S Corporation And Partnership Tax Returns Due

Today is the deadline to file your S corporation tax return or Partnership return .

Note that S corporations and Partnerships do not pay taxes on their income. That tax is paid on the individual incomes of the shareholders or partners, respectively.

March 15 is also the deadline to file for an extension for S corp and partnership tax returns.

Forms:

Don’t Forget To Check That Bitcoin Box

Don’t leave the boxes blank on the front of your return where it asks about virtual currency. Be sure to check “Yes” or “No” to the question that asks whether at any time during 2021, you received, sold, exchanged or disposed of any financial interest in any virtual currency. If you don’t, that could be a big red flag to the IRS.

Late Filing Penalties And Interest

If your tax return is filed after the deadline, the CRA will charge a 5% late filing penalty on the amount of tax you owe to the CRA and an additional 1% every month that passes after the deadline, for up to 12 months. Plus a 5% interest rate on the balance owing.

For instance, if your tax owing was $1,000 and you file taxes 12 months after the tax filing deadline: Youll pay a late filing penalty of $50, an additional 1% penalty for each month passing after the due date of $120 and interest of $59.98 on the overdue tax amount. So, youll pay $229.98 in interest and penalties.

If you dont owe any taxes to the CRA for the year or you are expecting a tax-refund, late filing wont result in penalties or interest.

Read Also: Doordash 1099 Example

Don’t Miss: When Do You Have To Pay Self Employment Tax

State Taxes Paid For A Prior Year

If you paid state, local or foreign income taxes for a prior year, you can deduct them on your tax return. The IRS allows a tax deduction if the tax was imposed on you and you were required to pay it during the year. Examples of deductible taxes are real estate taxes, general sales taxes and personal property taxes. You would need to itemize your deductions using Schedule A of Form 1040 to qualify for the deduction.

Federal Income Tax Deadline For 2021 Tax Returns

The filing deadline for the 2021 tax year is April 18, which falls on a Monday. If you need even more time to complete your 2021 federal return you can request a six-month extension by filing Form 4868 through your tax professional, tax software or using the Free File link on IRS.gov. Filing Form 4868 gives taxpayers six extra months to file their 2021 tax return but does not grant an extension of time to pay taxes due. You may owe a late payment penalty on any tax not paid by the original due date of your return.

If you mail in your return, it must be postmarked April 18, 2022, or sooner. The IRS typically issues refunds within 21 days after a tax return is filed.

People who still want to contribute to an individual retirement account for the 2021 tax year still need to make contributions by April 15, 2022. It is also necessary to include contributions made to traditional IRAs on your tax return. If you contributed to a Roth IRA during 2021, you wont need to report those contributions on your tax return.

Also Check: How To Get An Extension On Filing Taxes

What If I Cant Pay My Tax Bill

If you cant afford to pay your tax bill in full on the deadline, dont pull out your credit card or ignore the situation.

The IRS offers reasonable payment plans at much lower interest rates than most banks. You may even be able to settle the bill for less than you owe, called an offer in compromise, or request a deferment until you can make a payment. Offers in compromise and requests for deferment require additional paperwork and must be approved by the IRS.

What Happens If You Miss The Tax Filing Deadline And Are Owed A Refund

If you overpaid for the 2022 tax year, there’s typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2022 tax returns, the window closes in 2025. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

Also Check: When Are Pa Taxes Due

Irs Tax Stimulus Checks For 2022 Perhaps With Recovery Rebate Credit

Some people might want to file returns even though theyre not required to do so to claim a Recovery Rebate Credit or the 2021 stimulus payments.

According to the IRS, individuals who didnt qualify for a third Economic Impact Payment or got less than the full amount may be eligible to claim the Recovery Rebate Credit. For those who got some money, the IRS says youll need to know the total received to calculate the correct rebate credit to avoid processing delays.

The IRS will send Letter 6475 starting in late January with the total amount of the third Economic Impact Payment received. Economic impact payment amounts also can be viewed on IRS online accounts.

What If You Miss A Deadline

You’ll probably be hit with a financial penalty, such as an extra interest charge, if you don’t submit a tax return and make any payment that is due by its appropriate deadline. There are two main penalties you may face:

- Failure-to-file penalty:This penalty for 1040 returns is 5% of the tax due per month as of tax year 2021, up to a cap of 25% overall, with additional fees piling up after 60 days.

- Failure-to-paypenalty: This penalty is 0.5% for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

If both are penalties are applied, the failure-to-file penalty will be reduced by the failure-to-pay penalty amount for that month. If you are on a payment plan, the failure-to-pay penalty is reduced to 0.25% per month during that payment plan schedule. If you don’t pay the taxes you owe within 10 days of receiving a notice from the IRS that says the agency intends to levy, then the failure-to-pay penalty is 1% per month.

Recommended Reading: How To Figure Out Tax Deductions From Paycheck

Here’s What To Do If You Missed The Deadline To Claim Your Child Tax Credit Or Stimulus Money

Nov. 17 was the final day to claim any missing stimulus or child tax credit money that you haven’t received through the IRS Free File form. But don’t worry: That money isn’t lost forever. You can still claim any money owed to you when you file your taxes in 2023.

Roughly 9 million people who didn’t receive their payments never filed a tax return this year, either because they’re not required to file or because they needed more time. However, the IRS used tax returns to determine eligibility for both of these payments.

Keep reading to find out what you can do to receive any stimulus payments or child tax credit money owed to you. For more, see if your state is mailing out stimulus checks this month.

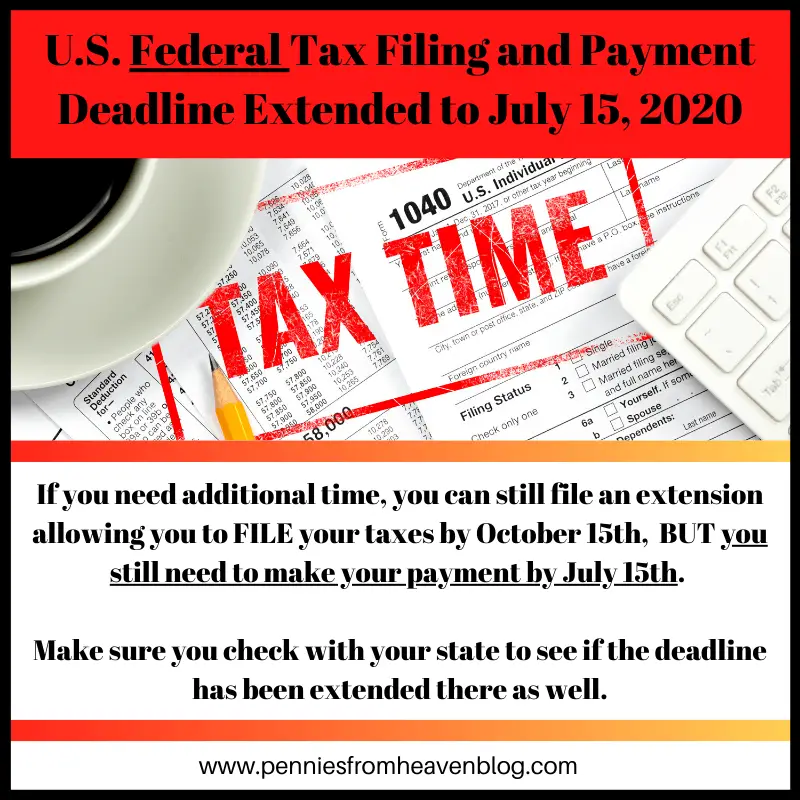

What I Still Need To Pay The Irs

That’s right getting an extension to file your tax return doesn’t give you an extension on paying what you owe the government.

The IRS expects people to make an effort to pay what they owe, Betterment’s Bronnenkant said. That may be difficult for people who haven’t yet filled out their tax returns, but it’s best to make a good-faith estimate.

“If your prior year is a good barometer for your current year, start with that as a way to come up with some sort of reasonable estimate,” Bronnenkant said. “Don’t let perfect be the enemy of good enough.”

For instance, if you estimate that you owe $10,000 but end up actually owing $11,000, you’ll be charged an underpayment penalty. But it will be less painful to face an underpayment penalty for $1,000 rather than the entire $11,000 that you owe, Bronnenkant noted.

You May Like: Where Do I Send My Tax Return From Florida

Be Aware Of Your Right To An Extension

If you miss the tax-filing deadline without realizing it, your best bet is to submit your return as soon as you can. In the future, if you realize ahead of time that you’re likely going to be late, be sure to request a tax extension by the filing deadline. That will give you six more months to complete your return.

If you ask for an extension and don’t get your return completed by the deadline, the late payment penalty will still apply to any unpaid taxes of yours from the current tax year. But you won’t be charged the more costly failure-to-file penalty as long as that extension request is in on time.

Best of all, you don’t need a specific reason to be granted an extension. The IRS doesn’t care if you need more time to file because certain tax forms got delayed or because you just plain procrastinated. So in that regard, you get a little leeway as long as you recognize in advance that completing your return by the tax-filing deadline probably isn’t in the cards.

Max Out Your 401 By Dec 31

Contributions to a traditional 401 reduce your total taxable income for the year.

For example, lets say you make $65,000 a year and put $19,500 into your 401. Instead of paying income taxes on the entire $65,000 you earned, youll only owe taxes on $45,500 of your salary. In other words, saving for the future lets you shield $19,500 from taxes . Many employers offer to match a portion of what you save, meaning that if you contribute enough to your account, you’ll also nab some free money.

» MORE:Estimate your tax bill with our free tax calculator

Don’t Miss: When Are Income Taxes Due In 2021

Natural Disaster Victims Get Tax Filing And Payment Extensions

If the Federal Emergency Management Agency declares a disaster area following a natural disaster, the IRS usually offers tax relief for the disaster victims in the form of tax filing and payment extensions. In the case of certain recent natural disasters, the April 18 tax filing and payment deadline was extended for individuals and businesses residing or located in the disaster area.

Victims of the following natural disasters were granted extensions that delay this year’s federal personal income tax filing and payment deadline:

- Wildfires and straight-line winds in New Mexico that began on April 5 .

If You Owe Pay As Much As You Can To Reduce Penalties

Although thereâs no penalty for submitting your taxes late when youâre expecting a refund, the IRS may assess penalties if you owe taxes.

If you think youâll miss the extended tax deadline, you should pay as much as possible as soon as you can. Taking this step can reduce any interest or penalties on your tax account, including not only the failure-to-file penalty but also the IRS failure-to-pay penalty.

The failure-to-pay penalty is assessed if you donât pay taxes reported on your return by the original due date or an approved extended deadline, such as those granted for a federally declared disaster. Taxes that remain unpaid for a month will be assessed a failure-to-pay penalty of 0.5% per month.

In months where both the failure-to-file and failure-to-pay penalties apply, the failure-to-file penalty is reduced by 0.5% . So instead of a 5% failure-to-file penalty for the month, youâll be charged 4.5%.

For example, letâs say you didnât file or pay your taxes of $5,000. If the IRS assesses both the failure-to-file and a failure-to-pay penalty in one month, you will owe a total penalty of 5% or $250 . Basically, thatâs a 0.5% failure-to-pay penalty and a 4.5% failure-to-pay penalty for one month.

To get a better understanding of how penalties may affect your account, speak to a tax professional to determine which penalties may apply to your tax situation.

Recommended Reading: Do I Have To File Unemployment On My Taxes

Income Tax Slabs For Fy22 And Assessment Year 23

In view of the crisis arising out of the epidemic in the year 2020, the government had decided not to make any changes in the income tax slab in the budget.

However, some exceptions were kept in the new slab.

According to this, such senior citizens of 75 years who depend on their pension and interest received on their income, were exempted from filing tax returns.

In this case, TDS will be deducted automatically by the bank.

You May Like: Irs Forgot Ein

How Long Do We Have To Review Your Return

When we receive your income tax return, we carry out a cursory review and send you a notice of assessment.

We generally have three years from the date of the notice of assessment to carry out a more in-depth review and, if necessary, issue a notice of reassessment . You must keep all documents substantiating the information provided in your return , as we may ask for them if such a review is carried out.

Also Check: How To Avoid Capital Gains Tax On Home Sale

What Are The Penalties If I Don’t Pay Enough

The failure-to-pay penalty is less punitive than the one for failing to file. The IRS charges 0.5% of the unpaid taxes for each month, with a cap of 25% of the unpaid taxes.

Take someone who pays an estimated tax of $10,000 by April 18, but it turns out they actually owe $11,000. They’ll face a 0.5% charge on the extra $1,000 they owe the IRS. If they file in June two months after the tax deadline they would owe $10.

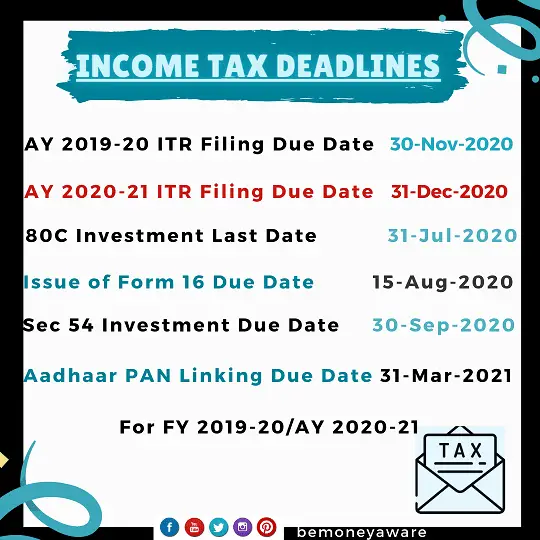

Tax Filing Deadlines In 2022

Deadlines for filing taxes typically fall within the same, general range. When it comes to filing your 2021 tax return, these are the dates you need to know about.

- Receiving your W-2 Form: Your employer has until Jan. 31, 2022, to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- Individual income tax returns: April 15 falls on a weekday in 2022, but it is Emancipation Day which is celebrated in Washington, D.C., causing all businesses and government offices to close. Therefore, the filing deadline for your 2021 personal tax returnForm 1040 or Form 1040-SRis Monday, April 18, 2022 .

- Partnership and S-corporation returns:Returns for partnerships and S-corporations are generally dueMarch 15. If you request an automatic six-month extension, though, this date is Sept. 15.

- Corporation income tax returns: For corporations, the due date is April 18, 2022. The extended deadline is Oct. 17, 2022. The deadline for C-corp returns is typically the 15th day of the fourth month following the end of the corporation’s fiscal year if the corporation operates on a fiscal year, rather than a calendar year.

Recommended Reading: Is There An Extension On Filing Taxes

What If I Cannot Complete And File My Return On Time

To avoid a late filing penalty, you must file your return by Oct. 16, 2023. Do not send an incomplete return.

To avoid other penalties and interest, you must pay your tax by the due date. If you do not know your total tax due, you may estimate the amount and pay it by the due date. To see your payment options and make a payment, go to .

Recommended Reading: When Do We Need To File Taxes

Free File Available January 14

IRS Free File will open January 14 when participating providers will accept completed returns and hold them until they can be filed electronically with the IRS. Many commercial tax preparation software companies and tax professionals will also be accepting and preparing tax returns before January 24 to submit the returns when the IRS systems open.

The IRS strongly encourages people to file their tax returns electronically to minimize errors and for faster refunds as well having all the information they need to file an accurate return to avoid delays. The IRS’s Free File program allows taxpayers who made $73,000 or less in 2021 to file their taxes electronically for free using software provided by commercial tax filing companies. More information will be available on Free File later this week.

You May Like: How Much Tax Gets Taken Out Of Your Paycheck

When The Deadline Is Different

Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension. Find out if you are eligible to pay this way.

HMRC must receive a paper tax return by 31 January if youre a trustee of a registered pension scheme or a non-resident company. You cannot send a return online.

HMRC might also email or write to you giving you a different deadline.

Pay Your Taxes From Abroad With Wise

Getting your head around taxes can be a nightmare, but paying them shouldnt cost you even more money. If you are paying your taxes from overseas with a non-US bank account, you can use Wise to get the real mid-market rate .

A Wise account can reduce the costs of paying from abroad. You can save 4-5% compared to typical banks.

Also Check: How To Calculate Taxes On Stocks

What Tax Documents Should I Look Out For Before Filing

The U.S. tax code can be complicated, with various forms that taxpayers need to file to report their income sources. Here are the most common tax forms and their respective deadlines.

Review the tax filing deadlines for each form below, including the due dates for businesses or employers to send forms and the filing dates for individual taxpayers.

- W-2 Form: Employers must send by January 31, 2022

- Form W-2 contains information about your employee earnings, any taxes withheld, and other employer-provided benefits. Your employer must provide your W-2 Form by January 31, 2022.

- Recipients must file by .