Would I Be Able To Use An Itin To Open A Bank Account

Indeed, you will readily open a bank account with your ITIN and apply it to get a credit card!

Your ITIN can enable you to:

Open a U.S. bank account whether both personal and business

Open PayPal and Stripe account

File federal tax returns

Apply for unemployment

For the taxes, youll find 2-types of TaxIDs s:

1. EIN represents a tax I.D. number for a BUSINESS. EIN is essential to legally operated business in the U.S. also, EIN is essential to open a business bank account. The certified IRS accountants likewise assist you with getting your EIN.

1. ITIN represents a tax I.D. number for individual use if you do not have a Social Security Number .

If you want to get a verified ITIN for Non-US Citizen checkout Mollaeilaw, they have special offers and will help you get ITIN within few minutes.

You can as well place your order with them here ÍTIN APPLICATION FORM.

It is my belief that youve learned how to get ITIN for Non-US Citizen and suppose you need more clarification kindly dont hesitate to comment below.

Get your ITIN for Non-US Citizen Now ta a discounted price at Mollaeilaw

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What Does Itin Mean

ITIN is an acronym that stands for Individual Tax Identification Number.

Your Individual Tax Identification Number is a tax identification number used by the IRS. It makes it possible for someone who cant get an SSN to still file taxes.

ITIN is only used as a label by the federal government for filing taxes. It serves no other purposes and does not offer a person the same benefits an SSN does.

Also Check: Www Aztaxes Net

What Documents Are Required When Requesting An Itin Number For A Dependent Child

This allows the taxpayer to take advantage of an additional exemption but does not allow the taxpayer to qualify for EITC or the child tax credit. There is no age limit to this exemption, as long as the child is dependent. The following documents have been accepted for verification of identity, in addition to a birth certificate: school records , medical records , visas .

However, in recent years the criteria for a valid medical record have become stricter. Immunization records are not acceptable documents for ITIN.

How Do I Get An Itin For A Non Resident

An Individual Taxpayer Identification Number or ITIN must be used by non US residents who must report taxes on their business to the IRS. A W7 form is used for this purpose. You can also use the number if you are a non resident or are not eligible for a Social Security Number , but wish to build your credit. Use the number to apply for business credit cards, auto financing, and similar business funding with US banking institutions. Some banks will not accept ITINs, so you always need to check with the bank before you apply for a business loan.

Don’t Miss: Efstatus.taxact 2014

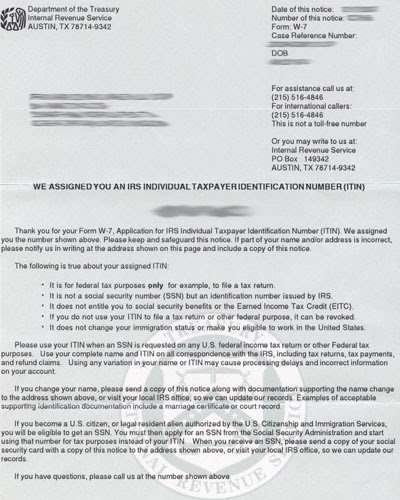

Will The Irs Return My Original Documents To Me How Long Will It Take To Get Them Back

Original documents will be returned to the address on record after processing your application. The IRS is currently processing Form W-7s within 11 weeks after receipt. We are taking every action to minimize delays, and we are processing requests in the order they were received. If you will need your original documents for any purpose within this processing timeframe, you may wish to apply in person at an IRS Taxpayer Assistance Center or CAA. You may also choose to submit certified copies from the issuing agency instead. Original documents you submit will be returned to you at the mailing address shown on your Form W-7. You dont need to provide a return envelope. Applicants are permitted to include a prepaid Express Mail or courier envelope for faster return delivery of their documents. The IRS will then return the documents in the envelope provided by the applicant.

What Addresses Must A Taxpayer Provide

Box 2 requests the taxpayers foreign address. The foreign address is only used for applicants who reside outside of the U.S., such as dependents.

However, in box 3 the taxpayer must list his/her local address, which is where the ITIN will be mailed. If the applicant lives in the U.S., then no foreign address is necessary.

Some advocates report problems with leaving the foreign address section blank even when they check that the taxpayer is a U.S. resident. If the taxpayer is in the United States, a U.S. address in box 2, and the name of the foreign city and country is sufficient for the foreign address.

If the taxpayer has a P.O. Box he/she can enter it in box 3, otherwise, box 3 can remain empty.

You May Like: Do I Pay Taxes On Plasma Donations

How Can I Get An Itin Number Quickly

According to the IRS, you have one of three options for quicker processing. These options are listed, as follows:

- Option One – You can mail a form W-7, tax return, and proof of identity along with foreign status paperwork to the IRS.

- Option Two – You can apply for the ITIN in person by going through an IRS-authorized agent certified to accept the application.

- Option Three – You can make an appointment with a representative at an IRS taxpayer assistance location.

Who Needs To Renew Their Itin

Two categories of ITINs expired on January 1, 2017:

- any ITIN not used to file a tax return for the last three years

- ITINs with middle digits 78 or 79

According to the IRS, the agency sent notification letters in August and September 2016 to all individuals whose ITINs had the middle digits 78 and 79 that were currently being used on a tax return, informing them that their ITIN would expire on January 1, 2017. Anybody who needs and wants an ITIN to file their taxes and whose ITIN expired on January 1, 2017, must apply to renew their ITIN.

Also Check: Efstatus Taxactcom

How Can You Apply For An Itin Number From Abroad

Individuals living across the pond from the United States can apply for an ITIN number by visiting a public accounting firm situated abroad. The public accounting firms are known as Authorized Acceptance Agents who you can visit to apply for an Individual Taxpayer Identification Number.

Another method you can use to apply for an Individual Taxpayer Identification Number is to send your application to the Internal Revenue Service by mail. The IRS will accept your Form W-7, only if you send original or certified copy of the documents issued by the agency along with it.

Volunteer Income Tax Assistance Program

VITA Programs are volunteer-run, community tax-assistance services. Visit the Central District VITA site for individual tax assistance. They are not trained for international students specifically, so make sure they know you are an international student and how to help Non-Resident taxes. They are volunteers, so they many not all be training in helping international students. VITA is hosted at UIW, Administrative Bldg., Room 62. SAT: 10 am – 12 pm

Read Also: Efstatus.taxact

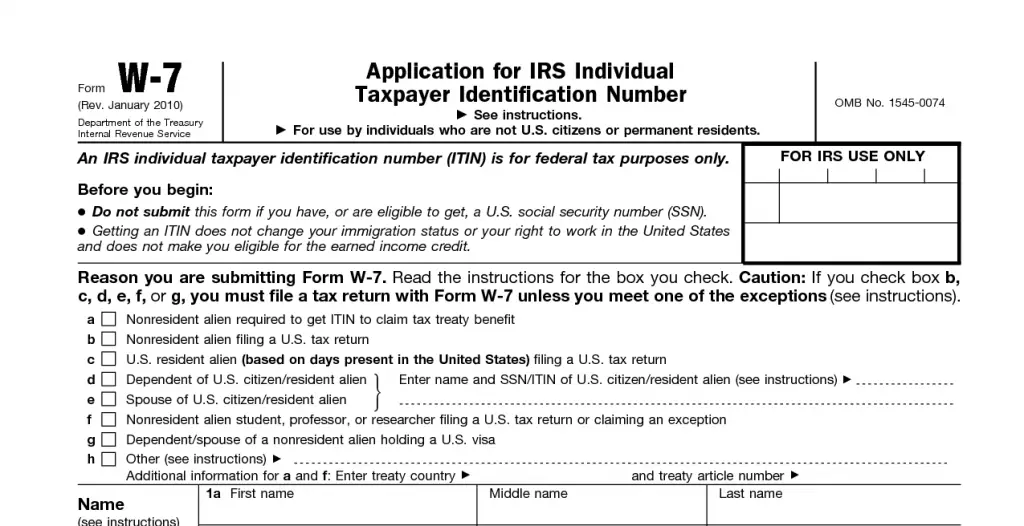

Fill Out The Itin Number Application Form

To start, you will use a Form W7 ITIN application:

ITIN Number Requirements

Before filling out your application, you must have at least one of the following ITIN Number requirements: identification card, drivers license from the US or your country of origin, passport, an official birth certificate for children under 18, ID Card of a US state, visa, American or foreign military card.

To apply for an ITIN number, you must fill out the W-7 form . Below, you have available both the English and Spanish versions. Or you can download it on the IRS Official Website too.

This ITIN application form is the first step to request an individual taxpayer identification number.

You must complete all the information requested in the form. If this is the first time you are requesting the ITIN, you must accompany this document with others who may specify the ITIN application form, depending on your case.

How Do I Get An Itin

You apply for an ITIN by submitting Form W-7 to the IRS. You can send your application by mail or schedule an in-person appointment to have someone assist you. Those instructions are found here.

The application requires basic information, such as name, mailing address, and birth date. You will also give the reason why you need an ITIN and some other information, like your U.S. visa number, if you have one.

Also Check: Www.1040paytax.com.

Who Needs An Itin Or Individual Tax Identification Number

OVERVIEW

The Individual Tax Identification Number, or ITIN, allows taxpayers who don’t have a Social Security Number to file income tax returns. Unlike other forms of ID, ITINs only have one purposetax filing and reporting. Having an ITIN number won’t make you eligible for benefits, such as Social Security or earned income credits that provide refunds to some low-income filers.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Avoid Concurrent Application For An Itin & An Ssn

Try not to apply for an ITIN if you vee applied for an SSN. According to U.S. law, a foreigner cant have both an ITIN and an SSN.

Provided you are qualified for an SSN and have presented an application for an SSN but yet get feedback, you need not bother applying for an ITIN. Your application for an ITIN will get dismissed should you apply.

Recommended Reading: How To Appeal Property Taxes In Cook County

Q: I Have A Social Security Number And No Longer Need My Itin That Will Be Expiring Do I Need To Renew My Itin

A20: No, you should not renew your ITIN if you have or are eligible for an SSN. Please notify us that you have obtained an SSN and no longer need the ITIN by visiting a local IRS office or writing a letter explaining that you have now been assigned an SSN and want your tax records combined. If you write a letter, include your complete name, mailing address, and ITIN along with a copy of your social security card and a copy of the CP 565, Notice of ITIN Assignment, if available. The IRS will void the ITIN so it cannot be used by anyone in the future and associate all prior tax information filed under the ITIN with the SSN. Send your letter to: Internal Revenue Service, Austin, TX 73301-0057.

Forms and Pubs

How To Get Itin Number For Undocumented Immigrants

First of all, immigration and taxes are completely separate.

We know people like to put them together, but they are very much separate. It has not just because you are illegal doesnt mean you cant apply for an ITIN and your status as an immigrant has nothing to do with your ITIN.

And it dictates how we felt the paperwork, but doesnt mean you cant get an ITIN. So they dont really go hand in hand and they are very much separate. But we always tell the individuals who reach out to you and they ask for consultations.

They say I report my income. I dont get any trouble.

So if illegal immigrants down the line want to hopefully get a green card or apply for citizenship etc.

One thing thats really important is youre an immigration attorney will tell you this is something called GMC, which is good moral character. And this is something that judges and immigration officers, they all look for.

And one of the things that they use to judge good moral character is, has this illegal immigrant been in this country on U.S. soil?

You know, had they been trying to comply with the requirements, the laws? And one of them is taxes.

Had they been reporting their income that theyve been making, had they been paying their taxes, filing their tax returns?

You know, this is one of the immigration officer love this judges love this. Its a really if you do this consistently, its really good for your case. So, yes, we always encourage illegal immigrants who come to us about this.

Don’t Miss: How To Do Taxes For Doordash

Why Did The Irs Change Itin Program Procedures

Section 203 of the Protecting Americans from Tax Hikes Act of 2015, Pub. L. 114-113, div. Q, enacted on December 18, 2015, modified section 6109 of the Internal Revenue Code, and in so doing, made significant changes to the Individual Taxpayer Identification Number program.

Also, please refer to ITIN Expiration Frequently Asked Questions.

What If I Dont Have An Immigration Status That Authorizes Me To Live In The Us

Many people who are not authorized to live in the United States worry that filing taxes increases their exposure to the government, fearing this could ultimately result in deportation. If you already have an ITIN, then the IRS has your information, unless you moved recently. You are not increasing your exposure by renewing an ITIN or filing taxes with an ITIN.

Current law generally prohibits the IRS from sharing tax return information with other agencies, with a few important exceptions. For instance, tax return information may in certain cases be shared with state agencies responsible for tax administration or with law enforcement agencies for investigation and prosecution of non-tax criminal laws. The protections against the disclosure of information are set in law so they cannot be rescinded by a presidential executive order or other administrative action unless Congress changes the law.

Knowing the potential risks and benefits involved, only proceed with an ITIN application or tax filing if you feel comfortable. This information does not constitute legal advice. Consult with an immigration attorney if you have any concerns.

Recommended Reading: Doordash Accounting Method

How To Check Itin Status

If you are applying for an ITIN on your own, then there is no official way for you to be able to check on the applications ITIN status.

However, if you are applying for your ITIN through an IRS Certifying Acceptance Agent, then your agent has a direct phone line with the IRS ITIN Department in which they can contact to check for an update in regards to your ITIN application.

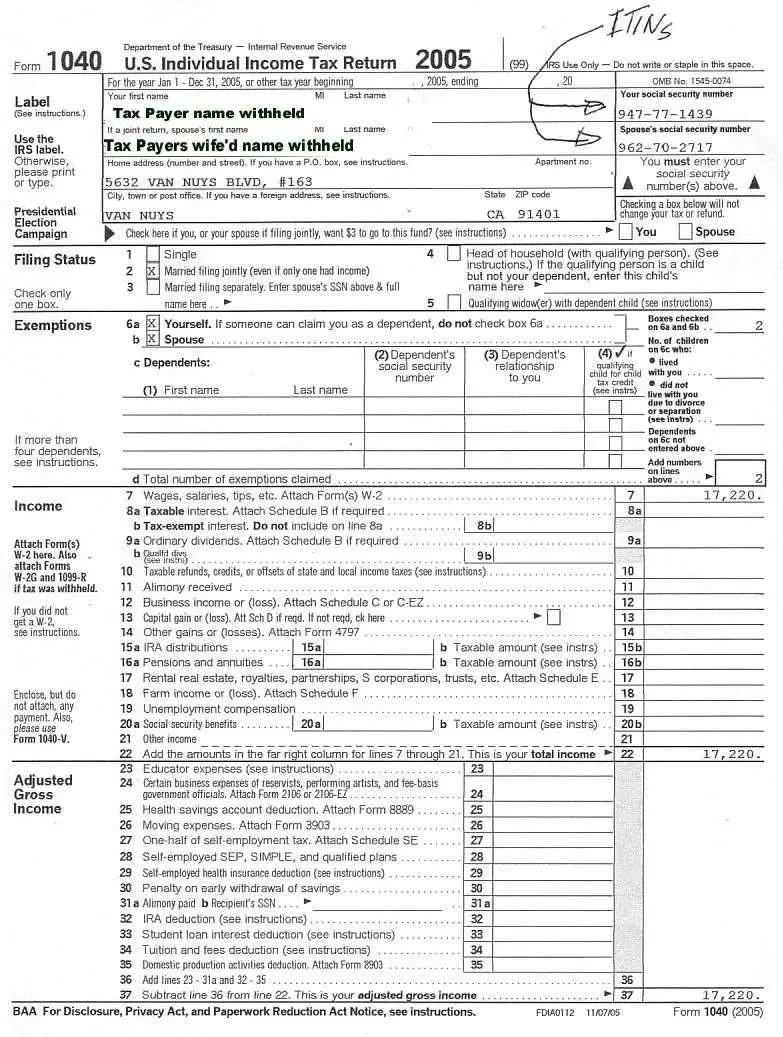

My Wife Does Not Have Ssn Or Itin How Should I File My Tax Return

Here is some information that should help. You may have to take some additional steps to be able to e-file.

You might need to apply for an ITIN for him. Per IRS, if your spouse is a nonresident alien, he must have either an SSN or ITIN if :

1. You file a joint return or

2. You file a separate return and claim an exemption for your spouse, or

3. Your spouse is filing a separate return.

For filing status, you can file either Married Filing Jointly or simply Married Filing Separate.

If you want to file Married Filing Separate, you can qualify for an exemption for your spouse only if:

– Your spouse had no gross income.

— Your spouse won’t file a tax return.

– Your spouse didn’t qualify as the dependent of another taxpayer.

Additionally, you cannot e-file a tax return which does not include a SSN or ITIN. If you fall under one of the above conditions, you will have to manually apply for an Individual Taxpayer Identification Number ITIN on Form W-7 for him.

You May Like: Do I Have To Claim Plasma Donations On My Taxes

Can You Get An Itin Without Filing A Tax Return

One route for example, to obtaining an ITIN without having to file a tax return is to open an interest-bearing bank account.

Under section 326 of the Patriot Act, financial institutions are required to open accounts if an application for an ID number is pending.

The taxpayer will have to submit with their ITIN application a signed letter from the bank on their official company letterhead stating that they have opened an interest-bearing account and will have it open pending they receive an ITIN.

The document should also include the account number of the client. The taxpayer should keep a copy of the letter filed with the ITIN application for their records.

How Do I File Taxes With An Itin

Filing taxes can serve as proof of good moral character in immigration cases. Filing taxes could be helpful for your immigration case if you are able to adjust your status in the future.

To file a tax return, you must enter your ITIN in the space for the SSN on the tax form, complete the rest of the return, and submit the tax return to the IRS.

Also Check: How Much Should I Set Aside For Taxes Doordash

How To Get An Itin Number For F2

To apply for an ITIN for an F2 visa, you simply fill out Form W7 with the IRS or hire a business lawyer to fill it out on your behalf. Your business lawyer will also be able to guide you about how to get an ITIN number.

Your F2 visa wont impact your ability to get an ITIN number, neither positively or negatively.