What Percentage Should You Pay Yourself From Your Business

There is no standard formula to pay yourself as a business owner. A sole proprietor, partner, or an LLC owner can legally draw as much as he wants for the owners equity. However, the amount withdrawn must be reasonable and should consider all aspects of business finance. These include operating expenses, debts, taxes, business savings

How Llcs As A Pass

LLCs treated as pass-through businesses â disregarded entities, partnerships, and S corporations â pay tax through their owner or owners.

Let’s say you’re the only owner in an LLC that provides landscaping services. Last year, you had taxable income of $100,000, and you paid yourself $50,000.

As a disregarded entity, you report $100,000 of income to your self-employment tax software. Even though you only paid yourself $50,000, you’re responsible for paying tax on the business’s entire taxable income.

Multi-owner LLCs treated as a partnership pay tax similarly.

Four brothers agree to be equal members at LLC registration. The business has $500,000 in taxable income, and each got paid $75,000.

Taxed as a partnership, each brother reports one-quarter of business profits on his Form 1040. Each brother enters $125,000 of income on his Form 1040. Their $75,000 draws are irrelevant because they pay tax according to business earnings.

S corporations are taxed the same way in both examples, but the calculation of taxable income changes.

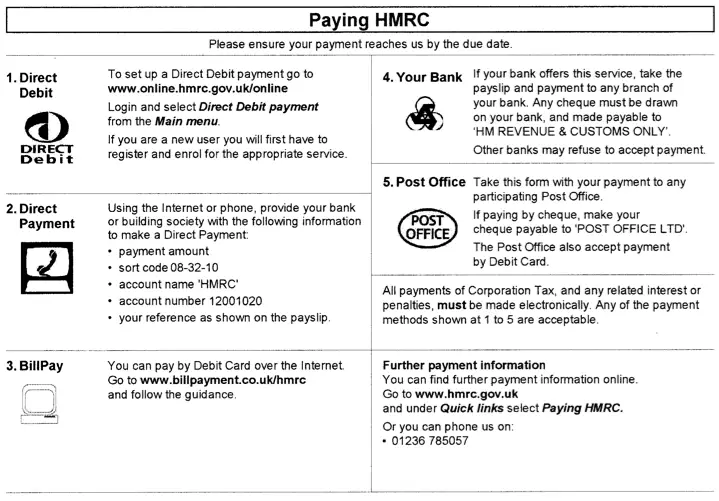

Submit Your Articles Of Organisation In Texas

You will certainly need to submit Articles of Organization in Texas to buy to form an LLC. Articles of Organization might be submitted online or by mail.

They consist of fundamental details about the Texas LLC consisting of the company name, company address, mailing address, registered representative name and address, the LLCs function, the efficient day of the LLC, as well as signature of a minimum of one specific functioning as an accredited representative.

As noted above, information required in the Articles of Organization covers fundamental details as it concerns the Texas LLC.

Don’t Miss: How To Buy Tax Lien Properties In California

Example : Foreign Fulfillment By Amazon Service Provider

A foreign entrepreneur sells products into the US market using Amazons Fulfillment by Amazon service. ;All marketing and procurement are managed online by the non-US citizen, who lives in Colombia. Products are ordered and shipped to Amazons warehouses, where Amazon employees package the products and ship to customers in the US.

In this case, Amazon is not a dependent agent but an independent agent that has its own business with millions of other clients. Amazon is not uniquely working for this foreign entrepreneur.

Even though Amazon is not a dependent agent, the Amazon seller may still engage in a US trade or business. If the seller doesnt manufacture the product, then the actual transaction, the transfer of ownership, takes place in the US. This means the seller may have to pay US income tax.

Again, the tax code and courts have been vague if this qualifies as ETOB. To mitigate the risk, setting up a C corporation would be a safer approach.

Faqs On Ohio Llc Business Taxes

Yes. Ohio does have a sales tax, which may vary among cities and counties. You can find more information above.

Yes. Ohio does have a general state income tax. You can find more information above.

Yes. In most cases you must pay estimated taxes on your Ohio tax, federal income tax and self-employment tax. Speak to your accountant for more information.

Read Also: Can You Refile Your Taxes

How Are Llcs Taxed

Because LLCs are a relatively new type of business entity, the Internal Revenue Service has not established a tax classification for them. Therefore, while there are forms and procedures for corporate tax returns, there is no such thing as an LLC tax return form.

That doesnt mean that limited liability company income isnt taxed. It just means that LLCs are taxed as though they were a different kind of entity.

If your LLC has only one owner , the IRS will automatically treat your LLC like a sole proprietorship. If your LLC has more than one member, the IRS automatically treats it like a general partnership.

However, if youd prefer to have your LLC taxed like a corporation, you can change its tax status by filing a form with the IRS.

How To Pay Yourself As A Default Llc

When your single-member LLC is taxed in the default way by the IRS, you can choose to pay yourself a distribution. The;distribution, or draw, then passes through to your individual tax return. This is known as pass-through taxation.

Pass-through taxation means the LLCs profit passes through to the member’s individual tax returns. This is the way the IRS taxes LLCs by default.;;

Pass-through taxation allows single-member LLCs to avoid double taxation. This means the IRS only taxes your business’s total profit one time.

How;Pass-Through Taxation Works For A SMLLC

Imagine your single-member LLC earns $6,000 in profits one year. You report these earnings on your personal tax return.;

From this $6,000 you decide to take $1,000 as a distribution. Because you already paid income tax on the whole $6,000 on your tax return, you dont have to pay any more income tax on your $1,000 distribution.

You will have to pay FICA self-employment tax on only the $1,000 distribution.

IMPORTANT:;The amount you pay yourself from your LLC can have serious implications. It is crucial that you keep enough funds in your business bank account to maintain your LLCs corporate veil. To learn more about this important topic, read our;Maintain Your LLC’s Corporate Veil;guide

When Is It Best To Choose Pass-Through Taxation?

Small businesses usually carry very little profit from one tax year to the next;because their owners;reinvest most;of the profit to help the business grow.;

Form An LLC

Recommended Reading: Can I File Old Taxes Online

How Does The Owners Draw Work

You can make business withdrawals through a cheque from your business bank account. Thus, you can pay for your expenses once the funds are deposited into your account.

This is unlike the case of an employee who is paid a salary via a payroll service that deducts employment taxes automatically.

Now, from an accounting perspective, withdrawing funds from your business reduces your capital account. This is because you are taking out funds from the owners equity.

Owners equity is nothing but the amount of money you have invested in the business. Hence, whenever you withdraw money, you tend to lower the amount of the owners equity.

This can be explained with the help of the following balance sheet equation:

Assets = Liabilities + Owners Equity

Salary Or Draw: How To Pay Yourself As A Business Owner Or Llc

The most compelling aspect of running your business is that you get to pay yourself as a business owner. Unlike a corporate business structure, you are not dependent on others to either run the show or pay you for your efforts.

This means that you have the flexibility to decide how much you earn as a business owner, how much effort you put in, and thus earn the rewards of the efforts made.

There are many advantages to running your own business. Still, the major contention you face is how to pay yourself as a business owner?

The way you pay yourself as a business owner depends upon the type of business structure you choose. You receive a draw if you are a sole proprietor. Likewise, you distribute profits or losses based on the percentage mentioned in your partnership agreement if you run a partnership firm.

Similarly, single-member LLCs are like sole proprietors and draw funds from businesses. However, multi-member LLC is treated like a partnership firm where profits and losses are distributed among members.

In this article, we will discuss how to pay yourself as a business owner, that is, pay yourself from a sole proprietorship, partnership, and Limited Liability Company .

You May Like: How To Appeal Property Taxes Cook County

Requirements For Llcs Treated As Sole Proprietorships

LLCs taxed as sole proprietorships dont have to file an annual federal business tax return in years of no business activity. Only single-member LLCs LLCs with one owner can be taxed as sole proprietorships.

Single-member LLCs are pass-through entities that report business activity on the owners personal return. Unlike C corporations, pass-through entities arent subject to a uniform small business tax rate. Pass-through businesses are taxed at their owners individual tax rates.

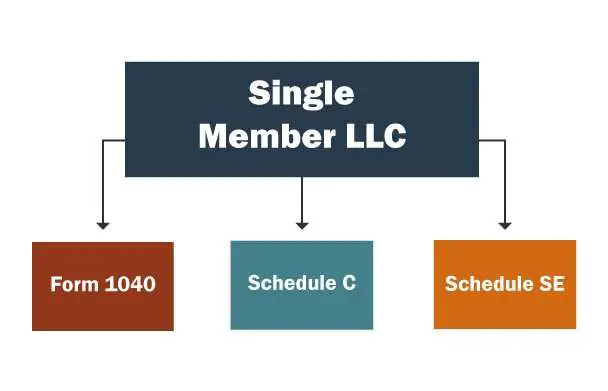

Your single-member LLC files Form 1040 Schedule C to detail business revenue, deductions, and credits to the IRS. Since LLCs taxed as sole proprietorships dont file a separate business tax return, theyre called disregarded entities, which are inseparable from their owners for tax purposes.

You dont have to file Schedule C for your single-member LLC when your company brings in less than $400 for the year. I still recommend attaching Schedule C whenever there is any business activity, though, even if its less than the required amount.

How To Write Off Llc Business Expenses And Deductions

In general, LLCs of any tax designation write off expenses and deductions just as other small businesses. Check out our guides to small business tax deductions.

Where LLC tax classifications diverge is the owner’s income from the business.

S corporation owners who actively participate in the business are employees, which means they must be put on the payroll and paid a salary or wage, which is subject to payroll taxes like Medicare, Social Security, and FUTA taxes.

What’s special about S corporations? Any leftover earnings are considered distributions that are not subject to payroll taxes.

But, don’t try to fool the system by making your business an S corporation and only paying yourself in distributions to avoid employment taxes: IRS Publication 535 requires that you pay yourself a “reasonable” salary.

Owners of other pass-through businesses â disregarded entities and partnerships â aren’t considered employees, and they’re required to pay self-employment taxes on their share of the LLC’s earnings, even if they didn’t remove the money from their business’s account.

Let’s look at a few examples.

Consider an LLC with two equal members and $500,000 in income.

| LLC Taxed as… |

|---|

| Amount not subject to payroll tax | $0 | $0 |

The S corporation tax classification benefits businesses that earn significantly more than their owners’ salaries. Businesses that are closer to the break-even point are better off sticking with the standard LLC tax designation.

Also Check: How To Calculate Net Income After Taxes

The Complete Guide To How Llc Taxes Work

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Taxes are a pain. This burden can feel like its amplified when you form an LLC.

Fortunately, this in-depth guide will explain everything you know about how LLC taxes work, including tips and strategies for LLC taxes.

Paying Yourself From A Corporate Llc

After that salary, they may take an extra percentage of the corporationâs income in the form of dividends. How much they take in dividends is laid out in the articles of incorporation.

As an employee of your corporation, your income tax and payroll tax are automatically withheld from your earnings.

Keep in mind that C corporations are double taxed. Meaning, the IRS charges your corporation income tax. Then, everyone who earns wages or dividends from the corporation pays personal income tax on their earnings.

One benefit of dividends: Theyâre exempt from payroll tax. So, the more of your income you receive as dividends, the less tax you need to pay. That being said, the IRS expects you to pay yourself âreasonable compensation.â

You May Like: Did The Tax Deadline Get Extended

How Are Llcs Classified For Tax Purposes

Heres how LLCs are classified by the Internal Revenue Service for federal income tax purposes:

1. An LLC with one member is classified as a sole proprietorship. A lone limited liability company member will file a 1040 return and report losses and profits on a Schedule C.

2. An LLC with multiple members is classified as a partnership unless the LLC chooses to be treated as a corporation. Like any partnership, the LLC must submit Form 1065 and a Schedule K-1.

A limited liability company must report losses and profits that pass to members on Schedule K-1 forms. Every member then reports that information on a 1040 form and attaches a Schedule E.

How Much Does An Llc Get Taxed

LLCs are taxed based on the owners tax bracket and the method of filing .; Sole Proprietorships are taxed at the standard Federal/State/Local rate plus total Self-Employment Taxes minus any deductions from the Jobs Act.; S-Corps are taxed at Federal/State/Local rate plus total Self-Employment Taxes for reasonable wages paid to the owner, and Federal/State/Local without Self-Employment Taxes for distributions.; Partnerships are taxed at Federal/State/Local rate plus total Self-Employment Taxes at the appropriate rates for each member of the multi-member LLC.; C-Corps are taxed initially on profits and then again when paying out to ownership members at Federal/State/Local rate plus total Self-Employment Taxes.

Read Also: Do You Have To Claim Social Security On Taxes

Paying Income Taxes As A Partnership

If a multi-member LLC does not elect to be taxed as a corporation or s-corporation, by default the IRS will treat the LLC as a partnership. Profits and losses of the LLC will be allocated among the members based on the LLCs operating agreement and reported on the members tax returns. The LLC does not pay income taxes on the profits earned by the company. The LLC reports profit allocations and distributions to each member on a form K-1. The members report company profits on Schedule E of their personal income tax returns. Members pay income tax based on their allocation of profits even if the LLC retains all or a portion of the money in the LLCs accounts.

Llcs Taxed As Sole Proprietorships

If youre operating your business as a single-member LLC, the default federal tax treatment is sole proprietorship.;;

If youve been working as a sole proprietor prior to establishing your LLC, youll already be familiar with these tax rules.;

When youre taxed like a sole proprietor, you and your business are considered one and the same for tax purposes.;;

The good news is that your LLC doesnt pay taxes or file federal tax returns.;Instead, you report the income you earn or the losses you incur from your LLC on your personal tax return .;

If you earn a profit from your LLC, that money is added to any other income that youve earned.;;This includes interest income or your spouses income if youre married and filing jointly.;;The total amount earned is then taxed.;;

Although youre taxed on your total income, the IRS still wants to know about the profitability of your LLC.;;

To show whether you have a profit or loss from your LLC, you must file IRS Schedule C, Profit or Loss from Business with your tax return.;Here, youll list all of your business income and deductible expenses.

Also Check: How Much Tax Do You Have To Pay On Stocks

How To File Llc Taxes In Florida

- Business Law

Its tax season again. If you are the owner of a limited liability company in Florida, how will you file your income taxes? Keep reading, and youll learn what you will need to know.

When entrepreneurs start up businesses, many favor LLCs because they are easier to operate than corporations. In fact, more than a million LLCs are now registered in the state of Florida.

If youre an owner, it is imperative to understand how a limited liability company is structured according to tax law. A limited liability company is considered a pass-through tax entity.

Do You Have To Pay Llc Taxes If You Made No Money

It depends. If your LLC did not make a profit, you will likely not have to pay income taxes, but you may still be required to file a tax return or pay local property taxes for equipment you own and payroll taxes for employees.;

Whether or not you have to file taxes for an LLC with no income largely depends on how the LLC is taxed and whether your LLC had no activity or it just didn’t make a profit.;

Zimmelman listed the following guidelines for LLCs that did not make a profit:;

- LLC filing as a sole proprietorship:;You don’t need to file if there are no business expenses or income. You still need to file your personal tax return, but you don’t need to include the LLC’s info on your Schedule C if there has been no activity.

- LLC filing as a partnership:;You don’t need to submit a partnership return if there are no business expenses to deduct or income.

- LLC filing as a corporation:;File a federal return every year, even if there was no income and no business activity.;

“If your LLC had business activity for the year, you should still include the LLC information on your tax return, even if you didn’t earn a net profit,” said Zimmelman. “You can deduct business expenses, but the IRS only lets you claim losses on your business for three out of five years. After that, they may reclassify your business as a hobby, which means you can no longer claim business expenses.”

Recommended Reading: Should I Charge Tax On Shopify

Limited Liability Companies And Limited Liability Partnerships

A limited liability company is an unincorporated organization, with one or more members, each having limited liability for the contractual obligations and other liabilities of the company, other than a partnership or trust, that is formed for any lawful business purpose under the Limited Liability Company Law of New York State or under the laws of;any other jurisdiction.

A limited liability partnership is a partnership whose partners are authorized to;provide professional services and that;has registered as a limited liability partnership under Article 8-B of the Partnership Law of New York State or under the laws of another jurisdiction.