How We Make Money

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the authors alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To support our work, we are paid in different ways for providing advertising services. For example, some advertisers pay us to display ads, others pay us when you click on certain links, and others pay us when you submit your information to request a quote or other offer details. CNETs compensation is never tied to whether you purchase an insurance product. We dont charge you for our services. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

Our insurance content may include references to or advertisements by our corporate affiliate HomeInsurance.com LLC, a licensed insurance producer . And HomeInsurance.com LLC may receive compensation from third parties if you choose to visit and transact on their website. However, all CNET editorial content is independently researched and developed without regard to our corporate relationship to HomeInsurance.com LLC or its advertiser relationships.

Obtain Proper Tax Forms

Obtain the correct forms and instructions for the specific tax year. Your past-due returns must be filed on the original tax forms. You can easily access prior year tax forms on the TurboTax website or by contacting the IRS. Don’t make the mistake of using current year tax forms or you may end up preparing the return again.

Stop Late Filing And Payment Penalties And Interest

Filing a tax return on time is key to avoid penalties, even if you can’t pay the balance you owe. If you don’t pay your balance, you may have to pay an additional 5% of the unpaid tax you were required to report for each month your tax return is late, up to five months. Minimum penalty limits also apply.

The IRS assesses another penalty for a failure to pay your taxes owed. If you do file on time, but you can’t pay what you owe in full by the due date, you’ll be fined an additional 0.5% of the amount of the tax not paid on time for each month or part of a month you are late. These fees will accrue until your balance is paid in full or the penalty reaches 25%, whichever comes first.

The IRS also charges interest on overdue taxes. Unlike penalties, interest does not stop accruing after a particular period goes by.

Read Also: How To Buy Tax Lien Properties In California

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The 183 Day Rule For Residency

The 183 day rule is fairly straightforward. This rule simply means that if you spend 183 days living in one location, that this location would be considered your primary residence.

For example, if I lived in California for 190 days of the year, my primary residence would be in the state of California. This rule can get complicated if you move frequently, own multiple properties , have investments in different states or even if you simply move.

However, this rule is usually the best way to determine where you live at least as a starting place. A qualified tax professional will be better able to assist you with any issues beyond this, so we recommend always using one, when it comes to filing income taxes of any kind.

Also Check: How Much Does H& r Block Charge To Do Taxes

Tax Privacy And Security Tips

One understandable concern weve heard from readers is the desire to know how these tax tools protect your privacy and financial information. The good news is, the government has been taking steps to make sure that doing your taxes online is more secure. For example, last year, the IRS mandated multi-factor authentication for all online tax-prep tools . We also looked at the privacy and security policies for the tax software we tested and asked the companies for information on how they safeguard customer data. The answer: All of them encrypt the data when its stored on their systems and follow the IRSs standards for electronically sending returns securely.

The bad news is that the nature of the internet means theres no such thing as 100% secure tax filing, and tax-prep services are especially common targets for hackers. We looked into software breaches from previous years at TurboTax and H& R Block and found that the breaches were caused by credential stuffingidentity thieves used passwords and usernames stolen from other services to log in to the tax software. The best thing you can do to protect yourself is to follow strong security practices, which includes never reusing the same password for different accounts. A password manager can help you create a strong, unique password for all of your accounts. Other recommendations:

Tips For Choosing A Tax

- Tax season is a good time to take stock of your overall financial picture. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- TurboTax and H& R Block are two of the most well-known tax-filing services. There are other great services to consider, though, so make sure to shop around. Check out our list of the best tax filing software, as well as the best free online tax software.

Don’t Miss: How To Get Stimulus Check 2021 Without Filing Taxes

A Quick Look At Turbotax

TurboTax has been around since the mid-1980s. Part of its popularity is due to the fact that its owned by Intuit. Intuit also makes a software called Quickbooks, which millions of companies use to manage their accounting. But TurboTax is also popular because it offers a user-friendly design and straightforward step-by-step guidance.

Like H& R Block, TurboTax has a free filing option that allows you to file your federal return and one state return at no cost. However, the free option only supports simple returns with form 1040. If you want to itemize your deductions with schedule A , you will need to upgrade to a paid plan. There are three paid plans that run from $60 to $120 for federal filing. State filing is always $45 per state, with paid plans. The free option includes one free state return.

| TurboTax Filing Options | |

| Federal: $170.00 State: $50.00 | Best for self-employed, independent contractors, freelancers, consultants and small business owners Comes with all previous features, plus access to self-employment tax experts, maximizing business deductions |

TurboTax doesnt have any physical locations like H& R Block, but it does provide access to tax experts . It will cost extra for you to get access to an expert, but there are four plans available, corresponding to the four plans listed in the table above.

Why Do People Need Tax Software Programs

For those who dont want to pay a professional to prepare their tax returns, tax software has two distinct benefits over trying to go it alone. The first is to ensure that every required expense and form are recorded and filed properly.

The second thing tax software can do is maximize tax returns. Because tax laws are changing all of the time, individuals and businesses cant keep track of every available new deduction. Since tax software gets updated constantly, users are guaranteed to find the latest opportunities to get more money back on their returns.

Also Check: How Does H& r Block Charge

H& r Block Vs Turbotax

The start of a new year means its time to file your federal tax return. Many people stress about filing taxes but there are a number of tax filing services to make the process easier. Two of the most well-known services are H& R Block and TurboTax. They both offer a friendly user experience. They provide information along the way so you understand what youre doing. And they both offer affordable filing options. Which of these services should you use when you file your 2020 taxes?

Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today.

Tips For Filing Multiple

Citizens or residents of the United States and Puerto Rico must file a federal income tax return for all years of earned and unearned income from all sources anywhere in the world. Ignorance of this law is not an excuse to skip the filing of your tax returns. If you have some unfiled income tax returns, it is never too late to voluntarily prepare and file them.

You May Like: Www Michigan Gov Collectionseservice

What Does Refile Exclude

In addition to the Change my return exclusions for individuals, and the EFILE exclusions for EFILE service providers, you cannot use ReFILE if you or your client is in one of the following situations:

- is applying for the disability tax credit

- has a reassessment in progress

- has a first return that has not been assessed view the regular NOA on Represent a Client or My Account for Individuals or have a paper NOA on hand to validate that a return has been assessed)

- is subject to provincial or territorial income tax in more than one jurisdiction

- the first return was filed by the CRA as a 152 assessment

Complete And File Your Tax Return

Once you have all the forms you need, be sure to use the tax forms from the year you’re filing. For instance, you must use 2018 tax return forms to file a 2018 tax return. You can find these documents on the IRS website. Patience is key when filling out a tax return by hand. And thankfully, you can also file tax returns from previous years using TurboTax.

- Select the year you want to file a return for to get started.

- Then, input your tax information and TurboTax will properly fill out the tax forms.

- You will have to print out and mail in your tax return for previous years as e-filing prior year returns is not an option through TurboTax.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Read Also: Www.1040paytax.com Official Site

Not Free No Help When The Irs Sends A Letter And Still Waiting For Refund Four Months Later

I used the TurboTax app to file my refund in early February. The app was relatively easy to use, but it did get old going in circles sometimes. Unfortunately, the free option really is not usable. If you have to file state taxes like just about everyone, then you will have to pay $40 per state. If youre a college student in another state like me, that means two states so $80. Of course, no student discount. Honestly, that was not too bad since I was supposed to get a lot back.Unfortunately, that was not what happened. I did get some from one the state returns, but that was it. The IRS sent a letter for a health insurance form that didnt even apply to me. If you want help with that, guess what? It will cost you even more money! At that point, I wasnt paying TurboTax any more so I went off on my own. Eventually I got it figured out, but not without massive disruption to my school work. None of that help was thanks to TurboTax which sends you to FAQs that dont really apply.They have online discussions which appear to have many people with the same problem. This program is made to look easy- and it is at first- but the headache it causes later is not worth it. Never had trouble like this with H& R Block so I think Ill go back to them next year. Whatever you do, dont use TurboTax. It is seriously not worth it. Still waiting for that federal tax refund BTW.

Is State Income Tax Based On Residency

Yes. For example, if you live in California but you made some money through an investment property in South Carolina all of your income needs to be reported in California.

Additionally, you will need to file a state income tax return with South Carolina, in all likelihood. While each state differ, it is always better to be safe than sorry, when it comes to filing taxes.

Of course, things get complicated if you have multiple states involved. For example, there are reciprocal tax agreements between states, which remove the multi-state filing requirements .

This is why we always recommend opting to utilize a qualified tax professional. They will have a lifetime of experience in dealing with the IRS, as well as with individual states.

Don’t Miss: How Much Does H & R Block Charge For Taxes

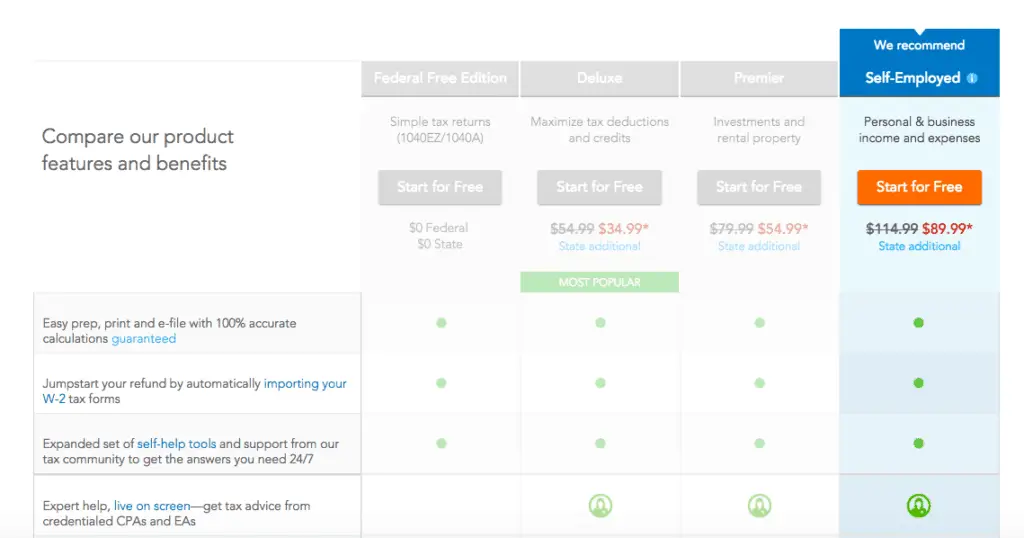

How To Choose Turbotax Version

- Free version: If you only need people who fill in W2, this is for you!

- Deluxe version: If you buy a house and have a mortgage, this version can provide you with more tax deduction options, such as mortgage tax deduction, donation tax deduction

- Premier version: suitable for friends who have stocks, bonds, and other investments! Or a friend who trades Bitcoin!

- Self-Employed version: If you start your own company or become a contractor friend, this one will be more suitable for you!

In fact, dont be afraid, fill in a few options below, and Turbotax will automatically recommend the tax filing version that suits you.

Best Free Tax Software: Credit Karma

We chose Credit Karma tax because its completely free to use for any supported tax situation.

-

Free filing for all tax returns

-

Imports from other tax software

-

Free audit defense support

-

Doesnt support all forms

-

No multi-state filing

-

No phone support

Like its competitors, Credit Karma lets users import a previous return from other software and a photo of a W-2 and then walks them through the rest of the process using a series of questions and prompts.

As a free service, Credit Karma offers no phone support. It does, however, include audit defense for its customers which includes consultation from a representative in the event of an IRS audit who will also attend a hearing on their behalf. Users also get accurate calculations and max refund guarantees with reimbursements up to $1,000 in IRS or state tax penalties and up to $100 if another provider shows a larger refund.

- Support: Live chat, in-person, full tax preparation

- Accuracy Guarantee: $100

We like Jackson Hewitt because it offers a huge network of locations for both online and offline preparation tax help.

-

Tax professionals can finish for you

-

100% accuracy guarantee

-

Limited tax support unless you pay

-

Only imports past Jackson Hewitt returns

Those who want to stick to Jackson Hewitts DIY online filing can still enjoy support through an extensive online help center, connect to a real person during business hours via live chat, and benefit from the companys 100% accuracy guarantee.

You May Like: How To Buy Tax Lien Certificates In California

H& r Block Vs Turbotax: Cost

Cost is always a consideration when you choose a tax filing service. H& R Block and TurboTax are the two most comprehensive online services available and likewise they are also the most expensive.

As mentioned, both services offer a free option, covering simple returns. You can also file some additional schedules and forms with this option. However, H& R Block does cover more forms and schedules with its free option. It also allows you to file multiple state returns for free. By contrast, the free plan from TurboTax includes only one free state return. This all gives H& R Block a slight advantage if you qualify for the free option.

Its great if you can file your taxes for free, but the average filer will need to upgrade to another option. The Deluxe option is enough for many filers. Both Deluxe options include deduction-finding software, help with charitable donations and access to tax financial experts through online chat.

There are a couple of big differences between the options in the forms that they support. TurboTaxs Deluxe option supports Schedule SE, which allows you to file self-employment taxes. It also allows you to file Schedule C and Schedule C-EZ if you have business income to report but do not have any expenses to report.

Practical Tax Filing Resources

- IRS Tax Assistance Center : You need to make an appointment in advance. This is the office of the IRS in each local government. Professional staff will answer your questions.

- Volunteer Income Tax Assistance : IRS-certified volunteers provide free basic tax filing services. NYU Sterns Accounting Fraternity, Beta Alpha Psi , i provides this service.

- TurboTax : Online tax preparation software, there are free version and paid version. The free version is suitable for users who do not have complicated tax refunds, and the paid version is suitable for people who have their own business or have income from multiple sources.

Recommended Reading: Buying Tax Liens California