How Do I Request Prior Year Federal Tax Returns

OVERVIEW

You can request prior tax returns, for a fee, from the IRS.

If you cant find one of your old tax returns, theres no reason to worry. The IRS can provide you with a copy of it if you prepare Form 4506. The IRS keeps copies of all returns you file for at least seven years. However, if the tax return you want is older than this, theres a possibility it may not be available.

A Quick Look At H& r Block

H& R Block has provided consumer tax filing service since 1955. Its become one of the most popular filing services since then, because it combines simple tools and helpful guidance. Thats useful whether youve never filed taxes or whether youve been filing for decades. Of course, tools and guidance come at a price. H& R Block currently offers four digital filing options. You can see the options and pricing in the table below.

| H& R Block Filing Options | ||

| Filing Option | ||

| Federal: Free State: Free | Best for new filers or simple tax returns supported forms include 1040 with some child tax credits | |

| H& R Block Deluxe | Federal: $29.99 State: $36.99 | Best for maximizing your deductions includes all free features plus forms for homeowners allows you to itemize |

| H& R Block Premium | Federal: $49.99 State: $36.99 | Best for investors and rental property owners all More Zero and Deluxe features, plus accurate cost basis Schedule C-EZ, Schedule D, Schedule E, Schedule K-1 |

| H& R Block Self-Employed | State: $36.99 | Best for small business owners all Free, Deluxe and Premium features, plus Schedule C |

How To Get Copies Of Past Years Tax Returns

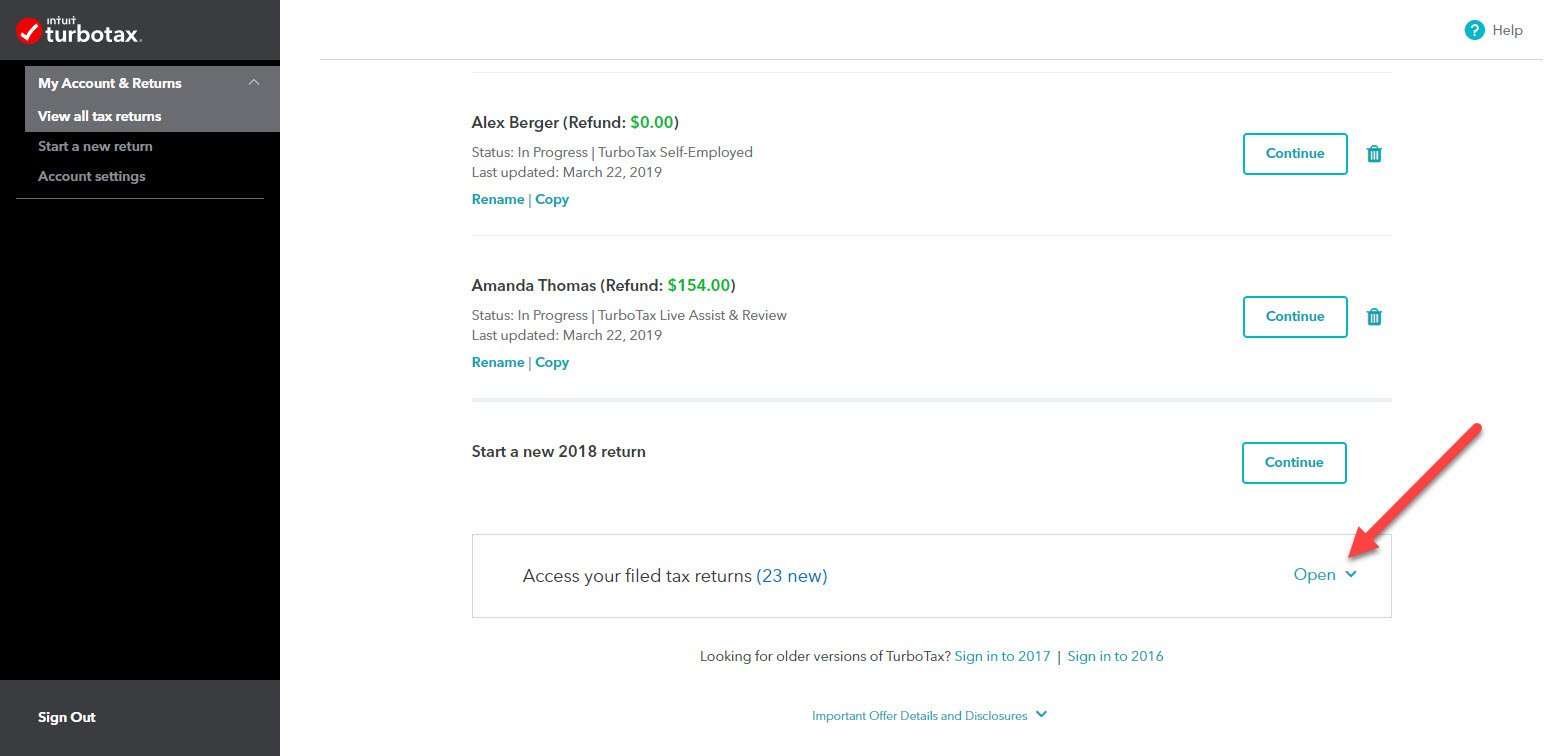

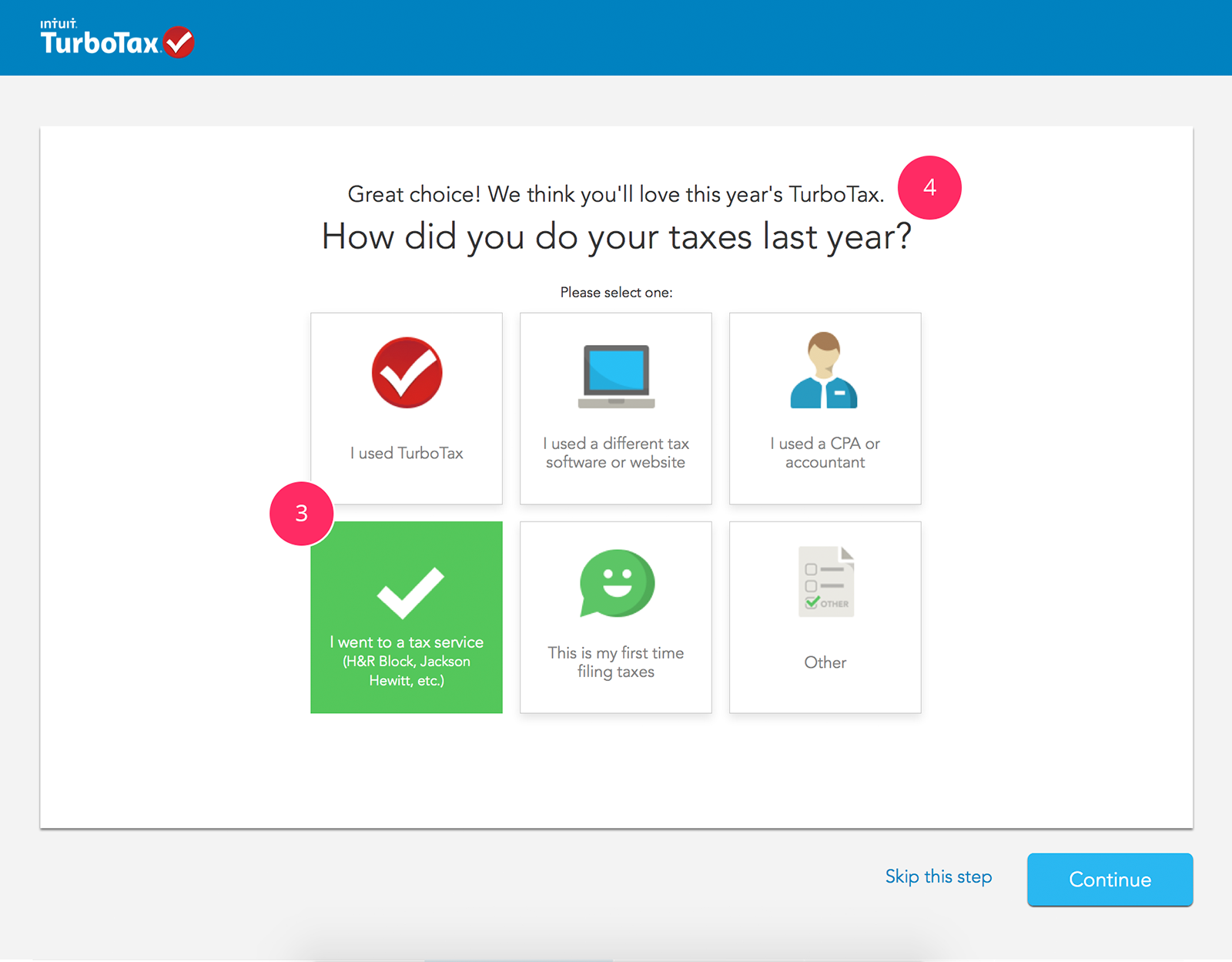

Here’s how to obtain copies of a prior year return you filed in TurboTax Online:

If you don’t see your tax year listed, you may have multiple accounts.

Hope this was helpful!

Don’t Miss: What Happens If You Cannot Pay Your Property Taxes

How Long Does It Take To Get Tax Refund From Turbotax Direct Deposit

Turbo Tax helps millions of people get their stimulus payments. As per the IRS, almost 80% of US citizens are eligible to claim for the stimulus payments.

Users can simply answer a few questions with the Turbo Tax Stimulus Registration Product and can easily file a return with the IRS through Turbo Tax.

What Is An Irs Tax Transcript And How Do I Request One

OVERVIEW

Learn which situations may require an IRS tax transcript, along with how to request your tax transcript, and how to interpret it when it arrives.

Do you need information from a tax return you filed three years ago because you’re making a major purchase and the lender wants to see your tax history? Maybe you need to provide your adjusted gross income from the past three years to demonstrate your financial picture but can’t find your tax return paperwork.

If you find yourself in a similar situation, you don’t need to panic. You can simply find this information by downloading your IRS tax transcript online or requesting a copy in the mail. This form provides most of the information you submit on your Form 1040, and you can access it for free.

Read Also: How Does The Irs Tax Bitcoin

What Does An Irs Transcript Show

There are five types of tax transcripts you can request from the IRS:

If You Used The Cd Or Downloadedversion

Your tax return is stored on your computer if you purchased the TurboTax CD or downloaded the program from the internet. It’s a tax data or .tax file, so you can only open it in the TurboTax software. Hopefully, that’s still installed on your computer, and you can print a copy of the return out from there.

Recommended Reading: How Can I Pay Tax Online

If You Preparedyour Taxes Online

You’ll have to use your TurboTax login if you used the online version of the product. Make sure you sign in to the same account you used to prepare your return. From there, it’s a simple matter of clicking on the “Documents” tab, then on the tax year you want, then finally on “Download PDF.”

TurboTax suggests using the “Account Recovery” tool if you can’t find the return you’re looking for. It’s possible that you’re not signed in under the same account you used to prepare it.

Income $72000 And Below:

- Free federal tax filing on an IRS partner site

- State tax filing

- Guided preparation simply answer questions

- Online service does all the math

- Free electronic forms you fill out and file yourself

- No state tax filing

- You should know how to prepare paper forms

- Basic calculations with limited guidance

Don’t Miss: How To Know Tax Id Number

Should You Sign Up With Turbotax

If you decide to use a tax software program, you cant do better than TurboTax. Not only is it incredibly user-friendly, but you can get help from tax experts at any time during the preparation process. Better yet, TurboTax is actually priced lower for 2021 than it was for the previous tax year. This means you can get the help you need at a lower cost than normal, which means more money in your pocket by the time you file.

The TurboTax Live option, which is available at a very reasonable cost, also enables you to get direct tax preparation assistance from either a CPA or an enrolled agent.

You can work the return as far as youre able, then bring in the tax expert to help you with what you dont understand. You can even have that expert help you prepare and complete the return on your behalf, and all through remote access.

As a final important bonus, TurboTax also offers both audit assistance and audit defense its your choice. In the unfortunate event you do face an audit, TurboTax can make sure that youre not doing it completely alone. And as complicated as the tax code is, thats an important feature to have.

Choose The Tax Years You Want Returns For

You can request more than one tax return on Form 4506 however, you must indicate the type of form you used to file each one, such as a Form 1040, 1040-SR, 1040A or 1040EZ. In the next section of Form 4506, you must provide the tax years you are requesting. For example, if you are requesting a tax return from 2018, the IRS asks you to enter 12/31/2019 rather than just 2019″.

Recommended Reading: Are Taxes Due By Midnight May 17

How To Use Turbotax To Get A Stimulus Check

To get a stimulus check, use the TurboTax direct registration process.

Fill in the following questions

- Did you file the 2020 taxes?

- Your filing status

- If somebody claimed you as a dependant on the tax returns

- For how many dependants did you claim your return?

- Do you have an SSN?

Further, users have to fill in some other questions to use Turbo Tax.

- Birthdate

- Fill in your non-taxable information

- Further Turbo Tax would help you file your IRS

- It would also calculate the total amount you earn annually.

- Finally, IRS stimulus checks would only be slightly away from you.

Steps To Install Turbotax With License Code

You can complete the process of installation with a license code by following the steps mentioned below. Please note the steps apply to Windows 10 desktop or laptop and when you have the installation CD/DVD drive. To Install TurboTax with license code, follow the steps below.

The steps mentioned above should serve to Install TurboTax with license code so you can utilize its service to the fullest. Now that you know how to do the same, you can use TurboTax with no worries. You can find more information in our other blogs related to TurboTax and other valuable software.

Also Check: How To Grieve Property Taxes

What If You Need Your Actual Tax Return

If your tax transcript won’t meet your needs, you can still access your tax return in other ways. If you used TurboTax Online to prepare your taxes, you can access your tax return by signing in to your TurboTax account and navigating to the “Your tax returns & documents” section.

If you prepared your taxes in another way, you need to complete IRS Form 4506 and mail it to the IRS along with a $43 fee for sending you a copy of your tax return . These requests can take up to 75 days to process. So, you’ll want to make sure a tax transcript won’t cut it before starting this process.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Get Our Top Investigations

Heres what happened when we went looking.

Our first stop was Google. We searched for irs free file taxes.

And we thought we found what we were looking for: Ads from TurboTax and others directing us to free products.

The first link looked promising. It contained the word free five times! We clicked and were relieved to see that filing for free was guaranteed.

We started the process by creating the profile of a TaskRabbit house cleaner who took in $29,000. We entered extensive personal information. TurboTax asked us to click through more than a dozen questions and prompts about our finances.

After all of that, only then did we get the bad news: TurboTax revealed this wasnt going to be free at all. Turns out the house cleaner didnt qualify because he is a independent contractor. The charge? $119.99.

Then we tried with a second scenario. We went back to TurboTax.com and clicked on FREE Guaranteed. This time, we went through the process as a Walgreens cashier without health insurance, entering personal information and giving the company lots of sensitive data.

Again, TurboTax told us we had to pay this time because theres an extra form if you dont have insurance. The charge? $59.99.

But wait. Are the house cleaner and the cashier not allowed to prepare and file their taxes for free because of their particular tax situations? No! According to the agreement between the IRS and the companies, anyone who makes less than $66,000 can prepare and file their taxes for free.

Don’t Miss: Where Do I Get Federal Tax Forms

How Can You Get Your Tax Transcript

There are two main ways get your tax transcript from the IRS:

Some Early Filers Will Wait Until Early March For Refunds

The IRS noted online earlier this year that the EITC refund can be expected “as soon as the first week of March if you file your return online, you choose to get your refund by direct deposit and we found no issues with your return.”

People can still prepare and file returns electronically but the IRS isn’t going to move the returns through the system until much later than usual.

Several tax preparation firms are open for business, so tax filers don’t need to wait until Feb. 12 if they have their paperwork in hand.

TurboTax noted Friday that it is open and accepting returns and will securely hold the returns for transmission to the IRS once the agency begins accepting e-filed returns.

H& R Block said Friday that it continues to encourage people to still file their taxes soon, so the returns can be processed as soon as the IRS begins accepting returns.

Recommended Reading: How To Find Tax Lien Properties

Why The Government Should Just Do Your Taxes For You

The actual work of doing your taxes mostly involves rifling through various IRS forms you get in the mail. There are W-2s listing your wages, 1099s showing miscellaneous income like from one-off gigs, etc. To fill out your 1040, you gather all these together and copy the numbers in them onto the 1040 form. The main advantage of TurboTax is that it can import these forms automatically and spare you this step.

But here’s the thing about the forms: The IRS gets them too. When Vox Media sent me a W-2 telling me how much it paid me in 2017, it also sent an identical one to the IRS. When my bank sent me a 1099 telling me how much interest I earned on my savings account in 2017, it also sent one to the IRS. If I’m not itemizing deductions , the IRS has all the information it needs to calculate my taxes, send me a filled-out return, and let me either send it in or do my taxes by hand if I prefer.

This isn’t a purely hypothetical proposal. Countries like Denmark, Sweden, Estonia, Chile, and Spain already offer “pre-populated returns” to their citizens. The United Kingdom, Germany, and Japan have exact enough tax withholding procedures that most people don’t have to file income tax returns at all, whether pre-populated or not. California has a voluntary return-free filing program called ReadyReturn for its income taxes.

The Obama administration supported return-free filing, and Ronald Reagan touted the idea in a 1985 speech:

Turbotax Stimulus Direct Deposit Check

Users have to file their IRS through Turbo Tax and in it, you have to update your account details. Once the bank account details are updated then you can get a direct deposit check. Follow the below steps to find out more

- Log in to your Turbo account.

- After TurboTax login, file the IRS through them.

- Go to the TurboTax portal for direct deposit information.

- In the Bank Account section, update your bank information.

- Enter all the other details as required.

Those who do not have a direct deposit account can receive the amount through check. Thus if youre wondering how to get stimulus check from TurboTax then you need not worry since all those users who will have a current direct deposit account, would receive a payment as a check or a debit card payment.

There was no stimulus check Turbo tax delay and it was primarily due to the IRS delaying the payments that some of the checks have got delayed.

Don’t Miss: Can I File Old Taxes Online

Where You Can Find Your License Code

- TurboTax Download

- After successfully downloading the software, the Installation Key will appear in as a receipt within your email.

- Check your junk email folder to ensure your TurboTax email receipt was not filtered out.

- If you fail to receive your receipt by email within 24 hours of purchase, immediately contact TurboTax Support to get a copy of your receipt.

- TurboTax CD

- In case you have bought a TurboTax CD, you will be provided the Installation Key on the sleeve of the CD cover