When Are Taxes Due

For most years, the deadline to submit your tax return and pay your tax bill is April 15. But for your 2020 taxes, it was pushed back about a month to May 17, 2021 due to the Coronavirus pandemic. Theres currently no such plan in place for the 2021 tax year, for which youll file in early 2022.

If you still cant meet the tax filing deadline for the upcoming year, you can file for an extension. But the sooner you file, the sooner you can receive your tax refund.

Got More Tax Refund Questions We Have Answers

One way is to qualify for more tax deductions and tax credits. They can be huge money-savers if you know what they are, how they work and how to pursue them. Here’s a list of 20 popular ones to get you started.

But beware of big tax refunds. They’re a direct result of overpaying your taxes all year, and that often happens because you’re having too much tax withheld from your paychecks. Get that money in your hands now by adjusting your Form W-4 at work. Here’s how to do it.

Yes. Simply provide your direct deposit account information on your Form 1040 or 1040-SR when you file. If you file IRS Form 8888 with your tax return, you can even tell the IRS to split the money up and deposit it into as many as three different investment accounts. Here’s how to do it.

Yes. Simply provide your direct deposit account information on your Form 1040 or 1040-SR when you file. If you file IRS Form 8888 with your tax return, you can even tell the IRS to split the money up and deposit it into as many as three different investment accounts. Here’s how to do it. Note that you’ll need to have an IRA account first. Here’s how to do that, too.

If you’re behind on your taxes, the IRS will withhold what you owe from your federal tax refund. You’ll get a letter from the IRS explaining what it adjusted.

You can fix it by filing an amended tax return using IRS Form 1040X. Here’s how to do it.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Also Check: Protest Property Taxes In Harris County

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

Tax Credits Deductions And Getting Your Biggest Refund

One of the first elements to getting your biggest refund is making sure you dont miss any tax credits or deductions you deserve. If your circumstances have changed from last year, there may be a number of new credits or tax deductions available to you. Because you may not know that youre eligible, a Tax Pro can help you make sure you dont leave any money on the table. Visit our Tax Refund Calculator to get your estimate.

You May Like: How Much To Save For Taxes Doordash

Tax Refund Schedule For Extensions And Amended Tax Returns

The refund schedule should be the same if you filed for a tax extension, however, there is no official schedule for tax refunds for amended tax returns. The above list only includes dates for e-filing an original tax return. Amended tax returns are processed manually and often take 8-12 weeks to process. If you do not receive an amended tax return refund within 8 weeks after you file it, then you should contact the IRS to check on the status.

When Will I Get My Irs Tax Refund

The IRS issues most refunds from e-filed returns in about 21 days, although some returns take more time to review. For example, the IRS is taking more than 21 days to issue refunds for tax returns with the Recovery Rebate Credit, Earned Income Tax Credit and Additional Child Tax Credit.

To find out where your refund is, first check your e-file status. If it’s been accepted, you can begin to track your refund at the IRS Where’s My Refund? site. You’ll need your Social Security number or ITIN, filing status, and the exact amount of your refund to check your status.

Paper-filers should wait at least 4 weeks after you mail your return before looking up your refund at Where’s My Refund?.

If it’s been more than 21 days since your e-filed 2021 return was accepted, you can to check on your refund status.

If you’re still waiting on your refund from your 2020 tax return:

- Dont file a second tax return or contact the IRS about the status of your return

- If you filed electronically and received an acknowledgement, you don’t need to do anything other than wait and promptly respond to any requests from the IRS

- If you filed on paper and Wheres my refund? says your return has been received or is being processed or reviewed, you don’t need to do anything other than wait and promptly respond to any requests from the IRS

Was this helpful?

Don’t Miss: License To Do Taxes

What To Do Once Your Refund Arrives

For many people, their IRS tax refund is the biggest check they receive all year, the IRS says. In anticipation of your windfall, its wise to have a plan for how youre going to use your windfall. Deciding how to spend, save or invest the money in advance can help stop the shopping impulse from getting the best of you.

Your refund is yours to use how you see fit and can be used to help pay for day-to-day expenses or invested for long-term financial stability.

If youre expecting a refund, put it to good use. Looking for inspiration? Bankrate offers five smart ways to invest your tax refund.

Can I Contact The Irs For Additional Help With My Taxes

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to contact the IRS. You can call 800-829-1040 or 800-829-8374 during regular business hours.

Also Check: When Does Doordash Send 1099

Tax Refund Status Faqs

The IRS usually sends out refunds within three weeks, but sometimes it can take a bit longer. For example, the IRS may have a question about your return. Here are other common reasons for a delayed tax refund and what you can do.

At H& R Block, you can always count on us to help you get your max refund year after year. You can increase your paycheck withholdings to get a bigger refund at tax time. Our W-4 calculator can help.

The IRS usually sends out most refunds within three weeks, but sometimes it can take a bit longer if the return needs additional review.

The IRS’ refund tracker updates once every 24 hours, typically overnight. That means you don’t need to check your status more than once a day.

Your status messages might include refund received, refund approved, and refund sent. Find out what these e-file status messages mean and what to expect next.

Having your refund direct deposited on your H& R Block Emerald Prepaid Mastercard® Go to disclaimer for more details110 allows you to access the money quicker than by mail. H& R Block’s bank will add your money to your card as soon as the IRS approves your refund.

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

One More Thing To Know About Your Tax Refund

It’s actually something you kind of want to avoid. It may seem great to get a big check from the government, but all a tax refund tells you is that you’ve been overpaying your taxes all year and needlessly living on less of your paycheck the whole time.

For example, if you got a $3,000 tax refund, you’ve been giving up $250 a month all year. Could having an extra $250 every month have helped with the bills? If you want to get that money now rather than later, you can adjust your withholdings by giving your employer a new IRS Form W-4 .

Don’t Miss: Do You Have To Do Taxes For Doordash

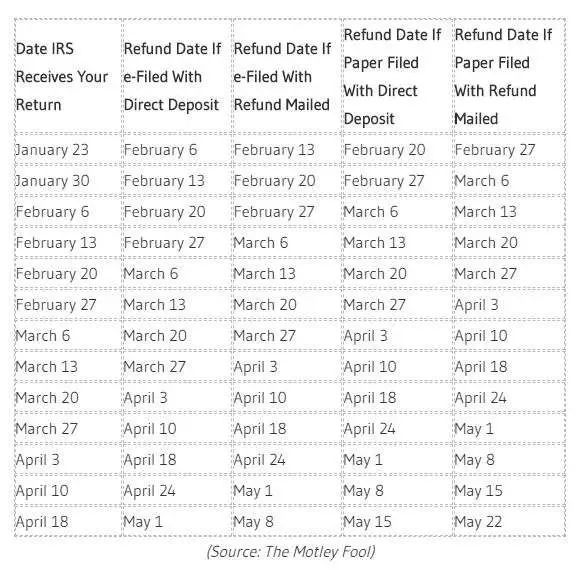

Estimated Irs Refund Tax Schedule For 2020 Tax Returns

In prior years, the IRS issued its refund tax schedule to provide a timeline when you can expect to receive your tax refund. While the IRS no longer publishes a refund tax schedule, we put together an estimate when you might expect to receive your tax refund based on previous years.

|

Date IRS Accepts Your Return |

Expected Direct Deposit Refund Date |

Expected Mailed Check Refund Date |

Are There Any Expected Tax Refund Delays

Yes, tax refund delays are common. The IRS is required by federal law to withhold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax Credit until at least Feb. 15, 2020. Keep in mind it can still take a week to receive your refund after the IRS releases it. So some people who file early may experience delays while awaiting their refund. Refunds should be processed normally after this date.

Note: The IRS anticipates a slower tax season for the 2020 tax year due to the backlog of tax returns that were delayed due to the pandemic. There may also be some complications for those who did not initially qualify for the the 2020 economic stimulus payment, but may qualify for the payment based on a change of income in 2020.

The IRS recommends filing your tax return electronically for faster processing and tax refund payments.

Also note that new identity theft protections and anti-fraud measures may hold up some refunds, as some federal tax returns may be held for further review.

Also Check: Grieved Taxes

Be Aware Of Changes Due To Covid

Last year’s broad set of tax changes not only affected individuals and their families, but could also affect the tax return they file this year. A new IRS fact sheet explains what taxpayers need to know to file a complete and accurate tax return.

The IRS recognizes that this year’s filing may be complex for some taxpayers and it’s important to understand how to claim credits and deductions, get a timely refund, and meet all tax responsibilities.

How Long Will My Tax Refund Take

The IRS sends over 9 out of 10 refunds to taxpayers in less than three weeks.

Unfortunately, a 21-day delivery of your tax refund isnt guaranteed. There are a number of factors including the choices you make when you file that could impact how long it takes for you to receive your tax refund.

You get to choose how you want to receive any refund the IRS owes you. Here are your options:

- Direct deposit into your bank account .

- Paper check sent through the mail.

- Debit card holding the value of the refund.

- Purchase up to $5,000 in U.S. Savings Bonds.

- Split your refund among up to three financial accounts in your name, including a traditional IRA, Roth IRA or SEP-IRA.

The delivery option you choose for your tax refund will affect how quickly you receive your funds. According to the IRS, the fastest way to receive your refund is to combine the direct deposit method with an electronically filed tax return.

You May Like: Is Plasma Donation Taxable

Irs Refund Schedule For Direct Deposits And Check Refunds

The following tax refund table is based on previous refund tables released by the IRS to help taxpayers know when they should receive their tax refund. The IRS moved to the Modernized E-file System in 2013 . The IRS only issued refunds once per week under the old system. They now issue refunds every business day, Monday through Friday .

Due to changes in the IRS auditing system, they no longer release a full schedule as they did in previous years. The following chart is based on IRS statements, published guidelines, and estimates from past years. This IRS refund schedule should only be used as a rough guideline.

What Information Is Available

You can start checking on the status of your refund within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Wheres My Refund? will give you a personalized refund date after we process your return and approve your refund.

The tracker displays progress through three stages:

To use Wheres My Refund, you need to provide your Social Security number, filing status and the exact whole dollar amount of your refund.

Read Also: Buying Tax Liens California

Will Ordering A Transcript Help Me Find Out When Ill Get My Refund

A tax transcript will not help you find out when youll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation.

States Also Offer Earned Income Break

In addition to the federal credits, most states have implemented their own Earned Income Tax Credit. This tax season, residents of 28 states and the District of Columbia can get an additional usually smaller credit against their state taxes.

State credits vary widely in terms of the incomes and types of households that are eligible, as well as how much money they give back. Depending on an individual worker’s circumstances, a state’s Earned Income Tax Credit could add 3% to the value of their federal credit or double the credit

Recommended Reading: How Much Is Taxes For Doordash

Where Is My Tax Refund Check

You can check the status of your federal tax refund as soon as 72 hours after the IRS acknowledges receipt of your e-filed return. Please note the IRS only updates the status of your refund once a week, on Wednesdays. So checking back several times a day throughout the week wont normally give you any new information. The quickest and easiest way to get this information is to go to the Wheres My Refund page. Or, call 1-800-829-1954 or 1-800-829-4477.

How Fast Can I Get My Tax Refund This Year

If youre like most Americans, your tax refund feels like the biggest paycheck youll receive all year. Learn when youll be receiving your refund in 2021, and how you could hurry that process up.

When it comes to taxes, one of the most important questions we are often asked at Jackson Hewitt is, Will I get a tax refund? When the answer turns out to be YES! this good news leads almost immediately to clients asking, How fast can I get my refund?

For millions of Americans, your tax refund feels like the biggest paycheck youll receive all year, so filing your taxes is your most important financial transaction*.

Recommended Reading: How To Get Tax Form From Doordash

When To Expect Your Refund

The IRS has advised filers that electronic filing and using direct deposit will result in faster refunds.

If you file a paper return, you can expect to wait between six and eight weeks for a refund to be issued.

The IRS has stated you should only call them if it has been 21 days or more since you e-filed, six weeks since you mailed your return, or if your Wheres My Refund tells you to contact the IRS.

You can call the IRS at 18008291954, 18008294477, or 18008291040 to inquire about your tax return status with an IRS customer service representative.