How Does The Wheres My Refund Tool Work

To use the IRS tracker tools to check the status of your 2020 income tax refund, youll need to provide the following information: your Social Security number or Individual Taxpayer Identification Number, your filing status , and your refund amount in whole dollars . Also, wait at least 24 hours before beginning to monitor your refund.

Go to the Get Refund Status page of the IRS tool Wheres My Refund, input your SSN or ITIN, filing status, and precise refund amount, then click Submit. If you submitted your information properly, you will be sent to a page that displays the status of your refund. If you dont, you may be prompted to validate your personal tax information and try again. If everything appears right, youll need to input the date you filed your taxes, as well as whether you did it online or on paper.

The IRS now offers a smartphone app called IRS2Go that allows you to check the status of your tax refund; it is accessible in both English and Spanish. You will be able to check if your return was accepted, authorized, and delivered. Youll need certain information to log in, including your Social Security number, filing status, and anticipated return amount. The IRS refreshes the data in this tool nightly, so if you havent seen a status change after 24 hours or longer, return the next day. Once your return and refund have been authorized, you will be given a customized date to anticipate your money.

What Do These Irs Tax Refund Messages Mean

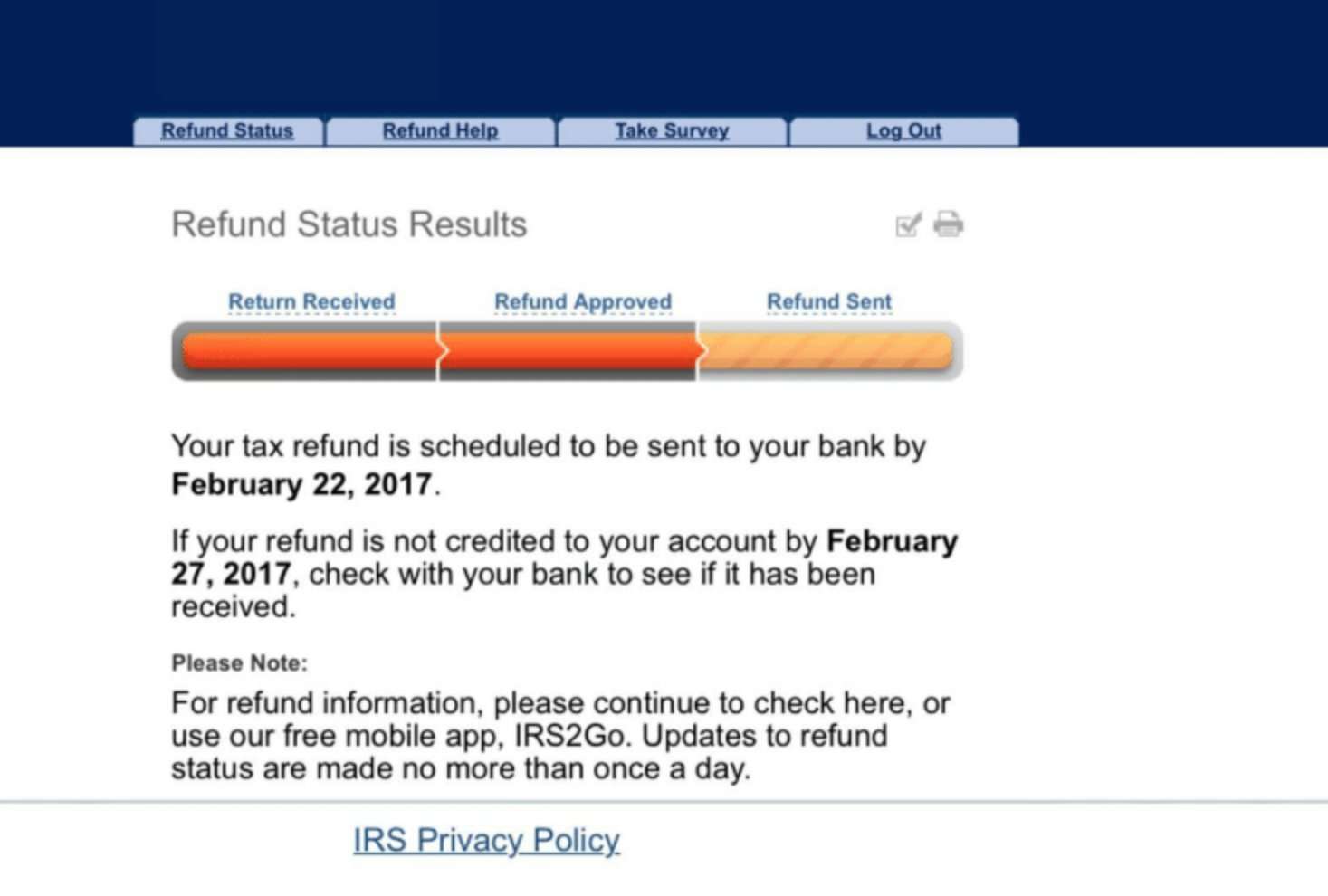

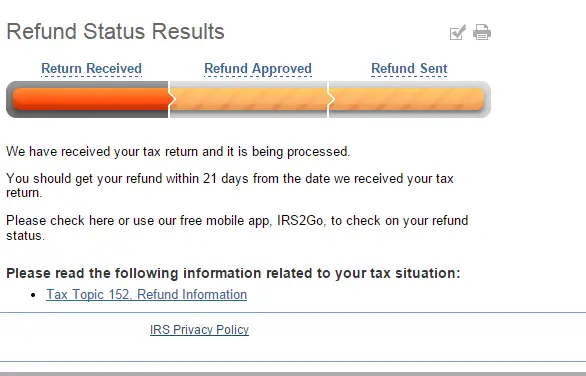

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

What’s Causing The Massive Irs Backlog And Delays

Because of the pandemic, the IRS ran at restricted capacity in 2020, which put a strain on its ability to process tax returns and created a backlog. The combination of the shutdown, three rounds of stimulus payments, challenges with paper-filed returns and the tasks related to implementing new tax laws and credits created a “perfect storm,” according to a;National Taxpayer Advocate review;of the 2021 filing season to Congress.;

The IRS is open again and currently processing mail, tax returns, payments, refunds and correspondence, but limited resources continue to cause delays. The IRS said it’s also taking more time for 2020 tax returns that need review, such as determining;recovery rebate credit;amounts for the first and second stimulus checks — or figuring out earned income tax credit and additional child tax credit amounts.

Here’s a list of reasons your income tax refund might be delayed:;

- Your tax return has errors.

- It’s incomplete.

- Your refund is suspected of identity theft or fraud.

- You filed for the earned income tax credit or additional child tax credit.

- Your return needs further review.

- Your return includes;Form 8379;, injured spouse allocation — this could take up to 14 weeks to process.

Read Also: When Is Tax Time 2021

Other Factors That Could Affect The Timing Of Your Refund

Additional factors could slow down the processing of your tax refund, such as errors, incomplete returns or fraud.

Taxpayers who claim the earned income tax credit or the additional child tax credit may see additional delays because of special rules that require the IRS to hold their refunds until Feb. 27. You should also expect to wait longer for your refund if the IRS determines that your tax return needs further review.

What To Know About The Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in;adjusted gross income;and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.;

The $10,200 tax break is the amount of income exclusion for single filers,;not;the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds have averaged more than $1,600.;

However, not everyone will receive a refund. The IRS can seize the refund to cover a;past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.;

If the IRS continues issuing refunds, they will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as;IRS TREAS 310 TAX;REF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.;

You May Like: How Much Can You Get Back In Taxes

How Tax Refunds Work

A tax refund is a reimbursement for excess taxes paid during the year. Most workers prepay their federal income taxes through their paycheck or by filing quarterly estimated taxes.

Employees are required to fill out a Form W-4 when they begin working at a company. The information entered on employees’ Form W-4 determines how much the employer will withhold from their pay to cover federal income taxes. If the employer withholds too much, you may receive a tax refund. If you come up short, you will owe taxes.

A contract worker is considered both an employee and an employer. They do not complete a Form W-4; instead, they are required to pay their own taxes on a quarterly basis.

Estimated tax payments for 2021 are due April 15, 2021; June 15, 2021; Sept. 15, 2021; and Jan. 18, 2022.

This is true even though the tax filing deadline for 2020 individual income taxes was moved to May 17, 2021.

You may also receive a tax refund if you claim a refundable tax credit, such as the Earned Income Tax Credit . Most federal income tax credits are non-refundable and will only reduce the amount you owe in taxes. However, if you claim a refundable tax credit that is greater than the amount you owe, you will receive the difference as a tax refund.

Are There Any Expected Tax Refund Delays

Yes, tax refund delays are common. The IRS is required by federal law to withhold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax Credit until at least Feb. 15, 2020. Keep in mind it can still take a week to receive your refund after the IRS releases it. So some people who file early may experience delays while awaiting their refund. Refunds should be processed normally after this date.

Note: The IRS anticipates a slower tax season for the 2020 tax year due to the backlog of tax returns that were delayed due to the pandemic. There may also be some complications for those who did not initially qualify for the the 2020 economic stimulus payment, but may qualify for the payment based on a change of income in 2020.

The IRS recommends filing your tax return electronically for faster processing and tax refund payments.

Also note that new identity theft protections and anti-fraud measures may hold up some refunds, as some federal tax returns may be held for further review.

Read Also: How To Efile Just State Taxes

Federal Tax Refund Schedule

The answer to that depends on how you filed your tax return, and how you want to receive your refund. For federal tax refund, heres what you need to know:

- Electronically filed, direct deposit to bank: anywhere between 1-3 weeks

- Paper filed by mail, direct deposit to bank: 3 weeks

- Electronically filed, refund check sent through mail: anywhere between 6-8 weeks

- Paper filed by mail, refund check sent through mail: anywhere between 6-8 weeks

If youre wondering about specific dates, you should know that the IRS usually issues over 90% of tax returns within 21 days after tax returns have been processed.

As of writing, the IRS has yet to release an official tax refund calendar for this years tax season Still, we have got this estimate from WebCE based on the previous statements from the IRS over the past few years.;

How To Call The Irs If You’re Waiting On A Refund

It’s best to locate your tax transcript or try to track your refund using the Where’s My Refund tool . The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return.;

The IRS says not to call the agency because it has limited live assistance. The agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still try. Here’s the best number to call: 1-800-829-1040.;

Don’t Miss: What Do Tax Accountants Do

Some Tax Refunds May Be Delayed In 2021

In addition to the delays we outlined above, if you claimed the Earned Income Tax Credit and the Additional Child Tax Credit , your tax refund may also be delayed. If you claimed these credits, the IRS started to issue these tax refunds the first week of March if you claimed these credits.

Your financial institution may also play a role in when you receive your refund. Since some banks do not process financial transactions during the weekends or holidays, you may experience a delay in processing. If you opt to receive your tax refund by paper check, use our tax refund schedule to determine when you can expect to receive your refund.

Finally, you can expect your tax refund to be delayed if you filed an amended tax return. The IRS processes amended tax returns from three weeks up to 16 weeks after receipt. You can check the status of your amended tax return here.

Tax Refund Delay: The Latest On The Irs’ Backlog And How To Track Your Money

How long will it take the tax agency to get through its massive backlog? Here’s what we know.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.;

At the beginning of the month, the IRS announced it had 8.5 million unprocessed individual returns, including 2020 returns with errors and amended returns that require corrections or special handling. And refunds that usually take around 21 days to process are taking at least 120 days. Refund checks were expected to come this summer, but it’s nearly fall and the IRS hasn’t given an update to let taxpayers know when the money is coming.;

To add to that, the IRS has also been busy with stimulus checks, child tax credit payments and;refunds for tax overpayment;on unemployment benefits. The “plus-up” stimulus adjustments and the third advance monthly check of the child tax credit payment that went out today — could give families some financial relief, but an overdue tax refund would be an even bigger help.;

In most cases, taxpayers can only continue to practice patience — the tax agency isn’t easy to reach. The best solution is to track your refund online using the Where’s My Refund tool or check your IRS account. We’ll show you how. We can also tell you what to do if you received a “math-error notice” from the IRS. This story is updated frequently.;

Don’t Miss: What Tax Bracket Are You In

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long.;But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Where Is My Tax Refund Irs Has Backlog Of 85 Million Returns

This May 4, 2021, photo shows a sign outside the Internal Revenue Service building in Washington. AP

Millions of Americans are left waiting and wondering when they will see their tax refunds.

The wait may be a long one.

As of September, the Internal Revenue Service has a backlog of some 8.5 million individual tax returns due, in part, to a recent flood of math error notices from the IRS. CNBC reports the IRS has sent roughly 9 million such alerts from Jan. 1-July 15, an increase of 628.997 in the same period last year. The vast majority of these some 7.4 million were related to stimulus payments.

Why are returns delayed?

In a typical year, the IRS generally issues refunds in less than 21 days. According to its website, however, processing delays due to the COVID-19 pandemic means additional delays, particularly for people who submitted paper copies of their returns and e-filed 2020 tax returns that require review.

It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit, the IRS said.

In general returns will likely be delayed if it:

- Includes errors, such as incorrect Recovery Rebate Credit

- Is incomplete

Don’t Miss: When Does Income Tax Have To Be Filed

How To Get Your Tax Refund Faster

No matter how you plan on using your tax refund, youre probably anxious to receive it. Here are a few steps you can take to improve your chances of getting your tax refund quickly:

File early: In general, the sooner you file, the sooner you will get your refund. But returns claiming certain tax credits might not get processed any earlier than late February. Specifically, taxpayers taking advantage of the Earned Income Tax Credit and/or the Additional Child Tax Credit may have to go through this wait.

Check your return for errors or omissions: When the IRS needs to contact you for additional information, it slows down how quickly you receive your refund.

Opt to use e-file to have your refund directly deposited into your bank account: With direct deposit, it might take a few days for the refund to show up in your account, depending on your financial institution. If you prefer, you can even spread out your refund among two to three bank accounts, including an IRA. The paper return with a check is a much slower process, which can take up to four weeks.

Make sure your direct deposit account is in your name: The IRS can only deposit a check into an account in your name, your spouses name or a joint account. If your account has others named on it or is in someone elses name, the IRS will mail a paper check to you instead.

Responds: Why Have I Not Received My Federal Tax Refund Yet

PROVIDENCE, R.I. This year, the tax deadline was extended to May 17, but 12 News continues to hear from viewers who say they filed much earlier than that and still havent gotten the refund theyre owed.

The Internal Revenue Service says it still has 16.8 million unprocessed individual tax returns as of July 3.

U.S. Sen. Sheldon Whitehouse, who chairs the subcommittee on Taxation and IRS Oversight, says there are a number of reasons behind the backlog, including the reduction of in-person staffing at the IRS due to the pandemic and the mailing out of stimulus checks during tax season.

Im pushing for more funding for the IRS so that the agency has the resources to handle demands and prevent these kinds of delays, Whitehouse said in a statement to 12 News.

Several viewers have written into 12 Responds saying theyre still waiting on their federal returns, like one person who wrote: I e-filed and it is past the 21 days which they usually take to send out return. Why is there a holdup?

Melissa Travis, president and CEO of the Rhode Island Society of CPAs, passed along information from the office of the IRS Stakeholder Liaison team, which says while the IRS opens and processes tax returns in the order theyre received, there may be a delay if theres a mistake or suspected identity theft or fraud.

Also Check: How To Know If My Taxes Were Filed

A Shelby Township Man Wonders

James Hanlon filed his return in late March but he and his wife Janice continued to wait around the Fourth of July for what they thought would be a tax refund of around $4,800.

“My tax return has been in a black hole for three months now,” said Hanlon, who lives in Shelby Township.

Hanlon, 71, retired from a job as a retail help desk manager at Comerica Bank. He likes to problem solve and has prepared his own tax returns for years using TurboTax. He remembers one issue several years ago when he mistakenly missed reporting capital gains from a mutual fund. But otherwise, he said, everything has been fine working with tax software.

He isn’t sure what created the delay. But after hearing that the IRS had;issues relating to the Recovery Rebate Credit, he began to wonder;if that was the trouble spot.;

The Recovery Rebate Credit found on Line 30 of the 1040 form was brand-new on the 2020 income tax returns. The worksheet itself doesn’t use the words “stimulus payments” but that’s what the worksheet involves.;

The one-page worksheet has 21 lines and talks of EIP 1 and EIP 2 and says to put in a zero on some lines;if $2,400 was received for EIP 1 for a couple and $1,200 was received for EIP 2 for a couple. EIP stand for Economic Impact Payment.

The credit;was put on the tax return to enable people who didn’t get a first and second Economic Impact Payment, known as a stimulus. The credit also helps those who got less than the full amount owed to them;to now claim what they were owed.