How Do I Find How Much Property Tax I Paid

Where do I find my property taxes?

- Required Information for a Search. All you need to perform a property tax search is the physical address of the property. Homeowners should obviously have this information, and investors can get it by driving past a property or looking at any number of online websites such as Zillow, Realtor.com or Redfin.

Keeping Track Of Payments

If you have mortgage payments, you must remember to keep track of property tax payments. You should receive a notice from your mortgage company indicating that they are requesting an amount to be paid for taxes. You can also check the treasurers website to determine whether your mortgage company will pay the taxes for you. The website is updated nightly, so you will be able to see which payments are posted on a daily basis.

Pennsylvania Property Tax Rates

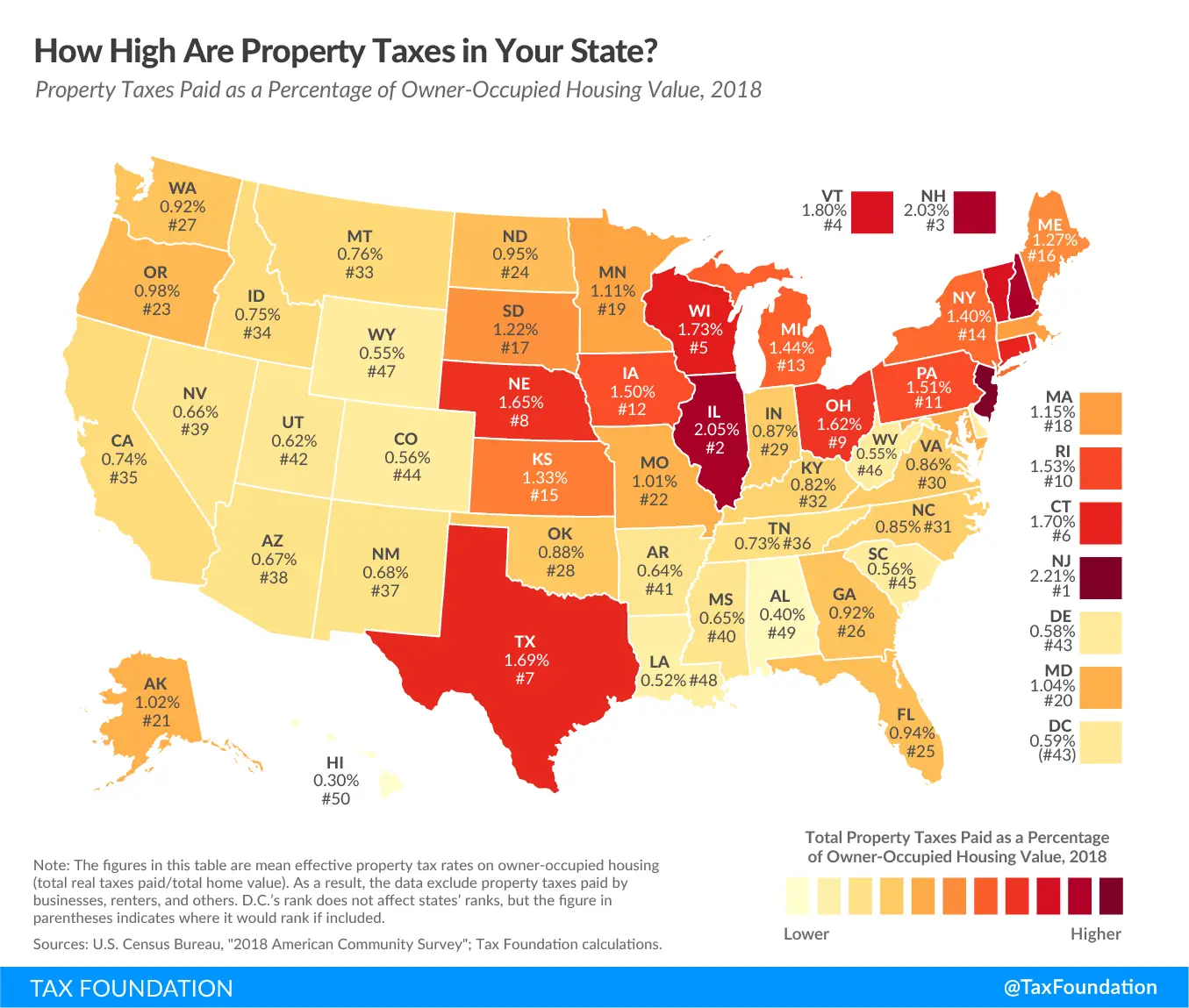

Property taxes are collected on a county level, and each county in Pennsylvania has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in Pennsylvania.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across Pennsylvania. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in Pennsylvania.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the Pennsylvania property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free Pennsylvania Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Pennsylvania.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

Keep in mind that assessments are done on a property-by-property basis, and our calculators cannot take into account any specific features of your property that could result in property taxes that deviate from the average in your area.

Recommended Reading: What Is The Date To Pay Taxes

Pay Property Taxes Indiana

Property taxes in Indiana are imposed by the state government and are used to fund public services such as education, infrastructure, and public safety. The tax rate is set by the legislature and varies by county. The average effective tax rate in Indiana is 1.07%, which means that the average homeowner pays $1,070 in property taxes annually.

Sales Tax Calculator And De

This calculator requires the use of Javascript enabled and capable browsers. There are two scripts in this calculator. The first script calculates the sales tax of an item or group of items, then displays the tax in raw and rounded forms and the total sales price, including tax. You may change the default values if you desire. Enter the total amount that you wish to have calculated in order to determine tax on the sale. Enter the sales tax percentage. For instance, in Palm Springs, California, the total sales tax percentage, including state, county and local taxes, is 7 and 3/4 percent. That entry would be .0775 for the percentage. The second script is the reverse of the first. If you know the total sales price, and the sales tax percentage, it will calculate the base price before taxes and the amount of sales tax that was in the total price. This is particularly useful if you sell merchandise on a tax included basis, and then must determine how much tax was involved in order to pay your sales tax, this is the ideal tool. Several state tax agencies actually suggest our calculator to merchants that could use it in that manner.If you need to calculate the sales tax percentage and you know the sales amount and the tax amount, use our Sales Tax Percentage Calculator. CALCULATE SALES TAX

Recommended Reading: Do You Pay Taxes On Coinbase

How Do Property Taxes Work

State, county and local governments rely on tax funds to pay for services like schools, road maintenance and police and fire, among many other services. Depending on where you live, you may receive tax bills from the county, city and school district, but most areas provide one superbill for you to pay.

Every homeowner pays taxes based on their homes value and the property tax rates for the county or city. Most areas charge property taxes semiannually, and you pay them in arrears. For example, in 2021, youd pay the property taxes for 2020.

Treasury Services Are Currently Available Online By Phone Email Or Us Mail:

- Phone: Real Property Tax 206-263-2890

- Real Property Email:

- Phone: Mobile Homes and Personal Property Commercial Property Tax 206-263-2844

- Personal Property Email:

- Mail: King County Treasury Operations, 201 S. Jackson Street, Suite 710, Seattle, WA 98104 NOTE NEW MAILING ADDRESS

- Secure drop box: on side of 2nd Ave nearer to S Jackson St.

I know my parcel/account number

Need additional information? Check our Frequently Asked Questions .

Also Check: How Much Tax Do You Have To Pay On Stocks

Installment Payment Plan Dates

The first and second installments are based on ¼ of the previous years taxes. The third and four installments are ½ of the remaining actual tax liability for the current year.

- 1st Installment ¼ of the total estimated taxes discounted at 6%. Payment is due June 30

- 2nd Installment ¼ of the total estimated taxes discounted at 4.5%. Payment is due September 30.

- 3rd Installment ¼ of the total estimated taxes plus ½ of the adjustment for actual tax liability discounted at 3%. Payment is due December 31st.

- 4th Installment ¼ of the total estimated taxes plus ½ of the adjustment for actual tax liability. Payment is due March 31st.

Delinquent installment payments must be paid in full with the next installment payment. Unpaid installments are delinquent on April 1 and are subject to the same rules that apply to delinquent taxes.

If a taxpayer chooses to discontinue participation, they will not be entitled to receive the discounts provided by law. For more information, contact the Property Tax Department by phone at .

How Do I Pay My Pimpri Chinchwad Property Taxes Online

Steps to Pay PCMC Property Tax Online 2022

How can I check my property tax online PUNE?

How to Check Pune Property Tax Online

Don’t Miss: Can I Get Tax Credit For Leasing Solar Panels

General Questions About Property Taxes

In order for the amount of your taxes to be determined, the County Assessor must first assess the value of your property as of January 1. Generally, the assessed value is the cash or market value at the time of purchase. This value increases not more than 2% per year until the property is sold or any new construction is completed, at which time it must be reassessed.

For more information on how the assessed value is determined, see the County Assessors website.

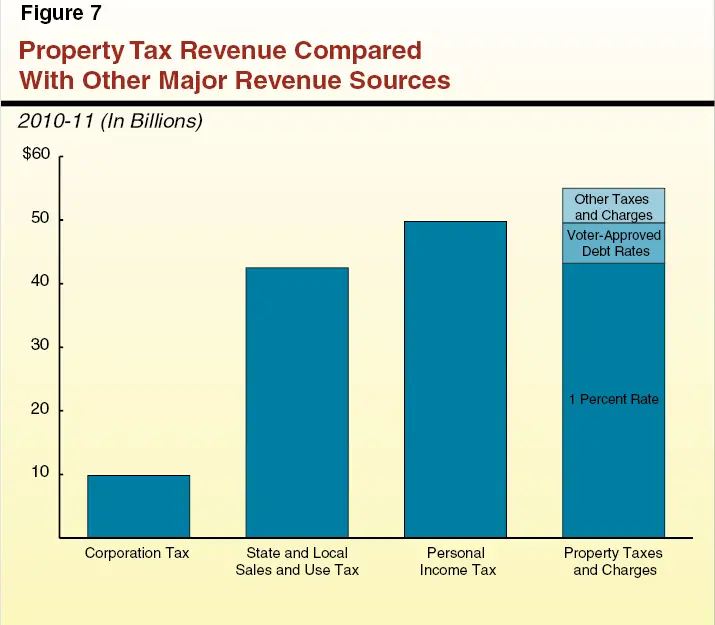

After the Assessor has determined the property value, the County Controller applies the appropriate tax rates, which include the general tax levy, voter approved special taxes, and any city or district direct assessments.

For more information on the applied tax rates, see the County Controllers website.

The general tax levy is determined in accordance with State Law and is limited to 1% assessed value of your property. After applying tax rates, the County Controller calculates the total tax amount. Finally, the Tax Collector prepares property tax bills based on the County Controllers calculations, distributes the bills, and then collects the taxes. Neither the County Board of Supervisors nor the Tax Collector determines the amount of taxes.

The annual tax bill identifies the following:

If your bill bears the statementPrior Years Taxes Unpaid, this is an indication that there are delinquent taxes from prior years, which are not included in your bill. Please call 808-7900 for more information.

Can I Pay Real Property Tax Online

Real property taxes can be paid online or in person by visiting the CityTreasurers Office or visiting one of your municipalitys partner merchants.

How To Calculate Real Property Tax

As a general rule, when calculating real property tax, one must take the following into account: *br> The RPT rate, according to the local government unit , is set each year. The assessed value, or the market value of the property as of the date of assessment, is calculated. Taxes on real property, personal property, and municipal permits are examples of these types of taxes. Metro Manila has an RPT rate of 2%, and PPT, MPT, and RPT are applicable taxes. The RPT rate and applicable taxes may differ in provinces, but the general formula remains the same.

No Comments

Also Check: How Much Is My Social Security Taxed

What Is The Best Way To Pay Taxes

Whats the Best Way to Pay Your Tax Bill

How Long Do You Have To Pay Property Taxes In Indiana

When do you have to pay property taxes? Property taxes must be paid in two installments: one on May 10 and another on November 10. The county treasurer must mail each taxpayer a TS-1 property tax bill and comparison statement no later than 15 business days before May 10.

How To Reduce Or Avoid Property Taxes

Taxable property values are used to calculate property taxes. This is the market value of a company, which means that someone will be willing to pay for it. The tax assessor will use a variety of factors, including the propertys age, size, layout, condition, and features, to calculate the taxable value of a property. Property taxes can be reduced or avoided in a variety of ways. A property can be purchased in advance of its listing on the market. Another option is to reduce the propertys taxable value. You can achieve this by taking advantage of tax breaks such as depreciation or an exemption, or by making improvements to the property that reduce its value.

Read Also: How Do Illegal Immigrants Pay Taxes

Where Can I Find Out How Much Property Tax I Paid

Here are some ways to figure it out:

- Check box 10 on Form 1098 from your mortgage company

- Review your bank or credit card records if you paid the property/real estate tax yourself

- Go to your city or county tax assessor’s website and look for a link to Property search or Property Tax records

Keep in mind

- If you pay your property tax with your mortgage, you can only deduct it after your lender has paid the tax on your behalf. You can contact your lender to find out when they typically make these payments. .

- Claim the deduction in the year you made the payment. If you paid your 2022 property tax on December 14, 2021, claim it on your 2021 return.

We’ve got more info on how to enter the property tax you paid.

Related Information:

Pay With Visa Or Mastercard

Fees for paying with Visa or MasterCard:

- Visa or MasterCard Consumer Debit card are assessed a flat fee of $3.95 per transaction regardless of the amount of tax paid.

- All other MasterCard and Visa cards incur a service charge of 2.3% of the tax amount charged. A minimum service charge of $1.00 applies.

Pay Online: The system is available 24 hours a day seven days a week and will advise you of the total charge prior to your authorization.

In Office:Credit cards may be used when paying in person at our main office located in downtown Raleigh at 301 S. McDowell Street, Suite 3800, Raleigh NC 27601.Please note, credit cards may not be used when making a prepayment on taxes.

Read Also: When Are Taxes Due 2021

Why Does My 1098 Not Show Property Taxes Paid

Your lender sends one copy to you and one to the Internal Revenue Service. If you take the mortgage interest write-off, the form gives you and the government a record of how much interest you paid. But, even if your lender handles your property tax payments, that information may not appear on your 1098.

Idaho State Tax Commission

VISIT »Property Tax Hub for a complete listing of all property tax pages

Property taxes are used to pay for schools, cities, counties, local law enforcement, fire protection, highways, libraries, and more. The state oversees local property tax procedures to make sure they comply with Idaho laws. Also the Idaho State Tax Commission sets property tax values for operating property, which consists mainly of public utilities and railroads.

Most homes, farms, and businesses are subject to property tax. Taxes are determined according to a property’s current market value minus any exemptions. For example, homeowners of owner-occupied property may qualify for a partial exemption. Also, qualified low income homeowners can receive a property tax reduction.

Read Also: How Much Is Capital Gains Tax In Texas

Pennsylvania Property Taxes By County

You can choose any county from our list of Pennsylvania counties for detailed information on that county’s property tax, and the contact information for the county tax assessor’s office. Alternatively, you can find your county on the Pennsylvania property tax map found at the top of this page. Hint: Press Ctrl+F to search for your county’s name

Median Property Taxes In Pennsylvania By County

How Do You Calculate New Price After Increase

Divide the larger number by the original number.

Also Check: How To Get Tax Exempt Status

You May Like: How To Minimize Taxes On Stock Gains

Important Dates To Remember:

– Unsecured tax deadline, 10% penalty added on September 1 – Secured property tax bills mailed late in the month – First installment of secured property taxes due delinquent unsecured accounts are charged additional penalties of 1.5% until paid – First installment is delinquent after close of business 10% penalty added to payments made after this date.* – Unsecured bills mailed out lien date for unsecured taxes and current secured taxes – Second installment of secured property taxes due – Second installment payment deadline 10% penalty plus $10 cost added to payments made after this date.* May – Delinquent notices for any unpaid current taxes mailed – End of fiscal year – Beginning of the fiscal year delinquent secured accounts are transferred to the defaulted tax roll and additional penalties added at 1.5% per month on any unpaid tax amounts, plus a $33 redemption fee. These bills are also referred to as prior year secured taxes or defaulted taxes. * If a delinquent date falls on a weekend or holiday, the delinquent date is the next business day.

What Is The Property Tax Rate In St Clair County Il

Overview of St. Clair County, IL Property Taxes

Clair County has the 23rd highest property tax rate. Compared to the state average of 2.02%, homeowners pay an average of 0.00% more. Put another way, if you live in St. Clair County, you can expect to pay $20.20 for every $1,000 of real estate value, or 2.02%.

Read Also: Are You Taxed When You Sell Your Home

Abatement Requests Due To Exceptional Hardship

Property owners have the right to request a property tax abatement to Ramsey Countys Auditor/Treasurer.

The request may apply to penalties, interest and/or costs. The request may be made whether or not the one-time waiver has been used on a parcel.

All requests will be reviewed. Generally, abatement requests are granted only in instances of exceptional hardship such as hospitalization or other medical emergencies directly affecting the taxpayer.

Call to request an abatement. Please know that if an abatement is not granted, Property Tax Services will work with property owners to provide information on all available forms of tax relief available, including developing partial payment schedules.

Every Homeowner Pays Property Taxes Heres How

A property tax bill is part of the homeownership experience. Local governments collect these taxes to help fund projects and services that benefit the entire communitythings such as roads, schools, police, and other emergency services. There are two primary ways to pay your property tax bill: as part of your monthly mortgage payment or directly to your local tax office.

You May Like: How To Avoid Paying Taxes On Crypto

How Are The Property Assessors Office And The Trustees Office Related

The Property Assessor is responsible for the appraisal and assessment of property, according to State law. The Trustees office is responsible for billing and collection of taxes based on assessments. The Trustee has no authority over the amount of assessment, nor can he be involved in the appraisal process.