Your Aging Parents And Tax Season: A Getting

With the first baby boomers reaching retirement age, many adult children are now or will soon be caring for elderly parents and family members. The U.S. Census Bureau tells us that the retired and retiring populations are growing and those born between 1945 and 1964 are now tasked with the care of the previous generation.

From managing healthcare costs to determining a final resting place, as parents reach their twilight years responsibility for their well-being, health and financial stability can increase on their children. All too often, these concerns are exacerbated by the death of one parent, leaving the surviving spouse in a state of confusion or despair.

Tax season is an ideal time of year to help your parents assess their financials. With the right preparation, what might seem an overwhelming process of collecting paperwork and scouring for deductions can become relatively pain-free.

Here, a getting-started guide to helping your elderly parents in tax prep:

Do my parents even need to file?

For a single person over the age of 65, the ceiling for gross income is $10,750. For a married couple, $20,900.

Where to begin

Deductions and exemptions

State Senior Tax Exemptions

Federal taxes arent the only tax burden seniors face. You may also have to file and pay state income taxes. State tax rules vary quite a bit, and the state in which you choose to live can significantly affect your tax liability.

A number of states offer specific tax benefits to seniors, and it is common for states not to tax Social Security earnings. Below are some examples of state tax benefits and exemptions:

-

The Kentucky state income tax is just 2 percent, and Social Security earnings are exempt.

-

Some states, such as New Hampshire, Nevada, and Florida, do not tax income at all.

-

Mississippis state income tax is just 3 percent, with exemptions for Social Security, pensions, and retirement plan withdrawals.

-

Several states, including South Dakota and Montana, have no inheritance tax.

If youre helping a senior parent file their taxes, youll already be talking finances, long-term plans, and healthcare. So consider having a conversation about how your loved one wishes to spend their retirement. Re-evaluate this plan each year as your loved ones needs change.

Many seniors can save lots of money by moving into a senior living community. These communities offer loads of activities, easy access to new friends, and a chance at a vibrant and meaningful retirement. For help talking to your loved one about the benefits of senior living, download our free guide, Talking to Your Senior Parent About Senior Care and Living.

No Tax Exemption For Age 65 And Over

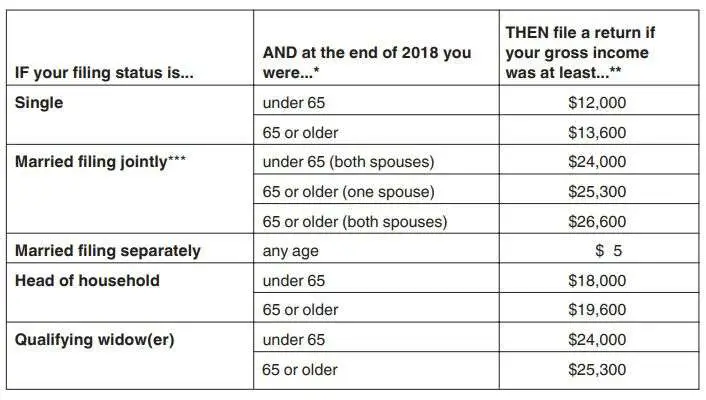

While there is no age 65 tax credit, you will only have to file a return if your gross income is more than the annual minimum threshold established by the IRS. Filing status determines which limit applies, so the limits will be different if you’re single rather than married. Of course, if you are due a refund because you had payroll taxes deducted or are entitled to a tax credit, you’ll want to file anyway. The limit amounts change yearly because of inflation, and with the new tax law in effect for 2018, your age no longer matters.

Read Also: How Much Is H& r Block Charge

When You Can Stop Filing Taxes

If your income comes solely from Social Security benefits, you can stop filing taxes. This is because taxed income does not include the benefits. Therefore, your gross income is technically $0 without Social Security. This can seem confusing, so follow the directions on the 1040 and 1040A forms, which help to calculate the taxable amount of Social Security benefits. Just because you are exempt from federal taxes, does not mean you are also exempt from state taxes, so be sure to check with a state representative for specific rules and regulations to follow.

Always consult an IRS representative or a local financial consultant if you have any questions about your situation. Wouldnt it be nice if we could all stop filing taxes?

Affordable Care Act Premium Credit Claim

If you got health care coverage as required by the Affordable Care Act, also known as ACA or Obamacare, you might need to file a return.

This is the case if you qualified for federal help in buying your health care coverage through the health insurance marketplace or exchange. If advance payments of the ACA premium tax credit were made for you, your spouse, or a dependent who obtained such marketplace medical coverage, that amount must be reported by filing a Form 1040 tax return and Form 8962, Premium Tax Credit.

This will ensure that you got the appropriate tax credit in advance. If you received too much premium help, youll have to repay it when you file your return. If you did not get enough, you can collect the extra when you file.

Recommended Reading: Where’s My Tax Refund Ga

When Can Seniors Stop Filing Taxes

Tips and Tricks current events Hearing Aid Prices Social Issues

We all know this time of year well. Either get excited for a return or dread liability for more taxes. When gross income is greater than your exemption amount plus the standard deduction, chances are you will end up owing the government money. If you receive some Social Security benefits, you may think you are rid of this arduous process but no such luck!

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How Do I Get My Pin For My Taxes

Four Factors That Impact Income Thresholds

Four factors determine whether you must file, and each circumstance has its own gross income threshold. The four factors are:

- Whether someone else claims you as a dependent

- Whether you’re married or single

- Your age

Some of these factors can overlap, which can change the income thresholds for required filing.

Do You Need To File A Tax Return This Year

Syndicated columnist, NBC Today contributor and creator of SavvySenior.org

Dear Savvy Senior: My income dropped way off when I retired early last year, and I’m wondering if I fall into the so called “47 percent” of Americans who won’t have to pay any income taxes this year. What can you tell me?

–Curious Senior

Dear Curious: The percentage of seniors, age 65 and older, who won’t have to pay income taxes this year, is actually around 56 percent according the Tax Policy Center. Here’s a breakdown of the 2012 filing requirements along with a few other tax tips to help you determine if you need to file.

Special Situations Be aware that there are some special financial situations that require you to file a tax return, even if your gross income falls below the IRS filing requirement. For example, if you had net earnings from self-employment in 2012 of $400 or more, or if you owe any special taxes to the IRS such as alternative minimum tax or IRA tax penalties, you’ll probably need to file.

To figure this out, the IRS offers a resource on their website called “Do I Need to File a Tax Return?” that asks a series of questions that will help you determine if you’re required to file, or if you should file because you’re due a refund. You can also get help over the phone by calling the IRS helpline at 800-829-1040.

Recommended Reading: How Much Does H& r Block Cost To File Taxes

Property Tax Exemptions Faqs

What are the different types of property tax exemptions?

For those who qualify, tax exemptions generally come in four different categories:Seniors: You may be eligible if you have a limited income and you are at or above a certain agePeople with disabilities: You may get an exemption if you have limited income and a disability keeps you from workingVeterans: Armed forces vets with a total disability and veterans with service-connected disability ratings of 80% or may get an exemptionHomestead: most states have a homestead property tax exemption that allows you to protect a certain amount of the value of your primary property from taxes

Are real estate taxes the same as property taxes?

Yes, real estate tax and property tax are considered the same. The Internal Revenue Service uses the term real estate tax. However, most homeowners call it property tax.

Whats a tax exemption vs. tax deduction?

These two are similar, but not synonymous. Much like a deduction, a tax exemption reduces your taxable income. However, exemptions excuse parts of your income from your taxable income and depend on your filing status and how many dependents you claim.

What is a property tax deferral?

A deferral means you can delay paying property taxes, as long as you meet the age and income guidelines. The property tax then becomes a lien on your house, which gathers interest as long as it goes unpaid.

When Does A Senior Citizen On Social Security Stop Filing Taxes

OVERVIEW

The IRS requires you to file a tax return when your gross income exceeds the sum of the standard deduction for your filing status plus one exemption amount. These filing rules still apply to senior citizens who are living on Social Security benefits. If you are a senior, however, you don’t count your Social Security income as gross income. If Social Security is your sole source of income, then you don’t need to file a tax return.

You May Like: How To Get Pin To File Taxes

Take Advantage Of Tax Breaks As A Senior

Benjamin Franklin once said that one of lifes few certainties is taxes.

When it comes to property taxes, retirees often find themselves in a unique position.

While home values continue to increase and with them, property taxes retirees incomes do not.

Several states have taken steps to ease this particular tax burden for seniors.

Heres how senior property tax exemptions work, and how to know if you qualify for one.

In this article

How Do You Earn Tax Breaks In Your Retirement Years

Once you turn 65, you automatically have a larger standard deduction available, so be sure you’re taking advantage of that if you’re not itemizing deductions. When you reach age 70 and a half, you can also reduce your tax liability by giving some of your IRA distributions directly to a charity. This counts toward your required minimum distributions. Talk to your financial advisor about other ways to lower your taxes in retirement.

Read Also: Where’s My State Refund Ga

Other Situations That Require Filing A Tax Return

In addition to requirements based on age, your filing status and income, along with rules regarding the Affordable Care Act and self-employment income, there are several other situations that require you to file a tax return.

This includes if you owe any special taxes, such as the alternative minimum tax extra taxes on qualified plans like an IRA household employment taxes for employees like nannies, housekeepers or gardeners or tips you didnt report to your employer. You must also file if you had write-in taxes that might include taxes on group term life insurance or health savings accounts. You also have to file if you have recapture taxes on the profitable sale of an asset.

A second instance in which you have to file a return is if you or your spouse received distributions from a health savings account, Archer MSA or Medicare Advantage MSA.

If you worked for a church or a church-controlled organization that is exempt from paying social security and Medicare taxes and you had wages of $108.28 or more, youre required to file a return.

Finally, if you have a tax liability and are making payments under an installment agreement, you must file a return.

How To Claim Your Senior Property Tax Relief

Its important to file for your senior tax exemption by the deadline imposed by your state. Each state has different deadlines.

Most states have websites where you can find the deadlines for filing, along with the necessary forms and instructions.

Most states have websites where you can find the deadlines for filing, along with the necessary forms and instructions.

Applications for property tax exemptions are typically filed with your local county tax office.

While most states offer basic exemptions for those that qualify, your county may offer more beneficial exemptions.

Whether you are filing for exemptions offered by the state or county, you should contact the tax commissioner or the tax assessors office in your county for more information or clarification about qualifying for tax exemptions.

Read Also: Efstatus Taxact Com Login

Can The Senior Tax Credit Help Me

The Senior Tax Credit is applicable to those who anticipate owing money to the IRS and if you meet certain qualifications. This tax credit for seniors or disabled can very much reduce your tax bill. Keep in mind that if you are expecting a return, then the Senior Tax Credit is not applicable. For more information on the Senior Tax Credit, please read here.

100% free consumer service

When You Must File Taxes

If you are over the age of 65 and live alone without any dependents on an income of more than $11, 850, you must file an income tax return. If part of your income comes from Social Security, you do not need to include this in the gross amount. If you are married and both are over 65-years-old, your combined income cannot exceed $23,100 if you plan to stop filing taxes. If your spouse is younger than you , this amount decreases to $21,850. Remember do not include Social Security in your gross income! This will drastically alter your income amount.

You May Like: Do You Report Roth Ira Contributions Your Tax Return

What Happens When A Person Fails To File An Income Tax Return

In line with the tax filing season, you may also ask: What happens if you dont file your taxes on or before April 15?

As a general rule, dont forget that you will incur a penalty for not filing taxes, called failure-to-pay penalty.

This penalty is usually 5% of the unpaid taxes. The penalty charge will not exceed 25% of your total taxes owed.

But, if you filed your tax return 60 days after the due date or the extended due date, then you might have a bigger penalty.

Your penalty will now be the smaller of $135 or 100% of your total tax debt. This will accrue beginning on the day after the filing date.

Also, the IRS will charge you a failure-to-pay penalty if you fail to pay your declared taxes. This is usually ½ of 1% of your total taxes owed.

If you are facing both types of penalties, then the maximum penalty you need to pay for both is 5% of your tax debt.

But dont worry, we have prepared a tax preparation checklist for you so you can start planning your taxes early.

Are Social Security Benefits For The Disabled Taxable

Disabled people are not liable to pay state or local taxes on their social security disability benefits. However, if the other incomes and social security disability benefits exceed the income guidelines, then the individual should report the expected amount for federal tax purposes.

MORE ADVICE

MORE ADVICE Discover more tips for comfortably aging in place

Retirees can make estimates for the tax payments throughout the year or ask the Social Security Administration to withhold the taxes from their monthly checks.

Also Check: How Much Does H & R Block Charge To Do Taxes

What Are Senior Property Tax Exemptions

A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own.

Property taxes are quite possibly the most widely unpopular taxes in the U.S. And for retirees, they create a unique problem as property taxes increase over time but incomes may not.

States have responded to this issue by enacting tax relief policies for certain homeowners, including senior citizens.

But states arent always proactive in getting seniors the help they need.

The state, county or city agency that collects your property taxes usually doesnt tell you that you qualify for an exemption. You have to find out for yourself whether you qualify.

In fact, the state, county or city agency that collects your property taxes usually doesnt tell you that you qualify for an exemption.

Instead, you yourself have to figure out whether youre eligible, and then request the tax deduction you qualify for.

Heres how to do that.