Frequently Asked Questions About Employer Withholding

You need to submit a completed Combined Registration Application. You can either download the paper version or register online. You can use this application to register the following business tax accounts:

- Admissions and amusement tax account

- Income tax withholding account

- Sales and use tax license

- Use tax account

- Transient vendor license

- Unemployment insurance account

You must have a federal identification number before you can register your business, unless you are only applying for a sales and use tax license. To apply for a federal identification number, visit the IRS Web site.

You need to to apply for the following:

- Alcohol tax license

- Sales and use tax exemption

Yes. You can file and pay employer withholding taxes and sales and use taxes online for free using bFile. Electronic filing for businesses is fast, safe and easy. You can pay by direct debit and schedule debit payments up to the due date of the return.

The Electronic funds transfer program is another easy way to file reports and remit taxes. You must first register by completing Form EFT-1, Authorization Agreement for Electronic Funds Transfer.

You can obtain the registration form and more information by calling Taxpayer Service at 410-260-7980, or 1-800-MD TAXES.

Yes. We can send you a confirmation letter if you call us at 410-260-7980 from Central Maryland or toll-free 1-800-638-2937 from elsewhere.

When you call, please provide us with the following information:

- account number

- your name and telephone number

Withholding Income Tax From Your Social Security Benefits

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply.

If you are already receiving benefits or if you want to change or stop your withholding, you’ll need a Form W-4V from the Internal Revenue Service .

You can or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

Only these percentages can be withheld. Flat dollar amounts are not accepted.

Sign the form and return it to your local Social Security office by mail or in person.

When To Check Your Withholding:

- Early in the year

- When the tax law changes

- When you have life changes:

- Lifestyle – Marriage, divorce, birth or adoption of a child, home purchase, retirement, filing chapter 11 bankruptcy

- Wage income – You or your spouse start or stop working or start or stop a second job

- Taxable income not subject to withholding – Interest income, dividends, capital gains, self employment income, IRA distributions

- Adjustments to income – IRA deduction, student loan interest deduction, alimony expense

- Itemized deductions or tax credits – Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, child tax credit, earned income credit

Also Check: Do You Have To Report Roth Ira On Taxes

General Unemployment Benefits Information

Filing for unemployment can be challenging. It can be done online to make it as seamless a process as possible, but you can always call for assistance. The form required to change the withholding amounts from your unemployment benefits must be submitted to your state’s unemployment office for the change to be processed. Don’t forget to utilize an unemployment tax withholding calculator to find out how much you will owe come tax time if you decide not to withhold from your weekly benefits.

References

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the “Request for Change in Withholding Status” form.

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2020:

Recommended Reading: How To Look Up Employer Tax Id Number

Here Are Other Types Of Payments Taxpayers Should Check For Withholding

- Benefits paid by a state or the District of Columbia from the Federal Unemployment Trust Fund

- Railroad unemployment compensation benefits

- Disability benefits paid as a substitute for unemployment compensation

- Trade readjustment allowances under the Trade Act of 1974

- Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974

- Unemployment assistance under the Airline Deregulation Act of 1978 Program

Recipients who return to work before the end of the year can use the IRS Tax Withholding Estimator to make sure the right amount of tax is taken out of their pay. This online tool is available only on IRS.gov, and it can help workers or pension recipients avoid or lessen year-end tax bills or can estimate a refund.

Taxes On Unemployment Payments

Everyone must pay Federal taxes on Unemployment payments. State taxes depend on the state .

For 2020, if you earned under $150k, the first $10,200 in Unemployment is tax-free .

âStandard paymentsâ and âbonusesâ are both taxable.

- Standard payments

- Weekly payments, either regular Unemployment or Pandemic Unemployment Assistance.

1099-G

Every January, each stateâs Unemployment department provides a Form 1099-G, which includes the total of all your Unemployment payments from the previous year as well as how much federal and state taxes were withheld for taxes. This 1099-G must be included in your tax return.

Read Also: How Much Does H& r Block Charge To Do Taxes

Reporting Unemployment Benefits At The Federal Level

For most states, you will receive Form 1099-G in the mail from your state unemployment office. Find out how you can obtain your 1099-G. On Form 1099-G:

- In Box 1, you will see the total amount of unemployment benefits you received.

- In Box 4, you will see the amount of federal income tax that was withheld.

- In Box 11, you will see the amount of state income tax that was withheld.

You dont need to attach Form 1099-G to your Form 1040 or Form 1040-SR.

In certain states, you will not automatically be mailed a Form 1099-G. You will have to access your Form 1099-G online through your unemployment portal or call your state unemployment office to request that they mail your Form 1099-G. In other states, you will only be mailed a Form 1099-G if you selected that as your delivery preference.

| States that will not mail 1099-Gs at all | Connecticut, Indiana, Missouri, New Jersey, New York, and Wisconsin |

| States that will mail or electronically deliver 1099-Gs depending on which option you opted-into | Florida, Illinois, Michigan, North Carolina, Rhode Island, Tennessee, and Utah |

If you received Form 1099-G, but didnt file for unemployment benefits, this may be a case of identity theft and fraud. Contact your state unemployment office immediately for additional information and how to report the potential fraud.

You Could Get A Hefty Tax Refund This Year

On the other hand, if youve been having income tax withheld from your pay for a substantial portion of the year already, you may be way ahead on paying taxes for this year.

In a progressive tax system, such as we have in the U.S., higher levels of income are taxed at much higher rates.

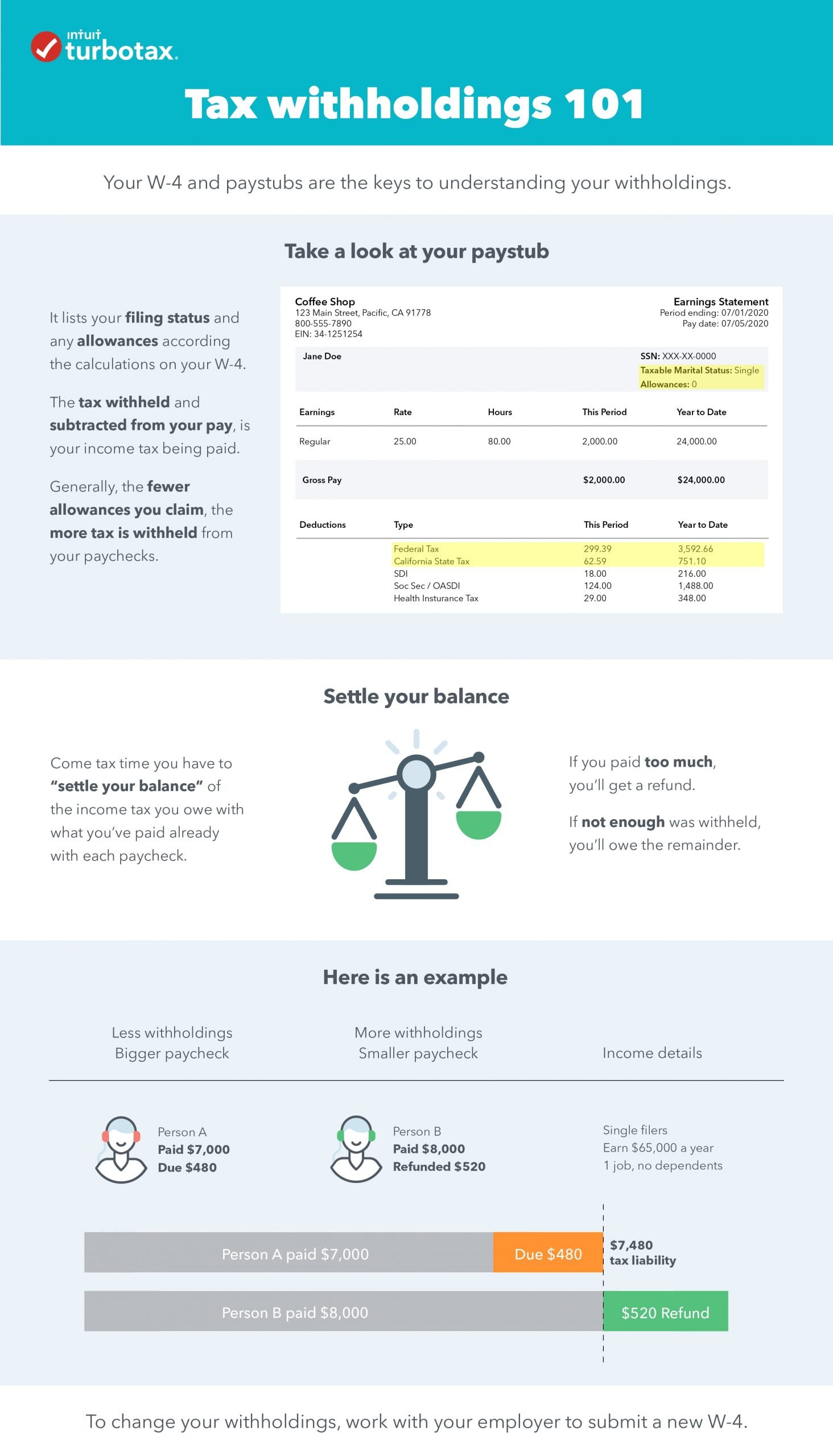

When your employer takes taxes out of your paycheck, the payroll department calculates your income tax withholding as if you will earn the same amount all year.

When you get laid off and make far less over the year, you may get a large portion or all of your income tax withheld back as an unemployment tax refund.

You cant get that over-withheld income tax back until after the end of the year. However, you may be able to make adjustments to minimize your over-withholding, giving you more money to live on now.

Don’t Miss: Where’s My Tax Refund Ga

People Should Have Tax Withheld From Unemployment Now To Avoid A Tax

COVID Tax Tip 2020-117, September 10, 2020

Due to the Coronavirus pandemic, millions of Americans received or are currently receiving unemployment compensation, many of them for the first time. It’s important for these individuals to know that unemployment compensation is taxable.

People can have taxes withheld from this compensation now to help avoid owing taxes on this income when they file their income tax return next year.

Unemployment Taxes At The Federal Level

At the federal level, unemployment benefits are counted as part of your income, along with your wages, salaries, bonuses, etc. and taxed according to your federal income tax bracket.

With most income, like wages, taxes are pay-as-you-go. With wages, you are expected to pay taxes on your income as you earn it. As an employee, part of your paycheck is usually automatically deducted to pay your federal income and Social Security taxes. Unlike wages, federal income taxes are not automatically withheld on unemployment benefits.

You are responsible for paying taxes on your unemployment benefits. You can request to have federal taxes withheld, make quarterly estimated tax payments, or pay the tax in full when it is due.

Recommended Reading: How Much Taxes Do You Pay On Slot Machine Winnings

Unemployment Insurance And Taxes

To prepare your tax returns, you will need all your taxable income information from the previous year. After all, most income is taxable. Did you know Unemployment Insurance is taxable income? UI is considered income and is subject to both federal and state income tax.

In this case, here are some tips for doing your taxes.

How To Adjust Your Tax Withholdings In 9 Steps

Heres a step-by-step guide on how to change your tax withholdings:

Step 1: Go to the IRS website and navigate to their tax withholding estimator.

The IRS has a handy tax withholding estimator tool to help you calculate how much tax to withhold from each paycheck.

Step 2: Complete the About You section.

Answer five questions about yourself, including:

- Filing status, such as single, head of household or married filing jointly.

- Number of dependents.

- Number of jobs you hold.

- Whether you will receive income from a pension this year.

- Other sources of income and tax payments.

Step 3: Complete the Income & Withholding section.

Enter your income and withholding for each job that you and your spouse have. Itll also ask how much you have contributed to a tax-deferred retirement plan, including 401s, and any other pre-tax accounts, such as flexible spending accounts.

Step 4: Complete the Adjustments section.

Input any adjustments you qualify for, which may reduce your taxable income. For example, you might enter a student loan interest deduction or alimony payments. Click the question mark icon for an explanation of each adjustment.

Step 5: Complete the Deductions section.

Choose whether to take the standard deduction or if you want to itemize your deductions. If youre unsure, input your itemized deduction, and the IRS calculator will let you know which one is higher.

Step 6: Complete the Tax Credits section.

Step 7: Review your results.

Step 8: Fill out a new W-4 or W-4P form.

You May Like: Can You File Missouri State Taxes Online

What Can I Do If I Cant Pay My Federal Taxes

If you owe taxes and cant pay them in full, it is important to pay what you can and make a plan. Consider using a payment plan, but note that unless you pay the amount owed in full, you will be charged interest and penalties.

To learn more about your different payment options based on your financial situation, read What to Do if I Owe Taxes but Cant Pay Them.

When Should I Adjust My Tax Withholdings

Youll need to complete a new Form W-4 if youre starting a new job. For everyone else, you might want to adjust your tax withholdings when:

- You want a larger paycheck instead of a tax refund.

- You get married, divorced or become a widow.

- You have a baby or adopt one.

- Your child turns 17.

- You buy a new home.

- Your income changes drastically, including unemployment or getting a new job.

- You pay off student loans.

Can I adjust my W-4 at any time during the year?

Yes. But the earlier in the year you update your W4, the more time it allows for the changes to take effect.

Also Check: What Does Agi Mean For Taxes

Dont Get Hit With Unexpected Tax Bill From Unemployment Insurance Payments New York State Tax Department Shares Money

For Release: Immediate, Tuesday, September 22, 2020

For press inquiries only, contact: James Gazzale, 518-457-7377

The New York State Department of Taxation and Finance today encouraged New Yorkers to review their current tax situation. By taking a closer look at your tax records now, you can ensure you dont end up owing unpaid taxes, and you may be able to claim valuable tax credits when you file your income tax return next year.

We understand many New York taxpayers are facing challenges this year, which is why were reminding them of all the money-saving tax programs and refundable tax credits available, said New York State Commissioner of Taxation and Finance Mike Schmidt. We also want taxpayers to understand that unemployment insurance payments are taxable. As a result, some taxpayers may need to adjust their withholding to prevent a tax bill in 2021.

Unemployment benefits are taxable benefits

If you are receiving unemployment benefits, consider having tax withheld from these payments to avoid owing taxes when you file your federal and New York State income tax return next year. New York State unemployment insurance benefits and any of the special unemployment compensation authorized under the Coronavirus Relief Act are considered taxable income. By law, the New York State Department of Labor must report these benefits to the IRS and to the New York State Tax Department.

Tax credits put money back in your pocket

How Can I Protect Myself

IDES will never send emails asking for personal or sensitive information. If you get any emails from someone claiming to be IDES and asking for personal or banking information, be careful. Verify which email address sent the emails to ensure that they are official. Also, any correspondence from IDES will include content and links that are labeled as IDES information.

Also Check: How To Buy Tax Lien Properties In California

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Unemployment Insurance And The Irs

Unemployment insurance is considered income for federal and state tax purposes. Each year all of your benefit payments are reported to the Internal Revenue Service and the Wisconsin Department of Revenue.

You can ask to have state and federal taxes withheld from your unemployment benefit payments or make estimated tax payments.

Don’t Miss: Efstatus Taxact Com Return

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Unemployment Taxes At The State Level

If you live in a state that has a state income tax, you may need to pay state income taxes on your unemployment benefits in addition to federal income taxes.

For states that dont have a state income tax or dont consider unemployment benefits taxable income, you wont need to pay state income taxes on your unemployment benefits. These are 17 states that dont tax unemployment benefits:

| States that dont have any income taxes | Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming |

| States that only have income taxes for investment income | New Hampshire and Tennessee |

If you dont live in one of these 17 states, your unemployment benefits may be taxed by your state. Your states individual income tax rate can be found here. To learn more about your state individual income tax, visit your states Department of Revenue website or read Kiplingers State-by-State Guide on Unemployment Benefits.

Also Check: How Does H& r Block Charge