Last Year’s Tax Deadline

Ok, so what if you blew right through the deadline without filing for an extension. Last year. And what if you haven’t filed your taxes for multiple years? Again, if you’re owed money, you might be in good shape as long as you file within three years . If, on the other hand, you’ve owed the IRS back taxes for the past few years, it’s also not time to panic. Taxpayers may enter into installment agreements with the IRS that allow monthly payments for a period of time instead of paying the full balance in one lump sum.

We don’t recommend procrastinating when it comes to filing your taxes — while it’s never really too late to file your taxes, filing late or failing to file can have serious financial consequences. But, life happens. If you’re running late, we do have some helpful tips, one of which is to talk to an experienced local tax attorney for assistance.

Related Resources:

Is It Still Possible To File My Taxes Even If Im Late

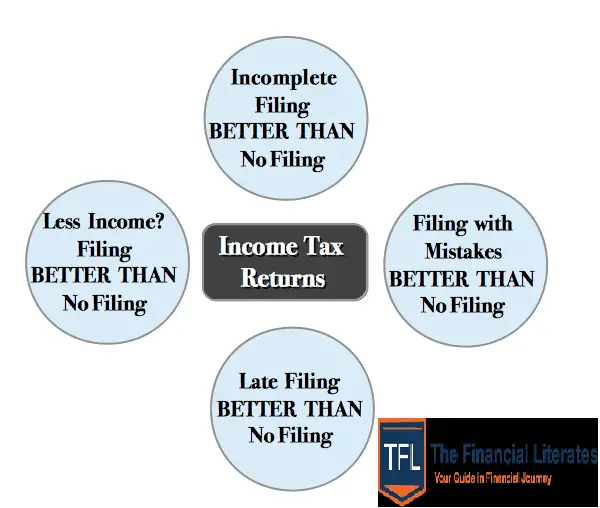

Late filing of taxes is much better than not filing at all. When you do the latter, the IRS will continuously add up your penalties and fees. If you fail to file, you will also extend your liens and garnishments since the amount you owe will already be more than your original tax bill.

If you are late, it is advisable to file your taxes within two months of the due date. By this time, youll be capped at paying a maximum of 25 percent of your overall tax bill. If you go beyond that, the IRS will add fines that amount to 100 percent of your bill.

If you will file taxes late, the best course of action to avoid penalties is to apply for an extension before the tax deadline. The extension given to you can range between 30 days to six months, depending on your case. However, you must keep in mind that you must pay 90 percent of your balance by the time the deadline comes.

What If I Cant Pay My Taxes Or The Late Fees

Many taxpayers can opt to set up a payment plan with the IRS using their Online Payment Agreement tool. If you can pay your taxes owed within a couple of months and owe less than $50,000, an Online Payment Agreement is probably your best bet.

An Offer in Compromise, on the other hand, is an agreement between you and the IRS to settle for a smaller amount if its actually impossible for you to pay the amount of taxes and fees that you owe.

Filing an Offer in Compromise should be more of a last resort than a first choice, though. The process itself is expensive, and if the IRS doesnt think your offer is appropriate, you have to start over. If at all possible, its better to go with the Online Payment Agreement.

Dont Miss: How To Find Real Estate Taxes Paid

Also Check: How Much Does It Cost To Amend Taxes

Can I Still File My Taxes If I Missed The Deadline

If a taxpayer is entitled to a refund, there’s no penalty for filing late. Penalties and interest began to accrue on any remaining unpaid tax due as of July 16, 2020. Anyone who didn’t file and owes tax should file a return as soon as they can and pay as much as possible to reduce penalties and interest.

Audit Alert For Amended Tax Returns

Filing amended returns claiming refunds slightly raises your audit likelihoodand not just for the amended items, but for the whole tax return. This is partly because 1040X forms are scrutinized by IRS employees rather than just computer processed.

On the other hand, the IRS ordinarily has only three years to audit a return from the date it was filed. An amended return filing does not extend the time the IRS has to audit the first return. Filing an amended return near the three-year audit deadline gives the IRS very little time to audit your tax return and it may simply pass it through.

This ploy can backfire on you, however, as the IRS is not legally obligated to accept an amended tax return. If you file an amended return near the three-year audit deadline, the IRS may be willing to accept it only on the condition that you agree to extend the time for audit beyond the three-year deadline. If youre considering this strategy, you may want to talk to a tax professional first.

Recommended Reading: How Much Is Capital Gains Tax On Real Estate

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

If You Owe Taxes You Should Hustle To Get That Return In As Quickly As Possible

If you owe the IRS money and didn’t submit your tax return by April 18, you’ve already signed yourself up for a nasty penalty — one you can minimize, however, by submitting your taxes as soon as you can. When you owe money and are late with a tax return, you get penalized to the tune of 5% per month or partial month your return is late, up to a total of 25%.

So, let’s say you owe the IRS $1,000 from 2021 and manage to get your tax return in by May 10, 2022. In that case, you’re only looking at a 5% penalty, or $50. But if you’re two months late with your return, that penalty will double.

You’ll also face a separate penalty for not paying your actual tax bill by April 18. The late payment penalty amounts to 0.50% of your tax bill for each month or partial month you’re late, up to 25%. You’ll notice that the penalty is way smaller than the late filing penalty. But it’s one you’ll want to avoid, so the sooner you get your taxes in and figure out exactly what you owe the IRS, the better.

Some people are routinely late with their taxes. If you’re owed money, that may be less of a big deal. But if you owe the IRS a pile of cash, make every effort to get that return done and submit it as soon as you can.

You May Like: Do Doordash Drivers Pay Taxes

What If I Filed An Extension On Time

Well done. You’ve got until Oct. 15, 2022, to file your tax return if you filed a tax extension by the April 18 deadline. As long as you paid an estimated amount that’s close to what you owe, you won’t be subject to fines or penalties if you file your return and pay any remaining tax liability by Oct. 15.

If you didn’t pay enough money with your tax extension, you may be subject to the late payment penalty. The IRS expects your estimated payment to be at least 90% of your total tax liability. The agency may charge a 0.5% per month penalty on the amount of unpaid taxes if you paid less than that, so you should still complete your tax return and file it as soon as possible.

Heres What To Do If You Missed The April 18 Tax Filing Deadline

- If you missed the April 18 tax deadline, you may cut back on penalties by filing your return promptly.

- The failure to file fee is 5% of unpaid taxes per month and late payments incur 0.5%, both capped at 25%.

- However, with a history of on-time filing and payments, you may qualify for one-time penalty relief.

If you missed the April 18 tax deadline, you may cut back on penalties by filing your return promptly, according to the IRS.

While it’s too late to request an extension, you can still reduce monthly late fees. Failure to file costs 5% of unpaid taxes per month and late payments incur 0.5%, both capped at 25%.

But you may qualify for one-time penalty relief with a history of on-time filings and payments, said Tommy Lucas, a certified financial planner and enrolled agent at Moisand Fitzgerald Tamayo in Orlando, Florida.

More from Personal Finance:What we learned from the Biden, Harris tax returns, according to experts

To be eligible, you can’t have late filings or penalties from the three prior tax years, and you must be current on all returns and balances, or have an IRS arrangement to cover unpaid taxes.

There’s no penalty if you’re getting a refund, said Sergio Garcia, a CFP and managing director of financial planning at BFS Advisory Group in Dallas. But the longer it takes to file, the more time you’ll wait for your payment.

Don’t Miss: Does Irs Tax Advocate Help

Gather Past Income Tax Return Documents

Longtime non-filers tend to lose their old W-2 and 1099 forms. Those forms are essential for filing an accurate tax return. You can start by asking businesses that issued you a W-2 or 1099. But many businesses either go out of business or dont keep their old records on file.

You cant get copies of W-2 and 1099 forms from the IRS. But the IRS does provide a computer printout with the W-2 and 1099 information on it. Call the IRS and request income data for the missing tax years. It may take several weeks for a written response. All your income may not be reflected on the printout, but it will show the minimum amount you must report on your tax return. You can also reconstruct your salary records on Form 4852, Substitute W-2 Attach it to the front of your tax return when you file it.

What Happens If You Miss The Irs Deadline

If you miss both the April 18, 2023 and the October 16, 2023 deadline, you’ll want to file your returns as soon as possible. We can help you file your late tax returns.Just go to our and select which tax year you want to file. After that, we’ll walk you through all thesteps you need to complete your prior year tax returns. You will have to print out your tax forms and mail them to the IRS becausethe IRS will not accept e-filed tax returns after the extension deadline.

You May Like: When Does Tax Season Start 2021

Is There A Penalty If You Miss The Deadline To File Taxes

If you file your taxes after the April 18 deadline, you may get hit with a Failure to File Penalty.

However, the penalty only applies if you aren’t owed a return.

According to the Internal Revenue Service, “The Failure to File Penalty applies if you don’t file your tax return by the due date. The penalty you must pay is a percentage of the taxes you didn’t pay on time.”

The amount you may have to pay is calculated by how late you file your tax return, and the amount of unpaid tax as of the original payment due date. Interest can also be changed on a penalty. Here’s a breakdown of the math.

If your return is over 60 days late, the minimum Failure to File Penalty is $435 or 100% of the tax required to be shown on the return, whichever is less.

Extension To October 15

To get an extension to file, complete Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, and send it to the IRS by April 15. This form changes each year. To get a current copy, visit your local IRS office, call 800-829-3676, or visit the IRS website at www.irs.gov. Your extension is granted automatically until October 15, and you wont incur any late-filing penalties.

If you live outside the United States, you get an automatic two-month extension to file to June 15. In the past, anyone physically outside the United States on April 15 could get the automatic extension. The law was changed to disqualify day trippers who made short April trips to Mexico and Canada just to get the extension. Even if you live outside the United States, however, you do not get extra time to pay the taxes you owe.

Some tax professionals contend that filing tax returns on extension decreases your chance of being audited. They reason that the IRS local offices fill their annual audit inventories before the returns on extension are processed. The IRS denies it works this way, but at the same time the agency wont say that returns filed on extension have a higher audit frequency. At worst, extensions are a neutral factor they cant hurt and just might help. I always file my own return on extensionand Ive never been audited. Maybe just a coincidence.

Dont File a Tax Return During an Audit

Caution

Read Also: Can I File My Taxes Without My Social Security Card

Consequences Of Not Filing

It is a crime not to file a tax return if taxes are owed. By contrast, there is no criminal penalty if you file but cant pay your taxes. Youll owe interest and penalties, but you wont be sent to jail. So even if you dont have two dimes to rub together and owe a bundle of taxes, file your return.

If you ignore this advice and fail to file, you can be fined up to $25,000 per year and/or sentenced to one year in prison for each unfiled year. Our justice system, however, doesnt have enough jails to put away even 1% of the nonfilers, so going to jail is highly unlikelyeven if you owe hundreds of thousands of dollars.

Read Also: Do You Have To Report Roth Ira On Taxes

Its Not Too Late To File Your Tax Return

Although the regular tax season is over, you can still file a late tax return until October 15, 2022. If you do not file you may miss out on a refund or any tax credits for which you may be eligible.While theres no penalty for filing late if you do not owe taxes, you could face fees and penalties if you do owe for 2021. The information below can help you navigate this process and complete your return before the final deadline.

Also Check: When Will My Federal Tax Return Come

What Happens If You Missed The Tax Deadline

If you owe Uncle Sam money, filing your tax return late can cost you big bucks.

If you didn’t file your 2021 federal tax return or request an extension by April 18 or Massachusetts ), don’t let that stop you from completing your 1040 and paying your tax as soon as possible if you owe the IRS money. If you can’t file your return, at least pay what you can now. Acting quickly will help keep the penalties and interest you may owe from getting out of hand.

Some people may have more time to file their tax returns and pay any taxes due. For example, filing and payment deadlines are later for some disaster victims, Americans living overseas, and military personnel . But if the special rules for these taxpayers don’t apply to you, then it’s time to stop procrastinating.

You can still file your tax return for free after the April 18 deadline. If your 2021 federal adjusted gross income is $73,000 or less, you can use the IRS’s Free File program up until October 17. If your income is too high for the Free File program and you’re comfortable doing your own taxes, you can also use the IRS’s Free File Fillable Forms until October 17. These are electronic versions of paper tax forms, and some of the math is done automatically.

Time Matters With Tax Refunds

If you miss the deadline, any excess in the amount of tax you paid every paycheck or sent as quarterly estimated payments in 2019 goes to the U.S. Treasury instead of to you. You also lose the opportunity to apply any refund dollars to another tax year in which you owe income tax.

Under certain conditions the IRS will withhold your refund check. It can be used to pay:

- past-due student loans,

- child support and

- federal tax debt you owe.

The IRS can also hold refund checks when the two subsequent annual returns are missing. That means you should file returns for 2020 and 2021 as soon as possible. For the 2020 tax year, with a filing deadline in May of 2021, the three-year grace period ends May 17, 2024.

Read Also: Can You File Taxes For Unemployment

Missed The Filing Deadline

Virginia grants an automatic 6-month extension to file your individual income tax return. However, the extension does not apply to paying any taxes you owe.

If you missed the deadline, and owe taxes, you should pay as much as you can as soon as possible to reduce additional penalties and interest.

Your options:

- If you havent filed your return, you should file and pay as soon as possible.

- If youre still not ready to file your return, make an extension payment online using the eForm 760IP or by check. If paying by check, be sure to include the 760IP voucher with your payment. To determine how much to pay, use the worksheet on the back of the Virginia Automatic Extension Payment Voucher for Individuals .

- If you filed your return on time, but didnt pay the taxes you owed, you should pay as much as you can now to reduce penalties and interest later. You have a number of payment options, both online and by check. If paying by check, be sure to include the 760-PMT voucher with your payment.

In all cases, you should pay as much as you can to reduce the amount of penalty and interest youll owe.

If you cant pay the full amount that you owe, well send you a bill to collect the remaining amount due, along with any penalty and interest. Once you have a bill, you can call to set up a payment plan.