How Long Does A Tax Rebate Take To Be Paid

Once your tax refund has been authorised, the length of time it takes for your HMRC repayment to be issued is normally relatively short, although exactly how long your tax rebate takes depends on how you are going to be paid:

- If you are being paid directly into your bank account or onto your credit or debit card this will usually be received within 5 working days.

- If you are expecting a cheque or âpayable orderâ you should receive this within 5 weeks.

- If you have received a P800 notice telling you that you are due a tax refund and that you can claim this online, then you will receive the money directly into your bank account within 5 working days of the claim being made. However if you do not claim online within 45 days, then you will receive a cheque within 60 days of the date on the P800.

- If you have received a P800 notice telling you that you will receive a cheque then this will arrive within 14 days of the date on the notice.

If you believe that you are owed a tax rebate, and especially if you claim is relatively complex, then we would recommend engaging the services of an accountant or specialist tax advisor to assist you in compiling your rebate request. As we have already stated wanting to know how long does a tax rebate tax is natural, but your case will be significantly expedited if your claim is fully complete and thus easier for HMRC to process.

Previous Changes To The Child Tax Credit

The;Tax Cuts and Jobs Act of 2017 brought some big changes to the U.S. tax code. These changes went into effect for the 2018 tax year and applied to 2020 taxes. This new tax plan;included the following changes to the CTC:

- The credit amount increased from $1,000 to $2,000.

- The CTC is refundable up to $1,400. It previously was not refundable.

- Children must have a Social Security number to qualify.

- The earned income threshold to qualify for the CTC is $2,500.

- The CTC phases out at an income level of $200,000 for single filers and $400,000 for joint filers. In 2017 the phase-out level was $75,000 for single filers and;$110,000 for joint filers.

- There is now a $500 credit available for each dependent older than 17.

Another big change was that the new tax plan largely combined the Additional Child Care Tax Credit with the CTC. This is part of the reason the CTC became refundable and its limits increased.

The American Rescue Plan, passed to help relieve the pressure from the COVID-19 economic crisis, expanded the CTC, making it worth $3,600 for children under 6 and $3,000 for children ages 6 to 17. It also removed the income floor and made the credit fully refundable and allowed for up to half of the credit to be available as a refund in advance, during the second half of 2021.

Why Does It Take This Long Will It Take To Get My Tax Refund

There are many reasons why there can be a delay in your tax refund. Firstly, check that all your documents were verified and have been properly uploaded. Secondly, keep in mind the eligibility criteria for the tax refund. It is important that you verify your income tax refund within 120 days. Any delay in the verification process can result in the delay of the tax refund.

If your income tax refund has been verified and you still havent received the refunds within the specific time then, here are a few reasons that might delay it:

In accordance to the Income Tax Department, the refund after processing of ITR gets reflected back in your bank account after 30-45 days from the date of e-verification of Income Tax Return. Filing the ITR manually or not filing the return may result in an error like No e-filing has been done . If the tax return is filed online it will not get get a refund. Before expecting the Tax refund keep in mind that filing tax return is the prerequisite step for getting a refund.

Also Check: Are Property Taxes Paid In Advance

What To Do While You Wait For Your Refund

Unfortunately, you wont be able to speed up your refund by calling and speaking with an IRS employee.The IRS says, Our phone and walk-in representatives can only research the status of your refund 21 days after you filed electronically; six weeks after you mailed your paper return. You can check the status of your refund from the Wheres My Refund page or download the IRS2Go app.

The IRS bottleneck may not get resolved soon. No one has control or the ability to jump the line Because there is no rhyme or reason to their processing order, Peeler says. We have had two related taxpayers that filed on the same day for the same refund amount and basically the same returns. Both received by the IRS on July 17, 2020 one was processed and the refund issued on March 8, 2021 and the other has yet to be processed.

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return.;We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.;

Tax refund offsets – applying all or part of your refund toward;eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills;and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies,;the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim,;and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to,;you’ll need call the agency that made the claim.;;

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Also Check: Can I Use Bank Statements As Receipts For Taxes

Wheres My State Tax Refund North Dakota

North Dakotas;Income Tax Refund Status page is the place to go to check on your tax refund. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. The refund status page also has;information on how the state handles refunds.

The state advises not to call unless you check your refund status and it says to call.

How To Claim Your Second Stimulus Payment On Your Tax Return

Despite initial delays, a majority of the $600 stimulus payments were issued to eligible Americans. As of Jan. 8, the IRS said it had issued over 100 million payments via direct deposit; an additional 8 million were issued by mail as a prepaid debit card and paper checks were mailed up to the deadline.

Still, many Americans will need to claim the Recovery Rebate Credit on their 2020 tax return to receive their payment. This applies to many people who see a Payment Status #2 Not Available message using the IRS Get My Payment tracker, non-filers, and those who didnt receive the full payment for which theyre eligible due to financial changes in 2020 .;

Your tax return is also an opportunity to claim any amount youre eligible for but didnt receive from the first round of $1,200 stimulus payments following the CARES Act last spring. The return will include a worksheet you can use to determine any amount youre eligible to claim using the Recovery Rebate Credit.

You May Like: How To Get Out Of Paying School Taxes

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund;on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct deposited or mailed your refund.

The turn around time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

How Long Does A Tax Refund Usually Take To Process

It is usually quite fast. And because most refunds come so fast, its not a good idea to visit a same day refund agent.

Electronic tax returns are the quickest, normally processed by the ATO within two weeks. Etax expects that most refunds will be out within 10 working days after lodgement of your tax return,;but some people will wait a bit longer for the ATO to get it done.

Paper returns are much slower, taking 10 weeks.

When you need your tax refund in a hurry and want to avoid ATO delays, make sure all your details are correct. Prepare your receipts early and only claim eligible tax deductions to avoid ATO complications that will slow down your refund.

Don’t Miss: Did The Tax Deadline Get Extended

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Wheres My Amended Refund

Mistakes on federal tax returns are normal and they can be fixed. When we are filing our tax returns each year, there is no guarantee that we will not make mistakes. After all, we are just humans. These mistakes may be in the form of mathematical errors. The IRS recognizes that this is normal and, as such, will usually correct them and provide you with a correspondence that indicates the changes made. However, there are situations where you may have unwittingly left out some incomes in your filing, or you made changes to your claimable credits and filing status, and you need to amend your return in order to avoid tax penalties.

An amended tax return is your chance to correct your mistakes; its sort of a second chance, your do-over, provided by the IRS via Form 1040X. Knowing that your amended tax return can take a long time, you usually dont get an immediate response. It takes too much boring and frustrating time waiting to know the status of your amended return, and even more frustrating is the fact that the IRS call center will not give you any additional information when your amended return is being processed, so not until it is completed. Generally, it can take up to 16 weeks from the day the IRS receives your amended return for it to be processed, and it may take 3 weeks from the day you mailed it for it to show up in the IRS system. This is why Wheres my Amended Return comes in handy.

Also Check: How Do I File Colorado State Taxes

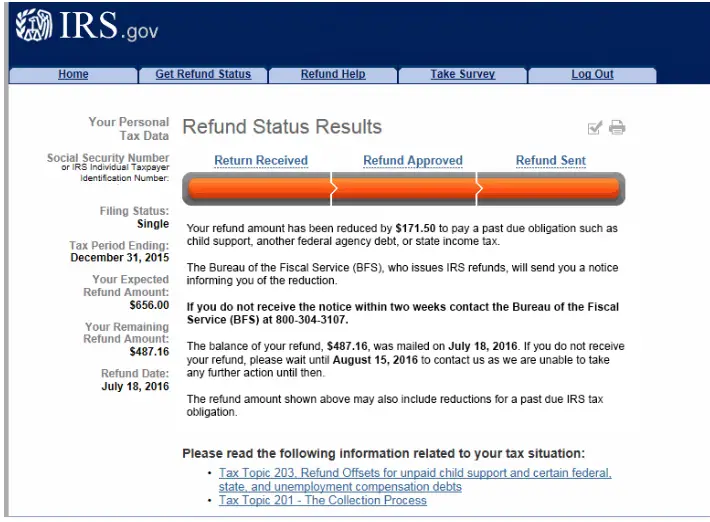

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund.;But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

When To Get Your Amended Tax Refund Back

After I am done with amending my tax return because I need to add my son as my dependent. I can see some estimated time frame for the tax refund. Below is a screen shot.

It tells you the estimated time frame is 8-20 weeks. If you choose to get your refund with direct deposit, it should be much faster and it guarantees the check wont be lost in the mail. Always save a copy for yourself to reference in the future just in case.

The other thing is its possible that you have to amend your tax return and you actually dont expect any refund. If thats the case, you still have to do it and always keep IRS informed and do the right thing. If you have to pay them more, then just brace yourself and do it.

Accuracy is a very important task because if the details are fudgy, it will take more time to get the amended Tax return back. The IRS service center might require all the documents which will be attached to the form for submission. Official would verify and scrutinize the documents individually to ensure that the tax returns are filled in a proper manner.

Number crunching plays a major role while evaluating the tax returns. Hence, a person should be vigilant in entering the correct figures because a slight mistake could lead to a delay in the return of the amended tax information. All the information such as salary and deductions should be double checked to ensure that data is authentic.

Don’t Miss: Who Needs To File Taxes

How Long Does It Take To Get Amended Tax Return Back

Update: One of our readers,Pete Lytle, mentioned that The IRS did not start processing amended returns until August 1st due to COVID-19. They received mine on March 16th. They said that the 16 week count down starts on August 1st. Which means I may have to wait until around Thanksgiving. Although the rep stated since mine was received in March, it should only take a few weeks. Now its near mid September and nothing. And my car has now been repossessed. Thanks IRS. Interesting note: during the shut down, the IRS collections department was open. I am hurt, pissed off and sad.

Recently, I filed my 1040X and I used TurboTax Online. I have to say, amending a tax return with TurboTax is really as easy as 1, 2, 3. I just logged into my account and clicked on Amend Your Tax Return for 2014 and it guided me through the process. My case was easy. My son was born in December of 2014. Because he was born overseas, it took a couple of months for him to receive his Social Security card. When I filed my tax return, I still hadnt receive his Social Security card, so I had to file it without adding him as my dependent. We finally received his card and I updated the 1040X form immediately, and I realized I can get about $1,500 dollars back because I am eligible for the Child Tax Credit, which is $1,000.

Receiving your amended tax returns back takes a long time. Usually, it takes about 3 weeks from the date you mailed the amended return for it to show up in the IRS system.

Should You Call The Irs

Expect delays if you mailed a paper return, had to respond to an IRS inquiry about your e-filed return, claimed an incorrect Recovery Rebate Credit amount or used 2019 income to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- “Where’s My Refund” tells you to contact the IRS

Do not file a second tax return.

Paycheck Checkup: you can use the IRS Tax Withholding Estimator;to help make sure your withholding is right for 2021.

You May Like: Where Can I Get My Taxes Done By Aarp

Analyzing Information On The Notice Of Assessment:

Until you get the tax refund, you should carefully review your benefits, credits and carryforwards listed on your Notice of Assessment. ;Your benefits are based on your family income and information reported on your tax return. Tax credits are based on how much you have contributed in the RRSP contributions and withdrawals.

For example, if you have a Registered Retirement Savings Plan, the Notice of Assessment will be able to provide you with precise information about the maximum contributions that you can make towards the retirement savings plan in the following year. And in case if you took part in a Lifelong Learning Plan or Home Buyers Plan, but withdrew from the registered retirement plan, you can take a look at Notice of Assessment and understand when the future payments are due.

If you are still confused about any of the topics mentioned above, feel free to contact Taxants.ca. They will be able to help you with your questions and concerns about the Canadian tax filing rules and regulations.