Spouses Children And Parents Of A Deceased Person Are Exempt From Iowa Inheritance Tax While Other Inheritors Might Have To Pay

By , J.D.

Update: In 2021, Iowa decided to repeal its inheritance tax by the year 2025. In the meantime, there is a phase-out period before the tax completely disappears. For deaths in 2021-2024, Iowa will reduce the estate tax rate by an additional 20% each year until the tax is fully phased out. In 2021, the tax rates listed below will be reduced by 20% in 2022, the tax rates listed below will be reduced by 40% in 2023, the tax rates below will be reduced by 60% and in 2024, the tax rates below will be reduced by 80%. For deaths that occur after January 1, 2025, there will be no inheritance tax at all.

Iowa is one of a handful of states that collects an inheritance tax. If you are an Iowa resident, or if you own real estate or tangible property located in Iowa, the people who inherit your property might have to pay a tax on the amount that they inherit. Whether they will have to pay the tax, and how much they will have to pay, depends on how closely they were related to youthe closer the family connection, the lower the tax rate. It also depends on the amount they inherit.

Does Washington State Have An Estate Tax

If you live in Washington state, you live in one of the few states that still levy estate taxes. Inheritances of residents of Washington, as well as estates of non-residents who own real estate and/or personal property therein, are subject to state property taxes in accordance with the following guidelines.

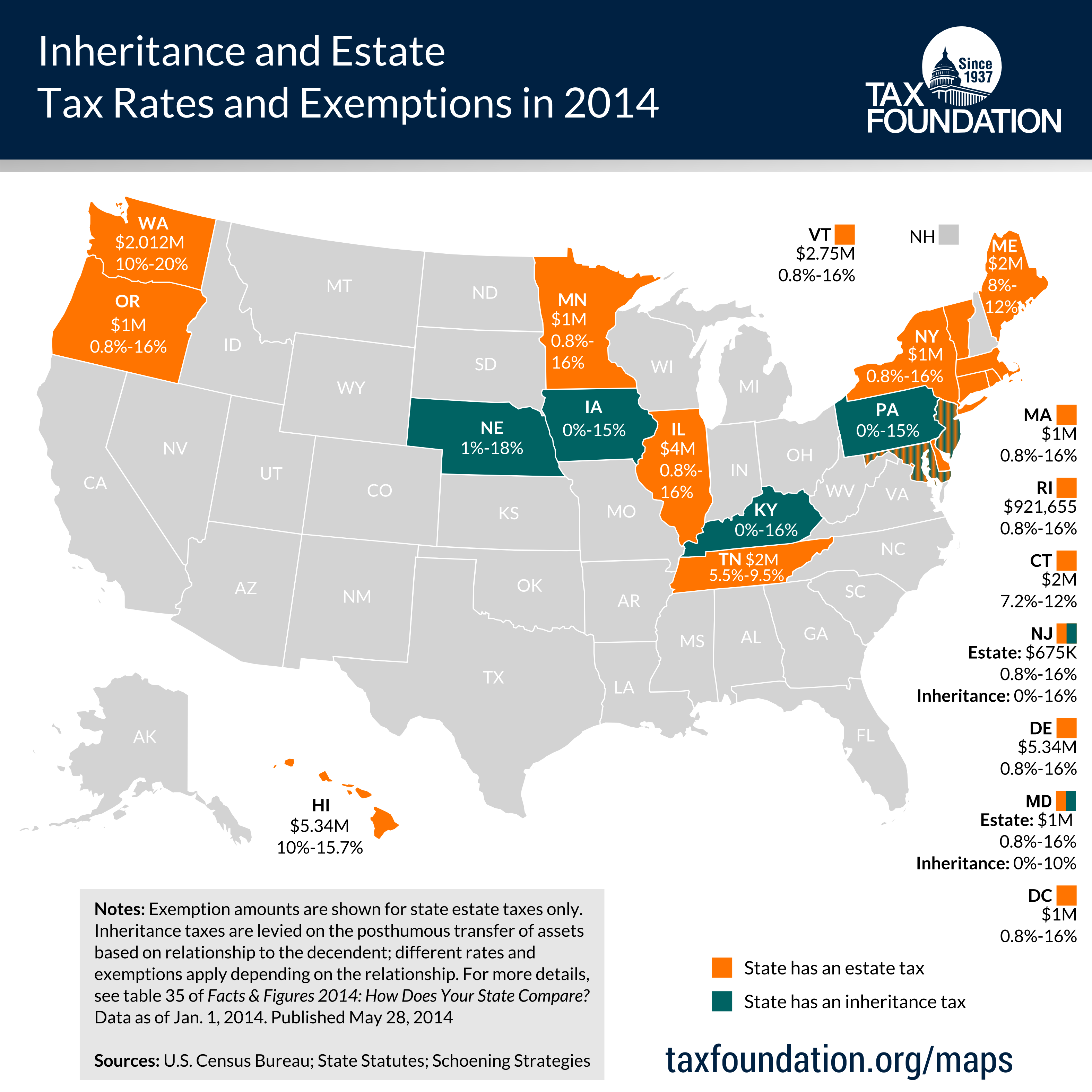

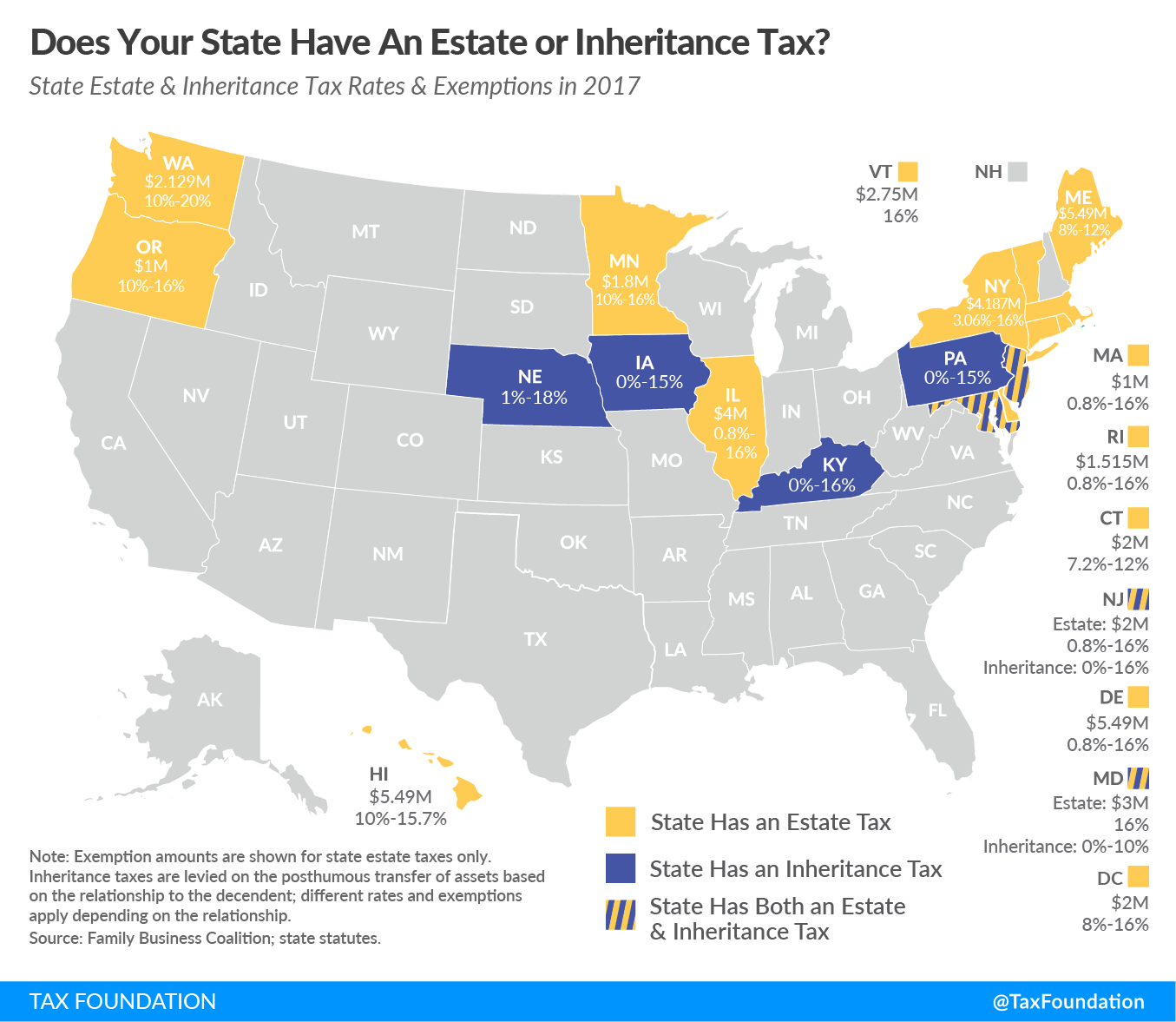

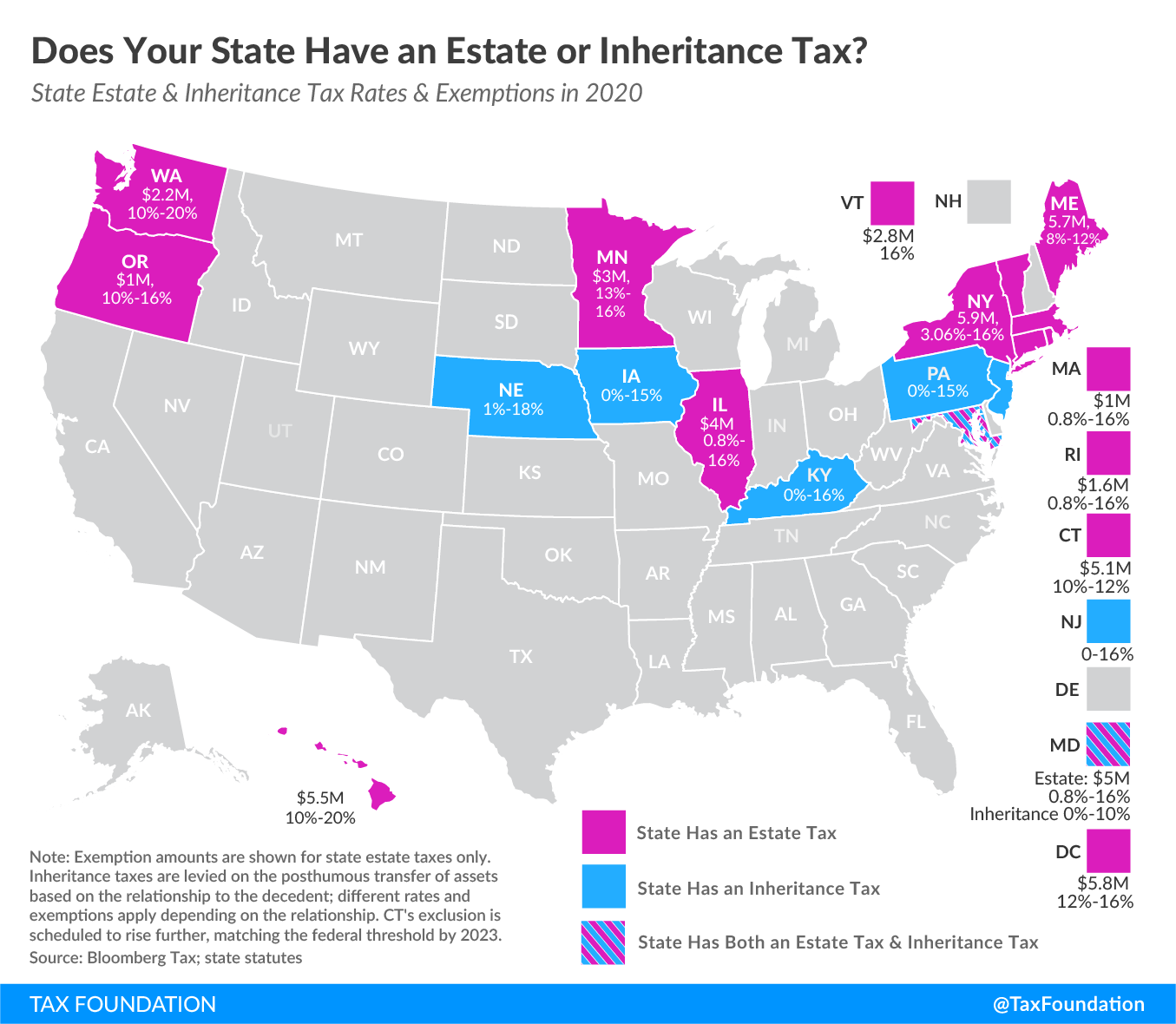

Which States Have An Estate Tax

Several states and the District of Columbia have an estate tax. Many have lower asset thresholds than the federal government. Each states exclusion amount is in the table below.

If you live in a state with an estate tax, the good news is that your estate tax bill is subtracted from the value of your taxable estate before you calculate what you might owe the IRS.

You May Like: Doordash Accounting Method

Other Stronger Reform Options

- Restore the estate tax to what it was under President Clinton a $2.6 million exemption per couple with a 55% top tax rate. This would generate an additional $249 billion over 10 years money that could be used to support popular public services and reduce the deficit. Even with this smaller exemption, the tax would affect fewer than 2 out of 100 estates. Rep. Jim McDermott proposed such legislation in 2011.

- Close the inherited capital gains tax loophole. Wealthy people avoid capital gains taxes by holding onto their assets until they die and bequeathing them to heirs. The increase in value is not taxable when they are sold. This loophole will allow the wealthy to dodge about $650 billion in taxes over the next 10 years.

- Close an estate tax loophole used by the super-rich, known as the Walton grantor retained annuity trust, or GRAT. These specialized trusts allow families like the Waltons to completely avoid paying estate and gift taxes. This loophole may have cost the U.S. Treasury $100 billion since 2000.

Inheritance Tax Gifts Reliefs And Exemptions

Some gifts and property are exempt from Inheritance Tax, such as some wedding gifts and charitable donations. Relief might also be available on certain types of property, such as farms and business assets.

If the person who died gave a gift in the seven years before they died, its counted as part of the estate, and likely to incur IHT.

How much tax is due depends on the value of the gift, when it was given and to whom.

Also Check: Is Doordash Contract Work

Who Has To Pay Inheritance Tax

In general, inheritance tax affects you if you receive an inheritance from someone who lived in a state with inheritance tax, or if you’re the beneficiary of property that’s in one of these states. A taxable inheritance can include money, real estate, personal property that generates income, and the proceeds of a life insurance policy. Surviving spouses are exempt from inheritance taxes in all states. The children and parents of a decedent are often exempt too, but not in all states. You may also be exempt from taxation if your inheritance was worth less than $500.

The inheritance tax rate vary based on a beneficiary’s relationship to the decedent and based on the fair market value of the assets inherited. States set a deadline for you to pay the tax, and you also have to file an inheritance tax return.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Reverse Tax Id Lookup

What Is The Estate Tax Rate

On the federal level, the portion of the estate that surpasses that $11.70 million and $12.06 million cutoffs will be taxed at a rate of 40%, as of 2021 and 2022, respectively.

Depending on where you live, the tax rate varies on the state level but 18% is the maximum rate for an inheritance that can be charged by any state.

Estate Tax In The United States

| This article is part of a series on |

The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person’s life.

In addition to this federal estate tax, many states have enacted similar taxes. These taxes may be termed “inheritance taxes” to the extent the tax is payable by a person who inherits money or property of a person who has died, as opposed to an estate tax, which is a levy on the estate of a person who has died.

The estate tax is often the subject of political debate, and opponents call it the “death tax.” Some supporters of the tax have called it the “Paris Hilton tax.”

Recommended Reading: Efstatus.taxact.xom

What Is The Inheritance Tax In Washington State

The Washington real estate tax no longer works because it no longer applies in Washington state. Instead, Washington levies an estate tax. The estate tax in Washington is separate from the federal estate tax rules and regulations. That’s why Washington only collects estate taxes from the state.

How To Value The Estate

To value an estate, youll need to:

- list all the assets and work out their value at the date of death, and

- deduct any debts and liabilities.

Remember to keep records of how you worked it out, such as estate agents valuation.

HMRC can ask to see records up to 20 years after Inheritance Tax is paid.

Assets include items such as money in a bank, property and land, jewellery, cars, shares, a payout from an insurance policy and jointly owned assets.

For a more detailed list, go to Lawpack or GOV.UK

Gifts also need to be included, such as cash or other assets, if they were given away in the seven years before the person died.

Youll also need to include any gifts given before this period if the person who died continued to benefit from the gift.

These are also known as gifts with reservations of benefit. For example, someone gave away their house but continued to live in it.

Debts and liabilities reduce the value of the deceaseds chargeable estate. Think about items such as household bills, mortgages, credit card debts, and, in general, funeral expenses.

But any costs incurred after death, such as solicitors and probate fees, cant be deducted from the estates value for IHT purposes.

It can be complicated, so its worth getting advice to help you make the right decisions.

If you think it would help to have a financial adviser, see our guide Choosing a financial adviser

Read Also: Csl Plasma Taxes

No Inheritance Tax In Nc

There is no inheritance tax in NC. However there are sometimes taxes for other reasons. These are some of the taxes you may have to think about as an heir.

- If you live in a state that does have an estate tax, you may be expected to pay the death tax on the money you inherit from a death in NC

- IRAs that distribute large amounts of income each year according to the new 10 year payout rule may cause you to pay taxes on the distributions

- Capital gains taxes might be accrued on some types of trusts

How Do You Calculate Federal Estate Tax

Calculate your property taxes by multiplying the estimated value of your property by the annual tax rate. From this amount, subtract the applicable exemptions that are allowed based on the tax number, then add any special fees you owe. The amount received is the property tax levied on your property.

Also Check: Appeal Cook County Property Taxes

How To Avoid Paying An Inheritance Tax

If you want to lower your estates tax burden and maximize the inheritance your beneficiaries receive, youll likely need to take steps before you pass away.

Beneficiaries might not have much they can do to lower their bills, but they can work with their descendants or relatives on finding the best tax-saving strategy for passing on their wealth.

What Is The Gift Tax

The federal government taxes gifts and estates in different ways. With an estate, the person giving the money is no longer alive to pay taxes on it. With a gift, they are still alive to provide money or property. People who receive an inheritance might have to pay taxes on it, but the giver has to pay gift taxes.

As of 2018, an individual can give another person up to $15,000 per year as a gift, tax-free. Any more than that in a year and you might have to pay a certain percentage of taxes on the gift. If you receive a large inheritance and decide to give part of it to your children, the $15,000 limit per year still applies.

Check out this video discussion on the federal tax rate on inheritance courtesy of Khan Academy:

When you expect a big inheritance from relatives, youll want to know if youll have to pay estate taxes. The new limit on the estate tax exemption means most Americans will pay nothing in taxes when they inherit an estate. Moreover, people should also invest the time to find out if they have to pay state estate taxes or inheritance taxes. Most people can avoid those taxes.

Can you share more information on the federal tax rate on inheritance? Share it in the comments below!

Also Check: 1040paytax Review

How To Calculate The Net Estate

The value of the net estate is often needed to determine how much each beneficiary inherits. It is also used to determine whether an estate is exempt from inheritance tax. Estates under $25,000 are completely exempt.

To calculate the net estate, first determine the “gross estate” by adding up the market value of all the property in the estate. If the deceased person was an Iowa resident, this includes all property that the person owned at death. For a nonresident, only Iowa real estate and other tangible assets located in Iowa are included.

Next, calculate the “net estate” by subtracting the estate’s liabilities from the gross estate. Examples of common liabilities include:

- funeral expenses

- debts the deceased person owed

- mortgages on estate property

- probate expenses .

Who Pays The Tax To Hmrc

Funds from your estate are used to pay Inheritance Tax to HM Revenue and Customs . This is done by the person dealing with the estate .

Your beneficiaries do not normally pay tax on things they inherit. They may have related taxes to pay, for example if they get rental income from a house left to them in a will.

People you give gifts to might have to pay Inheritance Tax, but only if you give away more than £325,000 and die within 7 years.

Don’t Miss: Www.michigan.gov/collectionseservice

Inheritance Tax Vs Estate Tax: How They Differ

Americans assets dont escape taxes after death. Taxable property can be cash and securities, as well as real estate, insurance, trusts, annuities and business interests, according to the Internal Revenue Service .

The most common death taxes Americans might see are inheritance taxes and estate taxes, though both are different.

The main difference between an estate tax and an inheritance tax is that the former comes directly out of the deceased persons estate before that asset is distributed to its beneficiaries. Meanwhile, the beneficiary is responsible for paying the inheritance tax as soon as they receive those assets.

Comparison With Estate Tax

The key difference between estate and inheritance taxes lies in who is responsible for paying it.

- An estate tax is levied on the total value of a deceased person’s money and property and is paid out of the decedents assets before any distribution to beneficiaries.

- However, before an inheritance tax is due, the value of the assets must exceed certain thresholds that change each year, but generally its at least $1 million. Because of this threshold, only about 2% of taxpayers will ever encounter this tax.

Don’t Miss: Michigan Gov Collectionseservice

What Other Taxes Do My Heirs Have To Pay On Their Inheritance

Your estate is only distributed after debts and Inheritance Tax are paid.

Depending on what they inherit, your heirs might also incur:

- Income Tax if what they inherit produces a regular income

- Capital Gains Tax if they sell their inheritance for more money than what it was worth when you died. How much they have to pay depends on whether they pay Income Tax at the basic or higher rate.

If youve put your assets into a trust or youre thinking about doing this, how much tax and what kind of tax they have to pay can get very complicated.

Its worth speaking to a tax adviser or solicitor for help in working this out.

To find out more about what tax your heirs will need to pay on their inheritance, go the GOV.UK website

Completing Your Tax Return

When you are a beneficiary, youll need to declare your share of any trust income, the amount of entitlements, assessable income, interest, any franking credits or dividends and income stream through superannuation on your tax return.

There are different rules and obligations for beneficiaries under a legal disability and for non-residents. Australian law does recognise a will prepared in another country, however there may be different laws and taxes that are required to be paid under the laws of other countries.

You May Like: Is Freetaxusa Legitimate

Inheritance Tax Threshold In The Uk

The inheritance tax threshold in the UK is £325,000, above which tax may need to be paid. This figure takes into account a persons whole estate which is any money saved, the valuation of any property, the valuation of possessions, and the value of any gifts made in the 7 years before death.

All people in the UK are entitled to a tax-free inheritance tax allowance of £325,000. This is also known as the nil-rate band. This means that if a persons total estate is valued at being lower than £325,000, they do not need to pay inheritance tax. If the value of a persons estate is estimated as being greater than £325,000, they will need to pay some inheritance tax.

People that pass property on to their children or grandchildren can benefit from a larger tax-free inheritance tax personal allowance. This extra allowance is £175,000 taking the total tax-free personal allowance to £500,000 for an individual. Therefore, Inheritance tax on property passed on to descendants is only applied when the total estate is valued at greater than £500,000.

Nebraska Inheritance Tax Rates

If you were the decedentâs parent, grandparent, sibling, child, other lineal descendant, or the spouse of one of those people, the first $40,000 you inherit is exempt but the value of your inheritance above $40,000 is taxed at 1%.

Assets passed to an aunt, uncle, niece, nephew, any lineal descendant of such persons or their spouses are taxed at 13% with the first $15,000 exempt.

All other beneficiaries will pay an inheritance tax rate of 18% with the first $10,000 of value exempt from taxation.

Don’t Miss: Doordash Tax Deduction