Does Every Business Need A Tax Id Number

If your small business does not need any of the tax accounts listed above , then your small business doesn’t require a Business Number.

For businesses, the CRA’s small supplier definition states that to qualify as a small supplier, your total taxable revenues from all your businesses are $30,000 or less in the last four consecutive calendar quarters and in any single calendar quarter.

How Do I Get A Tax Id

Your tax ID will automatically be issued to you the first time you register in Germany. Everyone who is planning on working in Germany or staying longer than three months;needs to register their address at their local citizens office within 14 days of arrival.

To register and receive your tax ID, you will need to provide a valid form of identification, such as a passport or identity card along with a proof of residence certificate . Once you have successfully registered and received your registration certificate , your tax ID will be sent to you in the post. It usually takes two to three weeks.

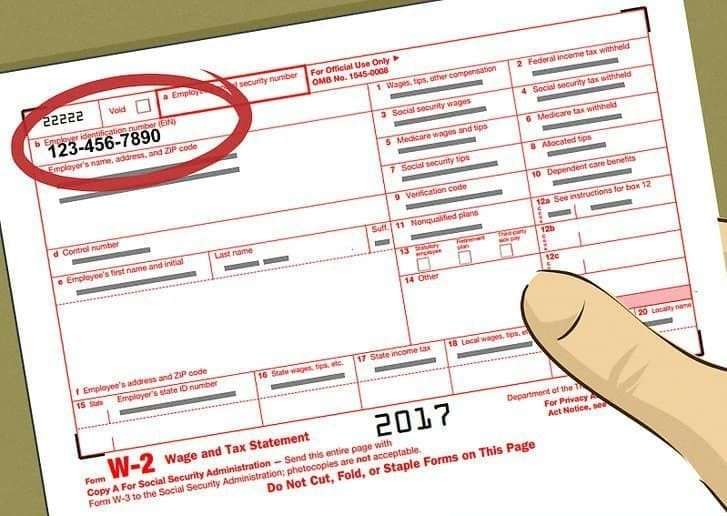

What Is The Employer Identification Number

EINs, also known as an Employer Identification Number or a Federal Tax Identification Number, is a nine-digit number. It is used by employers, sole proprietors, small businesses, corporations, LLCs, partnerships, non-profit associations, trusts, estates of decedents, government agencies, self-employed individuals, and other business entities.

You can obtain an EIN by using a Form SS-4.

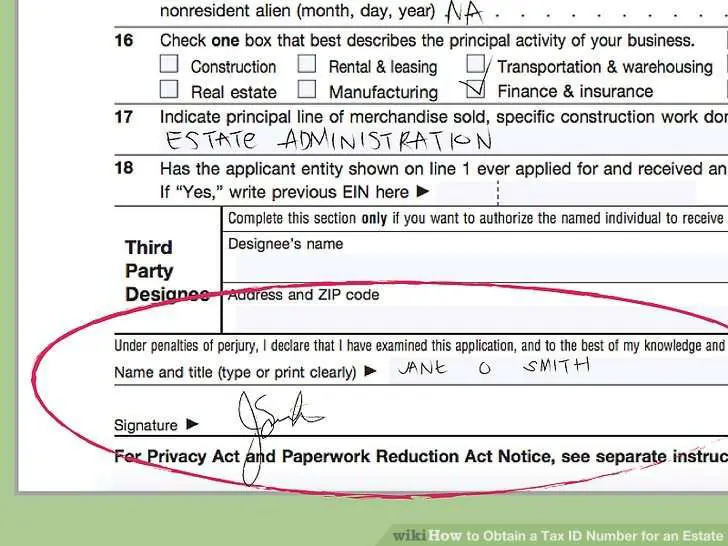

Since filing for taxes can be challenging, it is fairly common to ask for help from a third party. Many agencies and organizations are helping but since 2011, they need to have their own PTIN – Preparer Tax Identification Number. Every tax return or claim for refund filed by the paid tax preparer needs to include their PTIN. IRS is the only entity issuing these numbers, and you can apply online or by mail. In the case of a foreign tax preparer, who doesn’t have a Social Security Number, special rules apply.

Also Check: When Does Income Tax Have To Be Filed

What Is The Individual Taxpayer Identification Number

Individual Taxpayer Identification Number, or ITIN for short, is a tax processing number used by the IRS to aliens who may or may not have the right to work in the U.S., such as aliens on temporary visas and non-resident aliens. The ITIN is issued to persons who are required to have a U.S. taxpayer identification number but don’t have one or aren’t eligible to obtain an SSN. Often people who arenât U.S. citizens need this identification number to open a bank account.

When Does A Sole Proprietorship Need An Ein

A sole proprietor normally uses their own personal social security number for their business but even they must obtain an EIN to hire employees or files excise taxes. Learn more in our Does a Sole Proprietor Need an EIN guide.

Single-member LLCs should also generally obtain an EIN number and operate using their EIN number in order to maintain their corporate veil.

You May Like: Do I Pay Taxes On Stimulus Check

Filing For Tax Exempt Status

Its best to be sure your organization is formed legally before you apply for an EIN. Nearly all organizations are subject to automatic revocation of their tax-exempt status if they fail to file a required return or notice for three consecutive years. When you apply for an EIN, we presume youre legally formed and the clock starts running on this three-year period.

Under Which Circumstances A Tax Identification Number May Not Be Issued

The allocation of TINs does not automatically apply to all UK residents and nationals. UK-based individuals who will not be issued with a TIN include those who are not liable to pay tax or National Insurance in the UK, such as people under the age of 16 and those who dont have the right to work in the UK.;

We can help

Learning about tax identification numbers in the UK is just one aspect of running a business. Stay on top of the most important aspects by partnering with a payment platform like GoCardless. We make generating income through sales as simple as possible and this includes the more complex aspects such as dealing with ad hoc payments or recurring payments.

GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today.

Don’t Miss: Do You Have To Report Roth Ira On Taxes

How Can I Find My Tin Online

The agency that issues your TIN provides you with an official document with your unique identifier. Because it is a sensitive piece of information, you can’t go online to retrieve it. If you can’t remember or lose your documents, you should contact the issuing agency, such as the SSA, to get your TIN again.

Ein Lookup: Finding Your Ein Is Simple And Easy

How do I find my EIN number?! Its so hard!

It can be frustrating to attempt to open a new business account or apply for financing, be asked for your EIN, and proceed to find out that youve lost it and all relevant paperwork with your EIN or Tax ID number on it .

However, there are several simple and easy ways to obtain your EIN even if you dont have a single tax return or your confirmation letter.

If you cant find your EIN or Tax ID number, look around for your confirmation letter, and if you cant find it, look through your relevant tax and business documents. If that doesnt work, simply give the IRS a call and provide the necessary information.

No matter what, obtaining your EIN should be easy. So, if youve lost it, and not having it is holding you back from moving forward with something important, dont sweat it.

Also Check: How Much Time To File Taxes

Replace Your Social Security Card

If you go to your local Social Security Administration office, you can leave with a new social security card in hand. Be sure to take the appropriate documents to prove your identity: drivers license and birth certificate or passport ; legal immigration documents and work eligibility documents . If you dont need your SSN immediately, you can now request a replacement social security card online at the SSA.gov website by completing the security steps to set up a My Social Security account.

Does My Business Need An Ein

Businesses of all types are allowed to apply for an EIN. However, the IRS requires certain businesses to have one. If you answer yes to any of the following, you’ll need an EIN:

- Does your business have employees?

- Does your business file employment or excise taxes?

- Is your business taxed as a partnership or corporation?

- Does your business withhold taxes on non-wage income paid to a nonresident alien?

- Do you have a Keogh plan?

Even if your business is a sole proprietorship or LLC with no employees, its still beneficial to get an EIN. It makes it easier to keep your personal and business taxes separate, and it may be required to open a business bank account or apply for business licenses. If you don’t have an EIN, you’ll need to use your personal SSN for various tax documents.

Keep in mind that those with an SSN, an individual tax identification number , or an existing EIN may apply for an EIN.

You May Like: Can You Change Your Taxes After Filing

The Social Security Number Verification Service

The Social Security Number Verification Service is a service offered by SSAs Business Services Online . It allows registered users to verify the names and Social Security Numbers of employees against SSA records before preparing and filing Forms W-2. By verifying that the names and SSNs on the Forms W-2 match SSAs records, an employer may avoid additional processing costs, reduce the number of Forms W-2c that need to be filed, and help ensure proper credit to employees earnings records.;

There are two Internet verification options to verify that employee names and SSNs match SSA records:

SSNVS is to be used solely to ensure records of current employees or former employees are correct for the purpose of completing Form W-2.;

Search Business Records For Your Ein

Locating the EIN for your company should be much easier, as this number is often included on numerous types of company documents, including tax records, invoices, contracts, charitable donation letters, legal documents and more. Additionally, look for the official letter the IRS sent to your company when approving your EIN. You can also call the IRS to request the information, but you must be able to prove you are a person authorized to receive the information partner, corporate officer, trustee, executor, etc.

If your company is a publicly traded company, many online services maintain databases of EINs that are accessible to the public and most dont charge for the service. For example, the Electronic Data Gathering Analysis and Retrieval system is maintained by the Securities and Exchange Commission and contains publicly disclosed information about thousands of companies. Additionally, Melissa Data provides tax ID information for nonprofit organizations.

Don’t Miss: How To See My Past Tax Returns

Individual Taxpayer Identification Number

The IRS issues the Individual Taxpayer Identification Number to certain nonresident and resident aliens, their spouses, and their dependents when ineligible for SSNs. Arranged in the same format as an SSN , the ITIN begins with a 9. To get an individual tax id number, the applicant must complete Form W-7 and submit documents supporting his or her resident status. Certain agenciesincluding colleges, banks, and accounting firmsoften help applicants obtain their ITIN.

What Is A Tax Identification Number

A Tax Identification Number is a nine-digit number used as a tracking number by the Internal Revenue Service . It;is required information on all tax returns filed with the IRS.;All U.S. tax identification numbers or tax I.D. numbers are issued directly by the IRS except Social Security numbers , which are issued by the Social Security Administration .;Foreign tax identifying numbers are also not issued by the IRS; rather, they are issued by the country in which the non-U.S. taxpayer pays taxes.

Read Also: How Does The Irs Tax Bitcoin

What Is My Tin Finding Out Your Own Tax Number

The IRS have to process huge amounts of data from millions of different US citizens. Organizing this is a real challenge, not only because of the sheer volume of data to be processed, but also because identifying people can be quite tricky without the right system. For example, according to the Whitepages name William Smith has over 1,000 entries in the State of Alabama alone. Across the USA this number increases, and the likelihood is that some of these individuals will have the same date of birth, for example, which is often used to identify people. This means that there needs to be another system for keeping track of individuals for tax purposes in the US other than just their names: A taxpayer identification number serves this purpose.

A Taxpayer Identification Number is often abbreviated to TIN and is used by the Internal Revenue Service to identify individuals efficiently. Where you get your TIN, how it is structured, and whether a TIN is the right form of identification for your purposes sometimes seems like it isnt as straightforward as it should be. However, this guide will look at exactly these issues which should show that finding out this information can be as easy as 1,2,3. In this article, we want to concentrate on the tax number that you as an employee will need for your income tax return or the number that you as an employer require for invoicing, and well explain exactly where you can get these numbers.

Contents

Minnesota Unemployment Insurance Employer Account Number

All business entities, other than sole proprietorships, single member limited liability companies, partnerships without employees or corporations and limited liability companies with no employees other than owner/officers with 25 percent or more ownership share, must register with the Department of Employment and Economic Development, Unemployment Insurance Program.

The Unemployment Insurance Program issues identification numbers that are different from those issued by the Minnesota Department of Revenue and the Internal Revenue Service. Register at Employers and Agents. Employers may contact the Unemployment Insurance Program at 651-296-6141, option 4. The UI Program requests that businesses not register for a UI Employer account number until wages have actually been paid.

Also Check: How To Know If My Taxes Were Filed

Finding The Id For Your Employer

Does My Business Need To Reapply For A New Ein

Sometimes, your business may need to reapply for a new EIN. Rather than amending your business’s existing EIN, the IRS requires you to re-apply for one. According to the IRS, here are the most common reasons:

- You change the structure of your business, like incorporating your sole proprietorship or turning your sole proprietorship into a partnership.

- You purchase or inherit an existing business.

- You created a trust with funds from an estate.

- You are subject to a bankruptcy proceeding.

If your circumstances require you to reapply for an EIN, the application process is the same as if youre applying for one for the first time.

Read Also: Where To Find Real Estate Taxes Paid

How To Find Your Lost Tax Id Number

Imagine you’re filling out a form when you suddenly realize that you forgot your tax ID number. First of all, don’t panic this kind of situation is more common than you think. Locating a forgotten or misplaced tax ID number is quite simple and should only take a few minutes. Chances are, you can find this information on previously filed tax returns, bank statements or pay stubs.

Tip

First, determine whether you need to find your Social Security Number , Employer Identification Number or Individual Taxpayer ID Number . Any of these numbers will be listed on your tax returns, but you may need to call the IRS or the Social Security Administration to ask for help.

What Is An Ein And How Can I Get One

An EIN serves as a unique identifier for your company and is largely used for tax purposes. The IRS requires any registered business that has employees or is a corporation or partnership to have one. Your EIN serves as the primary ID of a business to the government. It’s also commonly referred to as a “tax identification number ,” “95 number” or “federal tax ID.” It is often used for the following reasons:

- Business taxes

- Obtaining a business license

- Various business legal documents

Applying for an EIN is easy; it can be done online within minutes on the IRS website through form SS-4.

We recommend that businesses apply for an EIN as soon as possible because its crucial for basic business functions. You don’t need an EIN if you are the only employee, but if you’re looking to quickly scale your business, having an EIN early on is only beneficial.

Completing on online SS-4 is fastest, but you also have these options if youre based in a U.S. state or D.C.:

- Fax: 641-6935

- Mail: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

If you’re an international applicant and don’t have a legal residence in the U.S., you can apply for an EIN via one of these methods:

- Telephone: 941-1099

- Fax: 215-1627 if within the U.S., or 707-9471 if outside the U.S.

- Mail: Send your SS-4 form to: Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999

Also Check: How To Find Tax Lien Properties

Property Id Number Availability Exceptions

If you hit a snag when searching for a new property tax ID number, you may be unable to find it because your assessors office has not yet assigned it. Processing times vary, and some government offices may set aside the task of assigning new numbers for a month or two during tax preparation season or other high-volume workload times. Another reason for a delay in obtaining a new property tax ID number occurs when the owner of two or more contiguous parcels requests a single parcel number instead of multiple numbers for each property.

Existing property tax ID numbers may be changed from time to time because of lot line adjustments, property map page layouts and land divisions . Even if you call your tax assessors office for the latest property ID number for a particular parcel of land, the staff may not have this information yet.