Making Money In Canada

Your Canadian residency status doesnt affect whether or not you have to file a Canadian income tax return, however, it does affect how you file your taxes, what income you need to report, and the availability of certain credits or deductions. If you meet any of the CRAs criteria listed above, for example, you have to file a tax return regardless of your residency status.

If you live in another country but receive income from a business you own in Canada, or from investments you have in Canada or if you have property in Canada, then you will need to file an income tax return.

What If Someone Else Can Claim You As A Dependent

Different income thresholds apply if someone else can claim you as a dependent, as well as the type of incomeearned or unearned. Your total income might be less than the standard deduction for your filing status. However, you will still need to file a tax return if one of the below situations apply:

| Unearned Income |

|---|

| 65+ | Yes |

For example, let’s say you’re single, 16 years old, not blind, and your parents claim you as a dependent. You had $13,000 in earned income last year. You would have to file a tax return because that’s more than the threshold of $12,550 for tax year 2021. If all else was the same, but you were blind, you would not have to file because that’s less than the threshold/standard deduction of $14,250 for 2021.

You must also file a tax return if your combined unearned and earned income exceeds either of the applicable amounts for your circumstances. For example, you would have to file a return if you had $1,101 in unearned income, even though you only had $10,000 in earned income, were single and under 65 last year, and someone claimed you as a dependent. The $5 rule for married taxpayers filing separate returns still applies, as well.

The IRS provides an interactive tool on its website that can help you determine if you need to file a tax return. Its only designed for taxpayers who lived in the U.S. throughout the entire tax year. Your spouse must also have lived in the U.S. if youre filing a joint return.

Should You Wait To File Your 2020 Return Is Caught In An Irs Backlog

Many people are wondering what to do if their tax returns from last year are held up somewhere in the IRS system. Should you then wait to file a 2021 tax return this year?

It sounds like an odd question until you realize that millions of returns are buried in an IRS backlog.

As of mid-December, the IRS had a backlog of 6.2 million unprocessed 1040 individual returns and 2.4 million unprocessed amended individual returns, Form 1040-X, according to a report by the National Taxpayer Advocate.

“While much of the processing delay is related to tax year 2020 paper returns, some taxpayers are still waiting for resolution of their electronically filed 2020 tax returns, amended returns, and correspondence replying to IRS notices,” according to the advocate’s report.

IRS: 2022 tax season set to begin 2 weeks early on Jan. 24

So do you need to wait? No.

The IRS says: “Taxpayers generally will not need to wait for their 2020 return to be fully processed to file their 2021 tax returns and can file when they are ready.”

The IRS also offered another tip to help with e-filing a 2021 tax return if you’re still waiting for a 2020 return to be processed.

“In order to validate and successfully submit an electronically filed tax return to the IRS, taxpayers need their Adjusted Gross Income, or AGI, from their most recent tax return,” the IRS said.

But remember, everyone else should enter their prior years AGI from last years return.

Also Check: H& r Block Early Access W2

Why You Might Want To File Even If You Didnt Have Taxable Income

All these rules apply when you are required to file a tax return, but there are a few good reasons why you might want to file even if you technically dont have to.

You may be eligible to claim the Recovery Rebate Tax Credit if you or one of your dependents were entitled to a stimulus check but never received it. Youre effectively letting the IRS keep that money unless you file a return to claim this as a tax credit.

The same applies to any other refundable tax credit you might be qualified to claim. You wont get that money unless you file a tax return to claim it. For example, if you did not receive advance monthly payments of the child tax credit, you may qualify for a lump-sum payment when you claim the child tax credit on your 2021 tax return when you file in 2022, even if you don’t normally file a tax return.

And if you had earned income that was less than the standard deduction and paid taxes through your paychecks, you may want to file to get some of that money back.

When Should I Receive My Tax Refund Here’s How To Track Its Status

If you’re on track to submit your 2021 tax return to the IRS, we’ll show you how to keep tabs on your tax refund.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.

The 2022 tax season kicked off this week, and once you submit your tax return to the IRS, it’ll be time to start tracking your refund. However, since the IRS is still facing challenges related to the pandemic, you’ll want to make sure to carefully review all the details on your tax return before submitting it to the agency .

The IRS recommends filing electronically and setting up direct deposit this year as it can help get your refund to you within 21 days, assuming there are no errors. “Filing a paper tax return this year means an extended refund delay,” IRS Commissioner Chuck Rettig said in a statement.

We’ll tell you how to track your refund online using the Where’s My Refund tool and how to check your IRS account. This story is updated frequently.

Read Also: Pastyeartax Com Review

When To Include Social Security In Gross Income

There are certain situations when seniors must include some of their Social Security benefits in gross income. If you are married but file a separate tax return and live with your spouse at any time during the year, then 85% your Social Security benefits are considered gross income which may require you to file a tax return.

In addition, a portion of your Social Security benefits are included in gross income, regardless of your filing status, in any year the sum of half your Social Security benefit plus all of your adjusted gross income, plus all of your tax-exempt interest and dividends, exceeds $25,000, or $32,000 if you are married filing jointly.

Although You Might Not Be Required To File A Tax Return It Might Be Wise To File One Today Anyway Here Are A Few Reasons Why

Filling out tax forms is a pain in the you-know-what. So why on earth would anyone file a tax return if they don’t have to? Well, actually, there’s one very important reason why you might get a big, fat check from the government.

People with income under a certain amount aren’t required to file a tax return because they won’t owe any tax. But if you qualify for certain tax credits or already paid some federal income tax, Uncle Sam might owe you a refund that you can only get by filing a return. Think about that for a minute!

If you want to know more, here are 9 reasons why you might want to file a tax return even if you don’t have to. Even though dealing with taxes can be a real drag, it’s probably worth it if you wind up with a much fatter wallet in the end.

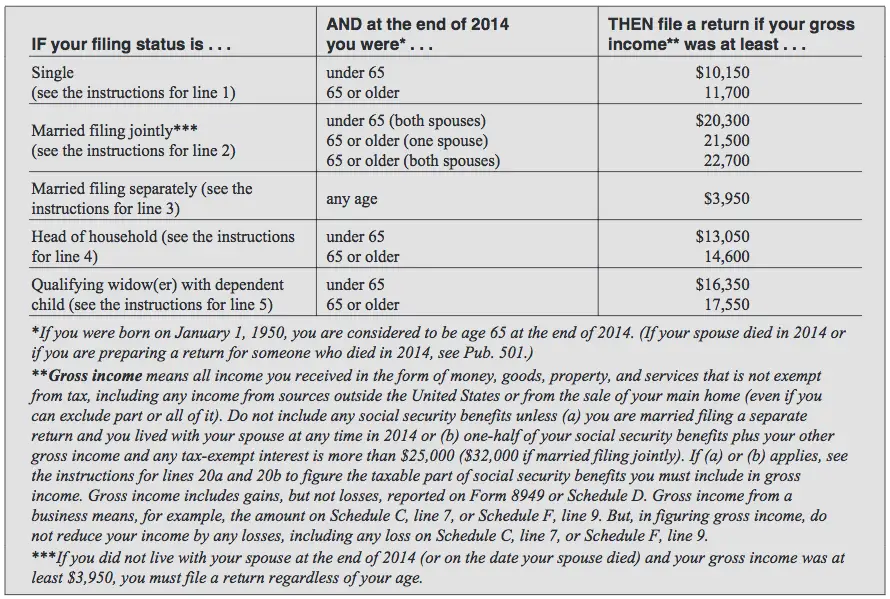

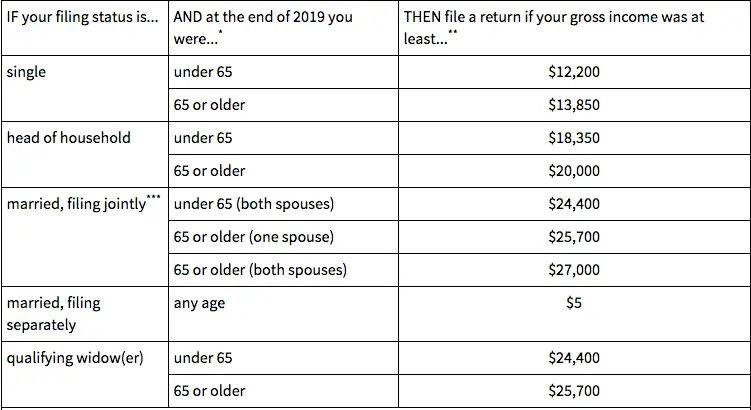

Federal Tax Return Filing Requirements :

|

Filing Status and Age at End of 2020 |

Income Required to File 2020 Return |

|

Single Under 65 |

Don’t Miss: 1040paytax.com Official Site

Charitable Donation Deductions Increased

On your 2020 tax return, a temporary provision of the CARES Act allowed for up to a $300 deduction per tax return for charitable giving, even if you don’t itemize your taxes. For your 2021 tax return, this benefit has expanded to up to $300 per person. This means if you’re married and filing jointly, you could be eligible for up to a $600 deduction for charitable donations.

You can search for eligible organizations with the Tax Exempt Organization Search tool on IRS.gov.

File A 2020 Tax Return If Youre Missing Stimulus Payments And Think Youre Eligible For More Money

I know many people have questions about tax law changes related to the American Rescue Plan Act of 2021. I urge you to start with IRS.gov Coronavirus Tax Relief to find the most updated information when its available. If youre looking for general information, the best place to start is IRS.gov. It will save you time because our employees wont be able to provide much more information if you call.

Economic Impact Payments, also known as stimulus payments, are different from most other tax benefits. Thats because people can get them even if they have little or no income, and even if they dont usually file a tax return. This is true as long as you are not being claimed as a dependent by someone else and you have a Social Security number. When it comes to missing stimulus payments, its critical that you file a 2020 tax return even if you dont usually file to provide information the IRS needs to send the payments for you, your eligible spouse and eligible dependents.For anyone who missed out on the first two rounds of payments, its not too late. If you didn’t get a first and second Economic Impact Payment or got less than the full amounts, you can get that missing money if youre eligible for it, but you need to act. All first and second Economic Impact Payments have been sent out by IRS. If your 2019 tax return has not been processed yet, the IRS wont send you the first or second payment when it is.

Read Also: Doordash Independent Contractor Taxes

Why Would My Tax Refund Be Delayed

Here’s a list of reasons your income tax refund might be delayed:

- Your tax return has errors.

- It’s incomplete.

- Your refund is suspected of identity theft or fraud.

- You filed for the earned income tax credit or additional child tax credit.

- Your return needs further review.

- Your return includes Form 8379 , injured spouse allocation — this could take up to 14 weeks to process.

If the delay is due to a necessary tax correction made to a recovery rebate credit, earned income tax or additional child tax credit claimed on your return, the IRS will send you an explanation. If there’s a problem that needs to be fixed, the IRS will first try to proceed without contacting you. However, if it needs any more information, it will write you a letter.

Protect Against Future Audits

The last thing you want to happen to you is an audit. In terms of auditing old tax returns, the IRS operates under a statute of limitations. When you make sure that you accurately report your information, they can only go back three years in general. But for the current year, it all starts only when you file the tax return. Not filing the tax return puts you at risk of having an audit performed by the IRS. So, the IRS says that in situations when you dont want to file, its essential to maintain all important financial records. Otherwise, you risk dealing with serious problems, and it can get unpleasant instantly.

Recommended Reading: Irs Business Look Up

How To File Taxes With No Income

The idea of not having to file your annual income taxes sounds like a daydream for most people, and if you made little or no income during the tax year, it’s very possible to make that dream come true. But can you file income taxes with no income? And perhaps even more pressingly why would you want to? As it turns out, not only can you, but the relatively minimal effort required to do so might just pay off in the end.

How Did Your Financial Life Change In 2021

Karen Orosco, president, global consumer tax and service delivery at H& R Block, said those who joined the gig economy or started a business are going to need to figure out how to handle their taxes.

Other big events could also influence your 2021 tax return: Did you have a baby in 2021? You could qualify for the child tax credit based on income. Did you buy a new home and now need to deduct mortgage interest and property taxes? Did you sell stock or cryptocurrency? All can those changes can trigger important tax situations and require more research.

Orosco said even do-it-yourselfers might need extra professional help on key issues, and H& R Block is marketing such services to those who want extra help.

You May Like: Doordash 1099-nec Schedule C

Reasons For Filing A Return With No Income

There are some reasons you should file a return even if you have little or no income. One is that you can earn refundable tax credits when you dont work, such as earned income tax credits or additional child tax credits.

Another situation is if you worked for a part of the year and your employer withheld taxes from your pay. Since your income was very low, by filing a return, you can get those taxes back. Moreover, if you’re attending college or a higher education program and earn very little to no income, you can take advantage of the American opportunity credit.

If you expect a tax refund from #IRS this year, remember to check the Wheres My Refund?” tool for status updates.

Individuals Required To File A North Carolina Individual Income Tax Return

The following individuals are required to file a 2020 North Carolina individual income tax return:

- Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020 for the individual’s filing status.

- Every part-year resident who received income while a resident of North Carolina or who received income while a nonresident that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020.

- Every nonresident who received income for the taxable year from North Carolina sources that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income from all sources both inside and outside of North Carolina for the taxble year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020. For nonresident business and employees engaged in disaster relief work at the request of a critical infrastructure company, refer to the Personal Tax Division Bulletins.

You May Like: 1099 Nec Doordash

Income Tax Brackets Were Raised

Income tax brackets were also raised to account for inflation. Your income bracket refers to how much tax you owe based on your adjusted gross income, which is the money you make before taxes are taken out, excluding itemized exemptions and tax deductions.

While the changes were slight, if you were at the bottom of a higher tax bracket in 2020, you may have bumped down to a lower rate for your 2021 tax return.

Filing Requirements Chart For Tax Year 2020

| Filing Status |

|---|

G.S. 105-153.8 requires a married couple to file a joint State income tax return if:

Generally, all other individuals may file separate returns.

On joint returns, both spouses are jointly and severally liable for the tax due. A spouse will be allowed relief from a joint State income tax liability if the spouse qualifies for innocent spouse relief of the joint federal tax liability under Code section 6105.

A married couple who files a joint federal income tax return may file a joint State return even if one spouse is a nonresident and had no North Carolina income. However, the spouse required to file a North Carolina return has the option of filing the State return as married filing separately. Once a married couple files a joint return, they cannot choose to file separate returns for that year after the due date of the return. If an individual chooses to file a separate North Carolina return, the individual must complete either a federal return as married filing separately, reporting only that individual’s income and deductions, or a schedule showing the computation of that individual’s separate income and deductions and attach it to the North Carolina return. In addition, a copy of the complete joint federal return must be included unless the federal return reflects a North Carolina address.

Don’t Miss: What Home Improvement Expenses Are Tax Deductible