Confirm Your Check Cleared

If you owed the IRS taxes and paid by check, contact your financial institution to make sure it cleared. If it didn’t, and it’s been at least two weeks since you sent the payment, call the IRS at 1-800-829-1040 to ask if the amount has been credited to your account. You also can use this number to confirm that your return has been processed. If you filed an amended return, go to IRS.gov and click the “Where’s My Amended Return” button. Note that it can take up to 16 weeks for amended returns to be processed, and three weeks for it to show up in the system.

How To Reach A Taxpayer Advocate

- File Form 911, Request for Taxpayer Advocate Service Assistance, with the Taxpayer Advocate Service or request that an IRS employee complete a Form 911 on your behalf .

800-304-3107866-297-0517

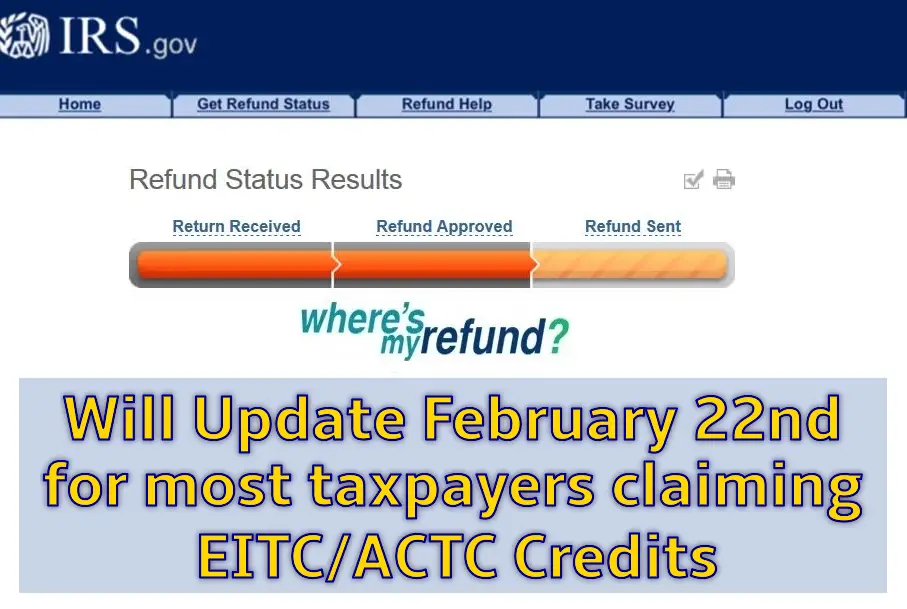

Wheres My Refund? will give you personalized refund informationThe IRS issues more than 9 out of 10 refunds in less than 21 days. Wheres My Refund? has the most up to date information available about your refund. The tool is updated once a day so you dont need to check more often. IRS representatives can research the status of your refund only if youve already checked Wheres My Refund? and its been 21 days or more since you filed electronically, more than six weeks since you mailed your paper return, or if Wheres My Refund? directs you to contact us.

Suspicious e-Mails, Phishing, and Identity TheftThe IRS does not send out unsolicited e-mails asking for personal information. An electronic mailbox has been established for you to report suspicious e-mails claiming to have been sent by the IRS.

Contact Your Local IRS OfficeIRS Taxpayer Assistance Centers are available for when you believe your issue is best handled face-to-face. Before you visit, check hours and services offered. Return preparation services are no longer available at your local IRS office. Use IRS Free File, free brand-name software that will figure your taxes for you. Or visit the nearest volunteer site for free help preparing and e-filing your tax return.

How To Speak Directly To An Irs Agent

The IRS indicates that “our phone and walk-in representatives can only research the status of your refund 21 days after you filed electronically 6 weeks after you mailed your paper return or if ‘Wheres My Refund?’ directs you to contact us.” Here’s how to get through to an agent.

- Select your language, pressing 1 for English or 2 for Spanish.

- Press 2 for questions about your personal income taxes.

- Press 1 for questions about a form already filed or a payment.

- Press 3 for all other questions.

- Press 2 for all other questions.

- Make no entry when queried for the SSN.

- Press 2 for personal or individual tax questions.

- Press 4 for all other questions.

You May Like: How Do You Pay Owed Taxes

Contacting The Irs By Phone

What Is An Irs Treas 310 Transaction

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see TAX REF in the description field for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

You May Like: Which State Has The Lowest Tax Rate

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of May 17, 2021.

Best Time To Call Irs Customer Support

IRS customer support, which can be reached at 1-800-829-0922, is available Monday through Friday from 7AM to 7PM.

According to the IRS website, wait times average fifteen minutes in the months preceding the filing deadline , and average twenty-seven minutes in the months following the filing deadline . Based on our experience the best times in general are afternoons and Thursdays & Fridays.

Also Check: How Do You Add Sales Tax

How Can I Track My Irs Refund

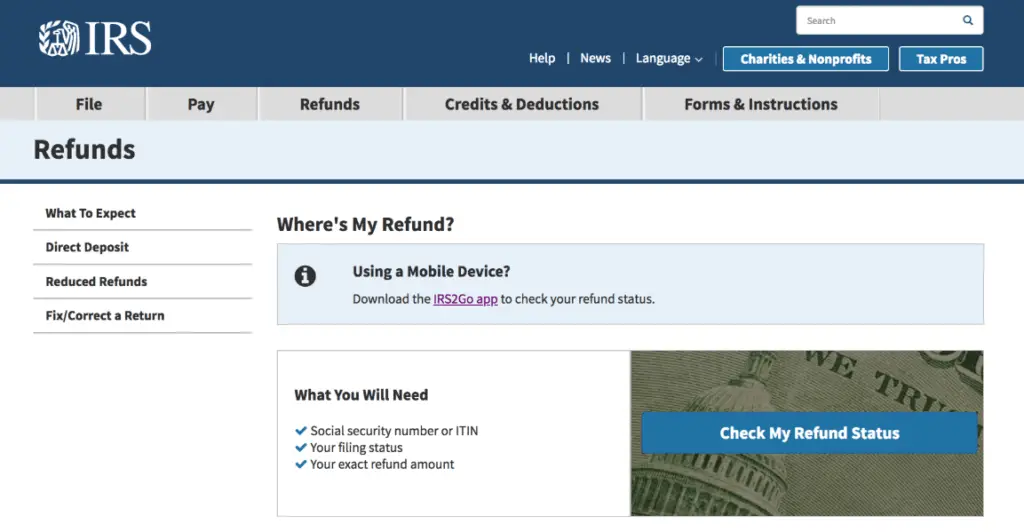

If you are still expecting a tax refund, you can check the status of your 2020 income tax refund by using the IRS Wheres My Refund tool. Taxpayers will need to input personal information, including their Social Security number or Individual Taxpayer Identification Number, as well as the filing status and the expected refund amount.

Taxpayers can also check their refund status on the agencys mobile app IRS2Go. The app will also allow you to make tax payments and get free tax help .

Those getting tax refunds via direct deposit could get an IRS TREAS 310 notification on their accounts, which identifies tax refunds processed through electronic payments. Note that IRS TREAS 449, indicates that your refund has been reduced to repay tax debt.

And for taxpayers expecting a refund for 2020 unemployment compensation the IRS said its correcting tax returns through the summer.

The agency has issued more than $10 billion in unemployment compensation refunds since May. The average refund adjustment is $1,686, and taxpayers may need to file an amended return if they failed to submit required forms or schedules.

Contact Your Local Irs Office

While most local IRS taxpayer assistance centers were closed during the height of the pandemic, theyve started to reopen in many areas. These offices can help you with account problems, allow you to make payments or adjustments, and look into issues with your stimulus payments.

Search for your nearest IRS office and use the phone number specified to make an appointment.

If you live very close to an office, Bell says you can also walk in to request an appointment for the future. If you take this route, he recommends taking your documents with you, just in case theres an immediate opening.

IRS taxpayer assistance centers are open Monday through Friday, and some are closed for a brief period during the workday for lunch.

You May Like: Where Is Your Agi On Your Tax Return

How Do I Use The Where’s My Refund Tool To Check The Status Of My Tax Refund

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund through the IRS2Go mobile app.

What A ‘math Error’ Notice From The Irs Could Mean

Millions of Americans have received confusing “math-error notices” from the IRS this year — letters saying they owe more taxes. Once they get the notice, they have a 60-day window to respond before it goes to the agency’s collection unit.

From the start of the year to August, the IRS sent more than 11 million of these notices. According to the Taxpayer Advocate Service, “Many math error notices are vague and do not adequately explain the urgency the situation demands.” Additionally, sometimes the notices “don’t even specify the exact error that was corrected, but rather provide a series of possible errors that may have been addressed by the IRS.”

The majority of the errors this year are related to stimulus payments, according to the Wall Street Journal. They could also be related to a tax adjustment for a variety of issues detected by the IRS during processing. They can result in tax due, or a change in the amount of the refund — either more or less. If you disagree with the amount, you can try contacting the IRS to review your account with a representative.

Don’t Miss: How Much Should I Withhold For Taxes 1099

Contact The Taxpayer Advocate Service

If youve exhausted the first three methods, it may be time to exercise your last resort: The Taxpayer Advocate Service . Its an independent office within the IRS that works to protect taxpayers, and its free to use. Since 2011, the TAS has handled more than 2 million taxpayer cases.

Every state has at least one TAS office. If you havent been able to reach anyone at the IRS or havent received a response in the time frame you were promised, the TAS may be able to help you if your problem is causing a financial struggle while you wait for a resolution, you may also qualify for help.

Us Department Of The Treasury

- Treasury Launches Effort to Study Impact of Climate Change on Households and CommunitiesOctober 12, 2021Guidance and Press Schedule for U.S. Secretary of the Treasury Janet L. Yellen and Deputy Secretary of the Treasury Wally AdeyemoOctober 8, 2021Joint Statement on the Eighth U.S.-India Economic and Financial PartnershipOctober 14, 2021

-

For individuals: IRS toll-free assistance line at 1-800-829-1040.

-

For businesses: IRS toll-free assistance line at 1-800-829-4933.

Don’t Miss: Where To File Quarterly Taxes

Where To Mail Your Personal Tax Return

The IRS has more addresses than you might imagine because its processing centers are located all around the country. The address you’ll use depends on what you’re mailing and where you live. Go to the Where to File page on the IRS website if you’re sending a personal tax return, an amended return, or if you’re asking for an extension of time to file. The page includes links for every state.

Note that the mailing address is usually different if you’re submitting a payment with your return. Youll typically mail returns withpayments to the IRS, and returns without payments to the Department of the Treasury.

IRS addresses do change periodically, so dont automaticallysend your latest tax return to the same place you sent it in previous years.

Note that the IRS uses ZIP codes to help sort incoming mail. To make sure your return gets to the right place as quickly as possible, include the last four digits after the five-digit zip code. For example, if delivering a Form 1040 in 2021 with payment from California, the correct address is:

Internal Revenue Service45280-2501

When Preparing To Contact The Irs Be Sure To Have The Following Information Available

When Calling About Your Own Account

- Social Security cards and birth dates for those who were on the return you are calling about

- An Individual Taxpayer Identification Number letter if you don’t have a Social Security number

- Filing status Single, Head of Household, Married Filing Joint or Married Filing Separate

- Your prior-year tax return

- A copy of the tax return you’re calling about

- Any letters or notices sent to you by the IRS

When Calling About Someone Else’s Account

- Verbal or written authorization to discuss the account

- The ability to verify the taxpayer’s name, SSN/ITIN, tax period, form

- IRS PTIN or PIN if you are a third-party designee

- A current, completed, and signed Form 8821, Tax Information Authorization or a completed and signed Form 2848, Power of Attorney and Declaration of Representative

What Does the IRS Help With?

The IRS can assist with concerns such as

Filing requirements/ status/ dependents/ exemptions

|

Department of the Treasury Internal Revenue Service Fresno, CA 93888-0045 |

Recommended Reading: Who Needs To File Taxes

You Have Outstanding Debt

For certain types of debts, the IRS has the authority to garnish your tax refund.

Common reasons that the IRS will garnish your refund include

- You owe money for back taxes

- You defaulted on a federal student loan

- You owe money for child support

- You filed a joint return and your spouse has outstanding debt

In the event that the IRS garnishes your refund, you will receive a notice explaining why it did so. If you dont think you owed that debt, you will need to dispute it with the agency to whom the money was paid.

Need Help Try Contacting Your Local Irs Office

If you cant reach a real person over the phone, you can contact your local IRS office. The Taxpayer Assistance Center operates by appointment only, where you can get help directly from an agent.

The IRS also provides a great service called the Taxpayer Advocate. to find a Taxpayer Advocate in your area.

You May Like: Do Businesses Get Tax Refunds

How Long Does It Take To Receive A Tax Refund

Processing time for refund returns depends on the method used for filing. If you e-file and opt for direct deposit and have not received your refund within three weeks after filing your return , you can check your refund on the IRS website or by calling the Refund Hotline at 829-1954. Be sure to have a copy of your current tax return available because you will need to know your Social Security number shown on your return, the filing status and the exact whole dollar amount of your refund. If you have requested direct deposit, the refund should take one week less time to be issued as opposed to getting a paper check.

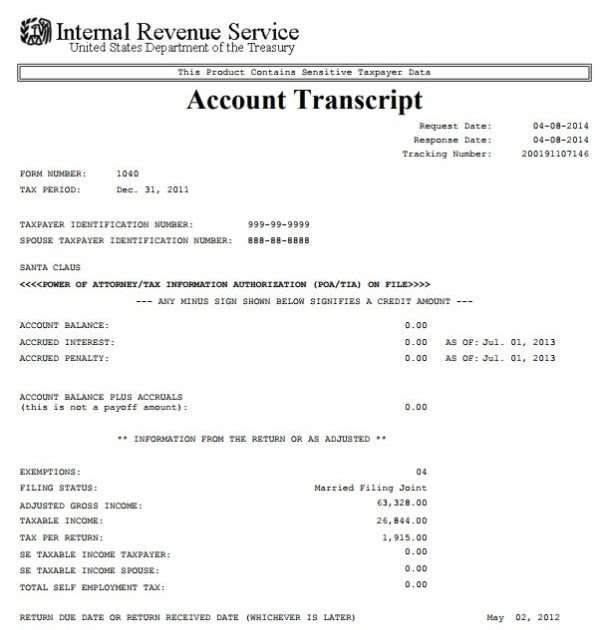

Copies Of Actual Tax Returns

Certified tax transcripts are acceptable to many, if not most, financial institutions as proof of your filing. However, on some occasions, a third party may request a copy of your actual tax return rather than a computer printout detailing the information you reported. Or, you may simply prefer to have such a photocopy for your records. In either case, the IRS can provide a copy to you for the past few years of filings.

Tip

The IRS makes copies of tax returns available for anywhere from the past three to the past 10 years, depending on the type of information requested. In general, the tax account transcript covers the longest time period.

You May Like: Do I Have To Pay Taxes On My Unemployment

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

How Do I Contact The Irs

You can contact the IRS by phone, mail, or walking in/making an appointment at a local Taxpayer Assistance Center. The IRS typically does not email taxpayers.

Most taxpayers contact the IRS by phone. The most common number to contact the IRS for individual taxpayers is 829-1040. However, the IRS has specific hotlines dedicated to taxpayer issues. For example, if a taxpayer needs to contact IRS Collection, the phone numbers are 829-3903 for individuals with small business/business entities and 829-7650 for wage earners.

It is sometimes very difficult to connect with the IRS by phone. In some cases, taxpayers can wait hours before talking to an IRS representative. Taxpayers may want to consider engaging and authorizing a Tax Pro who can use a special hotline to get through to the IRS.

Recommended Reading: What Is Low Income Tax Credit