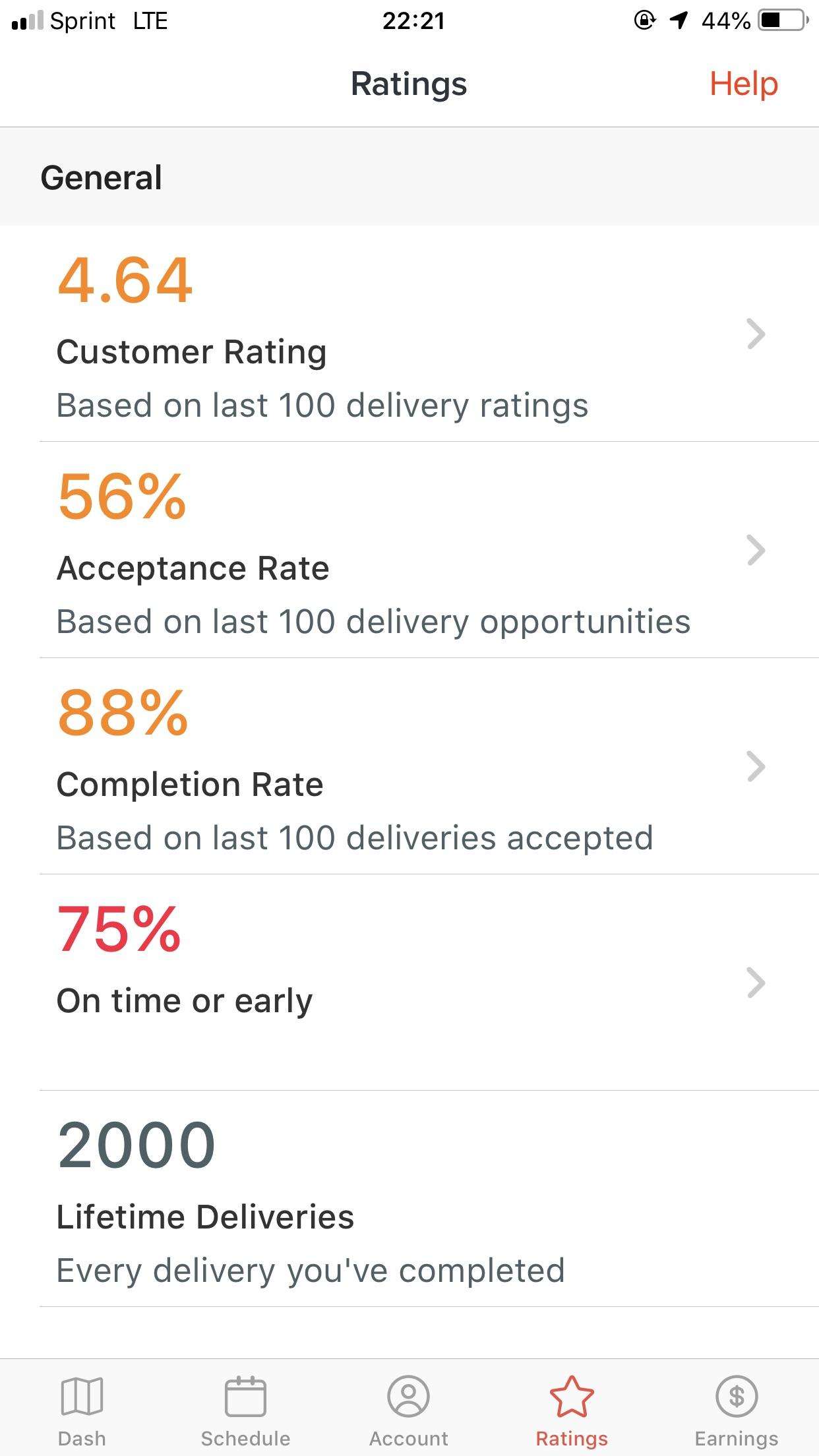

Heres where things get a bit tricky. Its hard to pin down the average DoorDash driver pay since the income depends on a variety of factors. Aspiring drivers must also be forewarned: a lot of DoorDash driver job reviews have blown up numbers.

The DoorDash website says that the base pay for Dashers ranges from $2 $10 per delivery, depending on the distance, duration, and desirability of the order .

DoorDash also said in 2019 that the average DoorDash driver can earn around $18.50 per hour.

While employment-related search engines such as Indeed.com can confirm this, we discovered that this number can go even lower after reading a handful of DoorDash driver reviews.

$10-$14 per hour

Here are some factors that may affect how much you earn.

The Equivalent Hour Pay Calculation

Gig economy platforms tend to focus on gross earnings the total amount deposited in a given week, including tips, and not accounting for mileage and other expenses. While this is a way to approach the advertised rates of earn up to $25/hour its not really an accurate indicator of the amount a worker can expect to have to live on.

The purpose of the equivalent hourly pay calculation is to account for the basic expenses incurred by gig workers and create a baseline of comparison between gig jobs and with conventional employment. This is the basis on which gig workers have made the demand to be paid at least $15 + expenses for all time with an active job.

This simple formula accounts for two key costs not accounted for in gross earnings. The first is the additional employer share of payroll taxes which are paid by independent contractors but not employees, which works out to 7.65% of pay. A second and much larger added expense is the cost of driving . The IRS mileage rate is a standard, widely-accepted, and comprehensive estimate of the full costs of driving a typical vehicle. While this mileage cost would be a large aggregate line item on a corporate financial report if the company owned the vehicles, the magnitude of the expense can be difficult for an individual worker to gauge it tends to be hidden on a job-by-job or day-to-day basis, but then shows up in a large repair or need to replace a vehicle far sooner than otherwise.;

Also Check: How To Get Tax Exempt Status

What Doordash Actually Pays After Expenses And Whats Happening With Tips

If my car breaks down I make $0 and I have no money to maintain my vehicle. So I sit at home and wait for the government to provide me with food stamps. Im making $5 in an hour with three kids as a single mom. I have no money to pay bills. It takes me all day to fill up my car to keep going. I make nothing to feed my kids and Im bringing food to other people. The $5 I made during that hour goes to gas so I can do 2 more orders in an hour to make another $5 to put more gas in to keep going.

Food delivery app DoorDash has grown rapidly into the national industry leader, serving all 50 states and outpacing GrubHub, Uber Eats, Postmates, and other players with an estimated 35% marketshare in a rapidly-expanding segment. The company is reportedly preparing for an IPO and has been valued at a remarkable $12.6 billion.;

DoorDash has also been the focus of a sustained controversy over a pay model which misappropriated customer tips intended for workers. Under the pay model the company employed from 2017 until the fall of 2019, each dollar of customer tip did not raise workers earnings by a dollar it simply meant the company paid the worker one dollar less. The company repeatedly defended this wildly unpopular tip-swiping pay model over several waves of public controversy, finally agreeing to change the policy in July, and only implementing the change in .;

Key Findings

8% of jobs include gross pay from DoorDash of just $2.

86% of jobs include a customer tip.

Should You Become A Dasher

Driving for DoorDash is a decent way to earn some cash on the side. Its nice that you can use some business savvy to boost your bottom line .;

If youre looking for a part time job that you can do on your own schedule, DoorDash fits the bill. I would still prioritize work on your main career above a side job like DoorDash, but its one of the better ways to drive and earn.

Also Check: How Much Income To File Taxes

How Long Does It Take To Become A Doordash Driver

It takes approximately 2 weeks to become a DoorDash driver. After you fill out the application, you have to wait for your background check to be processed which takes about 5-7 business days. Then, you either have to schedule an open slot for an orientation or wait for an activation kit in the mail which can take another 3-5 days.

Is Driving For Doordash Worth It

Thanks for reading my DoorDash review? I am sure you now know how DoorDash Work for Dashers. How much do DoorDash drivers get paid? Is Doordash driver pay and driving for DoorDash worth it?

While it may seem that Doordash offers you the opportunity of making about $25 per day, it doesn’t work that way.

For one, you have to live in an incredibly busy environment.

However, for some towns and cities, being a DoorDash Dasher will not be profitable.

On the other hand, I will like to introduce a product that has helped me earn six-figures monthly without having to drive around waiting for orders, Wealthy Affiliate.

This affiliate marketing program enables you to make while marketing the products of affiliates.

You do not need to do direct selling nor stock up any products.

Will you like to find out how I got started?

Do think DoorDash works for Dashers?; What do you think of my DoorDash review?

Have you used Doordash before? What was DoorDash Dasher’s service like? How much do DoorDash drivers get paid?

Kindly share your thoughts.

See My Compiled Rare Frequently Ask Questions About DoorDash Dasher. Click Here to learn more. Is Doordash worth it? What do you think?

Also Check: How Is Capital Gains Tax Calculated On Sale Of Property

Driving For Doordash In San Francisco Ca

Want to drive for DoorDash in San Francisco? DoorDash drivers in San Francisco report earning $21-30 per hour, not including tips! Drivers in San Francisco recommend driving during the weekends, and dinner hours, to earn more and to also communicate with your customer, especially if their order is running late, to increase tips.

Adding Up Your Income

Here’s where you list all of your sources of income. What W-2 income did you have? How much did you profit from your business or businesses? Did you have other income that counts, like interest or investment income, some forms of retirement income, etc.?

You add that all up.

Sometimes you subtract. If your business had a loss, you subtract the loss from other income.

Your Doordash expenses are part of the INCOME process.

This is the part that throws a lot of people off. You might be expecting to put your expenses into the deductions part of the process.

Remember what we’ve been stressing so far: You are taxed on your profits. You are not taxed on the total money received from Doordash or any other gig companies.

To figure out your income, fill out a form called Schedule C: Profit and Loss from business. List the money you received for your business. Then list your expenses. Add the two up. If your income was more than expenses, you had a profit. It’s that profit that gets moved to your tax form as income.

This is incredibly important to understand. Expenses go on Schedule C. Not on itemized deductions.

Your Schedule C is more like your version of a W2.

A lot of people think of 1099 forms as the independent contractor’s version of a W-2. They’re wrong.

There’s one box on a W-2 box that displays income. It’s very simple. You add that amount to your total income.

It’s your Schedule C that helps you determine what you are earning.

Also Check: Are Debt Settlement Fees Tax Deductible

Wear And Tear Of Your Vehicle

Your service vehicle or the car you use for DoorDash will go through many roads and weather while using it for business.;

Depending on the type of vehicle and the frequency you will deliver, your car will go through its natural wear and tear.;

Here are some recommendations:

- Avoid stepping on the brakes for a long time because it will faster wear out the brake pads.

- Keep your routine 15,000 miles regular maintenance for repairs, checkups, and fluid changeup to date.;

- Regularly change your motor oil and oil filter because it lubricates, cleans, and cools down the engines temperature.

- Warm-up your car in the morning before driving out to warm the oil and keep the parts lubricated.;;

- Check your tire pressure and use the factory recommendation PSI. Tire rotation preserves the cars suspension and gives a smoother ride.;

- Use the parking brake to avoid putting stress on the cars transmission.

How Does Doordash Pay

After you complete a delivery, the DoorDash app will display a quick earnings summary. When you click Got it, youre set to end your dash or accept another order.;

DoorDash pays its dashers via bank account direct deposit on a weekly basis. This means the company processes payments on Monday for the work you did the previous Monday to Sunday. Your earnings up to midnight PST on Sunday will be included in this payment.;

Be aware that depending on your bank, it may take a couple of days for your deposit to show in your account.;

Recommended Reading: How To File Taxes With No Income

Is It Worth Working For Doordash

If youre looking to make some extra cash, DoorDash is certainly a platform worthy of consideration. There is the potential to make up to $25 per hour. Furthermore, you can sign up for other delivery platforms to boost your earning potential.;

With the massive food delivery industry and the industry growth, this is certainly a niche that can make a great side gig or even replace an income.;

Subtract Deductions And Adjustments

As I noted at the end of Step 1: Your business expenses don’t go here. You don’t need to itemize to claim those business expenses. What we’re talking about here are your personal tax deductions.

For the sake of simplicity, this calculator is going to do three things:

Don’t Miss: How Do You Add Sales Tax

Use The Tools At Your Disposal

Overall, filing your own taxes will be easier than you think. But only if you have a proper bookkeeping system in place such as a 1099 tax app income and expenses. When you combine this with using free online calculators to help figure out the exact amount you need to pay on 1099 income, your tax filing process will become streamlined without the need for a tax professional.

Is Doordash Worth It 7 Things Drivers Can Expect

Disclaimer: This post may contain affiliate links. Please read my disclosure for more information.

One of the questions I hear from people thinking about driving for DoorDash is, Is DoorDash worth it?

Its a great question to ask if you want to work for DoorDash. There is a growing list of delivery services, and with recent driver strikes, you need to know youre starting a side hustle thats worth your time.

To help answer your question, Ive put together a list of things that you need to know if youre considering DoorDash. It includes the new Dasher pay model, how to earn more than average, and what you can expect with driver expenses.

Quick Links

You May Like: How To Calculate Net Income After Taxes

How Does Doordash Work For Drivers

DoorDash drivers execute delivery requests as planned by DoorDash App. As a driver, you will need to schedule your shifts in advance.

You are also allowed to use the open shift slot if available.

Then sign into the DoorDash App while you wait to receive your order. The order will contain details location of the customer requesting the food and the restaurant.

As soon as you accept the delivery request, you can then access the delivery details via the DoorDash app.

You will pick up the order from the restaurant and navigate your way to the customers location.

You can also contact the customer if you need extra information to deliver the order as regards directions to the location, parking, and gate access codes.

The summary of DoorDash driver job descriptions includes:

- You receive the delivery order details via the DoorDash app and deliver it to the customer.

- A schedule of shift for six days in advance is a must

- You can drop into any available shift if available and you are chanced.

- In some cases, drivers will need to do the ordering through a special DoorDash credit card referred to as Red Card.

As a DoorDash delivery driver, your request and delivery will be limited to your geographical locations and region as selected in the DoorDash app.

How Income Tax And Self

The important thing to remember when filing your federal taxes, you’re filing BOTH income tax and self-employment tax at the same time. You will calculate both tax bills. Then, after counting credits and what you paid in, you’ll either pay in or get a refund.

But there’s some important differences to be aware of:

Income tax is based on the total of all of your income. Self-employment tax is only calculated from your business profits.

There are several deductions that will reduce your taxable income for income tax. Those deductions do not apply to self-employment tax. Just like an employee’s FICA taxes, self-employment tax is charged on every dollar.

The income tax rate increases as your income increases. Self-employment tax is the same on every dollar you earn, up to a certain point . At that point the Social Security part is removed but Medicare tax continues to be charged.

Some tax credits are applied only to income tax but will not reduce self-employment tax. Those are called non-refundable tax credits.

Recommended Reading: How To Calculate Payroll Tax Expense

The Doordash Tax Impact Calculator

You can click here to access the calculator. You’ll be prompted to enter how much you made, how much you think you’ll owe, how you’ll file, and some places to enter extra information.

Remember, this is not a guaranteed number. This is an estimate to get you an idea. It depends a lot on information you provide, and there are tons of factors that can make an impact in many different directions.

And finally, I’ll repeat, this is about tax impact. How much higher is your tax bill going to be because of your self-employment? It’s a tool to help you plan, but not a guaranteed number.

Doordash Driver Review Conclusion

If you want to make some extra money for your weekly and monthly bills and expenses, then you must join DoorDash rather than hunting for the job.;

DoorDash opened the opportunity for all the people who are 18 or older. Even the students who meet the criteria can join DoorDash.;

I would advise you to take DoorDash Driving seriously as this app has the potential to bring consistent income like regular full-time or part-time jobs.;

Spend your spare time working for DoorDash and generate extra income that eventually makes you and your family financially strong.

Also Check: Where Can I Find My Real Estate Taxes

My Doordash Promo Code Doesnt Work

If for some reason your promo code doesnt work, double check to make sure there arent any expiration dates attached to it or any other restrictions, such as a minimum purchase. Also, keep in mind promo codes are case sensitive.

If you believe youve met all of the criteria and its still not working, go into your app, click on Account and scroll to Frequently Asked Questions. From there, youll be able to either start a chat with a DoorDash support agent or you can search through the frequently asked questions to find an answer that may help you.

Theres even one specifically geared toward your promotion code not applying correctly. Youre able to click on that question and file a support case if their steps to resolve it do not work.

This will likely only work if you do continue to place the order despite not having the promo code discount. Youre to take a screenshot of the promotion and terms and to submit information about the date and restaurant of the order.