Jeffrey H Kahn Harry M Walborsky Professor & Associate Dean For Business Law Programs Florida State University College Of Law

If Washington puts state capital gains taxes in place, might that pave the way for other states to do the same?

I do not think that the addition of a capital gains tax in the state of Washington would have much of a bearing on whether other states decide to impose one. The other considerations on whether to impose a state-level capital gains tax are likely more important.

For example, a capital gains tax on top of a higher federal tax might lead some to flee the state or at least make it less desirable to move there. We have seen a general trend of people moving from high tax states to low tax states and state governments are certainly aware of this.

I believe the pandemic has sped up the remote worker movement which allows people to be even more mobile and so tax rates may play an even larger role in residency decisions.

If the government expresses interest in raising capital gains taxes, could we see a stock sell-off in response? How might that affect the greater economy?

I believe a sell-off is certainty, especially if the increase is paired with the repeal of section 1014 which provides for a step-up basis at death.

The loss of value in the market will impact pension and retirement funds and make investments less attractive. It is unclear whether an increase will actually raise significantly more revenue so the trade-off does not appear to be worth it.

Factors That Complicate Measurement

Researchers usually use the top to characterize policy as high-tax or low-tax. This figure measures the disincentive on the largest transactions per additional dollar of taxable income. However, this might not tell the complete story. The table Summary of recent history above shows that, although the marginal rate is higher now than at any time since 1998, there is also a substantial bracket on which the tax rate is 0%.

Another reason it is hard to prove correlation between the top capital gains rate and total economic output is that changes to the capital gains rate do not occur in isolation, but as part of a tax reform package. They may be accompanied by other measures to boost investment, and Congressional consensus to do so may derive from an economic shock, from which the economy may have been recovering independent of tax reform. A reform package may include increases and decreases in tax rates the Tax Reform Act of 1986 increased the top capital gains rate, from 20% to 28%, as a compromise for reducing the top rate on ordinary income from 50% to 28%.

How To Avoid Capital Gains Tax As A Real Estate Investor

If the home youre selling is not your primary residence but rather an investment property youve flipped or rented out, avoiding capital gains tax is a bit more complicated. But its still possible. The best way to avoid a capital gains tax if youre an investor is by swapping like-kind properties with a 1031 exchange. This allows you to sell your property and buy another one without recognizing any potential gain in the tax year of sale.

In essence, youre swapping one investment asset for another, says Re/Max Advantage Plus White. He cautions, however, that there are very strict rules regarding timelines and guidelines with this transaction, so be sure to check them with an accountant.

If youre opting out of the rental property investment business and putting your money in another venture that does not qualify for the 1031 exchange, then youll owe the capital gains tax on the profit.

Read Also: How To Pay Taxes With Doordash

Federal Capital Gains Tax Rates

The tables below show marginal tax rates. This means that different portions of your taxable income may be taxed at different rates.

For example, a single filer who made $10,000 would pay 10% income tax on their first $9,950 and 12% on the remaining $50. That’s a total of $1,001 in tax and an overall tax rate of 10.01%.

How Are Capital Gains Taxes Calculated

You can calculate capital gains taxes using IRS forms. To calculate and report sales that resulted in capital gains or losses, start with IRS Form 8949. Record each sale, and calculate your hold time, basis, and gain or loss. Next, figure your net capital gains using Schedule D of IRS Form 1040. Then copy the results to your tax return on Form 1040 to figure your overall tax rate.

You May Like: How Do Taxes Work On Doordash

Do You Pay State Taxes On Capital Gains

In general, youll pay state taxes on your capital gains in addition to federal taxes, though there are some exceptions. Most states simply tax your investment income at the same rate that they already charge for earned income, but some tax them differently

Just seven states have no income tax Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Two other states New Hampshire and Tennessee dont tax earned income but do tax investment income, including dividends.

Of states that do levy an income tax, nine of them tax long-term capital gains less than ordinary income. These states include Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont and Wisconsin. However, this lower rate may take different forms, including deductions or credits that reduce the effective tax rate on capital gains.

Some other states provide breaks on capital gains taxes only on in-state investments or specific industries.

Compare 1031 Dst Properties

Simple & Easy to Understand

- 400 W. 15th Street Suite 700 Austin, TX 78701

SECURITIES DISCLOSURE

Realized1031.com is a website operated by Realized Technologies, LLC, a wholly owned subsidiary of Realized Holdings, Inc. . Equity securities offered on this website are offered exclusively through Thornhill Securities, Inc., a registered broker/dealer and member of FINRA/SIPC. Investment advisory services are offered through Thornhill Securities, Inc. a registered investment adviser. Thornhill Securities, Inc. is a subsidiary of Realized. Check the background of this firm on FINRA’s BrokerCheck.

Hypothetical example are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment.

Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors. Alternative investments are often sold by prospectus that discloses all risks, fees, and expenses. They are not tax efficient and an investor should consult with his/her tax advisor prior to investing. Alternative investments have higher fees than traditional investments and they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain and should not be deemed a complete investment program. The value of the investment may fall as well as rise and investors may get back less than they invested.

Don’t Miss: Door Dash Tax Form

Do Home Improvements Reduce Tax On Capital Gains

You can also reduce the amount of capital gains subject to capital gains tax by the cost of home improvements youve made. You can add the amount of money you spent on any home improvementssuch as replacing the roof, building a deck, replacing the flooring, or finishing a basementto the initial price of your home to give you the adjusted cost basis. The higher your adjusted cost basis, the lower your capital gain when you sell the home.

For example: if you purchased your home for $200,000 in 1990 and sold it for $550,000, but over the past three decades have spent $100,000 on home improvements. That $100,000 would be subtracted from the sales price of your home this year. Instead of owing capital gains taxes on the $350,000 profit from the sale, you would owe taxes on $250,000. In that case, youd meet the requirements for a capital gains tax exclusion and owe nothing.

Take-home lesson: Make sure to save receipts of any renovations, since they can help reduce your taxable income when you sell your home. However, keep in mind that these must be home improvements. You cant take a deduction from income for ordinary repairs and maintenance on your house.

Tax Law Adjustments To Watch Out For In 2022

Tax laws are often proposed with an expiration date, and changes in administration often lead to adjustments.

After coming into office, President Joe Biden proposed some new tax laws in 2021, which may be passed when current rules expire in 2022.

The proposed rules eliminate the step-up basis exemption on any inherited assets that have gained an excess of $1 million in value The difference in value is measured between the original purchase price and the fair market value at the time of death.

You would still benefit from the step-up basis rule if your inherited assets gained less than $1 million in value, or when the property was donated to charity.

Note that the estate and gift tax exemption is currently at $11.7 million . You can still bequeath and inherit property valued below the threshold without being subject to estate tax. However, any inherited property valued over this threshold would be exposed to double-taxation between estate tax and capital gains tax. Further, there is also a proposal to increase the capital gains tax top rate from 29 percent to 49 percent.

Key Takeaways:

Don’t Miss: How To Get Tax Information From Doordash

What Are The Exceptions To The Capital Gains Tax Rate For Long

One major exception to a reduced long-term capital gains rate applies to collectible assets, such as antiques, fine art, coins, or even valuable vintages of wine. Typically, any profits from the sale of these collectibles will be taxed at 28% regardless of how long you have held the item.

Another major exception comes from the Net Investment Income Tax , which adds a 3.8% surtax to certain net investments of individuals, estates, and trusts above a set threshold. Typically, this surtax applies to those with high incomes who also have a significant amount of capital gains from investment, interest, and dividend income.

How Do You Treat Capital Loss Tax On Your Tax Return

For tax purposes, your capital loss is treated differently than your capital gains. If you sell a capital asset at a loss, which typically means your selling price is less than its cost when you got the asset, you can claim a loss up to $3,000 on your tax return. The amount reduces your taxable income and reduces the amount you may owe in taxes. If your loss exceeds these limits, you may carry it forward to later tax years.

You May Like: How To Pay Taxes Doordash

What About The Primary Residence Tax Exemption

Unlike other investments, home sale profits benefit from capital gains exemptions that you might qualify for under some conditions, says Kyle White, an agent with Re/Max Advantage Plus in MinneapolisSt. Paul.

The IRS gives each person, no matter how much that person earns, a $250,000 tax-free exemption on capital gains from a primary residence. You can exclude this capital gain from your income permanently.

So if you and your spouse buy your home for $100,000, and years later sell for up to $600,000, you wont owe any capital gains tax, says New York attorney Anthony S. Park. However, you do have to meet specific requirements to claim this capital gains exemption:

- The home must be your primary residence.

- You must have owned it for at least two years.

- You must have lived in it for at least two of the past five years.

- You cannot have taken this exclusion in the past two years.

If you dont meet all of these requirements, you may be able to take a partial exclusion for capital gains tax if you meet certain exceptions . For more information, consult a tax adviser or IRS Publication 523.

Inheritance Tax Laws In Texas

Inheritance tax, also called the estate tax or death tax, is levied at both the federal level and state level and applies to any assets transferred to someone other than the deceaseds spouse at the time of death.

In some states, individual inheritors are charged a state inheritance tax on top of federal inheritance taxes. But Texas does not have a state tax for inheritance.

Don’t Miss: Square Dashboard 1099

Capital Gains Tax Breaks Dont Drive State Economic Growth

Proponents of capital gains tax breaks often argue that they spur economic growth by encouraging investment. But historically, there is no obvious connection between tax rates on capital gains and economic growth at the national level, tax policy expert Leonard Burman notes. There is even less reason to expect a state tax break on capital gains to boost a states economy. The companies, bonds, and other assets generating capital gains for a states residents could be located anywhere in the country or the world, so any possible economic benefit wouldnt necessarily go to the state giving the tax break.

Moreover, capital gains taxes generate revenue to support three major building blocks of thriving communities: K-12 and higher education, health care, and transportation. And, by increasing the share of state revenues paid by the wealthy, they allow states to keep taxes lower on people with moderate incomes, who spend a larger share of their incomes to boost local economies.

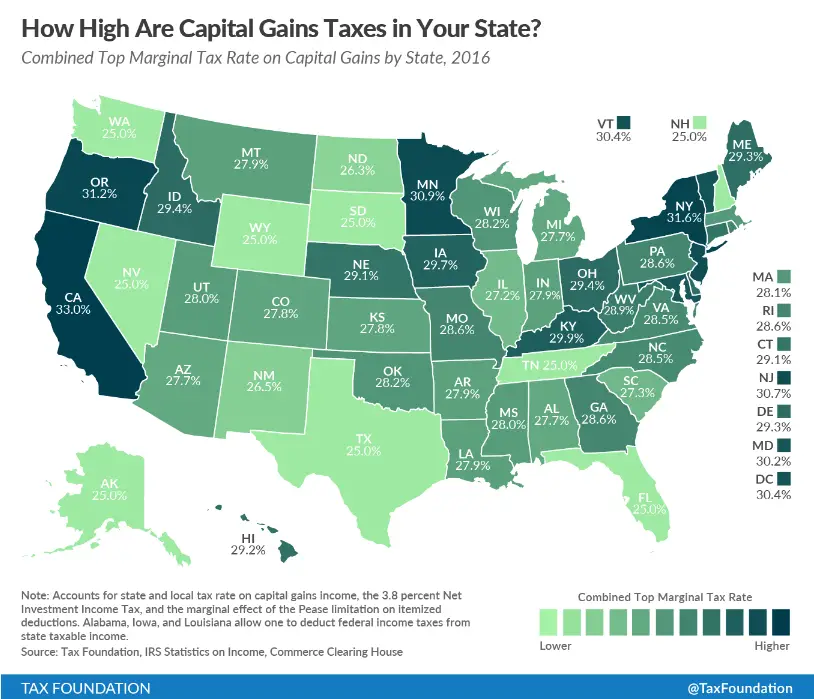

Capital Gains Tax Rates By State

Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets. The federal government taxes long-term capital gains at the rates of 0%, 15% and 20%, depending on filing status and income. And short-term capital gains are taxed as ordinary income. Some states will also tax capital gains. A financial advisor could help you figure out your tax liability and create a tax plan to maximize your investments. Lets break down how capital gains are taxed by state in 2021.

Recommended Reading: Is Freetaxusa A Legitimate Company

Do You Pay Taxes On A Home Sale

If you sell your house and make a profit, yes, there is a home sale profit tax. Also known as capital gains, the gain is the difference between a higher selling price and a lower purchase price. So basically, it is the profit made when you sell your house where the sale price exceeds the purchase price. Paying capital gains applies to homes, property, and possessions that you have had for over a year that earn you a profit when you sell them. The reason being when you sell something for a profit, it is treated as a commercial transaction when it comes to taxation.

There are two types of Capital Gains:

- Short-Term Capital Gains- will apply to your home sale if you have owned it for less than a year. You would only owe income taxes based on your regular tax bracket.

- Long-Term Capital Gains- apply if you have owned the property for over a year. Rates for long-term capital gains is a lot lower, even nothing, depending on seller income, filing status, and exemptions.

Capital Gains Tax Rates For 2021

The capital gains tax on most net gains is no more than 15 percent for most people. If your taxable income is less than $80,000, some or all of your net gain may even be taxed at zero percent.

As of 2021, the long-term capital gains tax is typically either zero, 15 or 20 percent, depending upon your tax bracket. This percentage will generally be less than your income tax rate.

2021 Long-Term Capital Gains Tax Rates Based on Taxable Incomes

| CAPITAL GAINS TAX RATE |

Source: Kiplinger

There are some exceptions to this 0-15-20 percent rule which allow certain capital gains to be taxed at higher rates.

Higher Capital Gains Tax Rate Exceptions

- Taxable portions of the sale of certain small business stocks are taxed at a 28 percent maximum rate.

- Net capital gains from selling collectibles such as coins or art are taxed at a 28 percent maximum rate.

- Certain portions of capital gains from specific real estate sales are taxed at a 25 percent maximum rate.

Source: Internal Revenue Service

Also Check: Is Giving Plasma Taxable Income

Rules On Property Sale Capital Gains In Texas

No matter which state you live in, you are subject to capital gains taxes on profits made on any property bought mainly for the purpose of investment, including stocks or real estate. The amount of federal capital gains taxes does not vary from state to state, though some states have state capital gains taxes as well. The rules on property sale capital gains in Texas mirror those of many other states.

Tips

-

The state of Texas will not impose any capital gains taxes when you sell your property. However, this does not mean that you are exempt from paying federal taxes for capital gains.

Don’t Lose More Of Your Hard

Every investor wants their investments to rise in value. But when you sell a winning investment, you typically don’t get to keep all your profits. Instead, the IRS steps in with taxes on your capital gains, leaving you with just a portion of the money you made investing.

Taxing your investment profits could be simple, but under the current tax laws, it’s anything but. With many different sets of rules, tax rates, and special provisions, it takes some effort to find out exactly how capital gains taxes work. Below, you’ll learn everything you should expect on capital gains taxes and how you can cut your tax bill.

Also Check: Pastyeartax.com Reviews

Capital Gains Tax Texas: What You Should Know

Before you start doing all your research on how to sell your house or ways to stage your home in Texas, you probably should find out if youre going to need to pay capital gains taxes. Hearing the word taxes instantly makes you think of money either being paid to the IRS or getting a tax return back, but in this case, you may owe capital gains taxes on your real estate. If youre not familiar with Texass capital gains tax or how much capital gains tax in Texas is, youre not alone. Lucky, you came to the right place to find out all you need to know about Texas capital gains taxes and how much the capital gains tax in Texas cost. To find out if you will need to pay capital gains on the sale of your Texas property, continue reading for more information.