Is It Safe To File My Taxes Online

Maybe youre nervous about filing your taxes online. Rest assured that at TurboTax, security is built into everything we do. We use multi-factor authentication, data encryption, and data safeguards to make filing your taxes online safe. Learn more about security at TurboTax.

As well as ensuring that weve taken every security precaution in our products, TurboTax Free connects securely with the government through CRAs Auto-fill my return to import your data into your return and submits your electronic return if you file online through the CRAs NETFILE service. For an additional layer of security when you file online, learn about using the CRAs new NETFILE Access Code to authenticate your identity when you submit your taxes this year.

There Are Different Ways You Can File Your Tax Return

Canadians can file their income tax and benefit return using other methods, such as online with NETFILE certified tax-filing software, on paper, through a tax preparer, or with the help of a free tax preparation clinic offered through the Community Volunteer Income Tax Program. To find out more about local clinics, visit canada.ca/taxes-help.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Read Also: How To Report Self Employment Income On Taxes

A Better Waywhy Your Tax Refund May Be Bad For Your Wallet

This leaves a copy of your data-rich W-2s, including Social Security numbers, in your phones photo storage, and/or possibly on your cloud storage, said Cris Thomas, Global Strategy Lead for IBM X-Force Red. Now, your data is in more places that have a higher risk of being compromised than just your tax providers systems.

Robert Sicliano, security analyst with Hotspot Shield, worries about lost or stolen mobile devices that do not have password protection.

When someone finds or steals your mobile phone they have access to everything on it and in this case, your tax return, he said.

Can I File Taxes Over The Phone

You cannot file your federal taxes over a landline phone since a program to do so was discontinued in 2005. You can file federal taxes online, however, including using some smartphone apps. Some states also allow you to file some tax forms by landline, and you can pay federal taxes that you owe by phone, although you can’t file new tax forms that way. You can also ask the IRS questions over the phone.

Tips

-

You can’t file federal taxes over the phone but you can sign up to make payments over the phone and you can call the IRS with tax any questions. You also can use a variety of smartphone apps to file your taxes. Some states allow some tax forms to be filed through a telephone call.

You May Like: How Do I Get My Pin For My Taxes

What Are Payment Plan Costs And Fees

If the IRS approves your payment plan , one of the following fees will be added to your tax bill. Changes to user fees are effective for installment agreements entered into on or after April 10, 2018. For individuals, balances over $25,000 must be paid by Direct Debit. For businesses, balances over $10,000 must be paid by Direct Debit.

Low income:

|

Note: If making a debit/credit card payment, processing fees apply. Processing fees go to a payment processor and limits apply.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

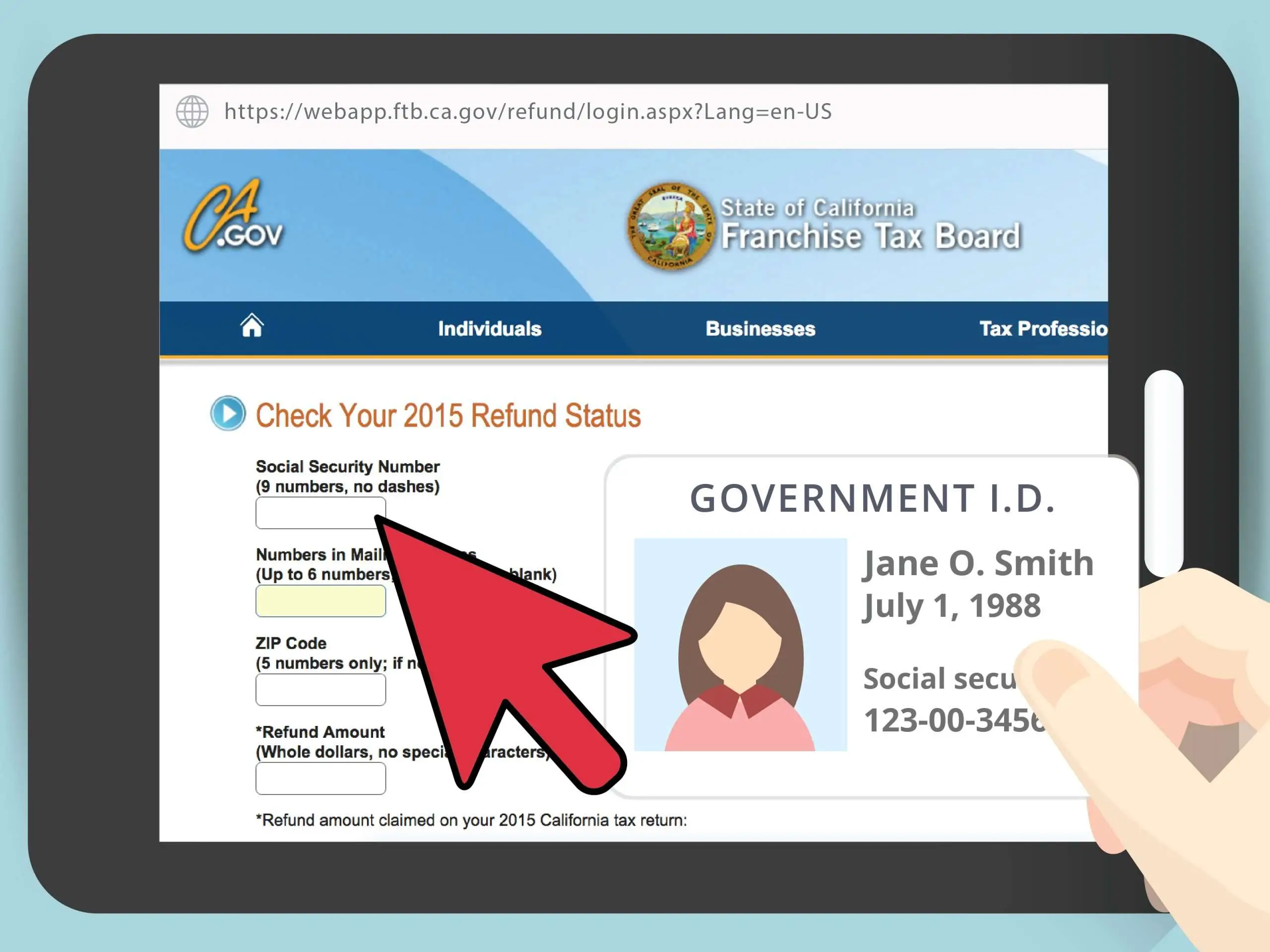

Recommended Reading: Where Is My California State Tax Refund

About Where’s My Refund

Use Where’s My Refund to check the status of individual income tax returns and amended individual income tax returns you’ve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

How Could Using A Tax App Affect My Taxes

Mobile tax apps can make the process of filing your tax return simpler and more convenient. As with any tax preparation service, however, its important to make sure the information you submit is accurate and complete. Accuracy not only helps prevent potential trouble from the IRS but can also help you maximize the value of your tax refund.

Recommended Reading: What Is The Sales Tax In Arkansas

Why Is It Important To Understand How Tax Apps Work

Filing a tax return is rarely someones idea of a good time, and the faster you can get it over with, the sooner you can get on with other things youd rather be doing.

With tax apps, you dont have to sit in front of a computer at home or meet with a tax preparer to get your return done. You can fill out your return and file it wherever you are, as long as you have a smartphone or tablet and an internet connection.

But its not necessarily wise to go with the first tax app you come across, as you might miss out on certain features and savings you might get from a different one. So its important to take some time to research different tax apps and compare their features and fees to find the best fit for your needs.

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of May 17, 2021.

You May Like: What States Do Not Tax Your Pension Or Social Security

Individual Income Tax Return Payment Options

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.

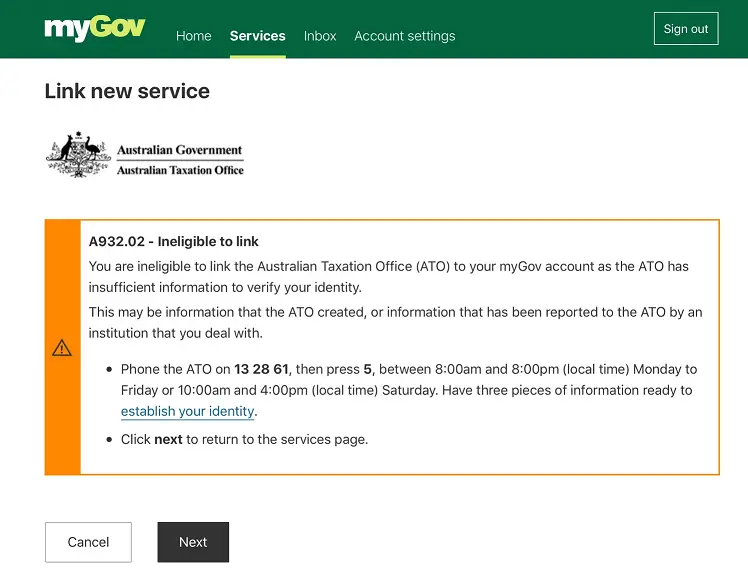

How Do I Revise My Payment Plan Online

ALQURUMRESORT.COM” alt=”How can i get my agi over the phone > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How can i get my agi over the phone > ALQURUMRESORT.COM”> You can make any desired changes by first logging into the . On the first page, you can revise your current plan type, payment date, and amount. Then submit your changes.

If your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount. If you are unable to make the minimum required payment amount, you will receive directions for completing a Form 433-F, Collection Information Statement or Form 433-B, Collection Information Statement for Businesses and how to submit it.

To convert your current agreement to a Direct Debit agreement, or to make changes to the account associated with your existing Direct Debit agreement, enter your bank routing and account number.

If your plan has lapsed through default and is being reinstated, you may incur a reinstatement fee.

Recommended Reading: How To Get Tax Credit For Solar

I Am Applying As An Individual:

- Name exactly as it appears on your most recently filed tax return

- Valid e-mail address

- Address from most recently filed tax return

- Date of birth

- Your Social Security Number or Individual Tax ID Number

- Based on the type of agreement requested, you may also need the balance due amount

- To confirm your identity, you will need:

- financial account number or

Can The 56% Of Americans With A Smartphone Use It To File Taxes

Today, 80% of Americans age 18-34 have a smartphone, while 56% of all Americans have one. With phones and tablets basically being an extension to our bodies, it shouldnt come as a surprise that we not only want to talk, text, tweet and read a book on one device, we also want to file our taxes from our phones. The big question is, can you really file your taxes from the palm of your hand? With RapidTax, you can.

Recommended Reading: How Long Can You Wait To File Taxes

How Do I Check My Balance And Payment History

Individuals can view the current amount owed and payment history by viewing your Online Account. Viewing your tax account requires identity authorization with security checks. Viewing your tax account requires identity authorization with security checks. Allow one to three weeks for a recent payment to be credited to your account.

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

You May Like: How Much Is Inheritance Tax In Indiana

Lets Face It We No Longer Run Home To Use Our Desktop Computer Instead We Have Everything In The Palms Of Our Hands

30 years ago, just about everyone drove to a tax filer to file their taxes. The annual routine became nothing but a memory when taxpayers realized they didnt have to leave home to file their taxes and could do everything online. The age of e-commerce has allowed businesses to grow in the cyber world while transforming the tax filing process.

I Can File My Taxes On My Phone Right Now

Bottom line, its pretty awesome that we can do just about anything from our phones and tablets. Twenty years ago, while walking into a brick and water accounting office to file your 1993 taxes, who would have ever guessed that in 2014, you would be filing your taxes on your phone?The IRS is now accepting 2013 e-filed returns. File your taxes now on RapidTax and by mid-February, youll open your phones banking app and see your 2014 tax refund, giving you something to tweet about!

1/31/2014 Photo via Macreloaded.com on Flickr

Also Check: What’s The Property Tax In Texas

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 238,000 electronic payments in 2020. The Department also received more than 2.6 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Can I File My Taxes Online For Free If Im A Non

Yes. TurboTax makes it easy to file your Candian tax return as a non-resident. In fact, if youre a non-resident you can use any of the TurboTax Online products, including TurboTax Free. For more info, read about How Residency Status Impacts Your Tax Return

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

You May Like: How Can I Make Payments For My Taxes

What Is A Payment Plan

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee. Not paying your taxes when they are due may cause the filing of a Notice of Federal Tax Lien and/or an IRS levy action. See Publication 594, The IRS Collection Process.

How Do I Manage My Plan To Avoid Default

In order to avoid default of your payment plan, make sure you understand and manage your account.

- Pay at least your minimum monthly payment when it’s due.

- File all required tax returns on time and pay all taxes in-full and on time .

- Your future refunds will be applied to your tax debt until it is paid in full.

- Make all scheduled payments even if we apply your refund to your account balance.

- When paying by check, include your name, address, SSN, daytime phone number, tax year and return type on your payment.

- Contact us if you move or complete and mail Form 8822, Change of Address.

- Confirm your payment information, date and amount by reviewing your recent statement or the confirmation letter you received. When you send payments by mail, send them to the address listed in your correspondence.

There may be a reinstatement fee if your plan goes into default. Penalties and interest continue to accrue until your balance is paid in full. If you received a notice of intent to terminate your installment agreement, contact us immediately. We will generally not take enforced collection actions:

- When a payment plan is being considered

- While a plan is in effect

- For 30 days after a request is rejected or terminated, or

- During the period the IRS evaluates an appeal of a rejected or terminated agreement.

Don’t Miss: How To Register For Tax Id

How Do I Get Help Filing My Taxes Online

If at any point you have a question about your taxes or the software, you can browse answers on our online help forum 24/7, or post a question for our online community of users and experts. While youre filing you may realize that youre looking for more guidance or help with your taxes. In that case you can upgrade to a different TurboTax Online product at any time without losing any of the data youre already entered.

Need more help? TurboTax Live Assist & Review gives you unlimited tax advice from one of our tax experts as you do your taxes, plus a final review before you file to make sure you didnt miss anything. Or if you want to hand off your taxes to one of our experts, TurboTax Live Full Service allows you to simply upload your documents and our experts will complete and file your return for you.

Am I Eligible For A Waiver Or Reimbursement Of The User Fee

Waiver or reimbursement of the user fees only applies to individual taxpayers with adjusted gross income, as determined for the most recent year for which such information is available, at or below 250% of the applicable federal poverty level that enter into long-term payment plans on or after April 10, 2018. If you are a low-income taxpayer, the user fee is waived if you agree to make electronic debit payments by entering into a Direct Debit Installment Agreement . If you are a low-income taxpayer but are unable to make electronic debit payments by entering into a DDIA, you will be reimbursed the user fee upon the completion of the installment agreement. If the IRS system identifies you as a low-income taxpayer, then the Online Payment Agreement tool will automatically reflect the applicable fee.

Recommended Reading: What Is Low Income Tax Credit