Surplus Earnings And Losses

Your earning and losses from 1 month can be taken into account when working out how much Universal Credit you receive in a later month.

If you earn more than £2,500 over the monthly amount you can earn before your Universal Credit payment is reduced to £0, you are said to have surplus earnings. This may reduce the amount of Universal Credit you receive in later months, or perhaps mean that you cant get any Universal Credit payment in those months.

If you make a loss in 1 month, the loss will be stored and taken into account in months when you make a profit. If the profits are not high enough to fully cover a loss, the remaining loss will be carried forward to the next month when you make a profit.

A loss will stop being taken into account once all your losses have been accounted for or if your self-employment business ends.

How To Calculate Taxes

The self-employment tax rate is 15.3 percent for 2019, which is made up of 12.4 percent Social Security tax and 2.9 percent Medicare tax. Multiple this rate by your net earnings to get an estimate of your self-employment tax liability. You can also use free tax calculators estimate your expected self-employment tax using free tools like this calculator from Quickbooks.

References

What Is Considered Self Employment Income

If youre a sole proprietor, an independent contractor, or youre part of a partnership, the money you earn operating a trade, business, or profession may be considered self-employment income. Should your net earnings exceed $400 in a year, then you must report your self-employment income to the IRS and pay taxes;

You May Like: How To Get The Most Out Of Tax Return

Line 8230 Other Income

On line 8230, enter the total income you received from other sources. Some examples of other income are:

- a recovered amount you wrote off as a bad debt in a previous year

- the value of prizes or vacation trips awarded to you because of your business or professional activities

- payments you received for land you leased for petroleum or natural gas exploration. For more information, see Interpretation Bulletin IT-200, Surface Rentals and Farming Operations.

- grants, subsidies, incentives, or assistance you get from a government, government agency, or non-government agency. Input tax credits are considered government assistance. Include the amount you claimed on line 108 of your GST/HST return only if you cannot apply the rebate, grant, or assistance you received to reduce a particular expense or an asset’s capital cost. For more information, see Grants, subsidies, and rebates.

If you use the quick method to calculate your GST/HST remittances, report the 1% credit that you claimed on line;108 of your GST/HST return . For more information, see .

Note

Enter on line 9974 in Part 5, the amount of GST/HST rebate for partners you received in the year that relates to eligible capital expenses other than CCA.

Treasury Bows To Pressure And Delays Rolling Out Making Tax Digital To Self

Millions of self-employed will not have to start reporting their tax income quarterly to the taxman from April 2023 as planned.

Bowing to pressure, ministers have postponed overhauling personal tax for the self-employed for another year, in what has been called the biggest shakeup in 25 years.

Making Tax Digital was scheduled to make 4.3m self-employed and small business owners keep digital records and report their income to HMRC every quarter rather than annually from April 2023.

Instead, the measures will now come into place in April 2024, the Government announced on Thursday.

Recommended Reading: How To Determine Taxes On Paycheck

Unique Types Of Business Operations

The CRA has information for sole proprietorships or partnerships involved in unique types of business operations.

- If you are a farmer or fisherman, or if you run an at-home daycare, you should note the CRAs special instructions for business claims that involve these activities.

- If your income is from a property, look for special instructions relating to rental income too.

How To Calculate Self

According to the IRS, if you earn more than $400 in self-employment income throughout the year, you must file a tax return. This requirement holds true regardless of any other W-2 income you bring in or your tax filing status.;;

Depending on how you earn money, you can calculate self-employment income in a few different ways.;

- 1099s: Do you earn at least some of your self-employment income as an independent contractor? If so, you should receive 1099s from the companies you contract to do work for throughout the year, assuming you earned $600 or more. Be sure to keep detailed records because even if you dont receive a 1099, you still need to report the income. Add up the total amount listed on each 1099 form plus any additional earnings from contract work and add it to your tax return.

- Gross Income: Does your business sell goods or services directly to others? If so, you will need to calculate your gross income and include it on your tax return. Gross income is the revenue you earn minus the cost of goods sold. Be sure to keep detailed records throughout the year of both your sales and expenses.;;

Read Also: How Do You Add Sales Tax

Ways To Save On Taxes

If you’re transitioning from a full-time position, it’s important to pinpoint write-offs. Here are six;ways to write off taxes:

- Startup costs:;If you recently started a new business, you can deduct the startup costs from your tax bill. These include legal fees, marketing costs and more.

- Vehicle expenses:;You can deduct up to $25,000 in vehicle expenses in addition to the mileage deduction for travel expenses.

- Home office deduction:;You can deduct your home office if you maintain a space dedicated to work tasks only. To do so, measure the square footage of your home office to determine how much you can deduct for rent or mortgage payments, utilities and property taxes.;

- Supplies and equipment:;Any office supplies or equipment necessary for the functioning of your job can be deducted from your taxes.

- Social Security and Medicare taxes:;Just like other employers, self-employed people must pay the full Social Security and Medicare tax. However, they can write off half of it at the end of the year.

- Health insurance premiums:;If you are self-employed, you might be eligible to deduct healthcare costs for you and your family from your taxes.

“You may be surprised about what is tax-deductible,” said Greene-Lewis. “For example, advertising helps people make money, but it’s also a big deduction for people.”;

How To Report Self

Millions of people have diversified the way they earn income and joined the gig economy. This could be a side gig to help them meet financial goals, running their own small business, a second job, or even multiple side gigs. Like any income, you must report income from your multiple sources or side gigs and file specific forms when you file your taxes.;

Dont worry about reporting self-employment income from multiple sources and knowing which tax forms to report your self-employment income. TurboTax Self-Employed will easily guide you through reporting your self-employment income and deductible expenses. You can also jump-start your taxes by snapping a photo of your 1099-NEC that reports your self-employment income or importing your information from hundreds of financial institutions.;

Although TurboTax Self-Employed helps you easily report your self-employment income from multiple sources and your deductible business expenses, here is a breakdown of some things you should know about reporting self-employment income from multiple sources.

Don’t Miss: How Much Is Tax In Washington State

T4 Slip Statement Of Remuneration Paid

An employed fisher’s income must be reported on a T4;slip. If you employ fishers, see the RC4120, Employers’ Guide; Filing the T4;Slip and Summary.

As a fisher, you may have received a T4;slip that shows your fishing income. Since your T4;slip may not show all of your fishing income for the year, you should keep a detailed record of all your fishing income. Enter on Form T2121 the income you received in your 2020 fiscal period.

Your T4 slip also shows the amount of income tax that has been deducted from your fishing income for the calendar year.

However, if your fiscal period ended on a date other than December;31, enter on line;43700 of your income tax return one of these amounts:

- the total tax deducted for the year, as shown on your T4;slip

- the part of the tax deducted for your 2020 fiscal period

In either case, include your T4;slip with your 2020 income tax return.

If you are claiming income tax that was deducted from a 2019 T4;slip, attach a note to your 2020 income tax return telling us you are doing this.

You can choose to have tax deducted at the rate of 20% on an amount you will receive from a catch. To do this, fill in Form;TD3F, Fisher’s Election to Have Tax Deducted at Source, which you and the buyer of the catch or the designated employer have to sign.

You can view your T4 and other tax information slips using My Account for Individuals.

How Do I File My Annual Return

To file your annual tax return, you will need to use Schedule C to report your income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C Instructions;may be helpful in filling out this form.

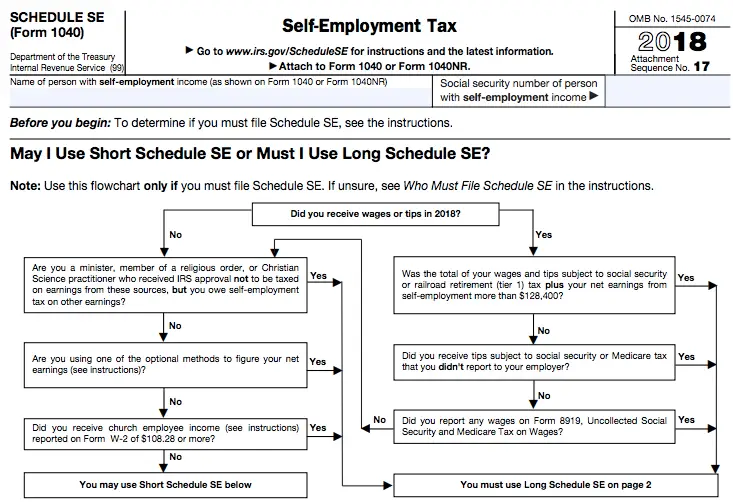

In order to report your Social Security and Medicare taxes, you must file Schedule SE , Self-Employment Tax. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare;taxes you should have paid during the year. The Instructions;for Schedule SE may be helpful in filing out the form.

Recommended Reading: How To Save Money On Taxes

Filing To Report Self

Your child can report income from self-employment using Form 1040 and Schedule C . If your child has a net self-employment income of $400 or more , the child must file a tax return.

To determine if your child owes self-employment taxes , use Schedule SE. Your child may have to pay self-employment taxes of 15.3%, even if no income tax is owed.

Wont My Business Be Considered A Hobby If I Dont Show A Profit In Two Out Of Five Years

Your business may be considered a hobby if you dont make a profit for two out of five years, but thats not always the case.

Some businesses never make a profit, but are still never considered a hobby. Thats because the profit rule-of-thumb is only one thing the IRS looks at to decide if a business is a hobby.

If your business is operating at a loss, you can still show that it is a business, and not a hobby, by operating it in a business-like manner. This means keeping good records and intending to make a profit.

If you own a business that is unlikely to be a hobby, such as a retail store or a construction company, you should have no problem convincing the IRS that you are operating a serious business.

Recommended Reading: When Do We Start Filing Taxes 2021

How Much To Set Aside For Taxes

There is no accurate way to determine the amount of money to set aside during the year so that you can pay your taxes in full upon filing. There are, however, some key factors to include when determining how to stay on top of your tax obligations.

The general rule is to set aside between 25% and 30% of the income earned for taxes. That range makes up the need to pay for the following taxes;

This number will change as your income fluctuates and as tax rates change.

Received A Payment And Other Reporting Situations

If, as part of your trade or business, you received any of the following types of payments, use the link to be directed to information on filing the appropriate information return.

- Payment of mortgage interest or reimbursements of overpaid interest from individuals

- Sale or exchange of real estate, for example the person responsible for closing the transaction

- You are a broker and you sold a covered security belonging to your customer

- You are an issuer of a security taking a specified corporate action that affects the cost basis of the securities held by others

- You released someone from paying a debt secured by property or someone abandoned property that was subject to the debt or otherwise forgave their debt to you

- You made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment

Read Also: Are Taxes Due By Midnight May 17

Who Must Pay Self

In general, you must pay self-employment tax if:

- Your net earnings from self-employment were $400 or more, or

- You had church employee income of $108.28 or more.

If you earned enough self-employment income, you must pay self-employment tax regardless of your age, even if youre a minor dependent or are retired and already receive Social Security or Medicare benefits.

Net earnings are calculated by subtracting deductible expenses from your gross self-employment income. Use Schedule SE to figure your net earnings from self-employment and the amount of self-employment tax you owe.

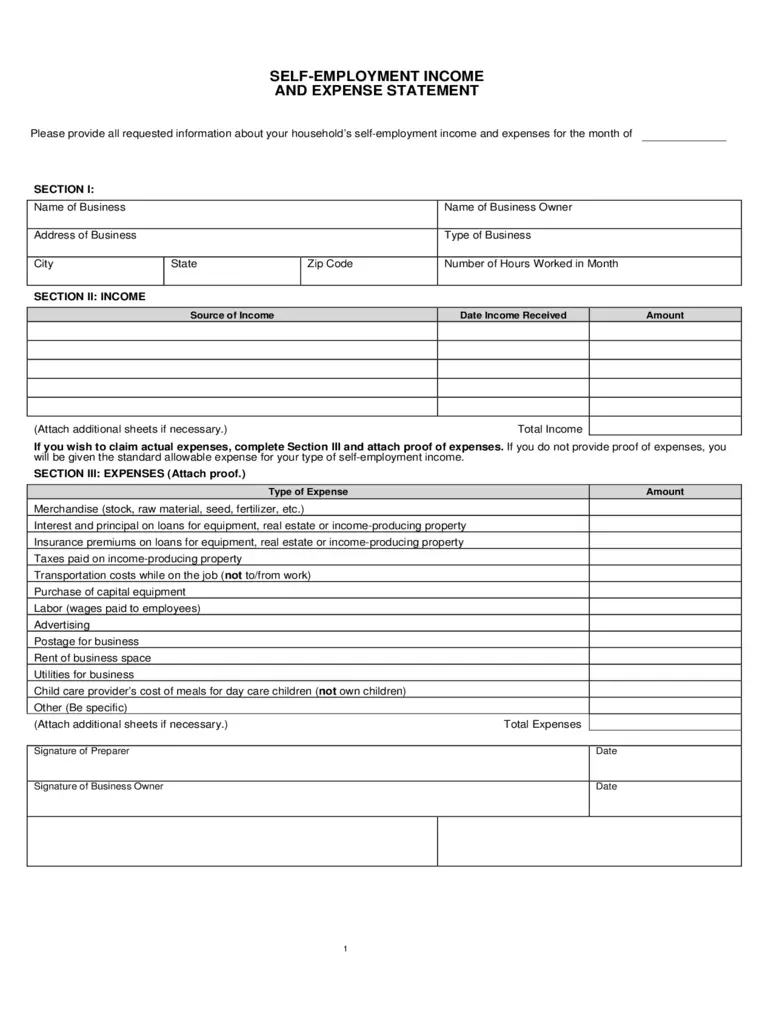

Submit Your Profit And Loss Statements

Something else you can use to show your proof of income is your profit and loss statements. If you don’t currently use them, we highly suggest starting now. Not only can they be used as proof of income, but they can also help you track your net income better. You may seem like you’re doing well in terms of profits, but in reality, you may be losing a significant amount of money to an expense like rent.Putting all your income and expenses in one form will show you your overall profitability. This can help you assess whether or not you should continue with your self-employment.

Recommended Reading: How Does Doordash Do Taxes

Gross Sales Commissions Or Fees

Your sales include all sales, whether you received or will receive money, services, or other goods that have bartering or monetary value . Bartering is when two people agree to exchange goods or services without using money. For more information, see Interpretation Bulletin IT-490, Barter Transactions.

At amount 3A, enter the gross sales, commissions, or fees .

At amount 3B, enter any GST/HST, provincial sales tax, returns, allowances, discounts and GST/HST adjustments .

Note

If you are using the quick method of accounting to calculate your GST/HST remittances, calculate government assistance as follows:

- At amount 3D, enter GST/HST collected or collectible on sales, commissions and fees that are eligible for the quick method.

- For each applicable remittance rate, include the sales, commissions and fees eligible for the quick method plusGST/HST collected or collectible. Multiply this amount by the quick method remittance rate and enter the result on amount;3E. This is the amount you enter on line;105 of your GST/HST return .

- The subtotal at amount 3F is amount;3D minus amount;3E.

For more information on the quick method and examples, see Guide RC4058, Quick Method of Accounting for GST/HST.

Amount 3G is the total of amount 3C;plus amount 3F.

Adjusted gross sales Amount 3G

Enter this amount on line 8000 in Part 3C of Form;T2125.

Relevant Cra Forms For Self

Self-employed business income is reported on the;form T2125, Statement of Business or Professional Activities. This form can help you calculate your gross income and your net income , which are required when you complete your T1,;General income and benefit return.

In order to maximize your deductions and minimize your taxes owing, its imperative that you keep all your receipts.

Article Contents7 min read

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Wealthsimple Tax is offered by SimpleTax Software Inc. under the terms of our Wealthsimple Tax User Agreement.

Don’t Miss: When Do You Get The Child Tax Credit

Filing For Educational Purposes

Filing income taxes can teach children how the U.S. tax system works while helping them create sound filing habits for later in life. In some cases, it also can help children start saving money or earning benefits for the future as noted above.

Even if your child doesn’t qualify for a refund, wants to earn Social Security credits, or opens a retirement account, learning how the tax system works is important enough to justify the effort.

Where Should You Start To Prove Income When Self

You may wonder if your income tax returns matter considering theyre not enough proof of your self-employment income. The answer is, of course they matter. Youre responsible for reporting your income to the CRA, and you want to avoid committing possible tax violations. Making sure you understand the income tax return filing rules and timing requirements ensures smooth sailing at tax time and when youre proving your self-employment income. Establishing your income accurately starts with submitting complete and accurate income tax returns. The CRA self-employment income Guide T4002 provides the tax information you need for all types of self-employment.

As a self-employed sole proprietor, you pay federal taxes by reporting your income or loss on a T1 income tax and benefit return with the CRA. Generally, if you set aside at least 25% of your net income for taxes, youre in the right ballpark. The CRA bases your tax liability on your net income, which you calculate by taking your gross income and subtracting your expenses. You report your business income on Line 104 of your tax return . You also need to complete Form T2125 , which covers your income and expenses. As of 2018, if youre paying more than $3,000 a year in taxes, you need to file quarterly tax returns with the CRA.

You May Like: How Do I Know What Form I Filed For Taxes