What Happens If I Later Receive My W

If you receive your W-2 after filling out Form 4852, double check what you reported on your tax return against the information on your W-2. If you notice any discrepancies, you need to file an amended return to avoid any penalties or fines. Use Form 1040X, “Amended U.S. Individual Income Tax Return,” to make corrections to your return. Keep in mind that this form is used only to correct information that changes your tax calculations. This includes things like changes to your filing status, errors in the number of dependents you claimed as well as corrected income credits or deductions.

If you notice math errors on your return, do not file an amended return, as the IRS will correct any math errors. You are also not required to file an amended return if you forget to attach any supporting tax documents. So, just because you did not have your W-2 when you filed your taxes, does not mean you must file an amended return to attach this form. Only do so if you notice an error that changes tax calculations.

References

Flexible Spending Accounts And Health Savings Accounts

Health savings accounts and flexible spending accounts are programs designed to allow people with health insurance to put money aside for qualified medical expenses. HSAs are designed for those who have a high-deductible health plan . The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. If you are enrolled in one of these programs, your contributions to your account will also show up on your paycheck.

Flexible spending accounts can also be set up as dependent care FSAs to allow for tax-free withdrawals for eligible childcare expenses. Your pay stub may reflect these deductions from your pay.

Calculate The Tax Refund With Paycheck Stubs

Taxpayers can estimate the refund before receiving W2 form with paycheck stubs. As most pay stub generator users already do, if your YTD earnings amount is the same as the rest of the months, you can simply put the same amount into the tax calculator too. This is the privilege you get when you preserve your check stubs of previous months.

If you have not been using pay stub maker till now, rethink if youre losing the major benefits it provides to users otherwise.

Also Check: Mcl 206.707

What Else You Might Need

As mentioned earlier, the IRS will require an explanation of how you arrived at the listed amounts. Therefore, to ensure that you have calculated correctly so that you do not pay too much or too little, you should consider utilizing a tax calculator. It is important to use a calculator when filing your taxes via your pay stub. There is an abundance of online tax calculators, so theres no reason not to be using one.Also, ensure to provide your tax calculator with any other relevant information. For example, if you have any dependents and similar outgoings, ensure that you feed them to the calculator. Make sure that the calculator is up to date and relevant to the current tax year. After running this information through the calculator, you should be able to determine how much you are owed in refunds by the IRS.Consider running that information through the calculator several times to certify the accuracy of the results.

How To File Taxes With Last Pay Stub The Right Way

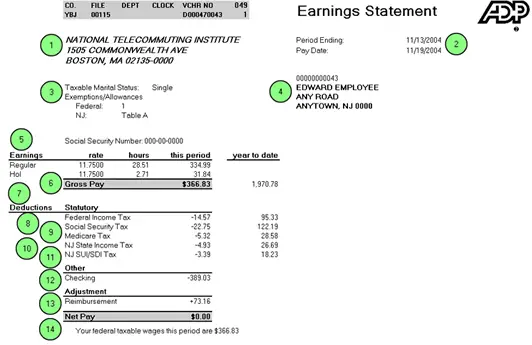

How to use your last pay stub as W-2 form is not as perplexing as it may seem? Essentially, a pay stub will be able to provide most, if not all of the information you need to file your taxes, that you would normally get from a W-2.Your pay stub will, of course, have your monthly or bi-weekly income on it, which is the most important piece of information the IRS needs. It will also list any tax deductions that come out of your paycheck. These are especially important for when you’re doing a tax refund calculator using pay stub.The tax deductions should be listed as abbreviations on your pay stub, next to the total amount deducted. These will normally include Federal Income Tax – this is usually withheld by the Internal Revenue Service.Your home state will also withhold any state income tax due, this is usually listed on your pay stub as “SIT”, although this varies. There will also be entries for any local taxes, social security taxes , and Medicare taxes.Medicare taxes are usually abbreviated as “MEDI”. Once you have all of these deductions in front of you, you can use them to estimate your annual tax payment. If it’s a monthly pay stub, simply add these deductions together and multiply them by 12. If it’s a bi-weekly pay stub, simply multiply by 24, and so on.Once you have your estimate, it’s time to use a tax calculator!

Also Check: How Much Does H And R Block Charge To Do Your Taxes

Can I Use My Last Pay Check Stub And File Today

Please do not try to use your pay stub to prepare your tax return. It will not match the W-2 that you will get from your employer in just a few short weeks. You employer has until the end of January to give you your W-2. By waiting for your W-2 you will be able to file accurately. If you try to guess what goes in the boxes and mess up your return, you will need to amend. It takes about 4 months to amend a tax return. The IRS is not accepting returns yet, so you can wait for your W-2.

You may be aware that in late December Congress passed a major tax reform bill. That has the IRS scrambling to get tax return forms ready for this tax filing season. They were waiting for the laws to pass.

Some forms are not finalized so you cannot file. The IRS has to finalize a number of forms and then approve the finalized forms in the TT software. Many state forms are not finalized either. No reason to be in a rush. The IRS will not be accepting returns until January 29 at the earliest, so filing early will not get you a faster refund. The earliest refunds will not be released until mid to late February. You just have to wait for the forms to be ready.

What Are The Requirements

There are a few steps you have to take, and the first one is notifying the IRS that you will file your taxes online. Then, you will have to fill out the 4852 form. However, keep in mind that there are certain requirements you have to meet in order to be able to do this online. Firstly, according to the IRS, your maximum gross income cannot surpass $57,000. If your income exceeds this number, you wont be able to do this online but, instead, you will have to mail the tax return. Secondly, you cannot use the e-filing system if you are under 16 years of age and have never done this in-person before.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Can I Use My Pay Stub To File My Taxes With Turbo Tax

Please do not try to prepare your tax return using a pay stub. The information on your paystub is very unlikely to match the W-2 you will receive by the end of January. There is no advantage to rushing to file before the correct information is available.

The IRS will start processing returns on January 23, 2017. Until then, any returns that have been e-filed will sit there on the server. Please be sure you really have all the information needed to file your return, such as your W-2 or 1099s, healthcare forms, etc. Employers and financial institutions have until January 31 to issue W-2s, 1099s, 1098s, etc.In some instances, they will not even be sent until sometime in February. Some state forms are not yet available, which is yet another reason to be patient and wait awhile to file. Filing too early and discovering you have errors and omissions will cause you more aggravation than having to wait. If you are seeking the Earned Income Credit or Additional Child Tax Credit, the IRS will not issue your refund before February 15, 2017, which means it cannot arrive in your account before February 27, 2017 or later.

For the availability of forms for state returns, see this:

Federal Payroll Return Requirements

Along with actually depositing your federal payroll taxes, you also have an obligation to file periodic returns that show how you computed your tax liabilities. As is true for deposits, the returns you must file for your income and FICA taxes are different from the returns you file for your FUTA taxes.

Recommended Reading: Can You File Missouri State Taxes Online

What If You Currently Dont Have A Job

Even though we have focused on people who are employed, we will also give you some advice on how to prove regular income if you are not. Just because you dont have a traditional job, it doesnt mean that you cannot obtain this document. Thats right. Maybe you are retired or receive disability benefits due to a previous injury.

If this is the case, all you need is a Benefit Verification Letter. When it comes to this one, you can get it from the Social Security Administration. It will demonstrate the reasons why you dont have a job , and it will act as confirmation that you are receiving monthly benefits. Clearly, it will include all the details and the exact sum of money you get every month.

State And Local Taxes

You may also see state taxes deducted from your paycheck. State tax rates vary significantly from state to state some states, like Florida and Texas, dont have a state income tax. If you need to pay state taxes, they are calculated in much the same way as federal income taxes.

Some localities levy an income tax. Some do not. If your city imposes an income tax, then you will likely have an amount withdrawn from each paycheck labeled local or with the name of your locality. You will generally pay the same amount each pay period for both state and local income taxes, so long as the amount you earn remains the same.

Read Also: Can You Change Your Taxes After Filing

How To Do Taxes With Last Pay Stub

Form 4852 is a surprisingly short, one-page document that is relatively easy to fill out, if you have your last paycheck stub of the year. This pay stub has year-to-date totals of all withholding and wages for the year. Simply follow the attached instructions at the bottom of this form. You will need to explain why you do not have your W-2 and supply information from your pay stub, such as your year-to-date gross income and your YTD deductions, including Social Security and Medicare, as well as withheld state, local and federal taxes. Sign the form to validate it, attach it to your 1040 form and submit it to the IRS.

If You Dont Expect To Get A Tax Slip

You have 2 options:

- Option 1:

- Get your tax slip from the CRA

You may be able to get slips for the current and past years from the CRA if the issuer has sent them to us.

- Online:

- Get tax slips by phone

- Before you call

-

To verify your identify, you’ll need:

- Social Insurance Number

- full name and date of birth

- your complete address

- details from your notice of assessment or reassessment, proof of income, or other tax document

If you are calling the CRA on behalf of someone else, you must be an .

- Telephone number

-

Yukon, Northwest Territories and Nunavut:1-866-426-1527

Outside Canada and U.S. :613-940-8495

-

9 am to 5 pm Sat and Sun

- Option 2:

- Estimate your income without tax slips

If you can’t get a slip in time to file your taxes, you can estimate your income manually. Add up your pay stubs or financial statements to estimate the income to report, and any related deductions and credits you can claim.

Include a note with your return stating the name and address of the issuer of the slip, the type of income, and what you are doing to get the slip.

- If you file electronically: Keep all of your documents in case the CRA asks to see them later.

- If you file by paper: Attach a copy of the pay stubs or statements and your note to your paper return. Keep the original documents.

You May Like: How To Buy Tax Lien Properties In California

State Payroll Tax Filings And Payments

You will generally have to send make tax payments and file returns for two types of state payroll taxes: income taxes and unemployment taxes.

The general rule for income taxes is that each state requires employers to file a quarterly tax and wage report on or before the last day of the month following the calendar quarter in most cases, if the due date falls on a Saturday, Sunday, or holiday, the due date is extended to the next business day.

Some states now require electronic filing for certain returns and payments. Consult your state’s department of revenue for information regarding the required returns and the deadlines for the remittance of withheld income tax. Consult your state unemployment tax agency to contact for information and tax forms relating to unemployment taxes.

What Are Gross Earnings On A Paycheck

A pay stub also lists gross and net income to-date. This means you know exactly how much money you are taking home. This allows you to accurately and confidently plan your monthly and yearly budgets.

Be sure to check that the information on your last pay stub of the year matches the information on your W-2 form, which details your wages and taxes paid for the year.

You May Like: How To Buy Tax Lien Properties In California

Getting Started With Employees

When you hire your first employee, you’ll need to get a federal employer identification number from the IRS if you do not already have one for your business. You may also need to get state and local tax numbers as well. In addition to assigning an employer identification number for use on all your correspondence, deposits, returns, and other documents, the tax agencies will usually supply you with information about your specific payroll tax obligations and may supply the forms you’ll need to use when you deposit the taxes and file returns.

For federal payroll tax purposes, you will have both reporting and depositing obligations. Although these relate to the same liability, the tax returns and tax deposits are generally done separately:

- Federal tax deposits must be made on a periodic basis.

- Federal tax returns must be filed on a quarterly or annual basis.

Also, it is important to note that different deposit rules apply to income and FICA taxes and to FUTA taxes.

Act now

The multiple filing and due dates can be difficult to calculate and remember. In order to prevent missed deadlines, the IRS publishes an annual calendar of due dates: Tax Calendars for 2021 .

The IRS also provides a free, downloadable Tax Calendar that contains all the federal tax due dates for the year, as well as an electronic reminder system. This calendar is available on the IRS website.

Federal Tax Deposits Must Be Made Electronically

Federal tax deposits must be made electronically, unless the small business exception applies.

There are four methods that an employer can use to electronically transmit tax payments:

- Use the Treasury Department’s free Electronic Federal Tax Payment System , either online or the voice response system.

- Ask your financial institution to initiate an ACH Credit payment on your behalf.

- Ask a trusted third party, such as a tax professional or payroll service, to make the payment for you.

- In extraordinary circumstances, ask your financial institution to make a same-day tax wire payment for you.

Limited exception to electronic filing requirement. Small businesses with a federal tax liability of less than $2,500 per quarter still have the option of mailing a check with their quarterly returns.

“Business daysâ and âlegal holidays.â What if the date that you’re required to make a federal tax deposit falls on a non-business day? In that case you have until the close of the next business day to make a timely deposit. A business day is any day other than a Saturday, Sunday, or legal holiday. For federal tax purposes, a legal holiday is federal holiday or a legal holiday in the District of Columbia. Other holidays, such as statewide legal holidays, do not delay the due date.

Example

If your deposit’s due date happens to fall on a Friday that is a legal holiday in the District of Columbia, you’ll have until the end of the following Monday to make your deposit.

Warning

Recommended Reading: How Do I Get My Pin For My Taxes

Filing Your Taxes Online

For those wondering “can you file taxes with your last pay stub?”, the answer is yes, but the best way to do so is online. It is possible to use a pay stub to file taxes in the traditional way, but you’ll need to notify the IRS that you’re doing so, and fill out a 4852 form.This can be done in lieu of a W-2. First off, it’s important to remember that you can only file your taxes online under certain circumstances. According to the Internal Revenue Service , the maximum gross income threshold for those wishing to e-file for free with the IRS FreeFile service is currently $57,000.If you earn any more than this in a year, you will have to file your taxes by printing and mailing your tax return. You will also be unable to e-file if you are under 16 years old and have never filled in a tax return previously.If you are currently resident in Guam, the U.S Virgin Islands, the Commonwealth of the Northern Mariana Islands or American Samoa, you will also be unable to e-file. You can still prepare your return online, but you will have to print and mail it if any of the above applies to you.If you fit the bill and have an accurate pay stub, as well as a decent WiFi connection, you’re good to go!