Foreign Persons And Irs Employer Identification Numbers

Foreign entities that are not individuals and that are required to have a federal Employer Identification Number in order to claim an exemption from withholding because of a tax treaty , need to submit Form SS-4 Application for Employer Identification Number to the Internal Revenue Service in order to apply for such an EIN. Those foreign entities filing Form SS-4 for the purpose of obtaining an EIN in order to claim a tax treaty exemption and which otherwise have no requirements to file a U.S. income tax return, employment tax return, or excise tax return, should comply with the following special instructions when filling out Form SS-4. When completing line 7b of Form SS-4, the applicant should write “N/A” in the block asking for an SSN or ITIN, unless the applicant already has an SSN or ITIN. When answering question 10 on Form SS-4, the applicant should check the “other” block and write or type in immediately after it one of the following phrases as most appropriate:

“For W-8BEN Purposes Only””For Tax Treaty Purposes Only””Required under Reg. 1.1441-1″”897 Election”

To expedite the issuance of an EIN for a foreign entity, please call . This is not a toll-free call.

Tin Search: Finding Your Tin Number

If youre a Canadian business owner looking for your TIN number, weve got good news: its easy to find.

For individual residents of Canada , your TIN number is your nine-digit SIN.;

So long as you know your SIN, youre good to go!

However, for corporations , your TIN is your nine-digit Business Number issued by the Canada Revenue Agency .;

So, lets talk about how to find your BN.

Finding The Employer Id

If you’re looking for the EIN of a business, there are several places to search.

Hire the top business lawyers and save up to 60% on legal fees

Recommended Reading: How To Calculate Sales Tax From Total

How To Get A Tax Id Number For An Organization

Every business or nonprofit organization needs to have a tax ID number in order to pay taxes and open a bank account. A tax ID number identifies the organization or business with the IRS and provides legality for the entity. If your organization receives any state or federal funds through grants, if your organization will maintain a bank account, pay employees or transact with money, the organization will need a tax ID in order to conduct business. However, obtaining a tax ID number is easy to do.

Step 1

Obtain all records about the organization. When you apply for the tax ID number, you will need to know the organizational structure. For example, is the business a sole proprietorship, a corporation, an LLC or a nonprofit. You will need to know the legal name of the business or organization. You will also need to know the mailing address and a phone number for the organization.

Step 2

Complete an application with the IRS for the tax ID number. The IRS form number for the tax ID application is IRS Form SS-4. You may request a paper version of the form. However, you may also apply for the tax ID over the phone or online. Call the IRS at 829-4933 to apply for the tax ID over the phone. Visit the IRS tax ID web application to apply online . If you apply for the tax ID over the phone or online, you will receive an ID during your session. A confirmation of the number will be mailed to the mailing address you listed for the organization.

Step 3

References

Finding An Ein For Another Business

Getting someone elses EIN is a more challenging process. Many of the documents with an EIN on them are public documents , but there’s still an overall concern about privacy and business identity theft.

You can look the business up on the EDGAR Search service on the Securities and Exchange Commission website if it’s a public company .

Your search will be more difficult if the company isn’t a public company. You might be able to buy a business credit report for the company, or you might be able to find another public document that includes the companys EIN.;

Don’t Miss: What Is The Date To Pay Taxes

Get An Ein For Small Business Disaster Loans

- Your business will need an EIN to apply for Small Business Administration loans, including disaster loans for businesses affected by the public health crisis and economic downturn, as well as the 2021 winter storms.

- The Economic Injury Disaster Loanprogram is an SBA disaster loan program for businesses with fewer than 500 employees, including;sole proprietors, independent contractors,;and self-employed;persons. Check with your local lender to see whether they participate in this program.

Federal Tax Id For A Business

A federal tax ID lookup is a method of searching for a business’s information using their tax identification number , or employer identification number .

Tax identification numbers are issued to businesses by the IRS depending on their structure. When a business changes its structure, it will usually be issued a new ID number. The United States federal government uses a federal tax identification number for business identification.

An EIN will possess nine numbers and is used by the IRS for administering taxes for the following entities:

- Employer

- Trust or government agency

- Corporation

Either the grantor, owner, or trustee of an organization will be issued an EIN. The practice of one per responsible party per day applies to the issuance of EINs. To make sure tax administration is successful, the IRS is focused on only providing qualified parties with an EIN. Third-parties applying for an EIN must identify themselves as a third-party designee.

An EIN can be applied for online or by using the paper Form SS-4. An organization whose primary business address is in the United States can apply for an EIN online.

An EIN is not a replacement for a Social Security Number .

Don’t Miss: How To File Taxes Doordash

How To Apply For A Federal Tax Id Number

Once youve determined that your business needs a tax ID, youll work with the IRS to receive one. You can apply online; other options include phone, mail or fax.

A federal tax ID number is free, so steer clear of any scams that try to get you to pay for an EIN. The IRS administers and grants tax ID numbers to businesses throughout the United States, so you can apply directly at IRS.gov.

Here are the three key steps:

Discover The Steps Involved In Getting A Federal Tax Id Number For Your New Business And How This Asset Helps Simplify A Range Of Financial Processes From Paying Employees To Filing Taxes Presented By Chase For Business

Getting a federal tax identification number is an important first step when you start your business.

According to the IRS, a federal tax ID number is used to identify a business. There are many reasons why a business may need one, including paying employees, claiming benefits and filing and paying taxes.

Heres how to figure out if you need a federal tax ID number, how to apply for one and when your business should use it.

Also Check: How Much Is Sales Tax In Illinois

Does My Business Need An Ein

Businesses of all types are allowed to apply for an EIN. However, the IRS requires certain businesses to have one. If you answer yes to any of the following, you’ll need an EIN:

- Does your business have employees?

- Does your business file employment or excise taxes?

- Is your business taxed as a partnership or corporation?

- Does your business withhold taxes on non-wage income paid to a nonresident alien?

- Do you have a Keogh plan?

Even if your business is a sole proprietorship or LLC with no employees, its still beneficial to get an EIN. It makes it easier to keep your personal and business taxes separate, and it may be required to open a business bank account or apply for business licenses. If you don’t have an EIN, you’ll need to use your personal SSN for various tax documents.

Keep in mind that those with an SSN, an individual tax identification number , or an existing EIN may apply for an EIN.

How To Do An Ein Lookup Online

You can locate a lost or misplaced EIN by the following

If you are trying to find the EIN of business other than yours there are a few options.

Paid Method of Finding an EIN For a Business

Try purchasing a business credit report from any of the major credit agency.

You May Like: Do You Have To Pay Taxes On Plasma Donations

How Do I Know If I Need A Tin

You need a TIN if you are authorized to work in the United States or if you plan to file taxes with the IRS. You’ll also need a TIN if you want to take advantage of benefits or services offered by the government. If you run a business or other organization, you’ll also need a TIN to run your day-to-day operations and to report your taxes.

What Information Is Needed To Apply

The legal business name, location and the name and address of a responsible party who can answer questions that might arise this would usually be an officer or owner of the company. This person also provides his/her social security number on the application form.

Also required is a general statement about the type of business activity the company will be involved in as well as the business structure ; the State where the company is incorporated, and the reason for application; and an estimate of the number and type of employees expected.

Read Also: How To Find Tax Amount

How To Check Your Tin For Non Individual Taxpayer

Visit the Website TIN Registration Search Panel

- Step 1: Select the Organizations Date of Incorporation

- Step 2: Select your preferred search criteria from the Select Criteria Dropdown-TIN or CAC registration Number or Registered Phone Number. CAC registration number should be typed in this format: BN1234 or IT1234 or RC1234.

- Step 3: Provide the appropriate value based on the search criteria in Step 2 above.

- Step 4: Confirm you are not a robot by checking the reCAPTCHA Box.

- Step 5: Click the Search button.

You can also check out

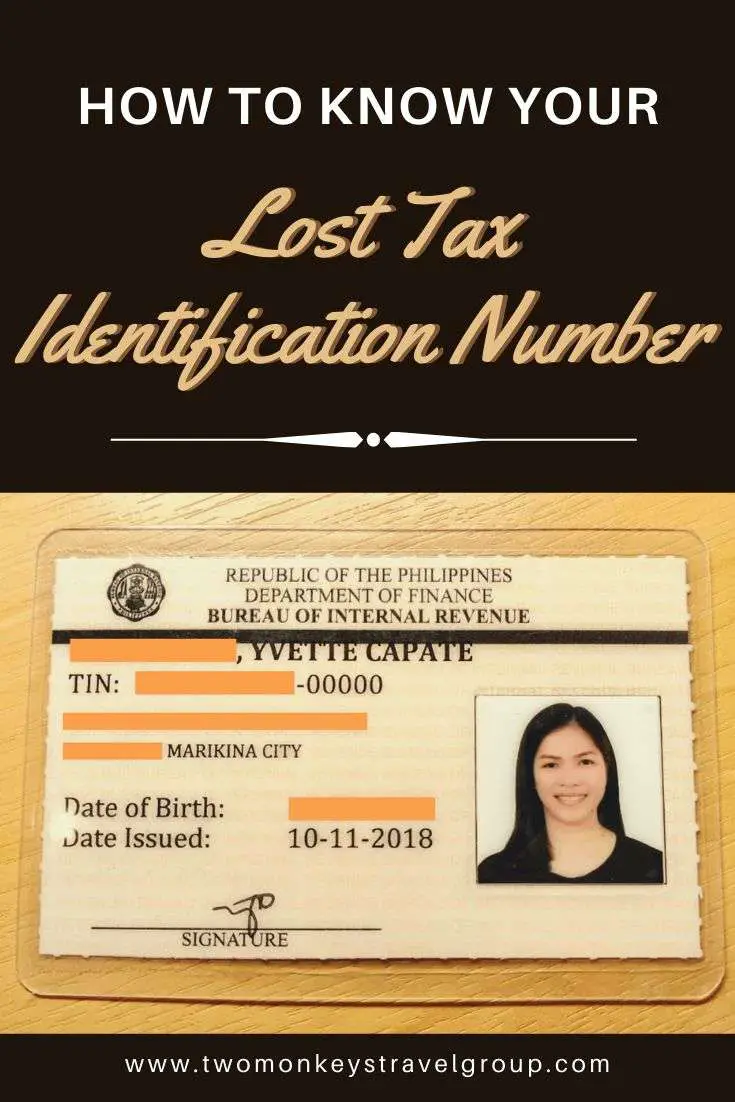

How To Get Tin Number In The Philippines: 2 Ways

Taxpayers can secure a TIN either through walk-in registration at their assigned revenue district office or online registration via the BIR eRegistration website.

a. TIN Application Using BIR Form 1901 .

The BIR Form 1901 is filed by self-employed individuals, whether single proprietors or professionals, to register with BIR as taxpayers and obtain their own TIN.

The same form is also used for BIR registration by mixed-income individuals or employees who are also running a business on the side; those who want to register their estates and trusts; and non-resident aliens engaged in trade/business.

b. TIN Application Using BIR Form 1902 .;

The BIR Form 1902 is the tax form used to register new employees who will earn purely from their salary/compensation income in the Philippines.

Most of the employers take care of their employees BIR registration. If this is the case, all you need to do is to fill out the form and submit the required documents. Once registered, youll be issued your permanent TIN.

Read Also: How To Appeal Property Taxes Cook County

Tax Id And Tax Number: Everything You Need To Know

Where can you find your tax ID and tax number? We’ll explain everything here!

Tax ID and Tax Number: Everything You Need to Know!In Germany, there are various numbers for different types of income and tax purposes. This can get quite confusing: tax identification number, VAT identification number, tax number, eTIN what is used for what? Well clear this all up for you!

Understanding Employer Identification Numbers

An Employer Identification Number, or EIN, is not just for companies with employees. In fact, most business entities require this number for tax purposes and the IRS refers to the EIN as the Federal Tax Identification Number. Some states require a company to have an EIN before filling out state tax forms or even registering the business in the state.

State governments use the EIN as a general identification number for business licenses and other requirements, in addition to taxes. In California, for example, most companies must have an EIN before registering for state payroll taxes.

Also Check: What Does Agi Mean For Taxes

Frequently Asked Questions: Ein Number Lookup

Do I need an EIN if Im self-employed?

You dont need an EIN if youre self-employed; you can simply use your Social Security number. Some people who are self-employed choose to apply for an EIN instead of using their Social Security number to reduce the risk of identity theft; its less likely for someone to break into your accounts when you keep business finances and personal finances separate.

I have a sole proprietorship with a DBA . Do I Need an EIN?

Having a DBA doesnt impact whether or not you are required to have an EIN for your sole proprietorship. The same rules apply to a sole proprietorship with a DBA as apply to a sole proprietorship without a DBA.

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

Is there a difference between an EIN and a TIN?

No, there isn’t a difference between an Employer Identification Number and a Taxpayer Identification Number . Both refer to the nine-digit number issued by the IRS;to identify;your business.

Is there a difference between an EIN and a FEIN?

No, there is not a difference between an EIN and a Federal Employer Identification Number . A FEIN can also be referred to as a Federal Tax Identification Number.

How To Check My Tax Identification Number

A Tax Identification number is used to identify a business for tax reasons. Tax ID numbers must be registered for a business to apply for a bank account, report employment tax and establish income tax reports. A Tax ID number defines a business in a similar way that a Social Security number defines a person. The Internal Revenue Service issues Tax ID numbers to ensure that business taxes are paid efficiently. The system is set up so that the owner of the Tax ID number has the authority to access and check the number when needed.

Read Also: What Do Tax Accountants Do