Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Free File: About The Free File Alliance

The Free File Alliance is a group of industry-leading private-sector tax preparation companies that provide free online tax preparation and electronic filing only through the IRS.gov website. IRS Free File is a Public-Private Partnership between the IRS and the Free File Alliance. This PPP requires joint responsibility and collaboration between the federal government and private industry to be successful.

How To Figure Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax.

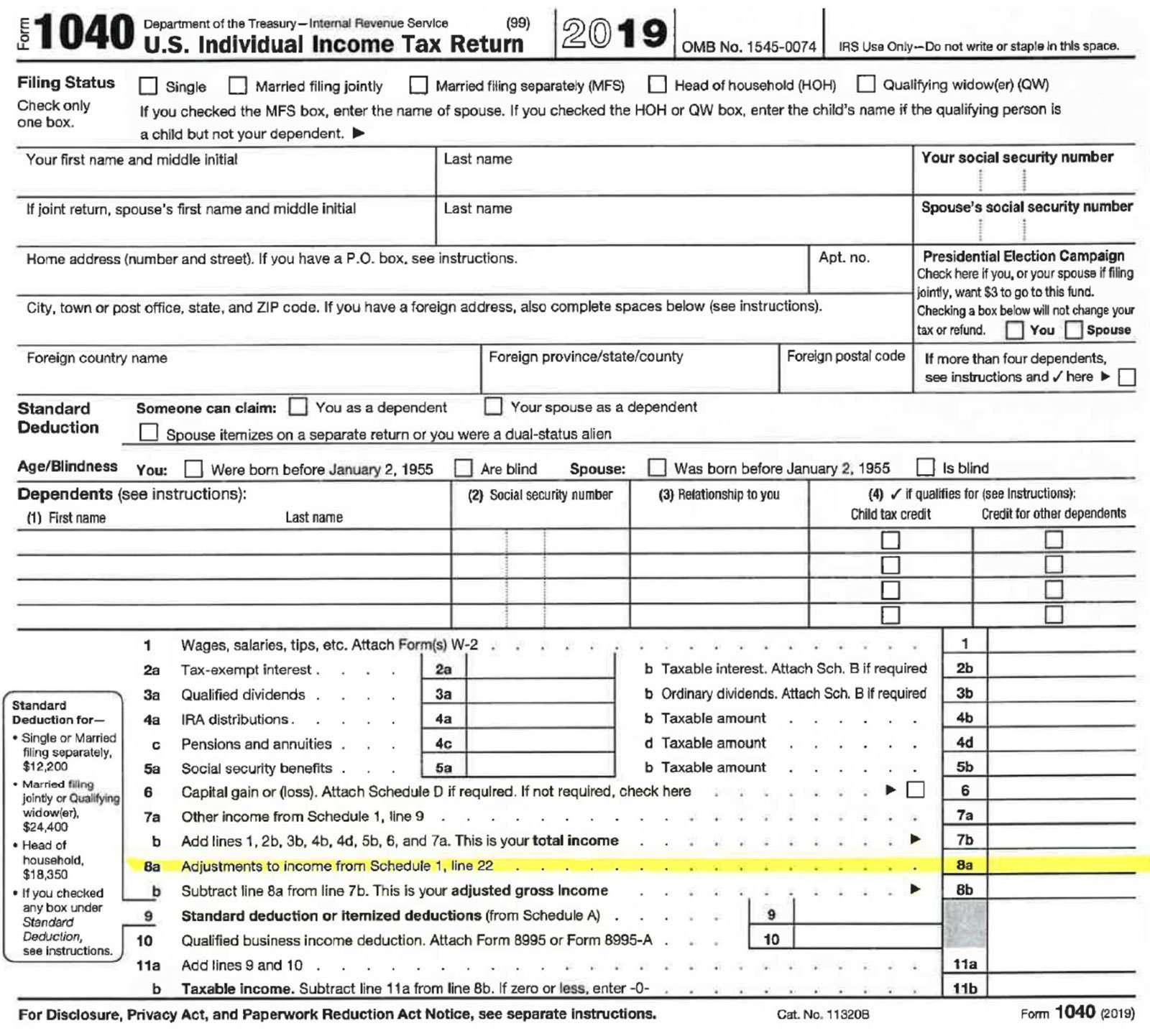

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

Read Also: Prontotaxclass

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions , for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

- The failure to make estimated payments was caused by a casualty, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or

- You retired or became disabled during the tax year for which estimated payments were required to be made or in the preceding tax year, and the underpayment was due to reasonable cause and not willful neglect.

Verifying Your Identity And That Includes Your Social Security Number

The portion on the W-2 that includes identifying information is mostly a tracking feature. If the income you declare in your tax returns does not correspond to the information you have on your W-2 or W-2, the Internal Revenue Service will investigate the reason. In the same way it is the Internal Revenue Service will check the amount of your tax refund against your employers tax return to confirm that the information is correct.

Above all else, since the Internal Revenue Service obtains a copy of the W-2 you signed, they already knows whether or whether you owe taxes and could contact you if you fail to file your tax return. If you find the name of your employer or Social Security number on your W-2 is incorrect and you are not sure, inform your employer as soon as possible to ensure that the error is rectified.

You May Like: Have My Taxes Been Accepted

From Your Bank Account Using Eftpsgov

You can schedule payments up to 365 days in advance for any tax due to the IRS when you . register with the Electronic Tax Federal Payment System . As with DirectPay, you can cancel or change payments up to two business days before the transmittal date.

EFTPS is a good choice if:

- You want to schedule all of your estimated tax payments at the same time

- Your payments are particularly large

- Payments are related to your business

The Treasury Department operates EFTPS, and it doesn’t charge any processing fees. It can handle any type of federal tax payment, including:

- 1040 balance due payments

- Corporate taxes

- Payroll taxes

You must enroll with EFTPS, but the site saves your account information. You don’t have to keep re-entering it each time you want to make a payment. You’ll receive an email with a confirmation number for each transaction. EFTPS saves your payment history for up to 16 months.

How To Find And File Your Federal Tax Forms

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

If bureaucracies are good at anything, its creating paperwork, and the Internal Revenue Service is the king of all bureaucracies, especially when it comes to tax forms. Most paperwork needed for filing your federal tax return can be completed and submitted electronically, but youll need to acquire some forms, on paper or via the web, to get the job done. Well explain how to find and obtain the forms you need, how often the IRS updates its forms, and the options for filing your tax forms online.

Read Also: Where Is My State Refund Ga

The Benefits Of Filing Your Taxes Online

After you understand what forms you need, common deductions to consider and your tax bracket, it’s time to start the process of filing your taxes. You should strongly consider filing your taxes online thanks to the power of e-filing.

- E-filing allows you to electronically submit your tax return to the IRS.

- The IRS processes e-filed tax returns much faster than mailed tax returns.

- If you’re expecting a refund, the IRS normally processes refunds faster for e-filed returns as well.

Figuring out how to file taxes online isn’t difficult. TurboTax makes it easier than ever with its tax preparation software. Simply grab the tax information you gathered earlier and answer simple questions. TurboTax then takes that information and uses it to complete your tax return for you. Once all of the information is input, you can e-file your taxes online and from home.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

How To Calculate Your Taxes

As a self-employed person, your business earnings and your personal income are one and the same. Thereâs no separate income tax rate for money you make from your business.

However, you do need to pay Canadian Pension Plan contributions, and you have the option of making Employment Insurance contributions as well.

So the total of your tax obligations would be income tax + CPP + EI .

Don’t Miss: How To Get Tax Preparer License

Are You A Sole Proprietor

As soon as you start trading goods or services for money without an employer paying you for it, the federal government considers you a sole proprietor.

At that point, youâre expected to report all income you receive as a sole proprietor to the Canada Revenue Agency . Itâs reported as part of your personal income on your personal tax return.

How Often The Irs Changes Its Tax Forms

The IRS has to update many of its forms annually. Even if the forms content doesnt change, the form needs to state the current year so that taxpayers can be confident theyre filing the correct paperwork and calculating the right amount of tax due. The IRS updates its forms because of new laws or guidance, new addresses or phone numbers, or the need to make a correction or clarification.

A big reason for tax form changes is new legislation, such as the Tax Cuts and Jobs Act of 2017. This legislation required the IRS to create new 1040 forms and new schedules. , standard deductions, itemized deductions, and more changed under the new law. Another major piece of legislation, the Affordable Care Act, necessitated changes to tax forms because of the subsidies, penalties, and new taxes the law mandated.

Also Check: Can Home Improvement Be Tax Deductible

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2020 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income. The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS starting mid-February. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

Also Check: Is Past Year Tax Legit

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

Read Also: Www.1040paytax.com.

Understanding Your Tax Bracket

Understanding your tax bracket is pretty straightforward. The federal income tax system is based on a marginal tax rate system. This means your effective tax rate is determined by taxing your income in each tax bracket that applies to you rather than taxing all of your income at the top tax bracket you fall into.

- Currently, your first taxable ordinary income dollars will usually be taxed at 10%.

- Once your income exceeds the 10% bracket, additional income will be taxed at 12% until you exceed that bracket and so on.

You can use our tax bracket calculator and the tax rate schedule to help you figure out how your income is taxed as well as the top tax bracket you fall in. Only the additional income that falls into your top tax bracket will be taxed at that top rate.

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

Read Also: Oregon Tax Preparer License Renewal

Free File Fillable Forms Is Now Open

Didnt Get Your Stimulus Payments? Claim the Recovery Rebate Credit.

If you arent required to file taxes and didnt receive all Economic Impact Payments, you can claim the Recovery Rebate Credit to get the full amount.

The fastest way to claim the Recovery Rebate Credit is to file a 2020 tax return with a Free File provider.

Is Filing Electronically Safe

The appeal of electronic filing is obvious, but is it safe? Your tax filing contains some of the most sensitive data about you: where you live, how much you earn, how many dependents you have, your Social Security number, how high your medical expenses were, and how much you gained or lost from selling investments.

Can you trust the tax software companies and the government to have employed best-in-class security to protect your data both as its being transmitted and while its being stored? If you use online tax software, your information is also being stored in the cloud, creating another point of vulnerability.

For this reason, some people prefer to purchase downloadable software so their data is stored only on their own computer. That way, they are vulnerable to one less data breach possibility.

In this era of data breaches and identity theft, security and privacy questions are important to ask. The table below shows what security features online tax services provide as of January 2021 for the 2020 tax return season. Note that the absence of a feature in the table doesnt necessarily mean the software provider doesnt have it, just that the information wasnt available on the companys data security page. Also, while each service describes its encryption practices differently, all appear to be using appropriate methods.

| Security and Fraud Prevention Features in Popular Tax Preparation Software, January 2021 | |

|---|---|

| Software Brand | |

| not advertised | not advertised |

You May Like: Louisiana Paycheck Tax Calculator

Extension Filers: File Your Tax Return By October 15

Your extension of time to file is not an extension of time to pay your taxes. Pay the tax you owe as soon as possible to avoid future penalties and interest.

If you didn’t get a first and second Economic Impact Payment or got less than the full amounts, use Free File to claim the 2020 Recovery Rebate Credit.

IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via Irs.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

About Free File Fillable Forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to:

- Choose the income tax form you need

- Enter your tax information online

- Electronically sign and file your return

- Print your return for recordkeeping

If you choose Free File Fillable Forms as your Free File option, you should be comfortable doing your own taxes. Limitations with Free File Fillable Forms include:

- It won’t give you guidance about which forms to use or help with your tax situation

- It only performs basic calculations and doesn’t provide extensive error checking

- It will only file your federal return for the current tax year

- No state tax return option is available

- You can’t make changes once your return is accepted

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose income is greater than $72,000. Taxpayers whose income is $72,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

Also Check: Www..1040paytax.com