Ten Things To Remember When You Owe The Irs

By FindLaw Staff | Reviewed by J.P. Finet, J.D. | Last updated April 01, 2021

The IRS Restructuring and Reform Act of 1998 was a landmark law that forced the IRS to change the way it treated taxpayers. The legislation required the IRS to more fully communicate with the public and grant taxpayers “due process” rights. In other words, the IRS could no longer take action to collect unpaid taxes without hearing the taxpayer’s side of the story.

While those rights will ensure that you have a fair hearing, if you are still found to have unpaid taxes the IRS will take action to collect what is owed. If you owe money to the IRS, here are ten things to remember:

Irs Rules To Borrow Against 401k 403b Or Pension Plan

For a 401k or 403B your employer must have language allowing loans to be taken by participants. You will want to make sure your plan allows for loans. The loan must be based on a legally enforceable agreement. The loan must be documented and include a date, amount of loan and a schedule for repayment. The loan can be up to 50% of taxpayers balance or a maximum of $50,000.

What If You Cant Pay Off An Irs Payment Plan

If you cant afford the monthly payments under an IRS installment plan, you may need to either request a settlement or declare bankruptcy. However, unlike often claimed, getting a settlement for less than you owe is rare and declaring bankruptcy should usually be your last option.

An IRS settlement, while available, is used by those who do not have the income or assets to pay the full amount and are not likely to ever be able to pay the full amount. IRS settlements are called an Offer in Compromise, and the IRS has been clear about how rare this type of compromise is. An online qualifier tool can be used to determine whether you may be able to get a settlement, but the IRS cannot give a settlement to anyone who would be able to afford payment plans.

If youre already on an IRS installment plan and you cannot make your next IRS installment payment, theres a 30-day grace period. You can make a payment at any time during this 30 day grace period to keep your installment plan. After the 30-day grace period, the IRS can cancel your installment plan. In this event, youll have to ask the IRS to reinstate it and this depends entirely on whether the IRS chooses to do so.

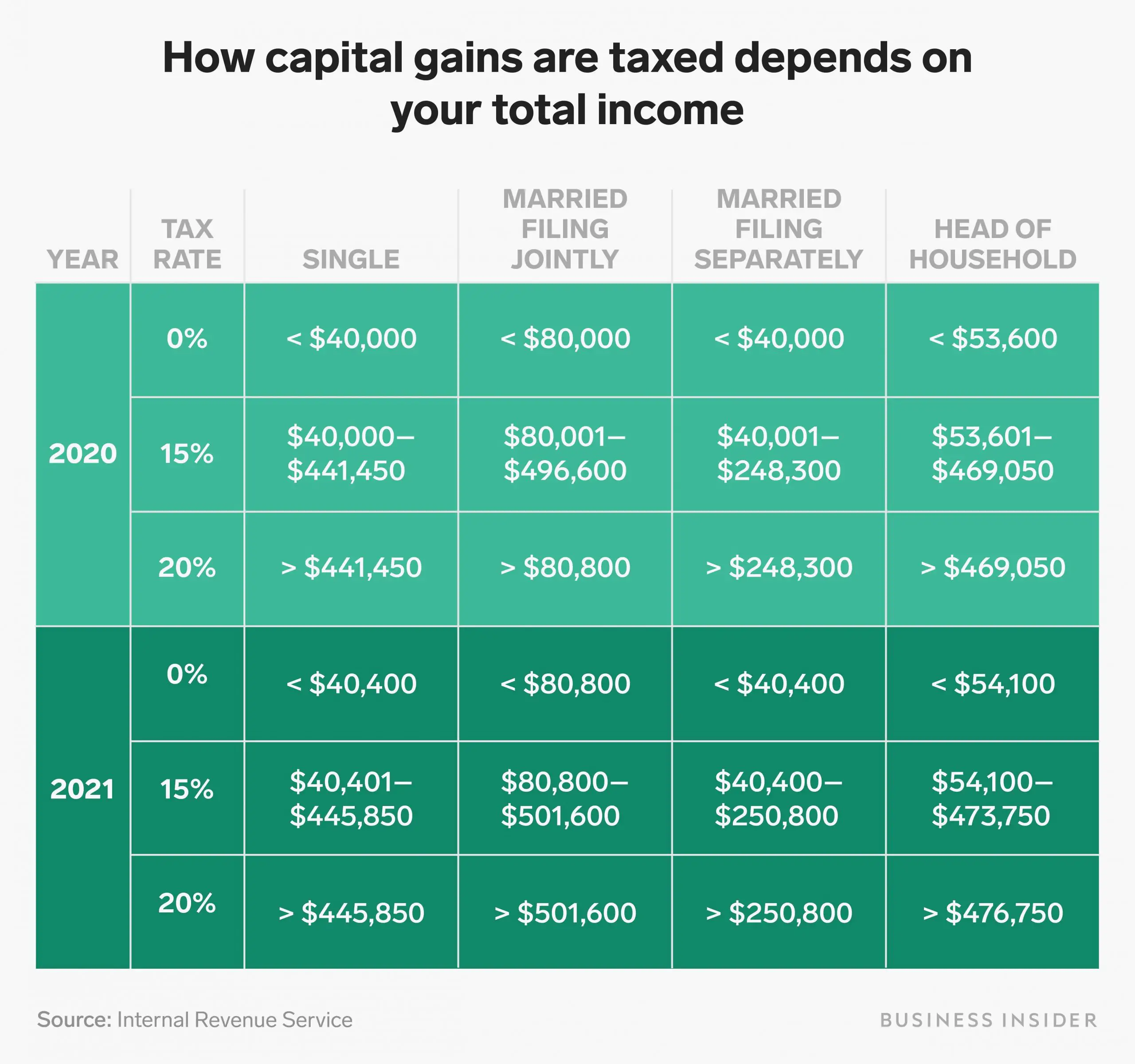

Recommended Reading: How Much Taxes Will I Have To Pay

Irs Payment Plan Qualification And Setup

Acceptance of your installment plan is not guaranteed. You need to be up to date on all tax filings and other taxes owed, and you must not have already requested an installment agreement in the past 5 years.

If the IRS decides that you can pay your taxes in full, they will not approve the request.

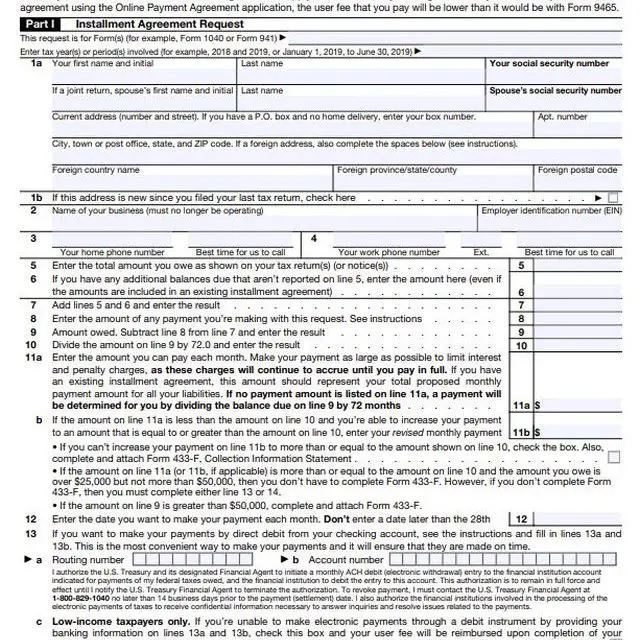

You will use Form 9465 to apply.

Expect to pay between $31 and $225 in setup fees, depending on whether you set up a direct debit from your bank or pay by check, and whether or not you use their online application.

The absolute cheapest way to go is to use an online payment agreement application at IRS.gov/OPA and set up a direct debit, which only costs a one-time $31 setup fee. Even this fee canbe waived for lower-income applicants).

How To Set Up A Payment Plan When You Owe More Than $50000 In Back Taxes

If you owe less than $50,000, you can set up a payment plan online. Typically, as long as your monthly payment is enough to pay off the tax bill within 72 months or less, the IRS will automatically approve your agreement. Taxpayers who owe more than $50,000, however, need to apply through the mail or over the phone.

Generally, when you owe more than $50,000, the IRS requires you to submit Form 433-F when you apply for a payment plan. This form requires detailed information about your finances, and it helps the IRS ensure that you are making the largest payment possible on your tax bill. The Taxpayer Relief Initiative allows some taxpayers to avoid this requirement.

Also Check: How To Lower Property Taxes In Illinois

You Owe The Irs Less Than $10000in Tax Debt

In most cases, tax debts situations of less than $10K are considered relatively minor and the IRS treats most taxpayers at this level differently. But how do you know how that affects you? Is your debt legitimate? Does the IRS understand all the circumstances surrounding your case? What choices do you really have? Do you go to a walk-in tax service, call an accountant or a qualified tax attorney? Do you even know what questions to ask?A FREE Consultation with the Tax Problem Solver Team can help you know the right questions and how to get the answers you need, right now!

Irs Penalties For Failure To Pay Taxes

The IRS doesn’t mess around when it comes to making sure your taxes are paid up, one way or another. First, the IRS will charge you interest on any unpaid tax balance.

The interest rate for any unpaid taxes for the calendar quarter beginning October 1, 2022, was 6% per year, compounded daily.

On top of that interest charge, the IRS can impose two different penalties:

- A late-filingpenalty, if you don’t file your taxes by the deadline

- A late-paymentpenalty, if you don’t pay your taxes on time

The penalty for filing late starts out at 5% of your unpaid tax balance per month, up to a maximum of 25% of your unpaid tax bill. If you wait more than 60 days after the due date to file, you’ll face a minimum penalty of either $435 or 100% of the tax required, whichever amount is smaller.

Also Check: What Is The Best Program To Do Your Taxes

Common Offer In Compromise Mistakes

Tax relief expert Jeffrey McNealsays when he processed offers, he saw tons of mistakes made on the forms, even when prepared by CPAs and enrolled agents!

Say, for instance, you owe the IRS $14,000 and submit an Offer in Compromise

Making sure all the math is right and all fields are filled out properly on Form 433 is just the starting point.

Only 41% of submissions get approved,so it must be done perfectly to give you the best chances. If it goes to appeal, you will not only need to fill out a form. McNeal states that just about the only ones to win their appeals were people who backed up their claims with:

- The Internal Revenue Code

- The Internal Revenue Manual

- Existing case law

Ask yourself: Would you be qualified to reference the above in your appeal for tax relief?

The Internal Revenue Code is made up of over 9,000 sections, while the Internal Revenue Manual is made up of 39 parts , and we know there are tens of thousands of cases in case law.

Knowing what applies and what doesnt to an Offer in Compromise would be nearly impossible for a non-professional.

Some More Good Calculators That You May Find Useful

US Salary examples are useful for those who want to understand how income tax is calculated in the US or to get a quick idea of how payroll deductions are calculated in the United States. If you have time and prefer to produce a more detailed and accurate calculation, we suggest you use one of the following tools:

Don’t Miss: Does North Carolina Tax Retirement Income

Exceptions To Underpayment Of Tax Penalties

If you underpaid your taxes this year but owed considerably less last year, you typically dont pay a penalty for underpayment of tax if you withheld at least as much as you owed last year. That, of course, is only true if you pay by the due date this year.

TaxAct can help determine if the safe harbor rule reduces your penalties and interest. Simply enter last years tax liability and the software will do the calculations for you.

You may also reduce your penalties and interest using the annualized income method if you received more of your income in the latter part of the year.

Balance Between $10000 And $50000

With a balance due above $10,000, you can qualify for a streamlined installment plan.

- While acceptance isn’t guaranteed, the IRS doesn’t usually require additional financial information to approve these plans.

- With a streamlined plan, you have 72 months to pay.

- The minimum payment is equal to your balance due divided by the 72-month maximum period.

- If you can’t pay an amount equal to what you owe divided by 72, you will need to complete Form 433-F unless you qualify for an exception.

You May Like: How To File Taxes With An Itin Number

If I File An Amended Return And Pay Tax Bill Before April 15 Deadline Can I Avoid The 20% Substantial Underpayment Penalty

File your amended return, and pay your tax owed before April 17. Don’t worry about the penalty for now. TurboTax may offer to calculate one, but the calculation is not precise and only the IRS has the final word. Let them send you a bill.

I have never heard of the 20% accuracy penalty being assessed in this kind of case. However, you may have an under payment penalty because you owed more than 10% of your overall bill. The underpayment penalty is about 1% per month of the amount of the underpayment. If you owe $6000 in tax roughly, then the IRS will expect you to have made $1500 quarterly payments in April, June, September, and January. So you would have 1% per month on $1500 going back to April, then 1% per month on $3000 from June, and so on.

Ial Payment Installment Agreement

“Installment agreement” is another word the IRS uses for payment plan, and similarly to the currently not collectible status, with a PPIA the IRS makes a determination you can’t pay your taxes in full. So you pay what you can afford. And that’s why it’s called a partial payment installment agreement.

When the 10 year collection period is over, oftentimes in this type of arrangement, you will not be able to pay off your texts in full. That and partial in that as opposed to full pay, you would have to make higher payments.

And also like currently not collectible set as a they review your financial information when you file your tax returns.

If you’re making more money, they’re going to want you to raise your payments. Conversely, if you’re making less money, you can negotiate a lower payment.

You May Like: How To Calculate Taxes For Business

What’s The Smallest Monthly Payment I Can Make On An Irs Installment Plan

Your minimum monthly payment will depend on how much you owe and the plan you set up. However, if you owe less than $10,000, you can stretch the repayment period to three years, or up to six years for debt up to $50,000. You can divide your balance by the number of months to figure out your minimum monthly payment. Higher balances may require more customized solutions.

Other Tax Relieving Options

If you can take steps to lower you tax debt to $50,000 or less, you can qualify for an IRS installment payment plan. If you have credit cards, particularly those that offer cash-back rewards, it might be wise to pay down your tax debt to $50,000 with plastic.

Racking up credit card debt that you cant repay within a month is often a bad idea, but if it allows you to avoid IRS penalties, it might work for you. Before using credit cards for taxes, make a budget so you know you can afford to make payments. You should also consider discussing your plan with a debt management or credit counselor.

Finally, if you enter an installment agreement with the IRS, make sure you make all payments on time. The IRS has little patience for those who dont stick to their agreement and it will quickly impose penalties and back interest on your tax debt.

About The Author

Also Check: How To Keep Track Of Mileage For Taxes

Request Currently Not Collectible Status

If you cant afford to pay anything right now, you may need to apply for currently not collectible status. You simply prove to the IRS that you dont have any money and that you cant sell assets or take out a personal loan to pay. Then, the IRS stops collection actions until your financial situation improves.

Making Payments On Your Installment Agreement

The amount you owe in back taxes also dictates how you must make your installment agreement payments. If you owe less than $25,000, you can just mail in your monthly payments or make them online before the due date.

However, if you owe between $25,000 and $50,000, you must set up a direct debit from your checking account. If you dont have a bank account, you can ask your employer to withhold the payments from your check. If you take this option, you give the IRS consent to contact your employer. Then, when they write you a paycheck, they take out your payment and send it to the IRS. Your employer may be able to charge you processing fees for this option.

Alternatively, if you dont want to take either of these routes, you will need to provide the IRS with financial information. The financial disclosures that the IRS requires are long and detailed. In most cases, its much easier to just agree to set up a direct debit from your account than it is to take this option.

Don’t Miss: How Do You Pay Taxes When You Are Self Employed

See If You Qualify For A Partial Payment Installment Agreement

This is where you make monthly payments until you reach the collection statute expiration date, and then, the IRS writes off the remainder of your balance. Compared to an offer in compromise, this option can give you more time to pay.

However, the downside is that the IRS reviews your financial situation every two years. If your updated financial information indicates that you can afford to pay, the IRS can rescind this offer and demand the balance in full.

Irs Help For Taxpayers

If you owe taxes, but cant pay the IRS in full, consider submitting an Installment Agreement Request with your return. In certain situations, the IRS cant deny a request for an installment agreement if you owe less than $10,000. That said, you should still pay as much as you can with the return. You will be charged interest and possibly a late payment penalty on any tax not paid by its due date, even if your request for an installment agreement is approved. You can avoid IRS collection notices and actions, like a Notice of Federal Tax Lien or an IRS levy, by establishing an installment agreement upfront and making your installment payments.

If you owe back taxes, there are several IRS tax relief programs to help, including the agencys Fresh Start initiative:

- An Installment Agreement is generally available to people who can’t pay their tax debt in full at one time. The program allows people to make smaller monthly payments until the entire debt is satisfied.

- Under its Fresh Start initiative, the IRS raised the threshold for streamlined installment agreements from $25,000 to $50,000 in tax debt, and the maximum repayment term from five to six years. Taxpayers who owe less than $50,000 may apply online with the IRS and dont have to complete an IRS Collection Information Statement .

Don’t Miss: How To File Lyft Taxes Without 1099

What To Do If You Owe The Irs And Cant Pay

mangpor_2004

Tax day has come and gone. The rush and stress of having to get everything done may have left you exhausted. In addition to that stress, you may owe more on your tax return than you can afford to repay. Thats okay.

If you find yourself with income-tax debt, you arent alone. According to the U.S. Internal Revenue Service Delinquent Collections Activities Data book, over 11 million Americans owed over $125 billion in back taxes, penalties and interest in 2019. That number can only grow as the economy weakens and small business owners continue to struggle.

The good news is there are plenty of ways to resolve your tax debt. Here are the four most common:

1. Online Payment Agreements

Under the IRS Fresh Start initiative, individuals who owe $50,000 or less in income tax and businesses that owe $25,000 or less in payroll tax may qualify for an Online Payment Agreement. You can set up the payment for any amount you can afford as long as the debt is paid in full within 72 months . You can also modify installment agreements through the program as well.

You may qualify to apply online for either of two types of plans:

- Long-term payment plan : You owe $50,000 or less in assessed tax, penalties and interest, and filed all required returns.

- Short-term payment plan : You owe less than $100,000 in combined tax, penalties and interest.

2. Installment agreements

3. Currently-Not-Collectible Status

4. Offer in Compromise

Other tricks of the trade

Is Bankruptcy A Solution

Bankruptcy is not a direct solution to a tax debt. Most tax debts cannot be discharged in bankruptcy, so you will have the same tax debt after bankruptcy that you did before.

Bankruptcy could still help. If you are unable to pay your tax bill because you are buried in other debts, bankruptcy could eliminate many of those other debts. You will still owe the tax debt, but youll have fewer other demands on your plate.

Bankruptcy is an extreme solution that will only be appropriate if your case is really desperate. Most bankruptcy lawyers offer free consultations, so if youre considering this option you can try consulting a lawyer to review your options.

Non-profit also provide free consultations that can help you clarify your options. They will not be able to resolve your tax debt, but they could help you manage your other debts or decide whether to consider bankruptcy.

Also Check: Is Ein Same As Sales Tax Number