Easiest App To Use For Mileage And Expenses

I really like Stride compared to the other apps out there. It tracks mileage well and instantly calculates your profit. I like the fact you can categorize by jobs, add photos of receipts, and other expenses all in one place. I would be willing to pay for a premium version. Id like to see auto detect motion start and stop, similar to MileageIQ. That should be an option to turn on and off as desired, since sometimes I forget to turn it on. My biggest complaint however, is it is not easy to search for added expenses and update or make modifications. There are 2 columns Deductions and Income. If I need to search for the expense I have to scroll the entire list looking for it. I should be able to search dash cam for example and find every expense associated for that category. IIll add to my review as I think of more improvements the developers can add.

Can You Use Year End Emails Or Estimates From The Delivery Companies

I mentioned that Doordash sent an email in February of 2021 telling me how many miles they show I had driven. Grubhub also sent an email . Uber Eats provides a miles driven number on their tax forms.

Unfortunately, none of them are IRS compliant. None of those provide a daily detail.

Would an auditor accept an email like that? I can’t tell you yes or no. It depends on how merciful they feel. Technically, a single year end number doesn’t match their requirement. However, it does provide some form of evidence that you drove a certain number of miles.

Ultimately that’s up to the discretion of the auditor.

A short lived alternative: PARA’s mileage tool.

At the end of 2020, Para devised an algorithm where they could sift through trip data from your apps including time that you are active on deliveries. Based on your activity, they could put together an evidence based log, including the date and miles.

David Pickerell, CEO of Para, told me they spent quite a bit of time going back and forth with tax lawyers and experts to make sure the information they provided was IRS compliant and that it met the requirements for reconstructing an acceptable mileage log.

I had them run my numbers, and the total they came up with was within 3% of the actual total, which was not bad at all. I have no idea whether they’re consistently that accurate, but I was impressed.

Update: it does not appear that Para will bring that feature back in 2022. The last I checked, it was not on their radar.

Keeping Records For The Actual Expense Option

The IRS allows two different methods for deducting driving expenses: Actual expenses or the IRS standard mileage allowance. If you are using the standard allowance method, you just have to show the mileage, date, and business purposes. There are advantages and drawbacks to each, and there are also some restrictions on reporting actual mileage.

If you are using actual driving expenses, you’ll need to keep receipts for all driving expenses, including gas, maintenance, and insurance. Then you multiply these expenses by the percentage of total miles used for business. If you are using a mileage app, it does the calculating.

For example, if you drove a total of 24,000 miles in a year, and you can prove 18,000 for business purpose, you are driving 75% for business. You would then multiply your total actual driving expenses by this percentage to get the amount to use for the expense deduction.

There’s a common misconception that if you keep track of actual expenses, you don’t have to track mileage. But you can only deduct business expenses, so you still have to track mileage to separate the business miles from the personal miles.

Also Check: Reverse Ein Search

Why Should I Track Instacart Mileage

Theres a common misconception that Instacart pays you for mileage because how far you drive for a delivery is a factor in how much you earn per batch.

This isnt the same as getting reimbursed.

Instacart pays you for completing deliveries, which involves driving, but this isnt the same as being explicitly reimbursed for driving.

So, its important to track your Instacart mileage, and doing so has two benefits:

- Depreciation. By tracking how much you drive, you can factor in vehicle depreciation with a vehicle depreciation calculator to get a more accurate picture of how much money youre making.

- Mileage Reimbursement. According to the IRS, the standard business mileage rate is $0.585 per mile. This means you might be able to score tax deductions depending on how much you drive for Instacart and how much money you make per year.

Even if you only drive for gig apps like Instacart or DoorDash every once in a while, its important to track your mileage so you know how much youre driving and can potentially get a bit of a tax break.

Irs Mileage Log Requirements

Depending on your situation, you might have to adhere to different IRS mileage log requirements, legal or otherwise, in order to keep compliant records.

Your employer might have specific requirements for mileage reporting, and the IRS also has rules that apply to business owners and self-employed.

In this article, we look at mileage logging from both the perspective of an employee and the self-employed.

Also Check: Employer Tax Identification Number Lookup

Look For Documentation Of Your Other Business Mileage

Lets assume that you are missing the miles from:

-

Between business meetings

-

When driving from your home office to your first meeting of the day

-

From your last meeting back to your home office

This is where the sleuthing starts. Youll have to find evidence that proves you actually incurred this non-trip mileage while running your business. Here are a few ways you can find that evidence:

What Qualifies As A Tax

If you go to the grocery store to buy a cake for your assistants birthday, is that technically a business expense? Kind of.

Business transportation would be:

- Traveling to work between two different places e.g from your office to a clients home

- Going on customer visits and client meetings away from the office

- Running business errands. This could be a trip to buy office supplies.

You cant claim deductions on:

- Your commute to work

- A trip where your work equipment happens to be in the car but you are not actually traveling to work

- Driving a branded car. Just because your logo is on the car does not make every trip a business trip

Recommended Reading: Doordash Taxes Percentage

Claiming The Standard Mileage Deduction

If you decide to go with the Standard Mileage Deduction over the Actual Expense Method, all you have to do is track your qualifying miles and multiply it by the cents per mile deduction for the year . Remember, only the number of miles traveled for business purposes is deductible.

The IRS’ standard mileage rate in 2021 is 56 cents per mile.

This method was introduced so small business owners did not have to track a mileage log or keep all their vehicle expense receipts . It’s as easy as that. Multiply your total miles by the deduction rate and compare it to maintaining the actual expenses for write-offs.â

Watch Out For Landmines

In theory, it sounds like an easy task to keep track of your trips. In practice, the IRS can request all of your business data: Business expense reports, odometer readings recorded at the mechanic, traffic cams, tolls, etc. If these documents do not match with your mileage logs a fine from the IRS can be crushing.

Read Also: How Much Do I Pay In Taxes For Doordash

How To Track Your Mileage

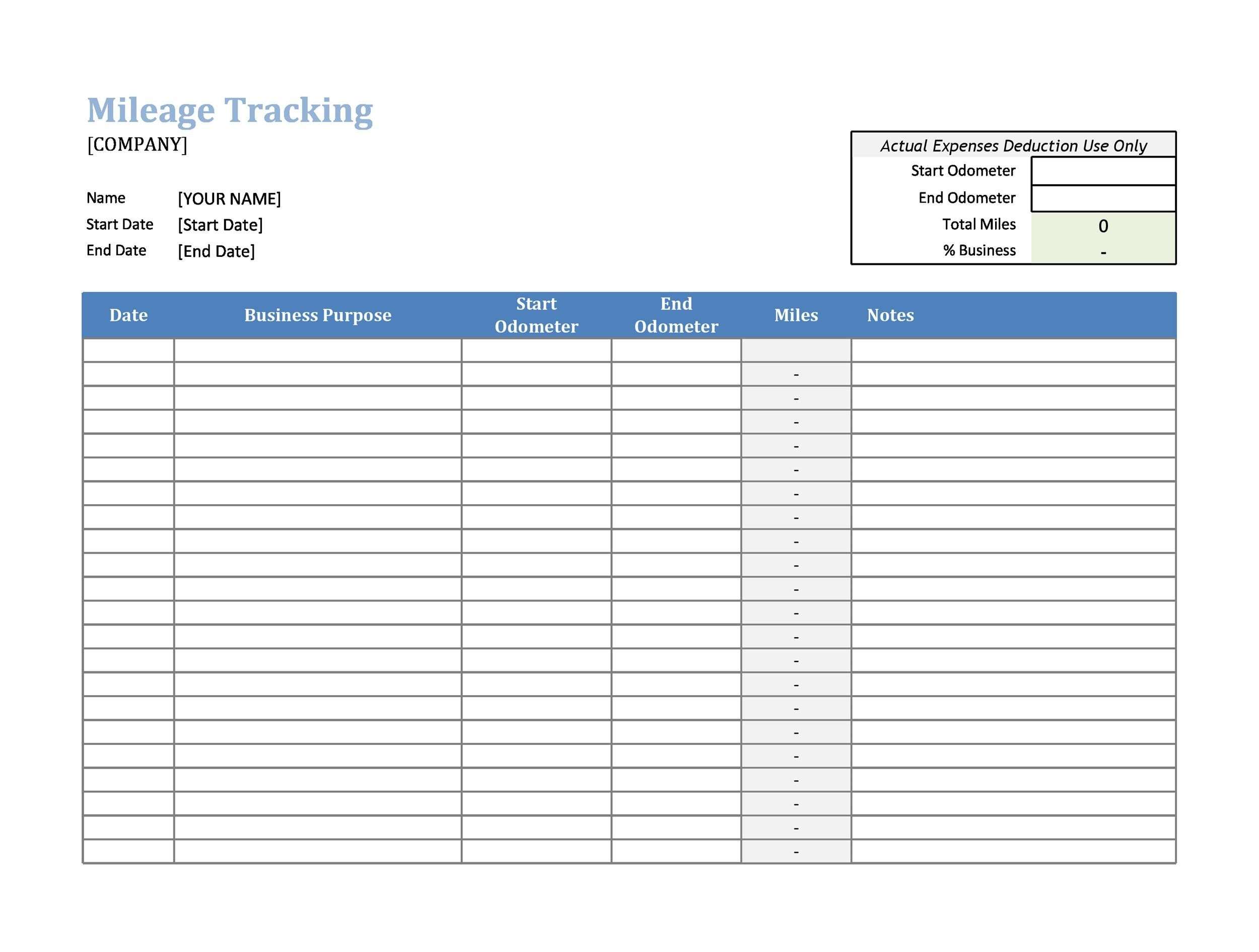

Some people track their mileages on paper. If you prefer this option, we have a for you. Nonetheless, a traditional mileage log in Excel, Google Sheets, templates, or samples will not perform even the simplest check-ups in your mileage log such as checking whether your odometer readings are realistic or not.

How To Deduct Your Mileage During Tax Filing

When its time to file your taxes as a small business owner, youll need a Schedule C form along with your standard form 1040. If you use any type of online tax filing system, theyll automatically take the information you provide to fill and submit the form for you.

Many systems will also automatically convert your mileage log into the total deduction amount. However, if you need to do the math, the standard mileage rate is $0.56 for business use . You can find the mileage rate for each year at the IRS.gov website.

You May Like: Tax Lien Investing California

Which Miles Can Be Deducted

Not every mile counts as a tax deduction. The following are eligible for tax deductions:

- Miles driven to pick up passengers

- Miles driven with a passenger in the car

- Miles driven returning from drop-off points to a place to wait for another ride request

- Any other mileage related to the business

The first drive of the day, from your home to the location where you wait for passengers, cannot be deducted for business mileage. Likewise, your last ride commuting home cannot be deducted. These miles are considered commuting miles, which are not deductible. In addition, any driving done for personal reasons during the day , cannot be deducted. Even if they are done between rides.

A Mileage Tracking App Can Ease Your Mind

Good mileage tracking apps take a lot off your plate, freeing your mind to focus on more important things. For example, people in the sales and service industries can spend more time helping customers understand their products instead of manually logging miles.

Since mileage tracking through an app is automated, you dont have to spend extra effort calculating your miles traveled or remembering to stop and take down your mileage when you are in a hurry.

Or worse, putting it off until the day before taxes are due and guessing!

When you turn on an efficient mileage tracking app and drive, it runs silently in the background, allowing you to keep your eyes and mind on the road. By focusing less on the mundane details of recording your mileage, you are free to look at the big picture and do whats best for your business. An app can ease some of the stress of day-to-day reporting so that you can use your mental energy for the things that need it.

Don’t Miss: Laurie Kazenoff

Ways To Track Your Mileage For Tax Purposes

Ive mentioned before that being a self-employed music teacher allows you to take advantage of some pretty valuable tax perks that our employed counterparts dont get. One of these is the mileage deduction.

Heres how it works:

For every mile you drive for business , you can deduct a certain amount of money from your income.

This deduction lowers your taxable income and reduces the total amount of taxes youll have to pay.

Every year around December, the IRS releases its standard mileage rate for the upcoming year. For miles driven in 2017, the rate was 53.5 cents per mile. For miles driven in 2018, the rate is 54.5 cents per mile.

The Best Mileage Tracker Apps

The best mileage tracker for your business will depend on your needs as a business owner. Are you a rideshare driver? Do you pay reimbursements to employees for travel? Do you use Apple iOS or Android? Different apps cater to different needs. Skip scrolling through an app store with the five best mileage tracker apps to make mileage logging stress a thing of the past.

Free version: Up to 40 trips per month

Full version: $5.99/month, or $59.99/year

Features:

-

Automatic mileage tracking: Once you flag certain routes, MileIQ will automatically detect them when you drive, classifying them as expenses.

-

Work hours: You can set work hours to determine MileIQâs automatic mileage tracking.

-

Integration with Freshbooks and Excel: If you use either of these apps to manage your expense tracking, MileIQ can export IRS-compliant reports to them.

Drawbacks:

- Only tracks miles: MileIQ doesnât offer any accounting tools, like expense calculation. It just tracks how far you drive and lets you classify the trip.

Overview:

As one of the most popular mileage tracking apps out there, MileIQ automates so much of the mileage tracking process. When you tag trips as âbusiness,â the app remembers the route and assigns it the same tag in the future. This means tracking business miles doesnât have to be a conscious thingâso long as youâre driving the same routes frequently. This feature may not be a good fit for rideshare drivers with routes that always vary.

Best for:

Features:

Drawbacks:

Also Check: Are Plasma Donations Taxable

Use The Documents Of Your Other Business Miles

If you had misplaced the miles for the miles between trips, when driving from home to where you had your first customer or your last trip back home, then you might feel like youre finished. Since you will need the official evidence about them, below are some of the options you might have to exhaust.

- Youll need to find out the lost mileage for the commute to and from home. It is often a tedious process, but youll have to do it.

- Youll also have to calculate the lost mileage between passengers the distance between where one trip ended and where the next one started.

- Finally, be sure to double-check your estimates, primarily using maintenance receipts and trip logs.

How To Track Tax Deductible Mileage For Uber & Lyft Drivers

Related Content

Hot Forum Topics

Posted by:Sergio AvedianFeb 27, 2020Updated Feb 27, 2020

I have recently written about helpful apps for Uber & Lyft drivers. They range from navigation, to towing, to mileage tracking and to filing taxes. It is a couple of months before tax filing season. Most drivers received their 1099s and should start gathering documents in order to maximize their deductions.

Tax Deductions for Uber & Lyft Drivers

As a self-employed worker, tax deductions for business expenses are the best way to prepare an accurate tax return and receive the largest possible rebate. You can deduct common driving expenses, including fees and tolls that Uber and Lyft take out of your pay. However, your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks and water for passengers, USB chargers/cables and monthly cell phone bills. If you dont take these deductions, more of your income will be subject to both income and self-employment taxes.

Make sure to track tax deductions as you go, it is much harder to recreate records later! Compile a list of these tax deductions and a mileage log so youre prepared to file. Tracking business expenses can also help you determine whether your driving is profitable.

Here are some tips to help you prepare your tax deductions for filing:

I use the Standard Mileage Deduction for tax filing purposes.

How to track your mileage for tax filing purposes

You May Like: Plasma Donation Tax

How To Start Tracking Miles So This Doesn’t Happen Again

You already know the requirements from the IRS. You need a record of your miles that includes:

- The date

- How many miles you drove

- The business purpose of your trip

- Where you went.

There are two good ways to do this.

You can keep a log manually. Record your odometer reading at the start and end of your trip and write down all the things in that log.

There are GPS tracking apps that can record for you. The free ones tend to require you to manually start and stop recording. If you’re prone to forgetting, you might consider Triplog, which will automatically start tracking your miles any time you are active on one of the delivery apps.

Continue reading for more detail on how to track your miles.

What Do I Do If I Forgot To Track Miles For Instacart

If you forget to track your Instacart mileage, your best option is to look through your previous batches within the app to see how far you drove. You can also make a rough estimate of this based on all of the batches youve completed, but make sure to be on the conservative side with this estimate.

Again, its vital to keep gas receipts and to stay organized so youre ready for filing taxes and dealing with potential Instacart mileage deductions.

You May Like: Ein Number Lookup Irs

Types Of Expenses Allowed Under The Actual Expense Method

Why does the actual expense method provide most taxpayers with more savings? It adds up quickly for small business owners when you consider all the expenses that qualify.

These include:

- Most lease payments

- Interest on a car loan

Remember, you can only deduct expenses you actually incur. Estimates or approximations of expenses won’t fly with the IRS.

You’ll want to keep all records that support the business expenses you deduct from your tax return. This can be credit card and bank statements, bills, cancelled checks, or even paper receipts that show the dollar amount, date, location, and the reason for the expense.

The IRS asks you to hang on to these records for three years after you file your return.

Choose A Method For Recording Your Mileage

There are several ways to track and record your mileage for tax purposes. A traditional mileage log, your accounting software, or even a smartphone app can be used to track your mileage throughout the year. Software like QuickBooks Self-Employed make it easy to track mileage.

No matter which method you choose, make sure to record your vehicles odometer reading at the beginning and the end of the year. Additionally, make sure that youre accurately tracking personal/business mileage and keeping your records updated.

Also Check: Does Doordash Take Taxes Out Of Your Check