How Long After Tax Return Acceptance Will It Be Approved

The IRS has created two tools to help those of us who want to check if our refund has been completed. One of them is IRS2Go. The official IRS website outlines how the application operates and what additional tax data is provided by the app.

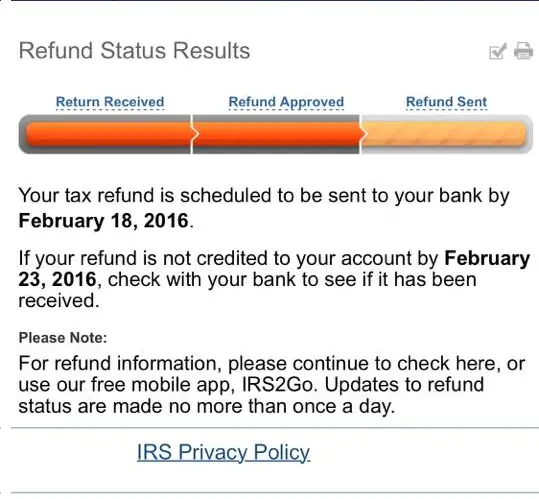

The second source is a web page named Where is My Refund, which was created by the IRS. There you enter your personal social security number, your refund date, and filing status. Afterward the IRS will inform you when you will receive your check or direct deposit. It is essential to know that the projections of the refund delivery are revised every Wednesday, and you must wait for the status of the reimbursement at least 72 hours after filing.

When Will I Get My Tax Refund

The Wheres My Refund? tool lets you check the status of your refund through the IRS website or the IRS2Go mobile app. If you submit your tax return electronically, you can check the status of your refund within 24 hours. But if you mail your tax return, youll need to wait at least four weeks before you can receive any information about your tax refund. Keep in mind that usually you can file your taxes in January.

In order to find out the status of your tax refund, youll need to provide your Social Security number , filing status and the exact dollar amount of your expected refund. If you accidentally enter the wrong SSN, it could trigger an IRS Error Code 9001. That may require further identity verification and delay your tax refund.

Most taxpayers receive their refunds within 21 days. If you choose to have your refund deposited directly into your account, you may have to wait five days before you can gain access to it. If you request a refund check, you might have to wait a few weeks for it to arrive. The table below will give you an idea of how long youll wait, from the time you file, until you get your refund.

| Federal Tax Refund Schedule | |||

| Paper File, Check in Mail | |||

| Time from the day you file until you receive your refund | 1-3 weeks | 1 month | 2 months |

Note that these are just guidelines. Based on how you file, most filers can generally expect to receive a refund within these time frames.

| 2021 IRS Refund Schedule |

Some Tax Refunds May Be Delayed In 2021

In addition to the delays we outlined above, if you claimed the Earned Income Tax Credit and the Additional Child Tax Credit , your tax refund may also be delayed. If you claimed these credits, the IRS started to issue these tax refunds the first week of March if you claimed these credits.

Your financial institution may also play a role in when you receive your refund. Since some banks do not process financial transactions during the weekends or holidays, you may experience a delay in processing. If you opt to receive your tax refund by paper check, use our tax refund schedule to determine when you can expect to receive your refund.

Finally, you can expect your tax refund to be delayed if you filed an amended tax return. The IRS processes amended tax returns from three weeks up to 16 weeks after receipt. You can check the status of your amended tax return here.

You May Like: How To Tax Return Online

What About My State Tax Refund

What weve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refund.

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive or longer, if your state has been or still is under social distancing restrictions. To find out the status of your refund, youll need to contact your state tax agency or visit your states Department of Revenue website.

Wait For Payment Delivery

If you filed your tax return on-line, then you probably were also able to accept an e-check refund payment. Typically, these take from 10 to 14 days depending on your bank’s direct deposit process. This payment takes the shortest amount of time to receive. Paper payments take longer to process and mail. While the payment may be mailed after 21 days, you’ll still need to calculate time in for the delivery.

You May Like: How To Check If Irs Received My Tax Return

How To Complete The Refund Approval In 2020

So, you want to know whats going on between the time you submit your tax return and the collection of your final refund? Lets find out what to expect from the refund approval process in 2020. First of all, lets explore what happens between the approval of the application and acceptance of your return.

Receive An Initial Acceptance

When you file your tax return, the IRS checks your basic information, such as social security number and address, for legitimacy. If there are no data errors, the return is usually accepted. You’ll know the government accepted your return when you receive an electronic notification that says something like “we’ve accepted your tax return.” After this, your return enters the processing stage, where the IRS checks all of your exemptions and credits for inaccuracies.

Don’t Miss: How To Calculate Your Tax Bracket

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

- The NCDOR will send a confirmation email to you once your electronically filed return is accepted. If you did not receive this email, there may be an error with your return and it is recommended you contact the Department at 1-877-252-3052 to confirm the return was successfully transmitted.

- You can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “duplicate” should be written at the top of the return that you are mailing. Please allow 12 weeks for your original return to be processed before mailing a duplicate return copy to this address. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

How To Know If Your Return Has Been Filed

To file a return in TaxAct®, you MUST complete the filing steps in the program. If you have not completed the steps below for filing electronically or filing a paper return, your return has NOT been filed. Review the information for your filing method to ensure your return has been filed.

Filing Electronically

To file your return electronically, you must choose E-File My Return on the Filing screen. Follow ALL of the steps. After answering a series of questions, you will reach a screen with a Submit button. Your return will not be transmitted unless you click the Submit button. You will then see a screen confirming that your return has been submitted. If you do not see this screen, repeat the filing steps to ensure your return is transmitted.

If you provided an email address during the filing process, you should receive an email within 24-48 hours indicating that your return has been received by TaxAct and transmitted to the IRS. Later, you will receive a second e-mail indicating the status of your return .

After transmitting your return, it is your responsibility to ensure that it is accepted by the IRS or state agency. If you do not receive an email confirmation or acceptance, you can check the status of your electronically filed returns at efstatus.TaxAct.com, or Electronic Filing Status.

You may also check your e-file status from your mobile phone via TaxAct Mobile Edition at m.TaxAct.com.

Filing a Paper Return

Also Check: Do You Have To Pay Taxes On Plasma Donations

Double Check Your Tax Return Before You File

Double checking your tax return prior to submission can ensure your tax refund is processed quickly. Failure to do so may cause the IRS to delay the processing of your tax refund.

Here is a list of questions to review prior to filing your tax return to ensure the IRS processes your tax refund as quickly as possible.

- Did I review my identifying numbers for myself, spouse and dependents?

- Did I ensure the names on my tax return are spelled correctly?

- Did I review my dependents information?

- Have I reviewed my banks routing and account numbers for accuracy?

- Did I include the correct date of birth for myself and dependents

- Did I electronically sign my tax return ?

Why Is My Refund Still Processing After 21 Days

There are cases when you might have to wait for your refund longer than the standard 21-day period:

- If there are misspellings in your application

- If your submitted application was unfinished

- If you are the victim of theft or identity fraud

- If there is an Earned Income Credit or Additional Child Tax Credit included in your tax

- If you have submitted an Injured Spouse Allocation Application 8379, which could take up to 14 weeks for the IRS to process

- If your tax return needs to be reviewed more precisely

You can use the following opportunities to expedite the refund process. The IRS suggests two options that may reduce your waiting period:

- Always e-file your tax return

- Request reimbursement by direct deposit

Try avoiding standard mail on both the front and back of the tax-filling process. Using this tip will get your refund back in your hands a little earlier.

Please, note that IRS telephone agents might confirm your tax status only 21 days after your online submission, and six weeks after the paper filing submission .

If the refund approval process is stressful and devastating for you, or you dont have enough time, please consider relying on DebtQuestUSA. Our specialists are always ready to help you with any tax refund or debt issue, and ready to fix any of your financial problems, saving both your nerves and a lot of money.

See If Our Program Is Right For You

Read Also: Do You Pay State Taxes On Unemployment

How To Contact The Irs If You Haven’t Received Your Refund

- In most cases, you’ll get your tax refund within 21 days of e-filing, though it can take longer.

- Check the status of your return online, then call the IRS if there seems to be a problem.

- Be prepared to follow up, too, because the IRS isn’t necessarily keeping track of your case.

- See Personal Finance Insider’s picks for best tax software »

I am a money nerd. I love adding the finishing touches to my tax return and generating pages that neatly summarize my income for a year. Some years, that also comes with the good news that a tax refund is headed my way.

I wasn’t sure what to expect for 2018, the first filing year under the new rules of a major tax overhaul. My results were much better than expected, but my refund was months late. I had to hunt down the steps to follow if your refund doesn’t show up as planned.

In most cases, taxpayers can expect to get their refund within 21 days of filing. If it has been longer, follow these steps to track down your refund.

Popular Articles

Reasons Why Your Tax Return Processing And Refund Has Been Delayed

To understand why processing has been delayed you need to understand the refund process. It starts with the submission of your final tax return. After your tax return has been accepted by the IRS they will start processing it over several days until finalized and a tax refund, if eligible, is disbursed . A refund payment date will then be available on the IRS Where is my Refund once sent out . If there are issues with your refund you may see an extended delay in moving to the next processing status and an applicable IRS message/code will be displayed once available.

The IRS and tax experts have said that there could be dozens of reasons when it comes to delays in processing tax returns that can then affect the timing of your refund. Some are in your control, but others may be purely do IRS processing delays that you cannot do much about. But common causes for tax return processing and refund delays include:

- Includes errors or is incomplete, which means the IRS cannot validate or match your data to their records. Especially for key items like your or your spouses SSN, dependent data or missing fields needed to process your return

- Is affected by identity theft or fraud. You will see a message if this is the reason and receive a letter in the mail to confirm identity and next steps. You need to ensure you follow instructions and provide required information to confirm your identity with the IRS.

Stay In the Know:or follow us on , and

Recommended Reading: Can You Claim Rent On Your Taxes

Can You Transfer Your Refund

Yes, you can ask the CRA to transfer your refund to your instalment account by:

- Selecting this option when filing electronically

- Attaching a note to your paper return

The CRA will transfer your full refund to your instalment account and consider this payment to be received on the date the CRA assesses your return.

Will Ordering A Transcript Help Me Find Out When Ill Get My Refund

A tax transcript will not help you find out when youll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation.

Recommended Reading: How To Figure Out Tax Percentage

What If I Miss The Deadline

Taxes are due on Monday, May 17, 2021. If you file your return after the deadline, you could be charged late filing fees and other penalties. The good news is, if you need more time to file you can request an extension with the IRS. It is important to note that an extension does not give you more time to pay your taxes. It only gives you more time to file your return. In other words, if you owe money on your taxes, your payment is still due by April 15th. If you request an extension, will have six more months to send your return to the IRS. The deadline to submit extensions for tax year 2020 is October 15, 2021.

How Do I Use The Where’s My Refund Tool

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund through the IRS2Go mobile app.

You May Like: Are Nonprofit Organizations Tax Exempt

What Is Happening When Wheres My Refund Shows The Status Of My Tax Return Is Refund Sent

This means the IRS has sent your refund to your financial institution for direct deposit. It may take your financial institution 1 5 days to deposit the funds into your account. If you requested a paper check this means your check has been mailed. It could take several weeks for your check to arrive in the mail.

Why I Still Have Not Received My Federal Tax Refund Yet Its Been Longer Than 12 Weeks

wrote:

I mailed them at the end of June and already got my state but still heard nothing about my federal. When I go to wheres my refund it tells me that the info is wrong

If you received the refund from your state then the federal tax return was filed and accepted by the IRS. The state return could not have been e-filed if the federal return was not e-filed and accepted.

You have to enter Exactly on the IRS tax refund website what is entered on your filed federal tax return, Form 1040, for the Social Security number, Filing Status and the whole dollar amount of the federal tax refund.

If the information has been correctly entered and is exactly what is on the Form 1040 and the IRS has no information concerning the refund, then the IRS has not started to process the federal tax return.

Also Check: Can Home Improvement Be Tax Deductible