Federal Top Income Tax Rate

| Year | |

|---|---|

| 2010 | 35.00% |

When it comes to tax withholding, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. While those hired before Jan. 1, 2020, aren’t required to complete the form, you may want to do so if you’re changing jobs or adjusting your withholdings.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 2021 filing season based on the Trump Tax Plan.

Read Also: How Much Does H& r Block Charge To Do Taxes

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

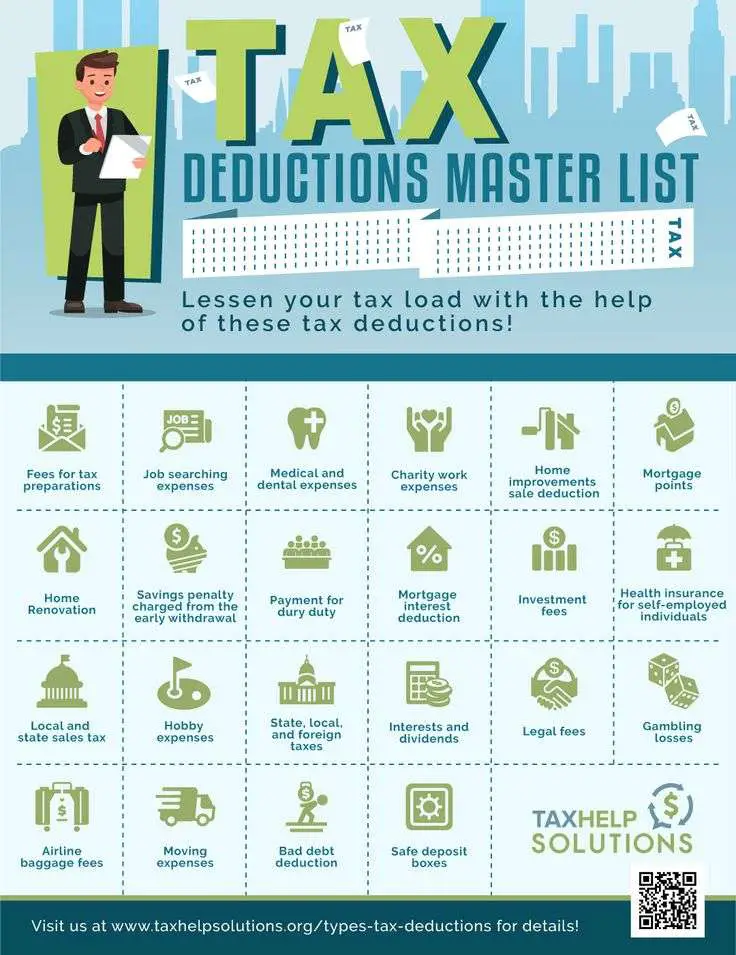

Eight : Take Other Deductions

You’re not quite done yet with deductions. Here are some other possible deductions from employee pay you might need to calculate:

- Deductions for employee contributions to health plan coverage

- Deductions for 401 or other retirement plan contributions

- Deductions for contributions to internal company funds or charitable donations.

Remember, all deductions start with and are based on gross pay.

Withhold State Payroll Taxes:

As you are done with Federal Payroll Taxes, now it’s time to discuss State Payroll Taxes. The very first State Payroll Tax is State Income Tax charged by Minnesota State on employee’s paycheck. Another one is State Unemployment Insurance tax that is to be paid by the employers only.

Minnesota State Income Tax

Like Federal Income tax, Employers are required to withhold State Income tax from the employee’s paycheck, at the rates ranging from 5.35% to 9.85%, distributed in 4 tax brackets depending on Income Level and filing status.

| $214,980+ | 9.85% |

This tax should be charged according to the details, including the number of allowances to claim, a number of dependents, additional state withholding amounts, etc. provided by the employee in Form W-4MN. Besides Form W-4, this form must also be updated regularly by the employee, especially on significant events like marriage, child’s birth, or divorce.

State Unemployment Insurance Tax

The State Unemployment Insurance Tax is an employer-funded program that provides temporary income to unemployed workers who have lost their job without fault of their own.

The Minnesota employers are required to pay State Unemployment Insurance Tax, at the rates ranging from 0.2% to 9.1% , on maximum taxable earnings of $35000 for each employee. However, new employers are to be charged according to their industry average. You can view new employer rates here.

Don’t Miss: How To Buy Tax Lien Properties In California

Use Td1 Forms To Claim Basic Tax Credits Upfront

Every year, the residency office will provide you with the federal and provincial/territorial TD1 Personal Tax Credits Returns. These forms are used to determine how much tax should be deducted from your employment income. Your employer keeps them on file you do not file them with the government.

See current versions of federal and provincial TD1 forms on the Canada Revenue Agency website if youre a Quebec resident, the provincial form is at the Revenu Québec website.

The forms are simple, and its easy to see which tax credits you could ask for. Every taxpayer gets a federal and provincial personal amount: for 2021, the federal amount, for example, is pre-filled as $13,808. If you dont add any further claims, this is all that will be deducted.

Aside from the basic personal amount, the forms allow you to claim other basic credits that could lower your taxes deducted. These include credits for:

- tuition

- eligible dependants

- a disability

If you dont claim all the credits youre entitled to, you may have more tax deducted from your pay than necessary. But youll get it back when you file your tax return. Its up to you, and depends on your situation.

Employees Who Are Suspended Or Resigns Due To A Labor Dispute

Minnesota does not have a law specifically addressing the payment of wages to an employee who leaves employment due to a labor dispute, however, to ensure compliance with known laws, an employer should pay employee all wages due by the next regularly scheduled payday. If the next regularly scheduled payday is less than five days after the employee quits, the employer may pay the employee on the second regularly schedule payday after the employee quits or within 20 days, whichever is sooner. MN Statute 181.14

Employees engaged in transitory labor

Don’t Miss: How To Appeal Property Taxes Cook County

How Are Pensions Taxed

Pensions are fully taxable at your ordinary tax rate if you didn’t contribute anything to the pension. If you contributed after-tax dollars to your pension, then your pension payments are partially taxable. If the payments start before age 59 1/2, you may also be subject to a 10% early distribution penalty.

Exceptions For State And Local Taxes

Most states and some local governments also levy income taxes. Each state or local government has its own formula for figuring its income tax. To find out how these taxes on your paycheck are calculated, contact your state and/or local government department of revenue or taxation. You can also use your state’s calculator to determine exactly how much you’re paying each year in taxes. If you live in California, for instance, you can use the California tax calculator to determine exactly how much you’ll pay in taxes each year, which will help you find out if your withholdings are in line with that.

Also Check: Do I Need W2 To File Taxes

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

Minnesota State Tax Resources

Minnesota SUI Rate > > SurePayroll, Inc. and its subsidiaries assume no liability and make no warranties on or for the information contained on these state payroll pages. The information presented is intended for reference only and is neither tax nor legal advice. Consult a professional tax, legal or other advisor to verify this information and determine if and/or how it may apply to your particular situation.This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.*Rates vary by industry.

You May Like: Efstatus.taxact.com.

Add The Employees Pay Information

You should see fields that say pay type, pay rate, hours worked, pay date,and pay period. Start with pay type and select hourly or salary from the dropdown menu.

If the employee is hourly, input their hourly wage under pay rate, and fill in the number of hours they worked that pay period. If the employee worked more than 40 hours, and thus accrued overtime, record 40 here and save the rest for additional pay.

If the employee is salaried, both the pay rate and hours worked fields will disappear. Instead, youll need to know how much the employee makes each pay period. Youll put that into the field labeled amount.

Then select the pay date and the employees pay frequencyor, rather, if you pay them weekly or every two weeks.

How Do I Create A Paycheck For An Employee

Employers typically have two basic options for creating paychecks:

Don’t Miss: Www.myillinoistax

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2021 is $142,800 . Any income you earn above $142,800 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

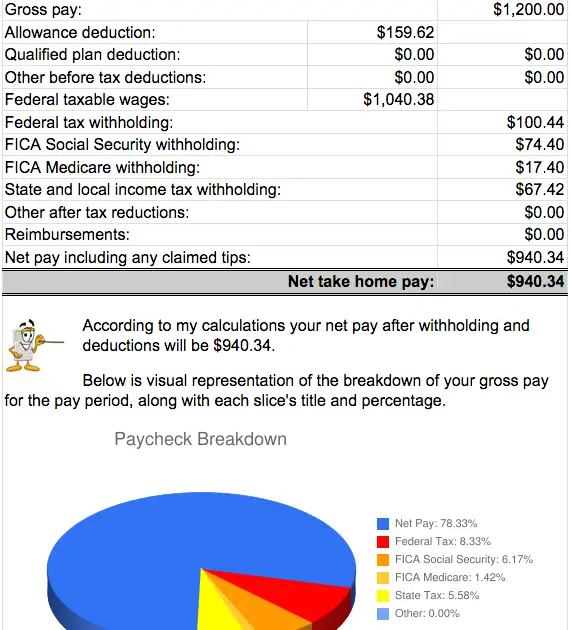

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

Read Also: Do You Have To Report Plasma Donations On Taxes

The Amount Up To A Is Taxed At X% Then The Amount Several Things Can Make Make The Federal Taxes For The Early Paychecks Larger Than Normal

Federal income tax and federal insurance contributions act . $232 after tax dp insurance premium: Those amounts that the government allows you to deduct from your gross income are known as a tax deduction is simply a legal way to lower the amount of your taxable income, which translates into. Can i recover a withheld paycheck from an employer in minnesota? Most tax deductions are expenses that you pay either to generate income or provide a social. Learn how the average american can reduce taxable income and how much do americans pay in taxes? Paycheck calculators can also help determine if you are deducting the correct amount of money from your check for taxes: Can i deduct business expenses paid with paycheck protection program loans? The social security tax is 6.2 percent of your total pay until if you live in california, for instance, you can use the california tax calculator to determine exactly how much you’ll pay in taxes each year, which will help. So, how much should we withhold in our paychecks? How to calculate withholding and deductions from employee paychecks. The average amount taken out is 15% or more for deductions including social security and income tax. Having enough tax withheld or making quarterly estimated tax payments during the year can help you avoid problems at tax time.

Restrictions On Job Termination Due To Wage Garnishments

Complying with wage garnishment orders can be a hassle for your employer some might prefer to terminate your employment rather than comply. State and federal law provide some protection for you in this situation.

According to federal law, your employer can’t discharge you if you have one wage garnishment. . But federal law won’t protect you if you have more than one wage garnishment order. Some states offer more protection for debtors. Minnesota law states that your employer can’t fire you because of an earnings garnishment. .

Read Also: Where Can I File An Amended Tax Return For Free

Calculating Withholding More Accurately

One way to adjust your withholding is to prepare a projected tax return for the year. Use the same tax forms you used the previous year, but substitute the current tax rates and income brackets. Calculate your income and deductions based on what you expect for this year, and use the current tax rates to determine your projected tax.

Then, use the withholding calculator on the IRS website to see the suggested withholding for your personal situation. The number of dependents you support is an important component of your analysis, as is the number of streams of income.

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

You May Like: How To Buy Tax Lien Properties In California

Federal And Minnesota Payroll Laws:

Taxes And Income Considerations

If you’re still filing 2017 taxes, it’s important to pay attention to the limits specific to that year. The income threshold for 2017 was $127,200. One withholding allowance was $4,050 annually or $77.88 per week in 2017. If you claimed two allowances and youre paid weekly, you would subtract $155.77 from your total weekly pay to find your taxable income for figuring federal income tax. Also in 2017, the first $44 per week was not taxed. Federal income tax was 10 percent of your weekly taxable income from $44 to $224. From $224 to $774 per week, the percentage was 15 percent.

References

Recommended Reading: How To Get A Pin To File Taxes

Adding Square Payroll As Your Unemployment Insurance Tax Agent

In order to file and pay your Minnesota unemployment insurance taxes, Square Payroll needs to be authorized as your agent.

Please follow the instructions on the Unemployment Insurance Minnesota website to authorize us.

The whole process can be completed online and you will need the following information:

-

Square Payrolls Minnesota UI Agent ID: AG017550

-

Roles to assign to

-

Account Maintenance Update and Submit

-

Tax Payment Update and Submit

-

Wage Detail Update and Submit

Please note that you will need to unauthorize any previous agents/payroll providers who had the above roles.